Let’s start with a flashback to 2011. We met with the CEO and Vice-President of Excelsior Mining (MIN.TO) in Paris, where the company was presenting its business case to a group of France-based financiers. We liked what we heard and saw, and spent several hours with Stephen Twyerould after the presentation to discuss the property in more detail.

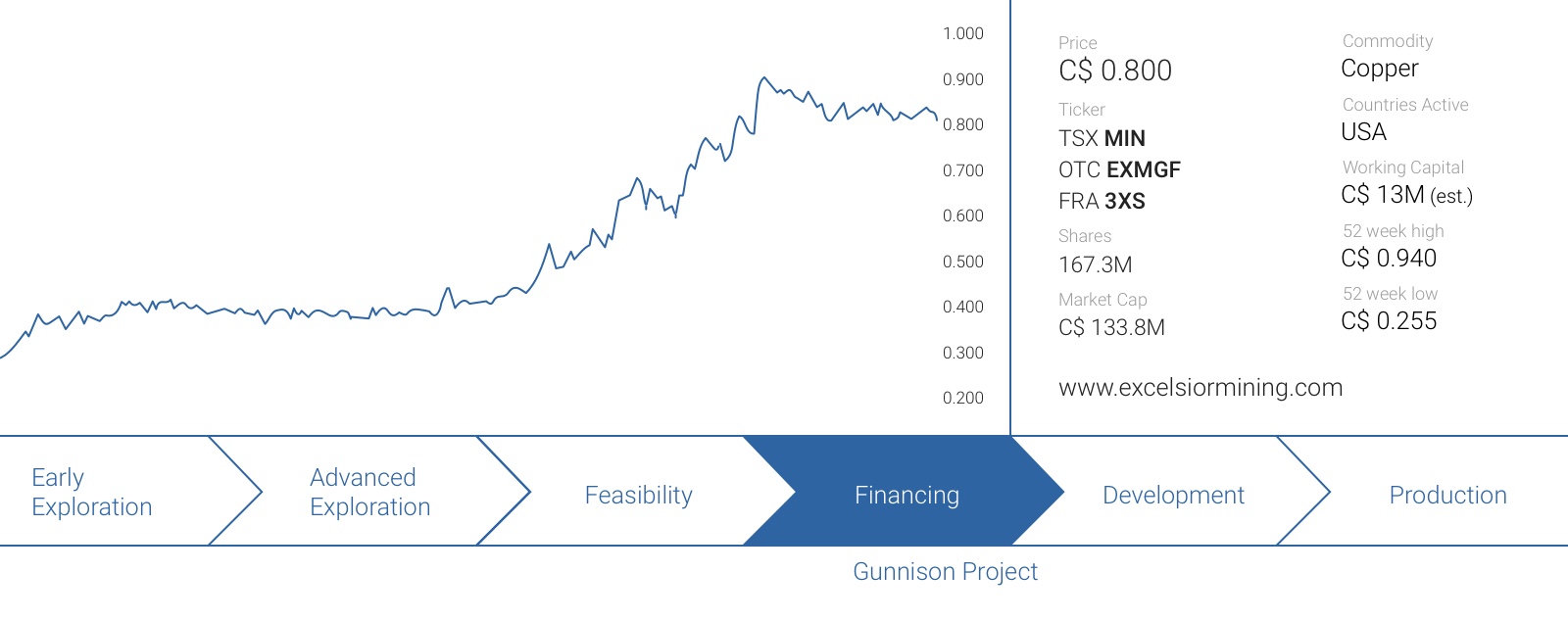

We then subsequently released a report on Excelsior Mining and another ISR company (which has now been acquired by Taseko Mines), when nobody cared about Excelsior. Its share price was trading at just C$0.43 back then, and dipped to C$0.10 before gaining momentum again and reaching C$0.80 today.

In these past years, Excelsior has continued to develop the asset and is awaiting the final permits before starting its construction activities.

The background of the Gunnison property and the Johnson Camp acquisition

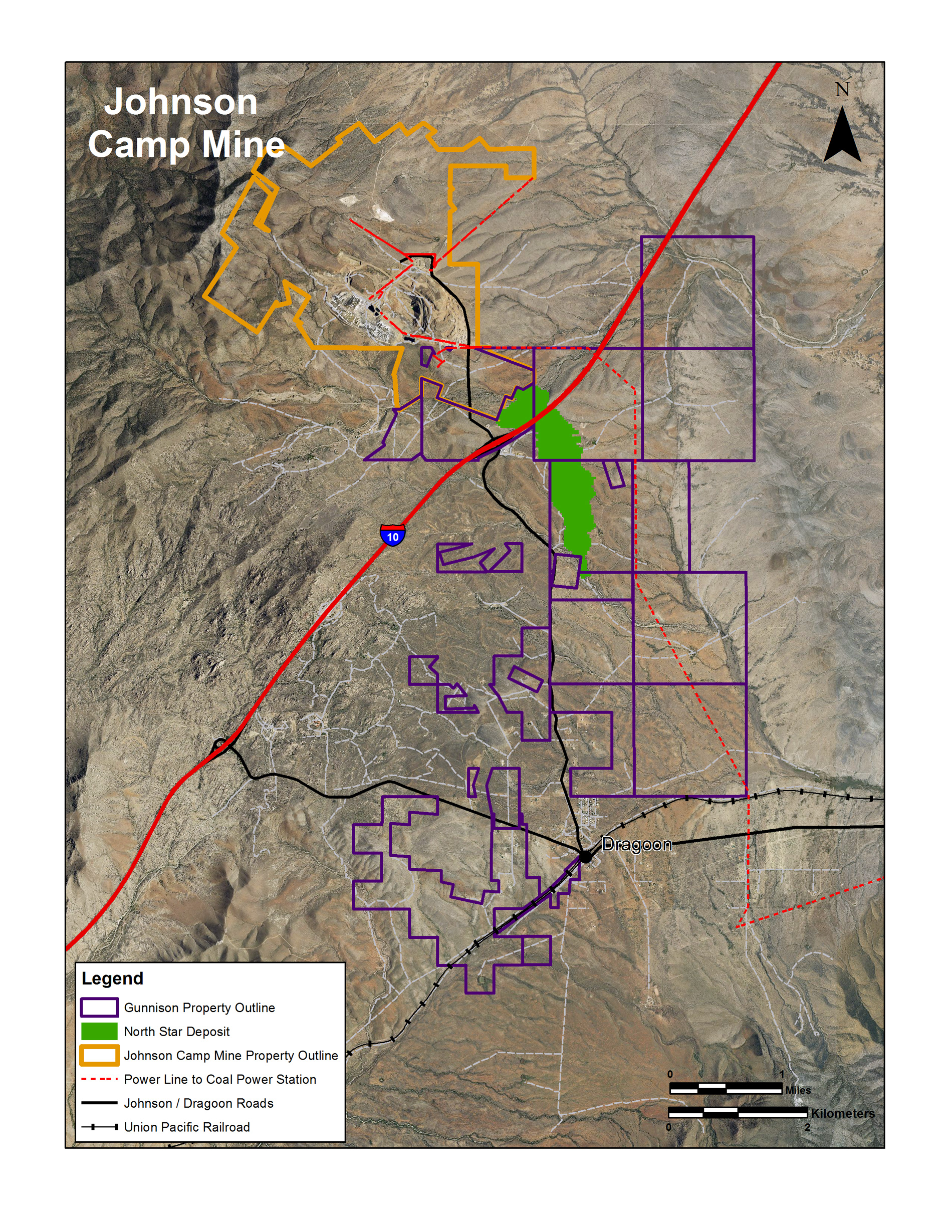

The Gunnison project is located in Cochise county, Arizona, approximately 100 kilometers east of Tucson, a city of approximately one million inhabitants and an international airport. The property is located right next to the I-10 highway, and in fact, the highway is running right through the property, which makes Gunnison one of the properties with the best access we have ever seen and visited. Additionally, there’s a railway just 5 kilometers to the south of the deposit (but still on Excelsior’s project), owned and operated by Union Pacific Southern Pacific. That’s a great bonus, as this will allow Excelsior to ship its copper cathode straight to the ports on the West Coast (if this would be the preferred option over trucking). This is also a cheap method to transport sulfuric acid to the processing plant.

Additionally, the immediate surroundings of the property are sparsely populated so the risk of locals trying to block the development of the mine is very limited.

Even though Cochise county has seen considerable mining development in the past, the Gunnison project has never been in production. The nearby Johnson Camp, which was acquired in 2015 has been the subject of historical production as there was small-scale production from copper-zinc veins, whilst an additional 187 million pounds of copper were produced from the open pits at Johnson Camp, which was in production until Excelsior bought it.

The North Star deposit was only discovered in the sixties, and contrary to what you might have thought, the previous operator was already conducting tests to figure out if the ISR technique could be used to recover the copper from the Gunnison project.

James Sullivan was able to acquire all pieces of the Gunnison-puzzle in the late 80’s and subsequently optioned it out to Magma Copper (now BHP Billiton) and Phelps Dodge. Both optionees decided to walk away from the property after a shift in their corporate focus (and NOT because Gunnison was thought to be unviable). From 1998 on, nothing of great significance happened at Gunnison, until AzTech Minerals came along in 2007 which was the basis to create Excelsior Mining in 2010.

The missing piece of the puzzle was the acquisition of the Johnson Camp mine and facilities.

In October 2015, Excelsior signed an agreement to purchase the Johnson Camp Mine out of receivership for a total consideration of US$8.4M. The majority of this sum has already been paid, but Excelsior is required to make one final payment of US$2.2M before the end of this year – which shouldn’t be an issue at all.

Why was Johnson Camp such an important addition? First of all, the claims are immediately adjacent to the Gunnison property, which means Excelsior now already has immediate access to the existing processing facilities. Perhaps the most important feature are the 88 electro-winning cells which provide Excelsior with the possibility to immediately start producing copper at a rate of 25 million pounds per year. This immediately reduces the initial capital expenditures, as Excelsior Mining will first refurbish the Johnson Camp equipment before adding new equipment to boost the production rate to 125 million pounds of copper per year.

The copper market – an overview

Whereas the copper price was trading at almost $4 per pound in 2011, the price of the commodity has gone south and reached a low of around $2 in 2016. This was an unsustainable price as most of the copper mines in the world have an all-in production cost higher than $2/lbs.

The best cure for a low commodity price usually is a low commodity price. We saw that in the oil sector where companies stopped developing their properties, resulting in a decreasing oil supply. You can’t immediately shut a copper mine down and most remained open, but the development of new mines came to a screeching halt. The new copper projects are either located in geopolitically unstable regions (Africa), or have a multi-billion dollar price tag to be built (Western Copper would be a good example of a good project but with a very high initial capital expenditure).

It’s not easy to find good copper projects as any project to be developed would preferably be located in a safe region and have a low production cost. After all, financiers will obviously also like to stress-test the business scenario using an extended period of $2 copper.

The demand for copper continues to increase and until now, the supply side has been able to match the total demand. This will very likely continue to be the case for the next 2-3 years (as China-owned and operated mines in South America will take care of the country’s need for more copper, and reduce the seaborne demand on the world market), but all bets are off for the post-2020 era. It’s definitely possible other projects will be advanced and developed, but most of those feasibility stage projects are still 3-5 years away from any production at all.

Long story short, Excelsior Mining’s Gunnison project might be in production at the exact right time as copper traders (think about a Trafigura or Glencore) will be looking to secure their position on the trading markets by locking in offtake agreements with new suppliers.

The feasibility study confirmed the results of the previous studies

To make sure Excelsior would be able to convince the doubters, it used a new test procedure to assess the leaching characteristics of the North Star zone. This ‘Core Tray’ leach test consisted of core samples with exposed natural fracture lines, which were subsequently exposed to the leach solution flowing over the surfaces of the fracture.

Excelsior has now spent approximately $30M on various metallurgical and hydrological tests, and feels very comfortable with the results.

The final feasibility study was able to incorporate the Johnson Camp facilities into the mine plan and production plan, which resulted in the creation of a three-phased development plan. Which would gradually increase the production rate starting from 25 million pounds of copper per year in Phase I to 125 million pounds per year from the 7th year on.

The initial capex is budgeted at just $47M as Excelsior would use the Johnson Camp as stepping stone to get the production going, but tripling the output to 75 million pounds per year will require to build a new SX-EW plant and constructing additional Electrowinning cells for a total investment of $117M. And finally, increasing the production rate by an additional 50 million pounds per year would require an additional $147M in years 6 and 7, which could probably already be funded by its own cash flow from the 75 million pound per year scenario. (That being said, we see no reason why Excelsior wouldn’t be able to skip Phase 2 and immediately increase the production capacity to 125 million pounds per year once the 25M lbspa plant is up and running. This would increase the capex in the first few years of the mine life but ultimately have a positive impact on the NPV and IRR).

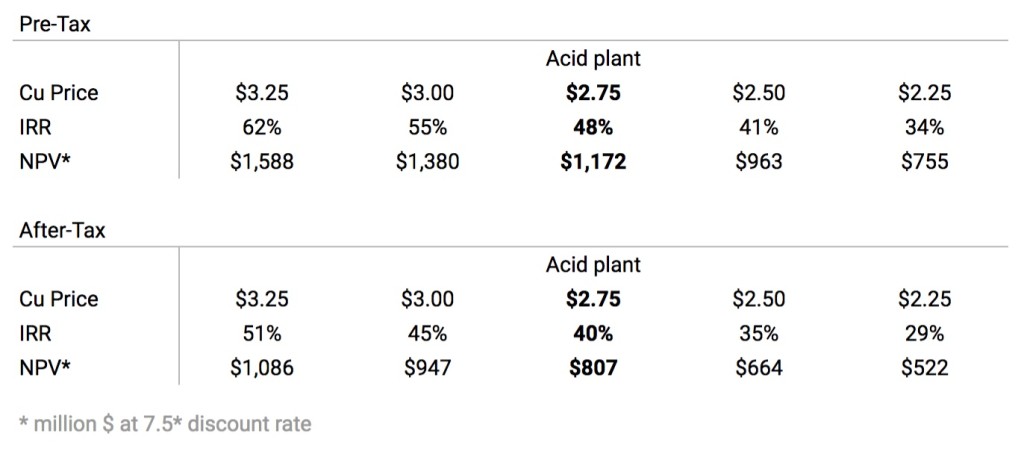

Excelsior Mining has developed two different scenarios for the Gunnison copper project; one with an acid plant and without an acid plant (which would cover the company’s acid needs for the 125M lbspa operation).

Considering the plan with the acid plant is clearly the superior business proposal, we will focus on that scenario. We are happy to see Excelsior Mining has actually provided a sensitivity analysis, which allows us immediately to see how the project would hold up under adverse market circumstances.

We already commend the company for using a copper price of $2.75 per pound as its base case scenario. That’s a very fair assumption, unlike other copper companies using $3-3.25/lbs as their base case scenario.

But thanks to the low-cost nature of the Gunnison project (with an AISC of $1.23 per produced pound of copper on an all-in basis, including the initial capex), the operating margin remains very robust and even at $2.50 copper, the operating margin will still be approximately 50%).

And even if we would use a copper price of $2.25/lbs during the entire mine life and assume a total share count of 250M shares for Excelsior Mining (currently: 168M shares), the after-tax NPV7.5% would still be C$2.75 per share. So, yes, the margin of safety is extremely robust at Gunnison, and this despite the 4% Gross Revenue Royalty due to Altius Minerals and Greenstone.

The timeline from here on

Excelsior Mining remains convinced it will be able to move fast, and the company expects to complete the permitting process in the third quarter of this year. Should this be true, it would be a major milestone for the company, and we would definitely be able to talk about a game-changer.

After all, it shouldn’t be too difficult to find the first $50M and will only focus on the Phase 2 development after having completed the first phase. So from the moment all permits necessary for the construction and production phase have been received, Excelsior should be able to hit the ground running.

As this will be an in-situ recovery (‘ISR’) project, no major open pit will have to be excavated and no huge pre-stripping activities will have to take place. That’s why Excelsior thinks it will need less than a year to complete all development activities, with commercial production to be declared shortly after completing and commissioning the wellfield. This is one of the key elements of the Gunnison project; it doesn’t happen very often to go from permit approvals to commercial production in 12 months, thanks to a short construction time of less than twelve months.

Conclusion

The Gunnison Copper project consists of a combination of interesting parameters. The property is located in a safe region and should be able to produce copper at an ultra-low all-in cost of less than $1.25 per pound. The initial capex is also quite low, and Excelsior Mining shouldn’t encounter any issues on the financial front at all.

We think the market is waiting for Excelsior Mining to receive the final permits, and perhaps to provide a ‘proof of concept’ with the first module producing 25 million pounds of copper per year. But once the company has been able to prove it knows how to produce copper from the Gunnison project, there’s no reason why Excelsior Mining should continue to trade at a huge discount to the Net Present Value of the project.

Disclosure: Excelsior Mining is a sponsoring company. We have a long position. Please read the disclaimer