X-Terra Resources’ (XTT.V) share price has performed really well in the first quarter on the back of signing a Cobalt-Copper project acquisition agreement, and the company finally being able to close the Veronneau earn-in deal. The XTT management team also made true on its promise to immediately start working on Veronneau, as the company completed an airborne survey within weeks after closing the earn-in deal. Time to sit down with CEO Michael Ferreira and director Michel Chapdelaine for an update!

Projects

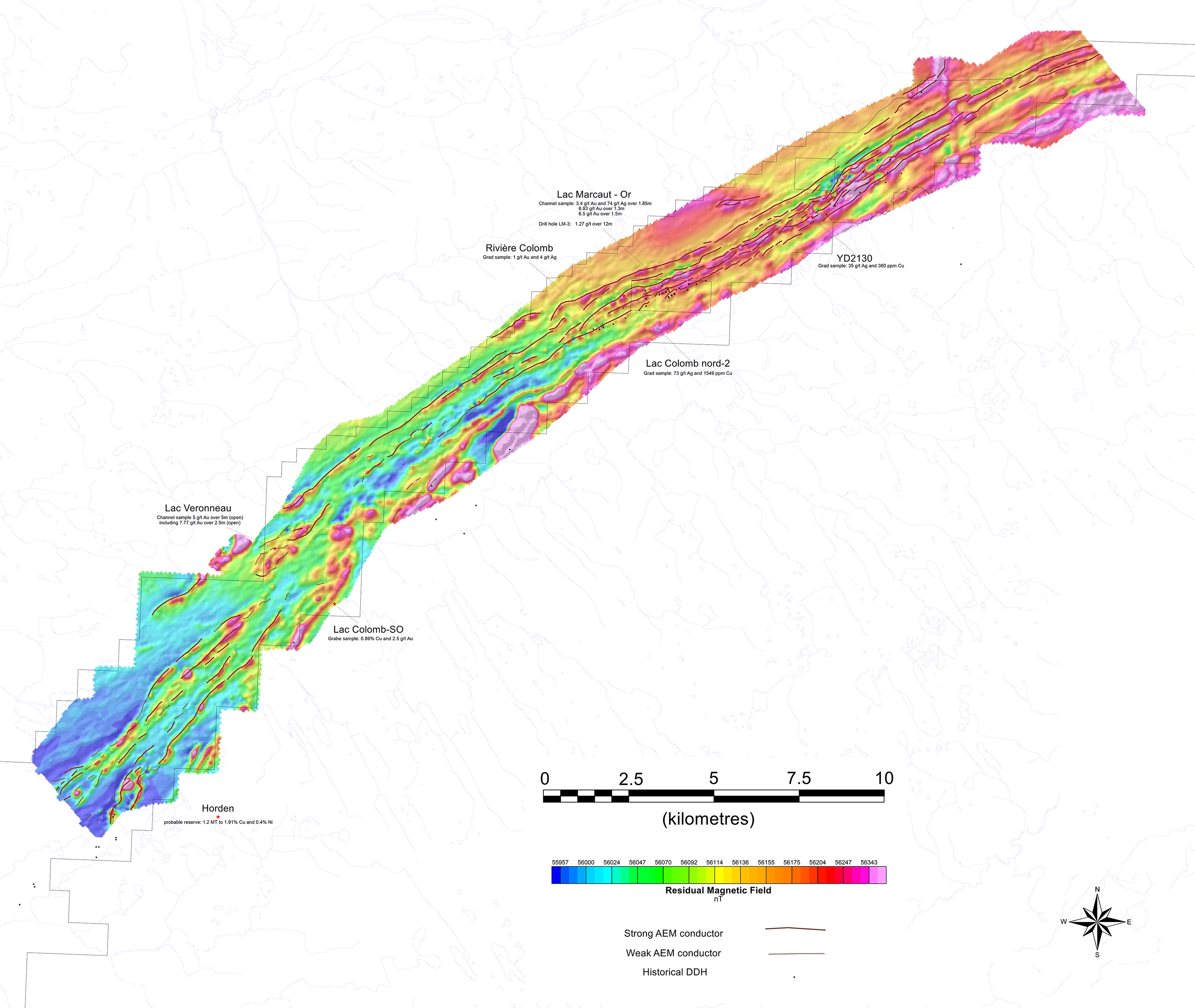

You have recently completed an airborne geophysical survey at the Veronneau project, which is your flagship asset. We had the impression you were quite efficient at this survey, as you were able to download and analyse the date almost in real-time. MB Geosolutions is now analizing the data in order to compile potential priority targets. When do you expect to be able to access and assess all data from the airborne survey?

Mr. Boivin from MB Geosolutions is working hard to get us the final data within the next few days. Given the vast amount of Electro-Magnetic (EM) anomalies/targets, it is taking a little bit longer than we originally expected but for good reason, as this opens up our exploratory targets this coming exploration season.

In a follow-up press release, you noted there’s a unique EM signature which is completely different from the rest of the property, and this signature coincides with the Veronneau showing. What does the EM signature really tell you about the Veronneau showing? What do you now expect after seeing the airborne data confirming the ground samples?

The geology and structure observed on the Veronneau showing which was preliminary, highlighted that the mineralisation was “cross cut” by the main foliation (North East). After analyzing some samples obtained from the field in late fall, the same correlation can clearly be seen, indicating the mineralization is PRE-deformation.

With that being said, when we look at the Mag/EM survey, it’s easy to see that the EM conductors and the MAG generally follow the strong regional foliation (North East trend). However, in the area of the Veronneau discovery showing, we can clearly see that some weak EM conductors are following an East-West trend. This East-West trend also seems to be cut by the North-East trend. The MAG signature when compared with the stratiform trend of the MAG survey in general is blurred in this particular area, and perhaps this could point in the direction of alteration.

All of this suggests that the mineralization occurred prior to the main deformation event. So it gives us a very good exploration tool by allowing us to focus on the structure that appears (on the MAG/EM survey) to be East-West instead of North-East.

Lastly, a thin section study is actually in process and preliminary observations clearly reveal that the mineralization is also pre-deformation, so we are seeing a lot of interesting features at Veronneau!

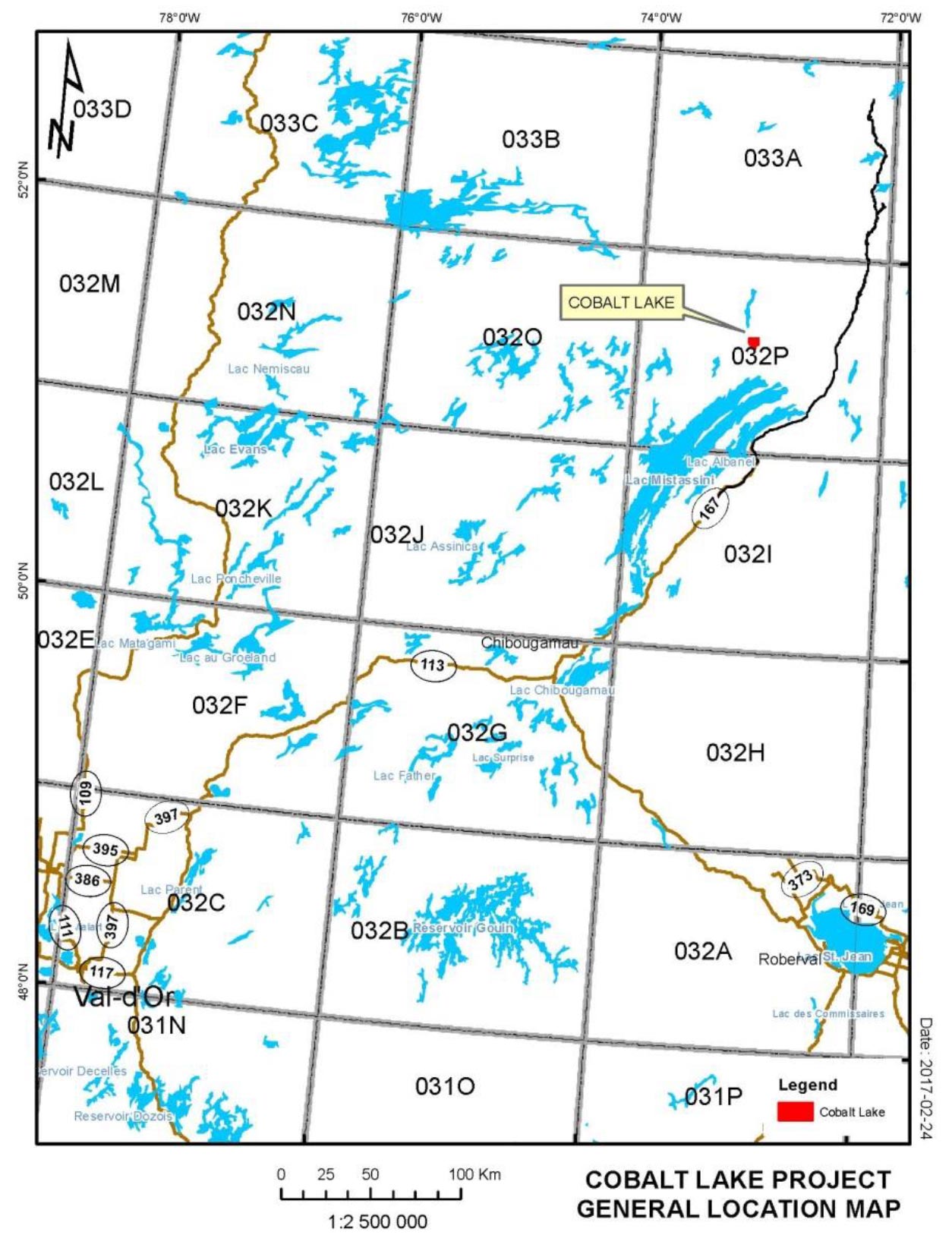

Veronneau project location map

Veronneau project location map

Assuming you receive your airborne survey data within the next few weeks, what will be your next steps to prove up the value at Veronneau? Are you still on track to spend the minimum exploration expenses to complete your earn-in on Veronneau?

Once we receive the final data, we will begin designing a detailed exploration plan. We have already begun the process of organizing camp arrangements for the teams that will be in the field this summer. They will be principally responsible for prospecting and expanding on the Veronneau discovery and also responsible for completing some detailed mapping to fully understand what is going on geologically.

As far as the minimum exploration expenses are concerned, we are way ahead of schedule as our first year work commitments of $250,000 are almost complete, the majority being the airborne geological survey recently completed. Once we start work this summer, we will begin carrying forward our expenses onto next year’s requirements, and this will put us in a great position.

Let’s take a minute to discuss the other projects in X-Terra’s portfolio. You have started to explore the strategic alternatives for Rimouski’s shale gas licenses. Are you looking for an outright sale? What about the Lindsay REE project, will you try to divest that property as well?

We recently announced we acquired the 50% ownership in the shale gas licences for the sole purpose of exploring strategic alternatives without the need of consulting our previous partner. Now that it is completed, we are open to either signing an option agreement or an outright sale if the right buyer came along. The process took much longer than anticipated, and now that it is finally completed we can start looking at offers.

Our REE Lindsay asset has been dormant for quite some time. Given that our main focus is on gold and its Michel Chapdelaine’s specialty, there are no plans in the immediate future for Lindsay. So to answer your question, yes, we will look at divesting it as well, either through an option or an outright sale where X-Terra would retain a royalty.

You also announced you have entered into an agreement to acquire a copper-cobalt asset in Québec. The project is obviously still quite early-stage, but a sediment survey encountered pretty decent cobalt values (1251 ppm). Could you elaborate (for the non-technical readers) what a sediment survey is, and why these results are encouraging?

This project is still in a very early stage but given the terms of the transaction, we were able to acquire 100% of the asset without the need to ever pay a royalty in the eventuality of a major discovery. And this gives us a lot of flexibility!

The reason the sediment survey is important is because the sediment cycle starts with the process of erosion whereby particles or fragments are weathered from rock material and transported by river systems, and eventually deposited in a lake or the sea. This is encouraging due to the fact the glacial flow in James Bay (which has been extensively studied) highlights the ice flow to be from the North-East to South West on a 30 degree vector.

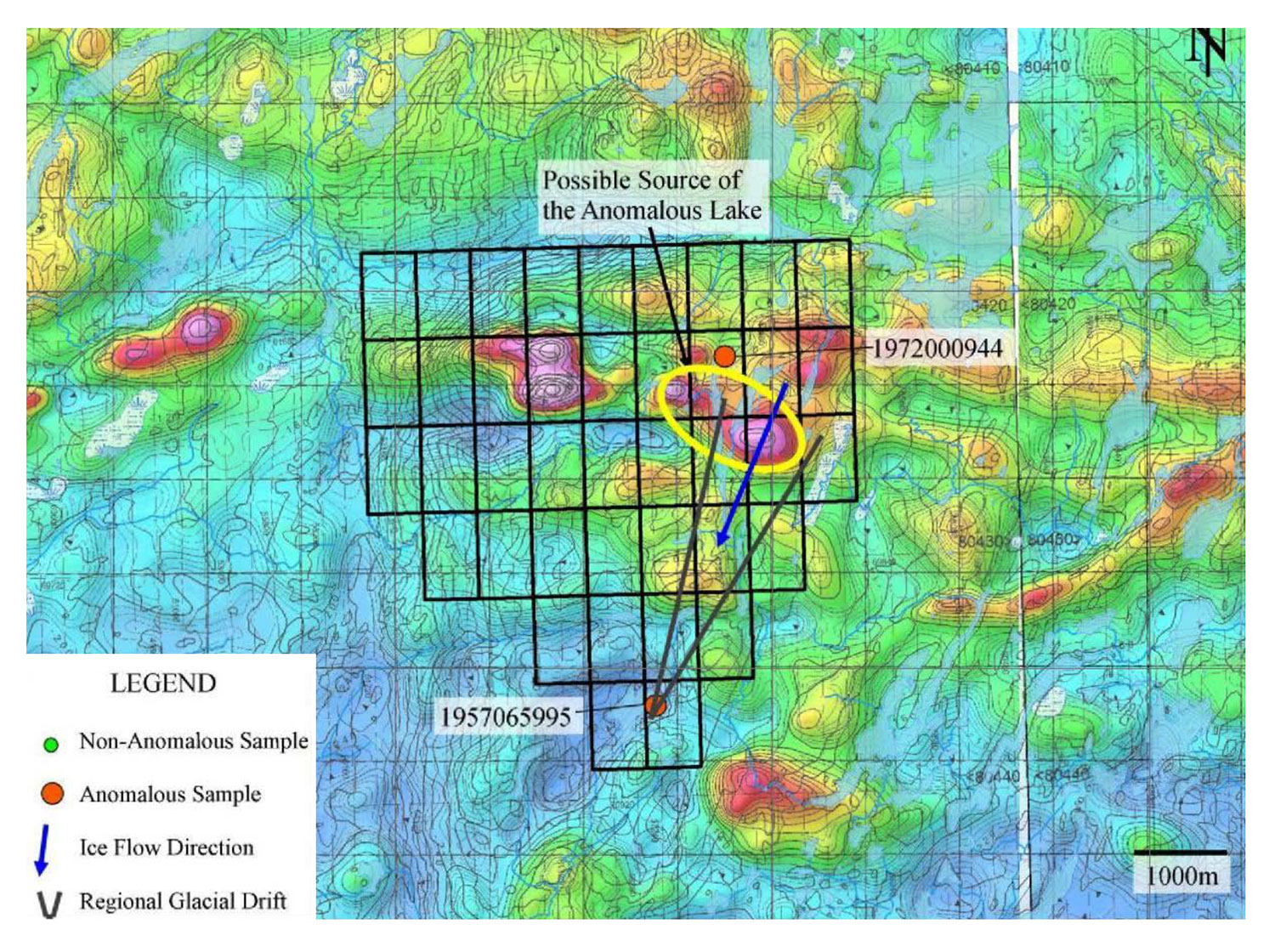

Could you tell us a bit more about the direction of the ice flow at Cobalt Lake, and why this is an important part of the exploration thesis there? We see there is a mag anomaly which has been detected several kilometers from where you discovered the anomalous cobalt values in the sample.

Given that we know the ice flow direction and our sediment samples are showing copper-cobalt values, we immediately looked at possible sources of these anomalies. Given the mag anomaly trending 30 degrees north east has never been tested, there is a possibility the anomalous values obtained in the sediment lake samples derives from there.

What are your follow-up (exploration) plans at the Cobalt Lake property?

While we will obviously be putting a lot of our efforts on the Veronneau gold discovery this summer, we still plan for a short 2-3 week prospecting program for the Cobalt Lake property to test the high mag anomaly in the later part of the summer.

Cobalt Lake Possible Source of the anomalous lake

Cobalt Lake Possible Source of the anomalous lake

Corporate

What’s your current cash position, and do you anticipate to raise more cash anytime soon? You run a company with a very low overhead, which is fantastic, but you are undoubtedly also putting an exploration budget together on Veronneau, and perhaps also on Cobalt Lake.

X-Terra’s current cash position is $175,000. We anticipate raising only what we need, in order to preserve the capital structure of the company which is very clean right now. With that being said, we are anticipating raising some exploratory funds at the beginning of the second quarter before the summer exploration season really begins. The amount we are planning to raise will ultimately depend on the final exploration budget, but the market can anticipate it being about $600,000-$750,000.

Insiders of the company have purchased in excess of 75,000 shares of X-Terra Resources in the past few weeks, which is a great vote of confidence. It’s also very encouraging to see Michel Chapdelaine, your new director and technical advisor, buying stock on the open market, as it could be interpreted as a sign he believes there’s definitely ‘something there’ at Veronneau. What’s the current insider ownership in X-Terra Resources?

While we were not able to buy everything we wanted, we feel buying XTT at these prices is nothing short of a great opportunity, given our current share structure. Insiders of X-Terra currently own over 20% of the shares outstanding, and this should confirm to our other shareholders our interests are very much aligned with theirs.

Conclusion

Interesting times at X-Terra Resources. The company made true on its promise to immediately hit the ground running at Veronneau, and we’re looking forward to see the final data from the airborne survey and the company’s plans to get some boots on the ground this summer.

We are very encouraged by the hands-on approach of Michel Chapdelaine, and Ferreira’s ability to keep the overhead at X-Terra Resources fairly low. This allows the company to maximize its exploration expenditures, and that’s ultimately what shareholders want to see.

Disclosure: X-Terra Resources Inc. is not a sponsoring company, we were compensated by a third party. We have a small long position. Please read the disclaimer