Millennial Lithium (ML.V) has done pretty much everything right in the past 18 months. Immediately after acquiring the Pastos Grandes lithium project in the summer of 2016, it started an extensive exploration program which culminated in a large maiden resource estimate and a positive Preliminary Economic Assessment.

The technical report of the PEA has now been filed, and we were obviously dying to dive into the numbers to have a closer look at Pastos Grandes in its current form, and where the company could go from here.

A brief recap of the Pastos Grandes project

Without any doubt, the Pastos Grandes lithium project, just a 4.5 hour ride away from Salta, is Millennial Lithium’s flagship project. Pastos Grandes is located right in the middle of the Lithium triangle, where any company with real ambitions in the lithium sector will want to be. And even though there never is a guaranteed outcome when you’re exploring, Millennial’s team immediately discovered lithium-bearing brines at Pastos Grandes.

This eventually culminated in the company reporting its maiden resource estimate at Pastos Grandes, and this completely blew our expectations away. We were aiming for a total resource estimate containing 1-1.5 million tonnes of lithium carbonate equivalent, but with a maiden resource estimate containing in excess of 3 million tonnes (!), even we were surprised. This resource estimate was based on a total of 4,000 meters of drilling at 11 locations of which one hole was expanded into a pumping test well. This resulted in a measured and indicated resource of 2.13 million tonnes of lithium carbonate equivalent, whilst an additional 878,000 tonnes are part of the inferred resource estimate.

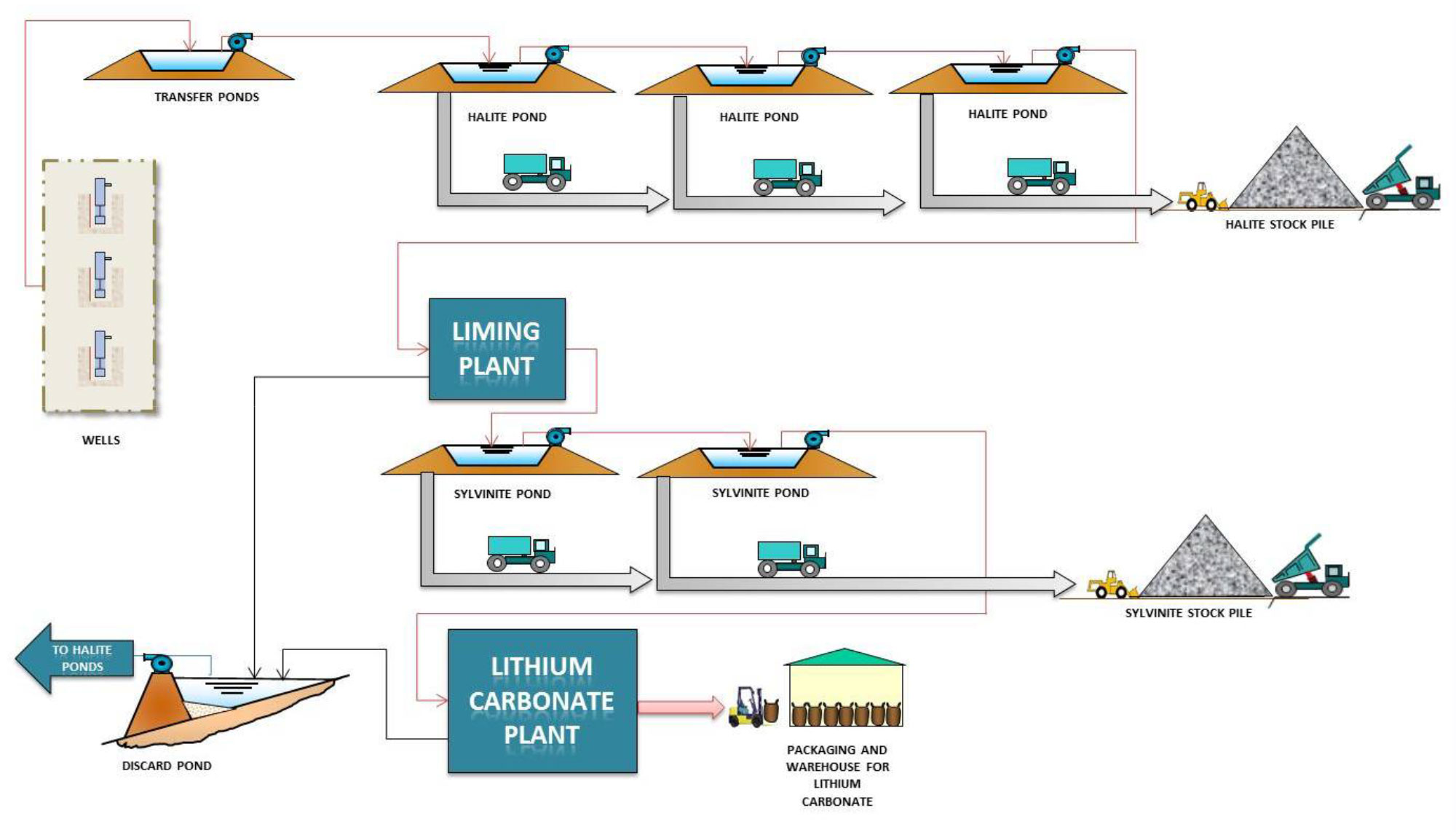

The average grade of 445 mg/liter (in the measured and indicated resource categories. The average grade of the inferred resource is approximately 469 mg/l) isn’t the highest in the lithium triangle but should definitely be sufficient to report robust economics in an upcoming Preliminary Economic Assessment, planned for 2018. Additionally, the 11.5 Million tonnes of KCl will be a very welcome by-product credit.

This excellent resource estimate allowed Millennial Lithium to immediately commission a Preliminary Economic Assessment. The first results were published in January, but we obviously wanted to wait for the full technical report to get a better insight in the economics of the project.

The Preliminary Economic Assessment has now been filed

The preliminary results of the PEA were released on January 31st, but we always like to have a look at the full report before forming an opinion about a project.

Whereas we originally expected Millennial Lithium to start with a 15,000 tpa LCE production scenario (which could then subsequently be increased to 25,000 tpa and more), it became clear the 3 million tonne LCE resource was a very robust basis for a larger project. This also helped with the economics as the economies of scale will immediately allow Millennial Lithium to capture additional benefits.

The initial capital expenditures are estimated at US$410M (for a capital intensity of US$16,400 per tonne of production, including a 17% contingency) whilst the 25,000 tonnes of lithium carbonate per year will be produced at a cost of just over $3,200 per tonne (note, it will take approximately three years to get the production up to that level). So even if we would use a lower LCE price of $8,500/t (which is substantially lower than the current price), the operating margin would still be approximately $5,000/t for a net operating cash flow of US$125M per year.

Millennial Lithium used a long-term lithium price of $13,499 per tonne, and this number was based on the average of the different forecasts for the battery grade lithium (20,000 tpa) and technical grade lithium carbonate (5,000 tpa). Using an 8% discount rate, the after-tax NPV is expected to be approximately US$824M which is in excess of C$1B (C$1.055B to be exact) at the current exchange rate.

According to the economic model, construction should start at the end of 2019, where after the initial revenue will start to come in in 2021 whilst 2022 is expected to be the first cash flow positive year.

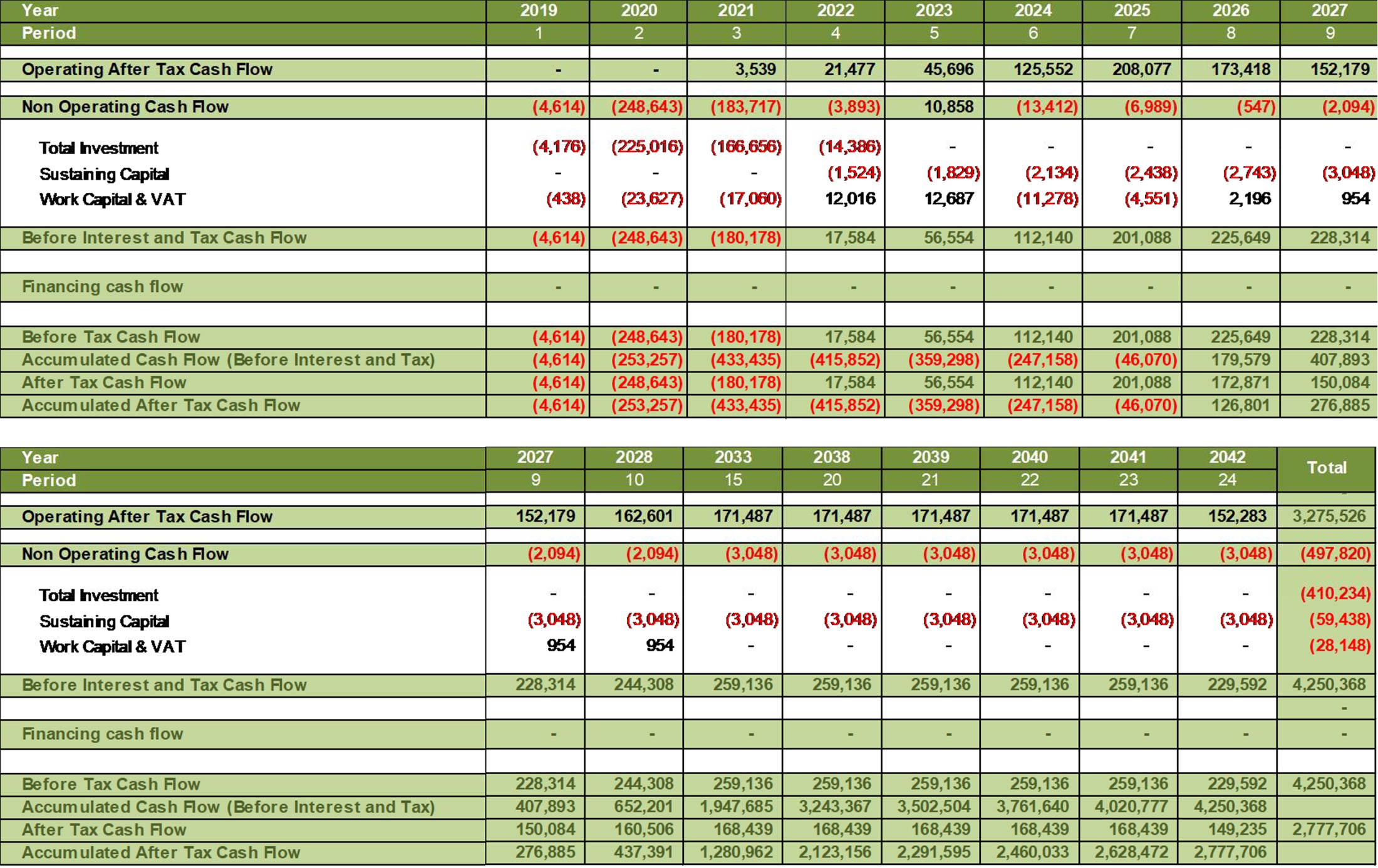

The discount rate also plays a very important role as the more substantial cash flows will only be realized from 2025 on, and the compounded discount rate has a huge impact on the net ‘present’ value of those future cash flows. As you can see in the previous table, the total net after-tax cash flow (on an undiscounted basis) is approximately 2.8B USD. Really nothing to sneeze at.

Whilst it’s acceptable to use a base case lithium price of $13,499/t, we would like to emphasize the project also works with a lower lithium price, as shown in the PEA’s sensitivity analysis. The ‘low’ price in the PEA is still relatively aggressive, but we would like to refer again to the low production cost. Even at a sub-$10,000 lithium price, the project will still generate in excess of US$150M in operating cash flow per year.

If anything, the Pastos Grandes PEA shows this is a very robust project. The NPV and IRR might be disappointing, but that’s entirely due to the relatively long construction and ramp-up period before the project will reach its designed output of 25,000 tonnes per year.

Bottom line: the Pastos Grandes project will produce lithium carbonate for several decades, at very attractive margins. The undiscounted after-tax sum of the cash flows is almost 2.8B USD, which is in excess of three (3!) times higher than the discounted NPV8%.

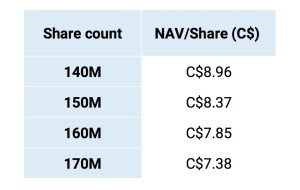

Of course, Millennial Lithium will have to issue more stock to complete the construction at Pastos Grandes (assuming a positive construction decision will be made), and on the assumption it will raise a total of C$200M to fund its equity portion and working capital during the construction phase, the NAV/share (expressed in C$/share based on the NPV + C$200M (as the raised cash will obviously have to be taken into consideration as well) using an USD/CAD exchange rate of 1.28) seems to be substantially higher than the current share price.

The resources will very likely increase

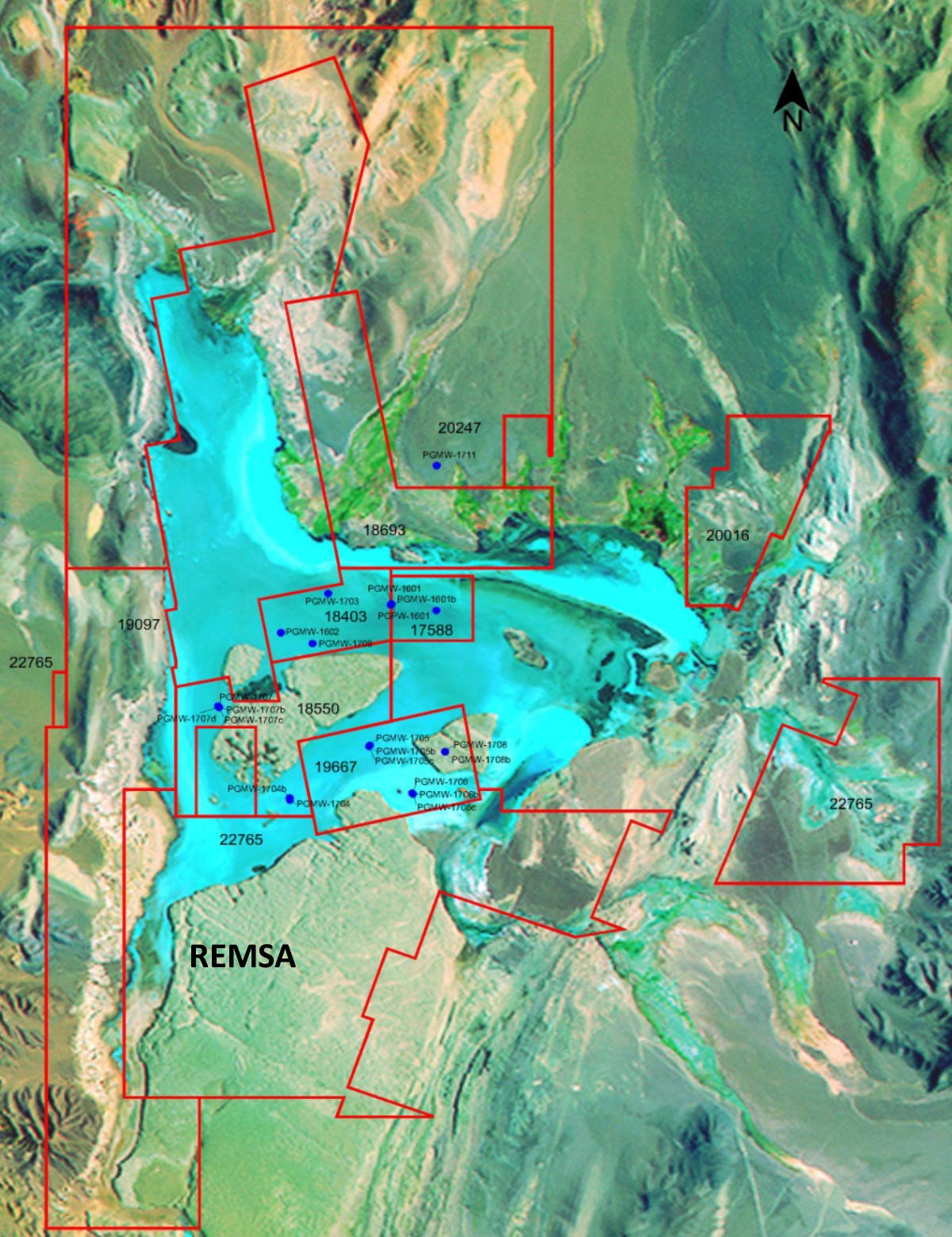

You might remember Millennial Lithium was (finally) awarded with additional claims in the second semester of last year after a delayed sales process. REMSA (the government agency of the province of Salta) awarded Millennial Lithium with an additional 2,492 hectares of land, contingent to the existing Pastos Grandes position.

It took a while before this transaction was confirmed, but all hurdles have now been cleared and Millennial Lithium is on track to earn a 100% stake in the property. As a reminder, Millennial Lithium will be required to pay almost US$7.5M in cash over 4 annual tranches and to spend US$15.4M in exploration activities on the new tenements.

Whilst Millennial Lithium will obviously have to drill this zone out in order to figure out what’s lying underneath the surface, we feel comfortable enough to assume the assay results will confirm the continuity of the brine zone on the REMSA land. As such, we would expect Millennial Lithium to be able to add 1-2 million tonnes of lithium carbonate equivalent to the existing resource estimate. Not only will this make the project one of the largest salar-based projects in Argentina (and by extension, the world), it will also make the property even more appealing for the potential end customers of the lithium, as it’s our understanding they are looking for reliable long-term supply sources.

Of course, we’ll only know for sure once the company will release the assay results of the drill program and we fully acknowledge exploration isn’t an exact science (the Pocitos West property which was optioned to Liberty One Lithium (LBY.V) wasn’t a success at all), we don’t think our expectations and assumptions are overly aggressive.

With C$65-70M in the bank, Millennial Lithium is fully funded to complete the feasibility study

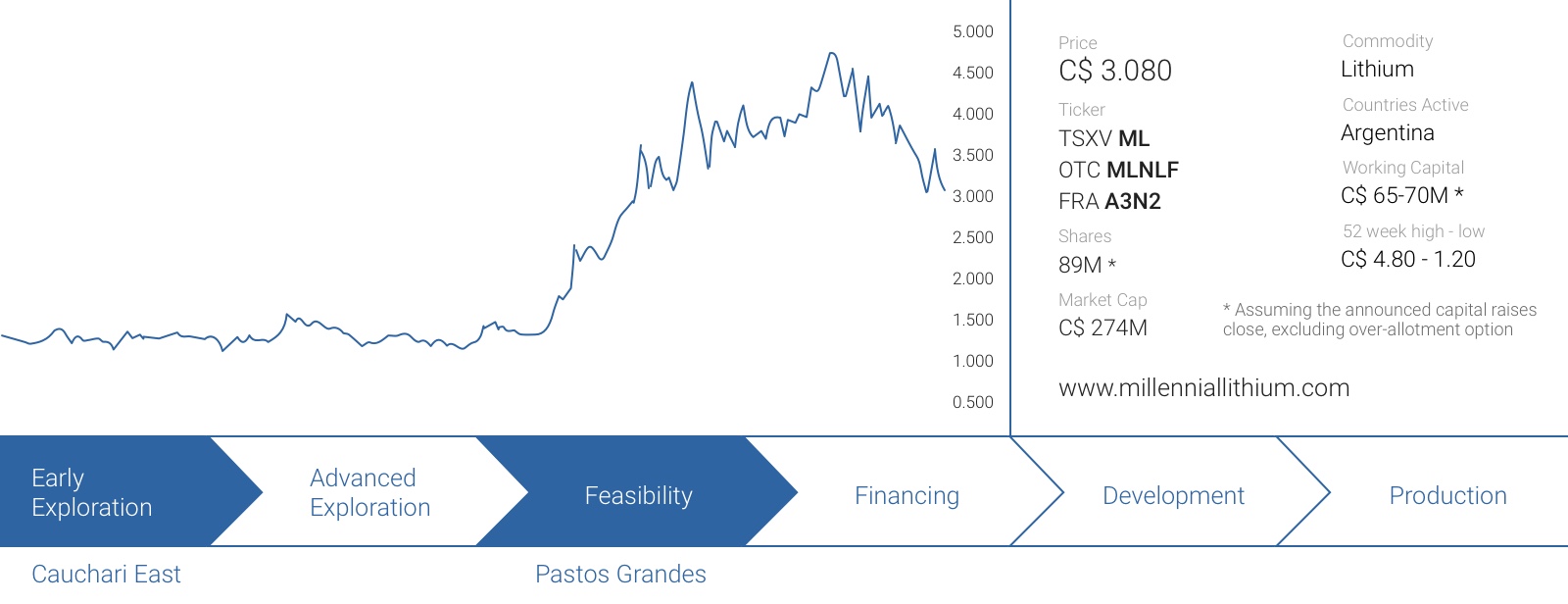

Millennial Lithium currently has a market capitalization of C$249M based on a share count of 80.8 million shares and a share price of C$3.08. However, the company will very likely complete two capital raises any day now. In a first move, a syndicate of underwriters (led by Canaccord Genuity and Cantor Fitzgerald) will raise C$21M by issuing 6 million units at C$3.50. Each unit consists of one common share and half a warrant with a full warrant allowing the warrant holder to acquire an additional share of Millennial Lithium at C$4.25 for two years.

Subsequently, Millennial Lithium’s strategic shareholder Million Surge Holdings is also putting more money in Millennial Lithium to avoid being diluted. Companies associated with MSH have subscribed for 2.2 million units at the same terms as the bought deal. This will result in Millennial Lithium raising a total of C$28.7M (before fees) by issuing 8.2 million units. This will increase the share count to 89 million shares whilst the total warrant count will increase from 7.6M to 11.8M.

The current cash position also means the company is fully funded for the proposed C$41M development plan, outlined by WorleyParsons. This development plant also includes the pilot plant, the effective cost of the feasibility study as well as the REMSA payments.

Conclusion

Millennial Lithium is ticking all boxes. With true HST-speed, it completed both a resource estimate and a Preliminary Economic Assessment. Especially the PEA provides investors with some sort of ‘tangible’ valuation on the property as we are certain VP Exploration Iain Scarr was on top of all the assumptions used in the PEA report.

With a Net Present Value of US$824M, Millennial Lithium has shown the Pastos Grandes project could be one of the world’s next salar-based lithium mines. Even if we would assume the share count to increase to 150M shares (compared to the 89M shares after closing the most recent financing), Millennial Lithium is still trading at less than half its NAV/share. And this excludes the additional exploration potential on the REMSA land package.

The share price has reached a 52 week high of C$4.80 and might have been a little bit ahead of itself, but the recent correction provides an opportunity to pick up stock at a discount of in excess of 10% compared to the level the bought deal is being completed at.

The author has a long position in Millennial Lithium. Millennial Lithium is a sponsor of the website. Please read the disclaimer