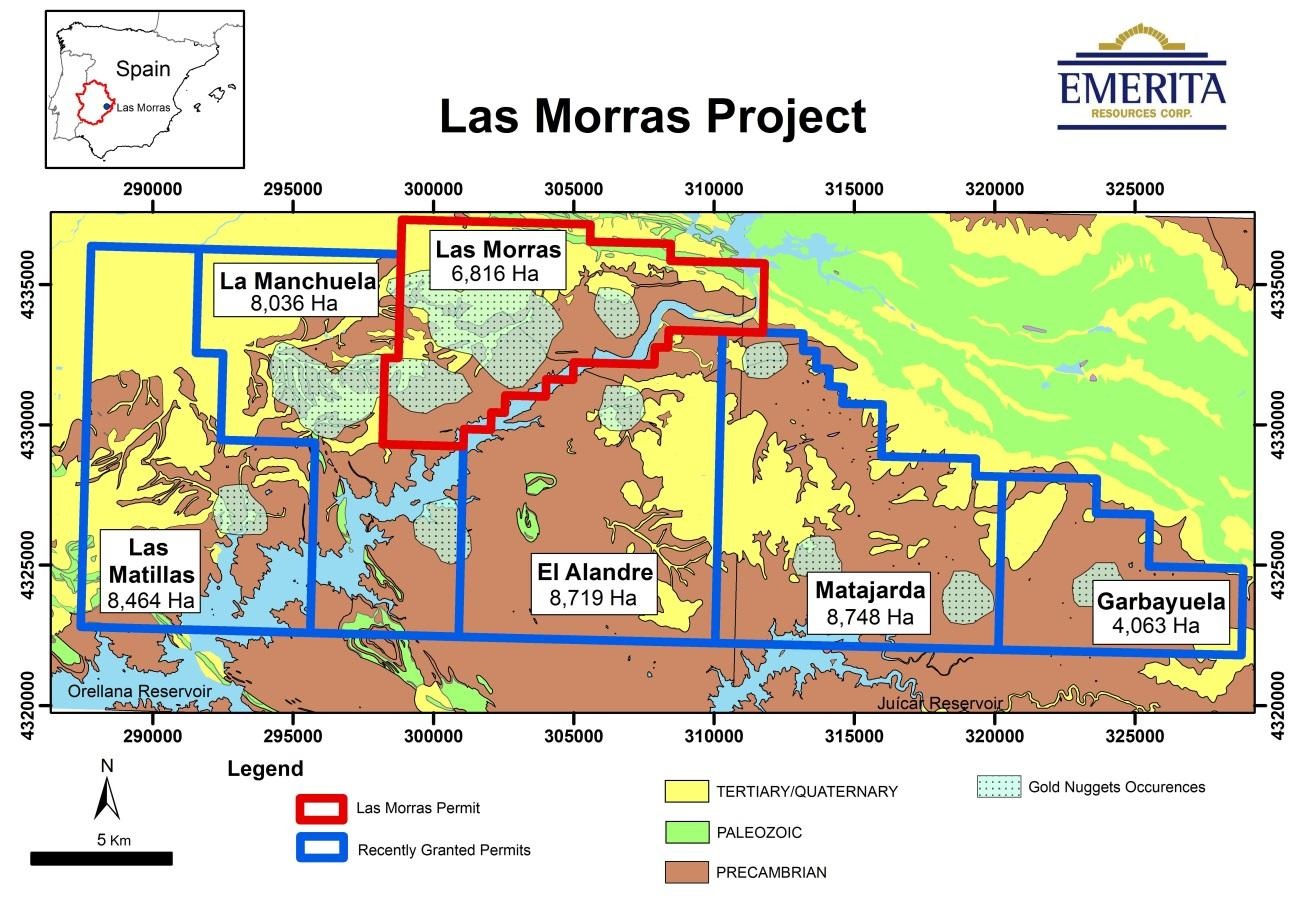

Copper One (CUO.V) has announced it acquired an option to purchase 100% of the Las Morras gold project in Spain from Emerita Resources (EMO.V). The project consists of a land package of approximately 7,000 hectares in the Badajoz province in Spain’s Extremadura region.

Las Morras still is an early stage exploration project, so the earn-in terms are in Copper One’s favor. The total cash payments are just C$350,000 (of which the first C$100,000 will only have to be paid in two years), whilst Copper One is committing to spend C$2M on exploration activities at Las Morras of which C$0.5M will have to be spent in the first two years, followed by an additional C$1.5M in the subsequent two years.

Copper One won’t need to raise any additional cash as it has received C$8M in cash from the Québec government as part of a settlement over the Rivière Doré project in Québec. Selling RD probably was the best move as despite the sunk costs, it still was an early stage project and Copper One’s cash position would have been spent on lawyer fees trying to get the license reinstated. Whilst it’s not an ideal scenario, it does show the Québec government is taking its responsibility when things go wrong, re-confirming Québec as a prime exploration and mining destination.

As of at the end of September, Copper One had a positive working capital position of C$325,000, and will very likely end the year with a net cash (and working capital) position of approximately C$8M, which represents C$0.23 per share. Ideally, Copper One should also search to acquire a more advanced stage project than Las Morras, or perhaps pursue a merger with a cashless junior with a promising project. It’s entirely possible the Las Morras acquisition was just meant to keep the regulator happy instead of converting itself into a cash shell (considering there are virtually no commitments in the first 12-18 months). We wouldn’t be surprised to see Copper One announce another deal in 2018 and returning Las Morras to Emerita.

Go to Copper One’s website

The author has a long position in Copper One. Please read the disclaimer