Several investors seem to be giving up on commodity-focused companies as the gold and copper price went down the drain. However, even though the situation looks quite bad, there still is value amongst the rubble.

Nevada Copper (NCU.TO), for instance, is currently trading at less than C$1.10 per share, the lowest value since 2009, right after the crisis. Indeed. The project’s scope has expanded since then, Nevada Copper has invested tens of millions in constructing a shaft and completing an integrated feasibility study at Pumpkin Hollow which is the largest undeveloped copper deposit in the USA currently not owned by a mid-tier or senior producer.

The most-heard comment from our readers and subscribers is that the deposit ‘isn’t viable’ at the current copper price. That’s a correct statement, but the mine doesn’t even need to be viable and profitable right now, it just needs to be when it goes into production. And yes, it will be tough (and close to impossible) to find project financing as long as the copper price is trading at the current levels, but Nevada Copper should be seen as a call option on the copper price. The earnings seasons has started, and Capstone Mining (CS.TO) which produced 45 million pounds of copper in Q2 reported an all-in cost per payable pound of copper of $2.84. Other mines which have already reported production and financial results such as Lundin Mining (LUN.TO), Freeport McMoRan (FCX) or First Quantum Minerals (FM.TO) (whose share price has dropped by almost 50% in just six weeks time!) have only released their C1 costs per pound of copper, and we dare to bet their all-in sustaining costs are also close to $2.5/lbs.

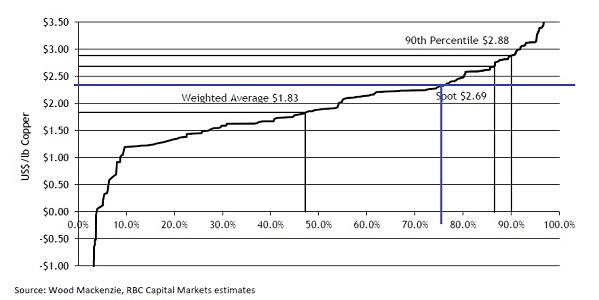

Image: courtesy of the Royal Bank of Canada

The Royal Bank of Canada has published a very interesting report on the copper mine market, and according to its research, in excess of 20% of the world’s mines have a total cash cost of in excess of the current copper spot price (see the previous image).

So how long can the current situation persist? A month? Six months? Probably. But in the longer run, some mines will have to shut down if the copper price doesn’t move. If you look at the previous image once again, RBC estimates 10% of the mines has a total cost of in excess of $2.88/lbs, which is more than 20% higher than today’s spot price. And keep in mind a large part of the lower cost copper mines are located in inferior areas with an increased geopolitical risk (for instance the DRC).

Image: Google Finance (click to enlarge)

In fact, based on a YTD performance, both Capstone Mining and Freeport McMoRan are doing worse than Nevada Copper, and that also says heaps.

Every copper company is hurting right now, but as a quarter of all copper mines are now producing at a loss, there are only two potential solutions. Either the supply dries up, or the equilibrium price has to increase again.

> Click here to read our site visit report of the Pumpkin Hollow project

> Click here to go to Nevada Copper’s website

Disclosure: The author holds a long position in Nevada Copper. Nevada Copper is a sponsor of the website. Please see our disclaimer for current positions.