All eyes were on lithium and lithium companies recently as the Electrical Vehicle (EV) sector is booming, but you can’t make batteries with just lithium. Another important component is cobalt and if there’s one metal which is heading towards a supply crunch, cobalt would top that list.

Enter the scene, First Cobalt Corp (FCC.V), which has acquired historic claims in Canada’s cobalt district where high-grade silver and cobalt were mined. First Cobalt will by far be the dominant player in the camp after entering into agreements with two other companies to merge.

A quick look at the cobalt market and why First Cobalt can make the difference

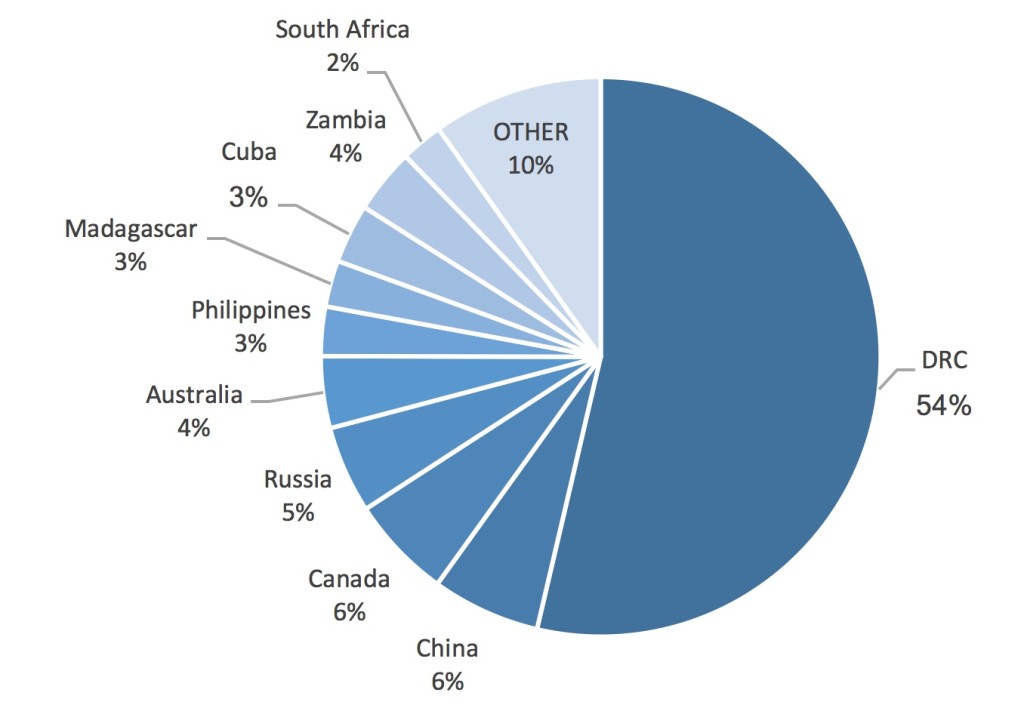

The EV sector is booming and the demand for the main components of the batteries continues to increase. The main issue with cobalt is the fact the world supply is relying on an uninterrupted supply from the Democratic Republic of the Congo (DRC), which takes care of approximately 2/3rd of the world production of cobalt.

Needless to say this is a dangerous situation as the DRC isn’t really the most stable democracy in the world (understatement), so the supply chain could easily be disrupted. Combine an uncertain supply with a booming demand, and you’ll understand the end users of cobalt would love to diversify their supply sources.

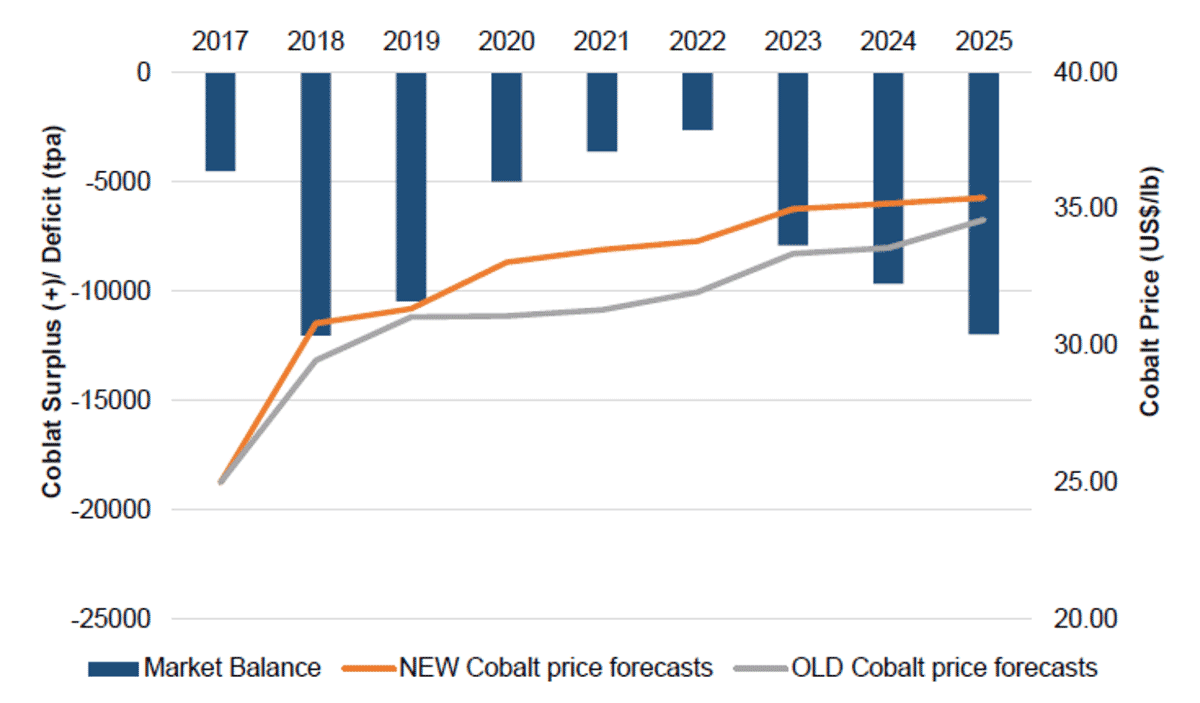

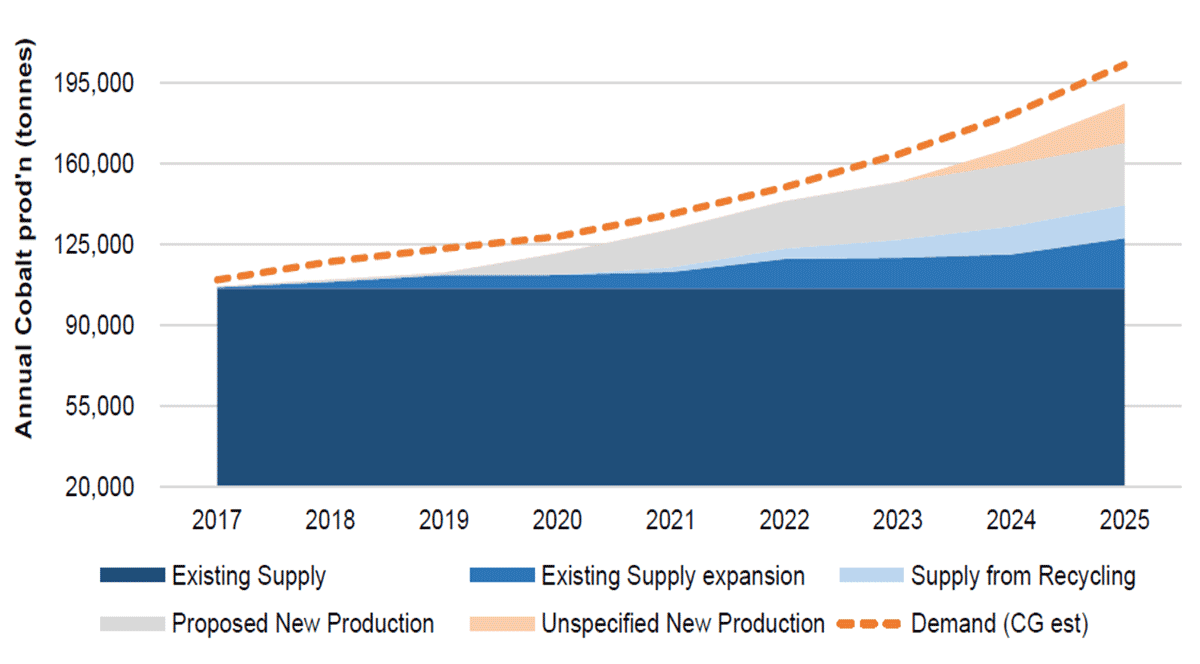

Images can tell more than words and the next few charts don’t need any additional explanation.

There’s only one conclusion; the world needs more cobalt projects, preferably in safe regions to avoid any future supply issues. And First Cobalt could be in an excellent position to cater to the market’s needs.

First Cobalt’s Greater Cobalt project: an overview

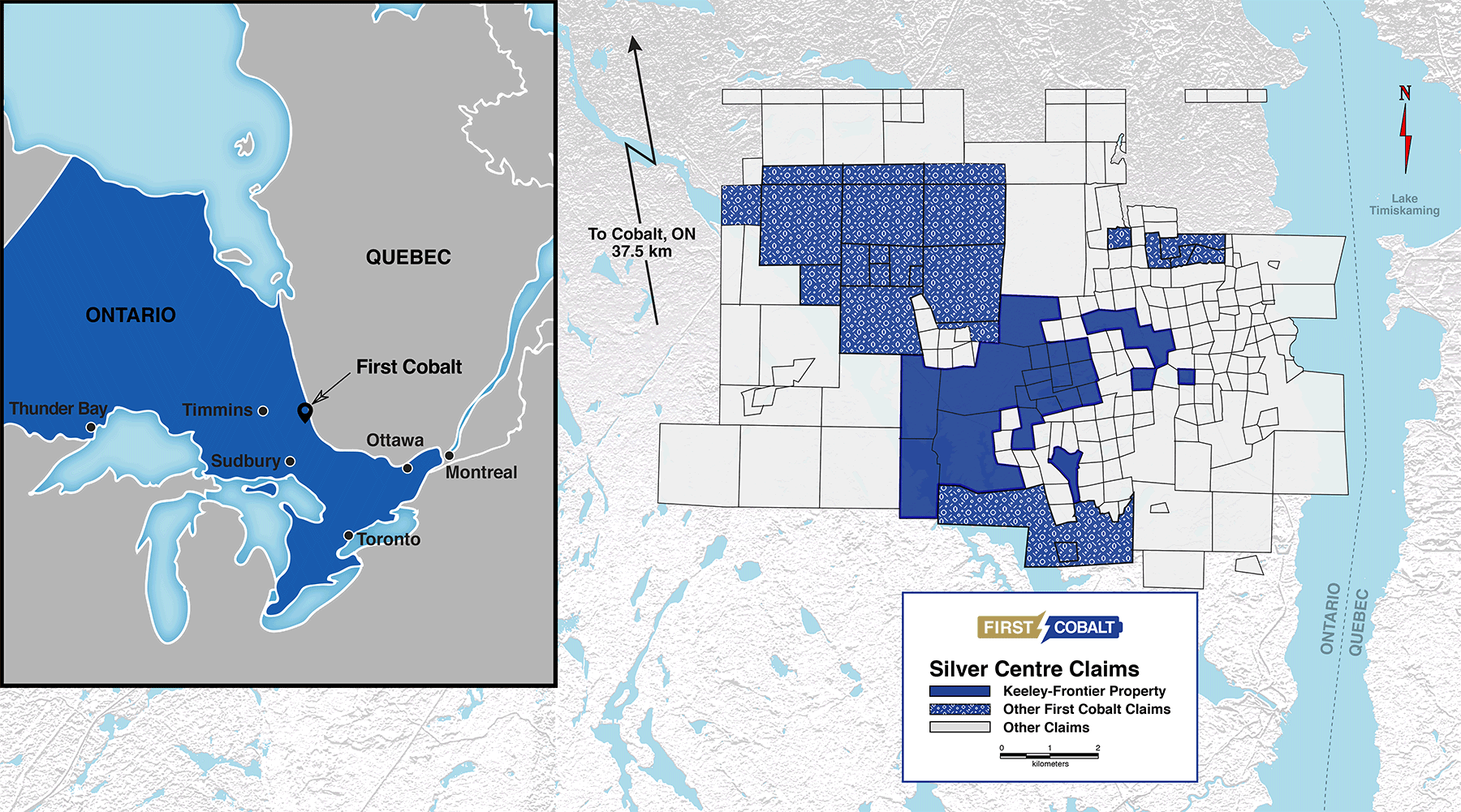

In April, First Cobalt acquired all outstanding shares of Cobalt Projects International which owned the rights to earn a 100% interest in the historic Keeley-Frontier Mine, which is owned by Canadian Silver Hunter. The project is located in Ontario, right on the border with Québec which is literally just a hundred meters away from the land claims.

To earn this 100% interest, FCC issued 4.45 million shares and can acquire a first 50% after making an additional C$500,00 payment and incurring C$1.75M in exploration expenditures. An additional 1% could be earned by paying an additional C$200,000. And finally, to go from a 51% stake to full ownership, First Cobalt will have to make a final payment of C$750,000 and spend a final C$1.25M on the property.

This earn-in agreement shows how important it is to have the first mover’s advantage, as First Cobalt has negotiated a really cheap deal as it will own 100% of the property for 4.45M shares, less than C$2M in cash payments and C$3M in exploration expenditures.

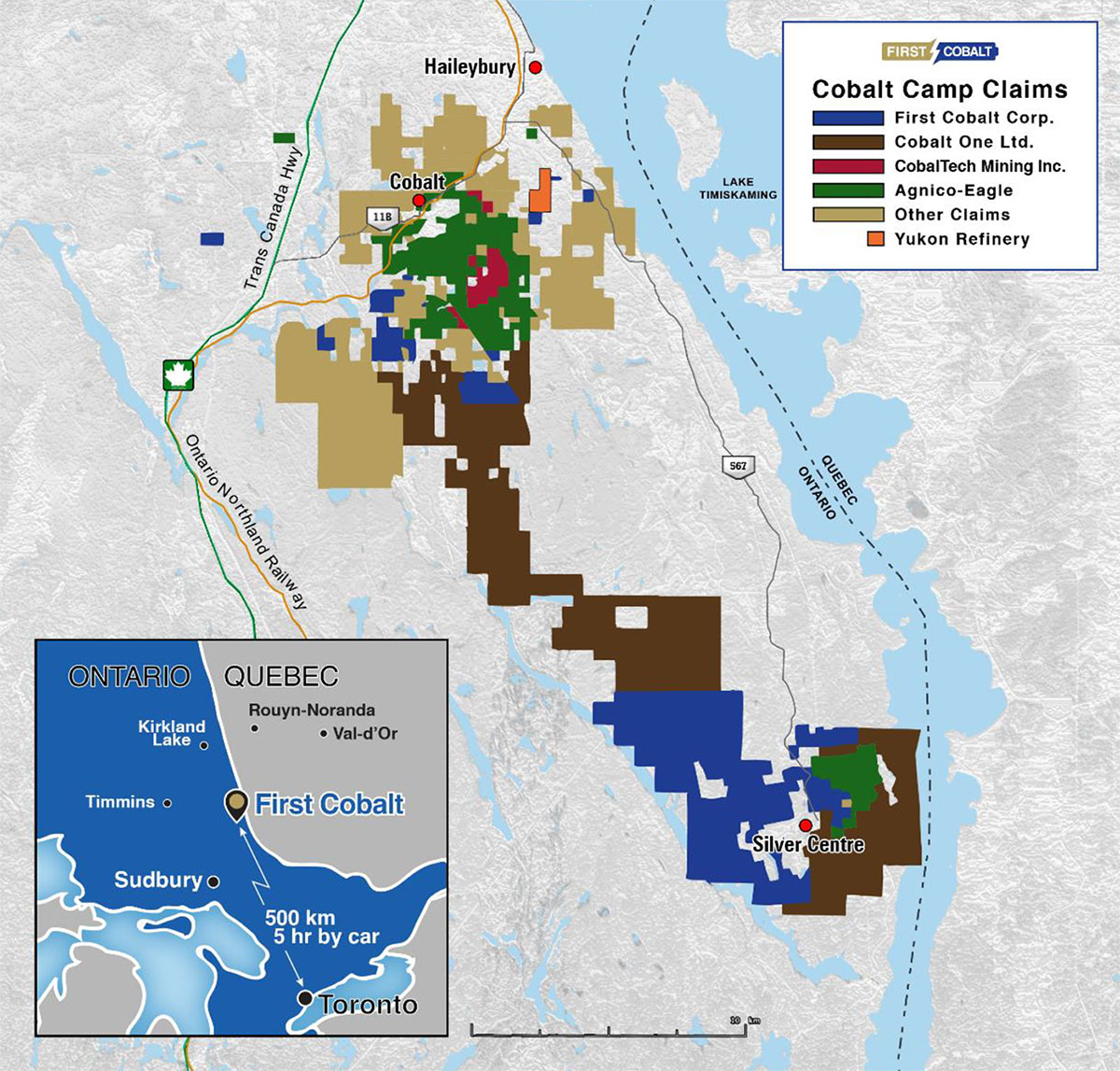

The acquisition of the Keeley-Frontier property was the first step in a series of moves to consolidate the ownership of different land packages in the area to create what’s currently known as the Greater Cobalt Project. As you can see on the next image, First Cobalt will own a substantial part of the areas of interest in the Cobalt – Silver Centre region as all claims in blue, dark brown and green will be part of the ‘enlarged’ First Cobalt empire.

Accessibility and infrastructure

The property is easily accessible as the Trans-Canada highway and the Ontario Northland Railway are running very close by, whilst the provincial highway 567 is located just a few kilometers away from the Keeley Frontier claims. On top of having good accessibility, it’s important to note Hydro One has two transmission lines either crossing the property or at least passing very closeby. As these transmission lines have a voltage of 115 and 230 kiloVolt, we are pretty certain all of the (future) power needs could be met.

The local town of Cobalt is pretty small (with just over 1,500 inhabitants), but the larger city of Temiskaming Shores is already larger (almost 10,000 inhabitants), so most of the labour could probably be sourced from the local communities and cities. As Sudbury is located just 200 kilometers south of the property boundary, we have no doubt all labour needs could easily be met.

The history of the Greater Cobalt Project

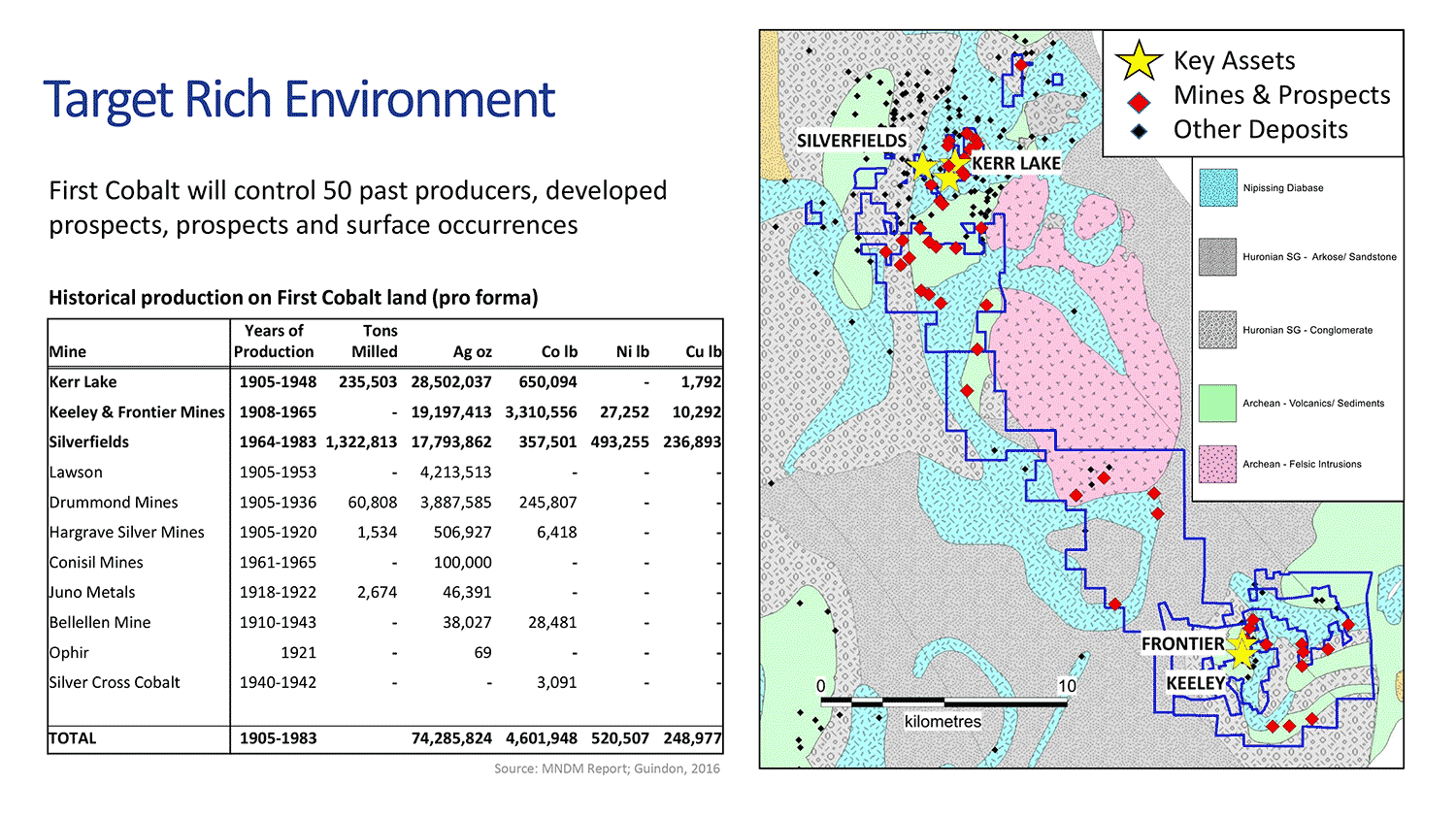

During the construction of the local railway in 1903, workers discovered high-grade silver and the production of silver and cobalt already started in 1904 and went on almost uninterrupted until 1989. First Cobalt’s technical report contains in excess of 3 pages of historical information about claim names, mine names and historical production data.

Although we would expect these results to be understated (we can’t assume the small-scale miners in the early 1900’s kept perfect records of their production results), a total of 8 million (known) tonnes were milled which resulted in the production of almost half a billion (!) ounces of silver, 23.3 million pounds of cobalt and a few million pounds of both nickel and copper. This means the entire camp had high-grade mineralization spread all over, as the recovered amount of metals was really high.

Considering the majority of the metals were recovered in the first half of the past century, the recovery rates will have been pretty low. We think it’s fair to assume the head grade of the ore would easily be 40-50% higher than the recovered grade per tonne. And you also shouldn’t worry about the low cobalt grade as the miners were chasing the silver.

Unfortunately, the historic data from the Keeley-Frontier mine doesn’t contain an estimated tonnage, but the production of 19.2 million ounces of silver and 3.3 million pounds of cobalt makes this mine one of the largest contributors of the total silver and cobalt production of the district with an interesting cobalt/silver ratio. According First Cobalt the Keeley-Frontier mine produced ore at an average grade of 58 ounces of silver and 0.5% cobalt per tonne of rock.

About the current exploration program

First Cobalt has now completed more than 50% of its original 7,000 meter drill program at the Greater Cobalt Project, and has just announced an additional 2,000 meters of drilling targeting the Bellellen Mine. The initial drill program was designed to test the cobalt rich zones of the Keeley Frontier system which have not been mined in the 1900’s. The holes will be drilled over a 2 kilometer strike length to determine the orientation of the veins and to get a better understanding of the grade of the veins which are expected to contain elevated levels of silver, cobalt and nickel. High grade surface sample results have made Bellellen a new high priority target for First Cobalt.

The now 9,000 meter drill program was based on a 3D model which was created based on the historic (production) documents and the results of a First Cobalt-initiated field mapping program which was completed in the third quarter.

Whilst waiting for the drill results to come in from the lab, First Cobalt is still sampling several muck piles on its property, and the results are actually very encouraging as the muck piles contain rock with relatively decent cobalt and silver grades. That’s intriguing as this could allow First Cobalt to mull over a plan to restart the 100 tpd mill to (re)process the muck piles, and to get a better understanding of the metallurgical details of the rocks in the wider Keeley-Frontier region.

The announced mergers with CobalTech and Cobalt One will ‘upgrade’ First Cobalt to a dominant player in the district

Being the first mover isn’t only an advantage when you’re locking up a property at an acceptable price, it also positions you in the drivers’ seat to try to consolidate the area. Smaller companies must have been thinking ‘if you can’t beat them, join them’ and two other land owners in the area are now teaming up with First Cobalt as the latter will acquire all outstanding shares of CobalTech Mining and ASX-listed Cobalt One in an all-share transaction.

This is a major step forward and this will establish First Cobalt as the dominant company in Ontario’s Cobalt camp. Not only will the majority of the land claims be owned by FCC (which will own in excess of 10,000 hectares), the combination of the three companies could also allow First Cobalt to fast-track the projects towards production thanks to the fully permitted 100 tonnes per day mill and the full ownership of the only cobalt extraction refinery in the Cobalt camp. Also keep in mind the enlarged land position contains ‘an abundance’ of muck piles which still contain reasonable cobalt and silver grades.

The strategic advantage of owning a mill and refinery is extremely important as this will reduce the operational risk, the financial risk and the permitting risk (as the production facility and refinery are both permitted). This could also mean the smaller explorers in the cobalt camp might be unable to avoid dealing with First Cobalt as it would make sense for them to use the existing facilities (and especially the refinery will be of the utmost strategic importance).

Additionally, First Cobalt will ‘inherit’ Cobalt One’s Australian shareholders and this might also immediately pave the way to tap the Australian financial markets to raise cash to advance the property. We are strongly in favour of the threeway merger and expect both CobalTech Mining and Cobalt One to be ‘absorbed’ by First Cobalt by December 2017.

Capital structure

As of at the end of June, First Cobalt had approximately 57.3 million shares outstanding, resulting in a market capitalization of C$41.2. There are also approximately 5.22 million options with an average exercise price of C$0.54 per option, and 3.6 million warrants at an average exercise price of just over C$0.095 per share.

This means that on a fully diluted basis, the share count totals approximately 66.1 million shares and should all options and warrants be exercised, an additional C$3.1-3.2M would be added to the company’s treasury. As of at the end of June, First Cobalt had a total working capital position of approximately C$4.5M.

Management

Trent Mell – President & CEO

Mell previously served as President & Head of Mining at Peartree Securities, President & CEO Falco Resources, as well as senior management positions with Aurico Gold Inc., North American Palladium Ltd., Sherritt International Corp., Barrick Gold Corp., Strikeman Elliott LLP, and Michelin North America.

Frank Santaguida – VP, Exploration

Santaguida is a geoscientist with over 25 years of experience who has worked globally on a wide range of base and precious metal ore deposits. His extensive experience in world-class base metal mining camps such as the Kidd Creek (Canada), Mt. Isa (Australia) and the African Copperbelt (Zambia-DRC) aligns with the Company’s strategy of building a geographically diversified portfolio of cobalt projects.

Peter Campbell – VP, Business Development

Campbell is a Professional Engineer with 35 years of experience in mining operations, mineral exploration and capital markets. His mining experience includes mining operations, mine design and on new mine developments for Falconbridge Limited, as Exploration Manager. In 2006, he moved into the capital markets and earned a reputation as an astute mining analyst, eventually becoming Chairman of Jennings Capital, an independent Canadian broker-dealer.

Paul Matysek – Corporate advisor

Matysek is a corporate entrepreneur, professional geochemist and geologist with over 30 years of experience in the mining industry. He was previously CEO of Lithium One, which merged with Galaxy Resources of Australia via a $112M plan of arrangement to create an integrated lithium company. He also served as CEO of Potash One, which was acquired by K+S Ag for $434 million in a friendly takeover in 2011. Mr. Matysek was also the founder and CEO of Energy Metals Corporation, a uranium company that grew from a market capitalization of $10 million to approximately $1.8 billion when sold in 2007.

Crushed stockpile & fully permitted Refinery on site

Conclusion

The old adage ‘the best place to find a new mine is in the shadow of an old mine’ is definitely valid in First Cobalt’s situation. It’s impossible to deny that the entire structural trend between the town of Cobalt and Silver Centre was the epicenter of a sizeable silver-cobalt trend. As records indicate half a billion ounces of silver and in excess of 23 million pounds of cobalt were produced, the ‘real’ total production was undoubtedly higher (as not all production results will have been documented).

We are looking forward to see the first assay results from the ongoing 9,000 meter drill program, and expect the completion of the threeway merger with Cobalt One and CobalTech Mining to be an important catalyst, as this will ‘upgrade’ First Cobalt from ‘a cobalt explorer’ to ‘the dominant cobalt-focused exploration company in Canada’ as it will be able to lock up a large part of the entire historic silver-cobalt district.

The author has a long position in First Cobalt Corp. First Cobalt Corp. is a sponsor of the website. Please read the disclaimer