When Millennial Lithium (ML.V) acquired the Pastos Grandes project last year, we were positively surprised the company was able to get its hands on a property with historical data on it as Eramet, (Euronext Paris: ERA) was the previous owner of the property. But in the past 14 months, Millennial Lithium has been able to do more than we ever imagined; as the company has now confirmed the existence of a large lithium-bearing brine with high lithium grades and exceptional hydrology.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

We have come a long way since Pastos Grandes was acquired

Millennial Lithium acquired the Pastos Grandes project last year for just $2.2M in cash, issuing $1M worth of stock and committing to complete $1.6M in exploration expenditures.

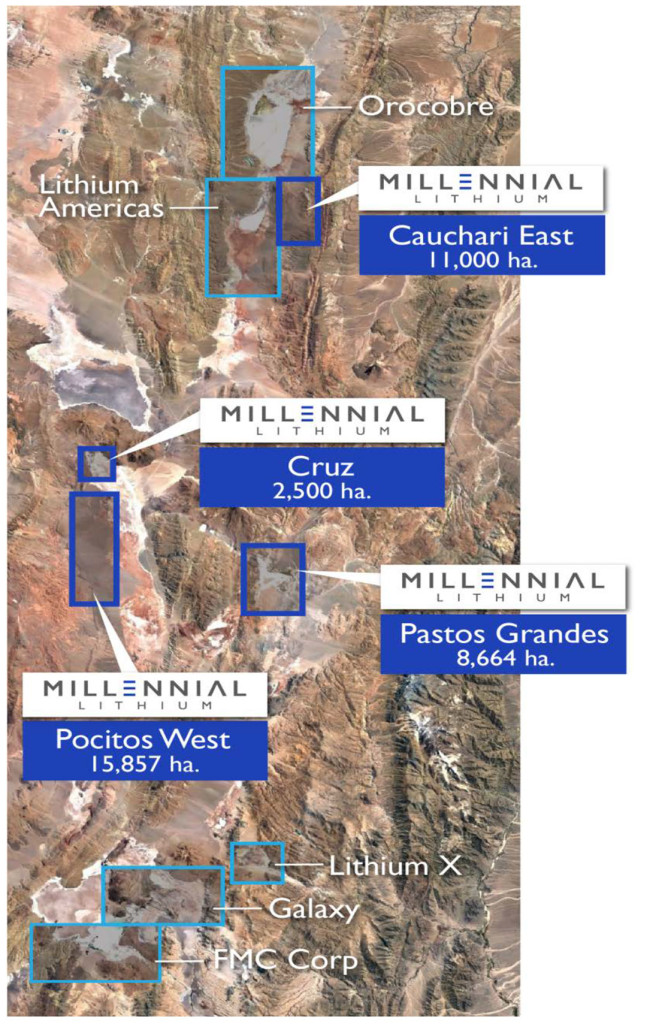

Millennial Lithium has made a lot of progress and is now in a position to prepare a maiden resource estimate, less than 18 months after acquiring the property. The size of the property is currently 6,360 hectares, but the company was awarded the rights to explore on thousands of additional hectares by REMSA, the provincial mining and energy company with an additional 2,492 hectares awarded as recently as August. However, this transaction still hasn’t been completed as the third party appealed against the decision to award the land package to Millennial Lithium.

The administrative appeal was rejected (which means the administration reconfirmed Millennial Lithium as the rightful owner of the 2,492 hectares – upon meeting the earn-in requirements). The third party then filed for a protective action from a provincial low level judicial court, effectively blocking the transaction for the time being. This indeed is a nuisance, but it looks like REMSA is defending its decision to award the claims to Millennial Lithium (note: ML is not a participating party in the lawsuit between the third party and REMSA). The ‘third party’ has not been named, but we think it could be LSC Lithium which owns some land claims in the same Pastos Grandes salar.

Whilst the confirmation of the additional 2,492 hectares has been delayed, we would expect REMSA to win the court case. REMSA based its original decision on several (objective) parameters and as Millennial has shown to be willing and able to fast-track the development of its lithium project, it made sense for REMSA to award the claims to a serious party which would be able to bring the project across the finish line. Millennial Lithium has already spent in excess of $10M on the Pastos Grandes property including drilling a total of 9 wells (with many more to be drilled in the future), so it really knows what it’s doing.

The delayed confirmation might also be a blessing in disguise as it also means the cash payments and exploration requirements are now pushed further into the future. As a reminder, Millennial Lithium will be required to pay almost US$7.5M in cash over 4 annual tranches and to spend US$15.4M in exploration activities on the new tenements. That’s indeed a lot of money, but the transaction definitely makes sense as the 2,492 hectares are located close to the high-grade discovery holes. Furthermore, when you start construction on pilot plants and evaporation ponds for a lithium project feasibility study, this commitment can easily be met.

The recent exploration results are extremely encouraging – and better than expected

In the first report wherein we discussed Millennial Lithium (read here), we argued that due to the density of lithium (which ‘sinks’), we would expect the Pastos Grandes project to contain higher lithium values at depth. As Eramet, the previous operator at Pastos Grandes, only drilled a number of shallow holes reaching a depth of just 100-120 meters, Millennial Lithium decided to drill deeper.

It’s always nice when a theory gets confirmed by exploration results, and that’s exactly what happened at Pastos Grandes. Millennial indeed drilled some deeper holes (up to 600 meters deep), and the average grades and flow rates were absolutely excellent.

Whereas historical grades encountered by Eramet were decent, this year’s drill program confirmed wide lithium-bearing brine intercepts with lithium grades of in excess of 500 mg/l, and that’s a very good result. In a recent August update, Millennial Lithium reported on the results of a new exploration well, which reached a depth of 601 meters (and ended in brine-bearing sand). This hole actually identified two different brine horizons of which one was located very close to the surface (starting at a depth of 27.5 meters) returning 523 mg/l, whilst a more important and thicker zone was discovered at depth.

Indeed, at a depth of almost 382 meters, ML intercepted a long interval of approximately 211 meters at an average grade of 545 mg/l. That’s on the higher end of the 330-560 mg/l range identified by Eramet and this bodes well for the potential economics at Pastos Grandes.

A good lithium grade is one thing, but there are several other important parameters to determine how good a lithium brine really is. One of those parameters is the magnesium:lithium ratio (the lower, the better), and the flow rates.

The Mg:Li ratio remains relatively low (it usually fluctuates between 6 and 7 which is very good and in line with SQM in Argentina), and the flow rates are exceptionally good.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

The next step? A maiden resource estimate

According to Millennial’s most recent Management Discussion & Analysis, the company is now expecting to publish its maiden resource estimate before the end of this month.

Millennial Lithium has not provided an official guidance for this resource estimate, but in a call before the summer, newly-appointed President & CEO Farhad Abasov, said “Millennial would only go ahead with a resource calculation when its technical team feels like it has sufficient data to reach the critical mass.” No exact minimum requirements for this ‘critical mass’ were provided, but we would expect the company wants to see a resource of 1.2-1.5 million tonnes of Lithium Carbonate Equivalent.

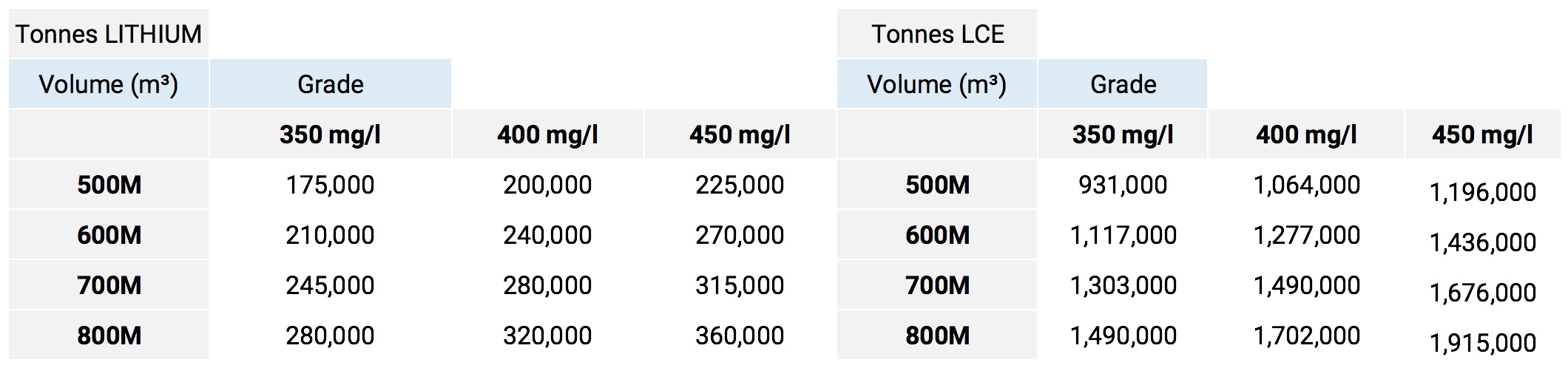

As the recent drill results intersected thick brine intervals, the total volume of the salar has increased substantially, and it looks like the ‘critical mass’ has now been reached, given Millennial’s outlook to publish a first resource estimate by the end of this month. The next table (provided for illustration purposes only) provides you with an overview of the potential volume of the brine, and the average lithium grade.

Assuming an average grade of 400 mg/l, Millennial Lithium would need to find a volume of 600-700 million cubic meters to reach the ‘sweet spot’. Given the recently announced thickness and high grade intervals, we would expect the company to come in between 600 and 700 million cubic meters with an average grade of slightly higher than 400 mg/l.

As Millennial Lithium has just completed a C$11.5M bought deal (priced at C$1.25 per unit, consisting of one common share and half a warrant valid for 2 years with a strike price of C$1.50), the company is fully funded to complete the resource estimate. This maiden resource estimate will also be the basis for Millennial Lithium to complete a Preliminary Economic Assessment on the property, which could be expected by the end of this year (although we wouldn’t be surprised to see this being pushed back to Q1 2018).

Millennial Lithium is also farming out its non-core properties

Something also particularly intriguing about Millennial Lithium’s business model is that due to its ability to secure quality properties, it’s also able to attract joint venture partners for these assets. This allows ML to keep a finger in different salar-pies without having to incur the exploration expenditures to advance the properties.

The Pocitos West property is being farmed out to Liberty One Lithium (LBY.V) which has recently completed a geophysical survey at Pocitos West. The results of this survey were actually better than we expected (and imagined) as the Vertical Electrical Sounding survey detected a good potential for brine content along the entire 27 kilometer long north-south extend of the Pocitos West property. The VES seemed to indicate the conductive layer reaches thicknesses of up to 164 meters.

Whilst having identified a conductive zone is a positive achievement (brines are salty, which means they are a good conductor for electrical currents), we’ll only know for sure after drilling whether or not this conductive zone is a brine. According to a recent update from Liberty One Lithium, the company is now in the permitting process to which could see it start a drill program as early as this quarter.

On the Cruz Lithium project (also in Argentina’s Salta province), Millennial Lithium is partnering with Southern Lithium (SNL.V) which can acquire up to 80% of the project. At Cruz, a Transient Electromagnetic Survey completed on a 4,500m by 4,500m grid has confirmed the existence of a north-south trending conductive zone and Southern Lithium should now be wrapping up a two-hole drill program at Cruz. This drill program will enable the company to confirm whether or not the conductive zone is indeed a lithium-bearing brine zone which starts at a depth of just 30 meters and has been traced to a total depth of (at least) 250 meters.

Conclusion

A year ago, Millennial Lithium had just acquired the Pastos Grandes project and had just begun an exploration program. Fast forward to today where Millennial Lithium has confirmed the existence of thick brines, good lithium values and strong flow rates, you will understand why the company is in a much stronger position today.

We’ve also seen an incredibly successful, new management team come into the company in executive positions, including CEO Farhad Abasov (which has now also assumed the role of President of the company), who sold his previous company (Allana Potash) to Israel Chemicals in 2015.

Raising the C$11.5M also is a good first step to make sure the company can meet its exploration commitments on the new Pastos Grandes tenements which we hope will be officially awarded soon.

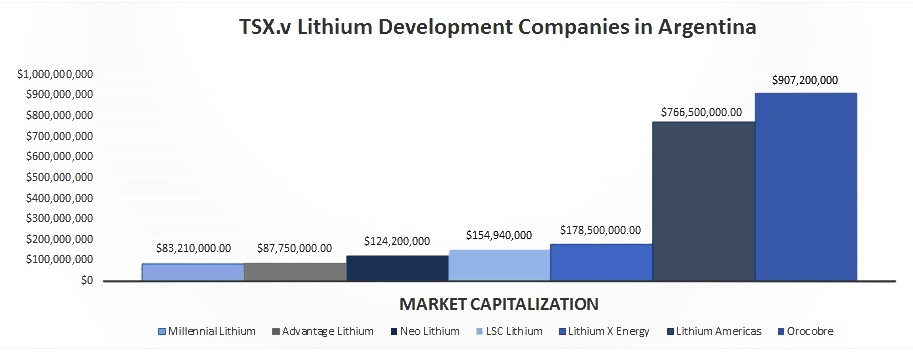

A maiden resource estimate will be published in the next few weeks, and that resource will be the basis for a Preliminary Economic Assessment. That PEA will provide a ‘tangible’ value for the Pastos Grandes project and we are pretty certain is will be a high multiple of the company’s current market capitalization. For instance if they are able to achieve the 1.2-1.5 million tonnes of Lithium Carbonate Equivalent, that would put them ahead of Lithium X (LIX.V), which just so happens to have a market cap of C$180M which is more than twice as high as Millennial’s market capitalization. This valuation gap could then easily be closed in the coming months as Millennial Lithium will complete a PEA which will provide the market with a NPV calculation which will undoubtedly be a multiple of the current market capitalization.

The author has a long position in Millennial Lithium. Millennial Lithium is a sponsor of the website. Please read the disclaimer

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.