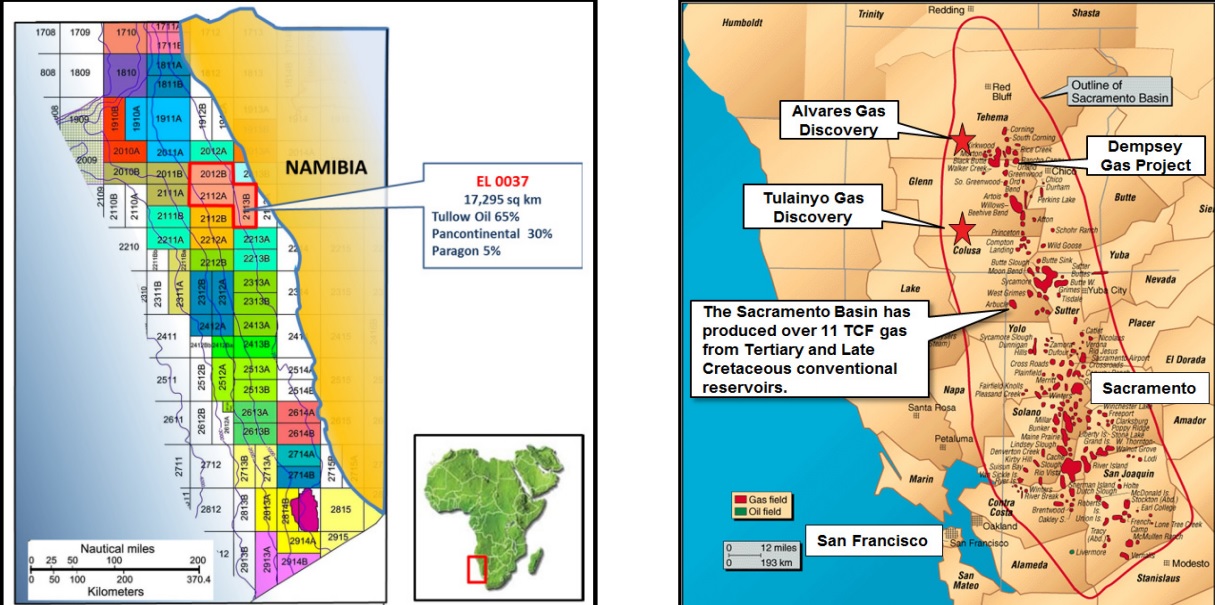

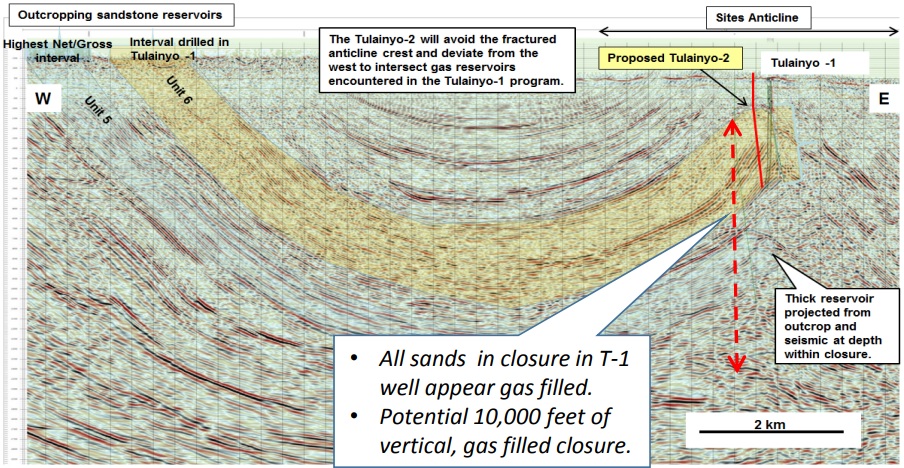

Pancontinental Oil & Gas (ASX:PCL) is trying to close the acquisition of Bombora Natural Energy, which is earning into the conventional Tulainyo gas project in California. The project has been drilled a few years ago (before the energy prices nosedived to unprecedented levels), and Bombora encountered multiple gas bearing conventional reservoirs which have not been tested so far (due to mechanical difficulties back in the day).

What’s important for Pancontinental is that it will be able to benefit from the expertise of California Resources (CRC) and Cirque Resources which are the joint venture partners on the Tulainyo gas field. The partners now expect to start a drill program in September to assess the economic potential of the gas reservoirs. Gas Fields, a subsidiary of Bombora (and soon a subsidiary of Pancontinental) can earn up to 33.33% in the property if it drills a second, deeper well after the first well.

The appraisal well in September will be a ‘proof of concept well’ for Pancontinental as it will flow tests the gas sands. To make the ownership even more difficult, the funding for the well will be provided by Magnum Gas and Power (ASX:MPE) which could earn an interest of up to 60% of Gold Fields. This will dilute Pancontinental’s working interest in the project to just 13.32% (40% of 33.33%), and the fair value of the California earn-in portfolio could easily exceed thecompany’s current (pro forma) market capitalization of A$8M (based on 4 billion shares outstanding after acquiring Bombora) .

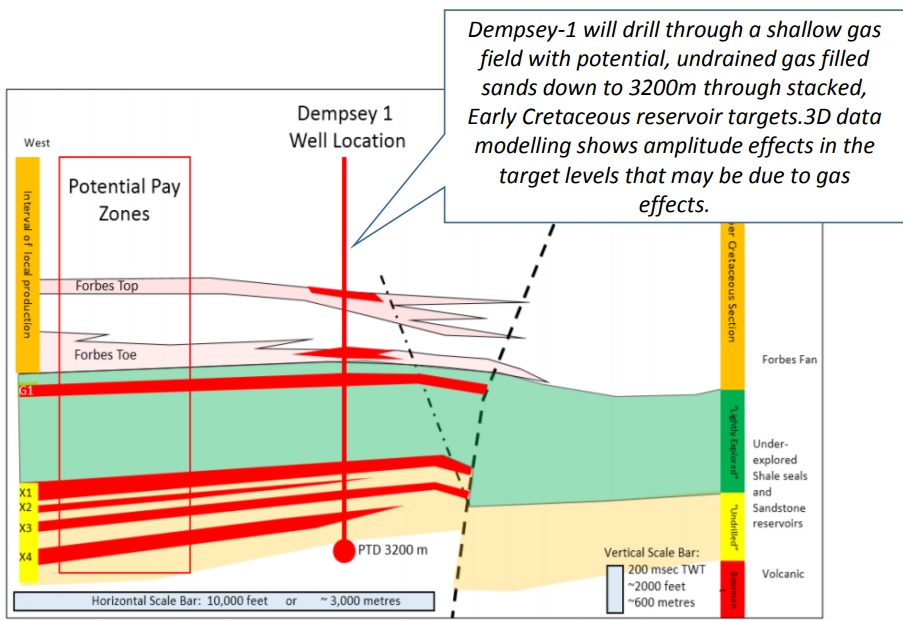

Meanwhile, drilling at the Dempsey gas project will start at the end of this month. Pancontinental could earn a 10% stake in Dempsey from Sacgasco (ASX:SGC), which will remain the 50% owner and operator of the exploration license.

Go to Pancontinental’s websiteThe author has no position in Pancontinental Oil & Gas. Please read the disclaimer