Sandfire Resources (ASX:SFR) has produced a total of 15,258 tonnes of copper (33.6 million pounds) as well as almost 10,700 ounces of gold, resulting in a C1 cash cost of just 95 cents per pound of copper. Despite the relatively low copper production, Sandfire maintains its production guidance at 63,000-66,000 tonnes of copper for the year, which means it will have to produce an average of almost 16,500 tonnes of copper on a quarterly basis for the next three quarters.

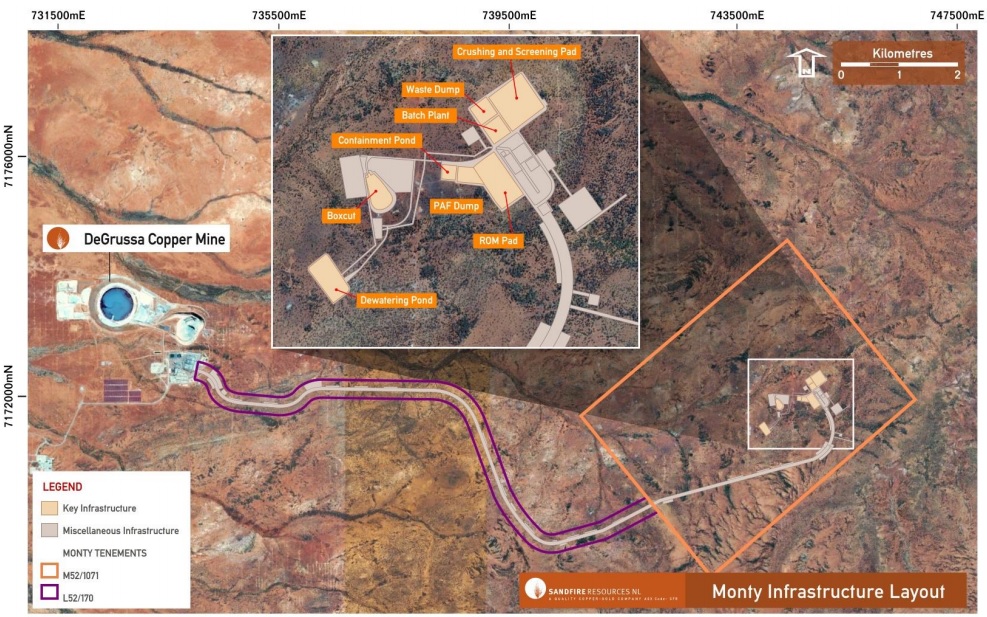

Meanwhile, the company continues to advance its project portfolio, and it has started to work on the decline portal at Monty, which will allow it to access the new underground mine. Whilst Monty is its near-term development project, we should also keep an eye on Tintina Resources (TAU.V), which owns the Black Butte copper-gold project in Montana. Readers of Caesars Report might remember Tintina’s CEO, John Shanahan, as he was the CEO of Revett Minerals (RVM.TO, RVM) which was sold to Hecla Mining (HL) a few years ago. If anyone knows how to navigate through a permitting minefield, John Shanahan might be the guy.

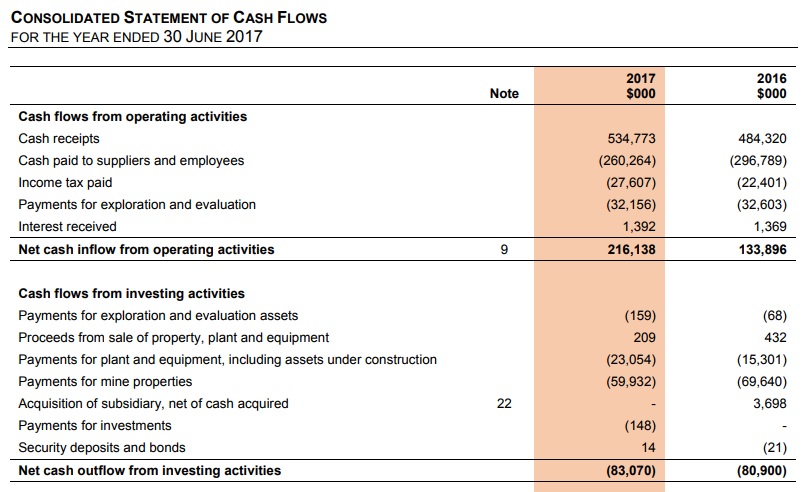

Looking at Sandfire’s financial performance in 2017, it’s clear the company is generating a lot of cash it will need to deploy somehow. In FY 2017 (which ends in June), Sandfire reported a total revenue of A$513M resulting in a net income of A$75M or 49 cents per share.

However, the adjusted operating cash flow (adjusted for changes in Sandfire’s working capital position) was almost A$202M, and after deducting the A$83M in capital expenditures (which includes equipment but also the payment for mine properties) and the A$1.2M interest expenses, Sandfire generated a free cash flow of A$117M.

Keep in mind this was based on a (much) lower copper price, and as the copper price is currently trading firmly above US$3 per pound, the free cash flow result will very likely be much higher this year. With a net cash position of in excess of A$125M as of at the end of June and approximately half a million dollar hitting the bank account on a daily basis, Sandfire Resources should be ready to secure its future. Tintina’s Black Butte copper project is an underground project, so Sandfire should be able to apply its Australian experience in Montana.

There’s very little doubt that once Black Butte gets permitted, Sandfire Resources will try to acquire the less than 22% of the shares it doesn’t own yet, as the project fits its bill. It could just use its underground mining experience from DeGrussa at Black Butte to replicate its success there.

Whilst Tintina would be the logical choice for Sandfire to bolster its production profile, very few people know Sandfire also owns tenements directly west of, and bordering the Pegmont Lead-Zinc project owned by Vendetta Mining (VTT.V), and has been doing some work on that land package in the recent past. We are pretty certain Sandfire is keeping an eye on Vendetta’s progress as we noticed in the past two editions of the PDAC conference in Toronto, Sandfire representatives stopped by at the Vendetta Mining booth.

Go to Sandfire’s website

The author has no position in any of the companies mentioned. Please read the disclaimer