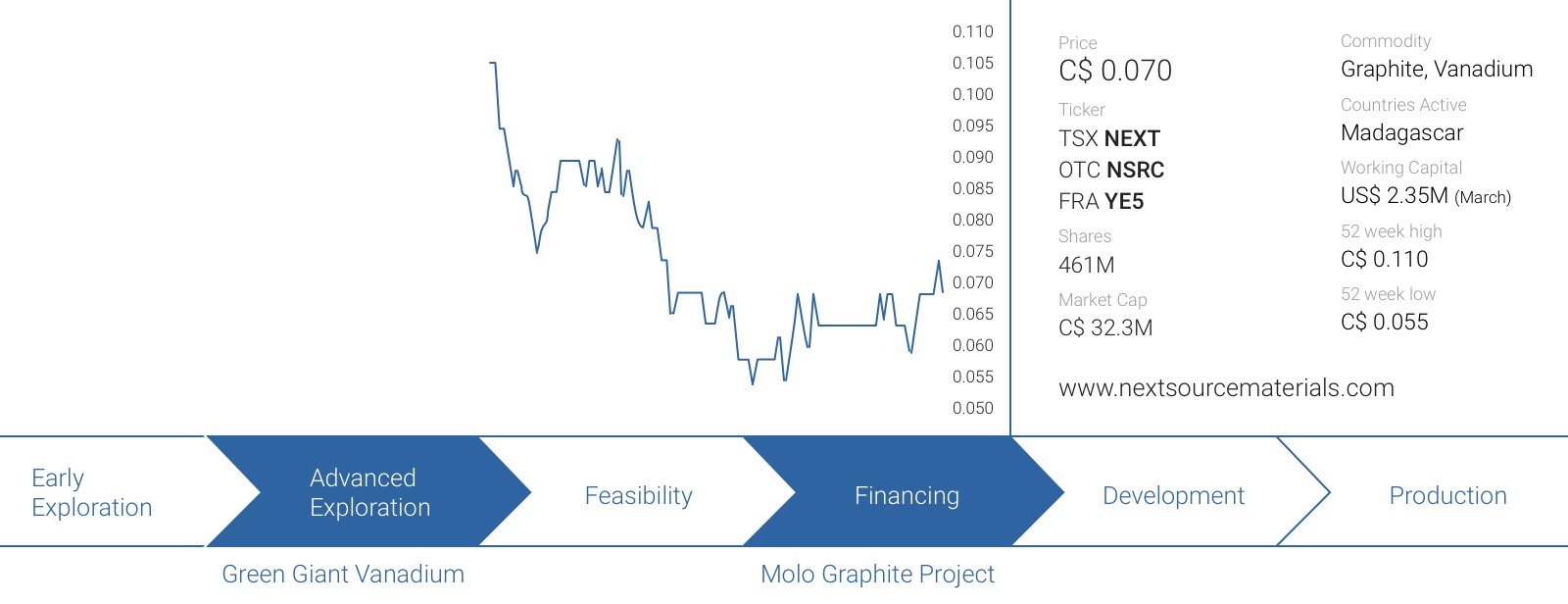

Sometimes a decreasing commodity price could be a blessing in disguise, and this seems to be the case for NextSource Materials Inc. (NEXT.TO). Whereas it was able to report very decent economics for a planned graphite mine in Madagascar in 2015, the lower graphite price practically killed pretty much every single graphite project out there as the annual cash flows suddenly weren’t sufficient to make the IRR and NPV acceptable. Most, if not all, graphite projects were rendered uneconomical overnight and only very few had the option to ‘make it work’ like NextSource did.

Tabula rasa, indeed, and now NextSource Materials is back with a new feasibility study based on an (initial) 17,000 tonnes per year. Not only did this drastically reduce the initial capex, the operating expenses on a fully delivered (CIF) basis were also reduced, making the Molo an attractive project once again which will make it easier to finance the mine.

The Molo graphite project

The Molo graphite project is located approximately 150-160 kilometers towards the southeast of Toliara, a port city and the administrative capital of the country (with Antananarivo obviously being the ‘official’ capital of the country). Molo is almost right in the middle between Toliara and Fort Dauphin, which also is a port city with modern facilities to load and unload vessels. This will also be the port that NextSource will use to export its graphite product. The port at Fort Dauphin was built with the assistance of the World Bank 5 years ago as part of Rio Tinto’s mineral sands operation (which produces ilmenite) and can easily handle more capacity.

The Molo graphite project is located approximately 150-160 kilometers towards the southeast of Toliara, a port city and the administrative capital of the country (with Antananarivo obviously being the ‘official’ capital of the country). Molo is almost right in the middle between Toliara and Fort Dauphin, which also is a port city with modern facilities to load and unload vessels. This will also be the port that NextSource will use to export its graphite product. The port at Fort Dauphin was built with the assistance of the World Bank 5 years ago as part of Rio Tinto’s mineral sands operation (which produces ilmenite) and can easily handle more capacity.

The property consists of more than 900 square kilometers and is serendipitously located in an ideal, open-pit, mining setting – a flat, sparsely populated, dry savannah-like land area situated far from the rainforest and mostly devoid of flora and fauna. NextSource has been working and exploring in Madagascar for nine years now, having invested over US$25 million to date and these efforts have allowed the company to delineate not one, but two massive resources compliant with the Canadian NI 43-101 standards – One massive graphite resource and an equally impressive vanadium resource, in terms of both size and quality. The Vanadium resource was actually discovered first and is a totally separate deposit from the graphite as both are located approximately 10 kilometers apart from each other. It was in 2012 that the company decided to focus exclusively on developing the graphite, which was then starting to develop a lot of market attention as a mineral that had a bright future as a material used in batteries.

As Madagascar is a former French colony, it shouldn’t be a surprise the BRGM (‘Bureau de Recherches Géologiques et Minières’) was the most active exploration company in the previous century, with very little exploration work having been completed since the late sixties and as far as NextSource knows, no historical trenches have been dug at Molo and NextSource was the very first company systematically exploring for graphite using trenching and geophysical surveys.

Following an extensive drill program that identified several viable graphite zones, NextSource chose the ‘Molo’ zone since it was the widest of the bunch and rapidly advanced the project to reach a measured reserve status over the subsequent three-year period. In all, NextSource has identified over 300 continuous line-kilometres of flake graphite, all immediately at surface on its property. It is safe to say that the company has sewn up an almost inexhaustible amount of graphite within its property boundaries, with only a fraction of that being included in the current total of 100 million tonnes in the measured and indicated resource categories (at 6.25-6.3% C) with an additional 41 million tonnes in the inferred category. The total reserve basis is approximately 22.4 million tonnes of ore at an average grade of 7.02% C.

When it comes to the metallurgy of the Molo project, it is completely de-risked. Back in 2013, NextSource conducted the largest pilot plant to date of any graphite project globally at Canada’s renowned SGS Minerals Lakefield, who has completed pilot plants for over 12 graphite projects. But none of the other pilot plants even compared to the scale of NextSource’s. The company extracted 200 tonnes of ore (consisting of two 100 tonne samples collected from a lower grade area and a high grade area, to make sure the metallurgical test work would be performed on a representative sample), which was then processed through the pilot plant, producing over 13 tonnes of graphite concentrate.

The results were very successful as the test runs confirmed the Molo ore could result in the production of a concentrate with an average grade of 97.2% TC at a carbon recovery rate of almost 90%. It’s also important to emphasize the flake size distribution as it is well above the global average for graphite mines. Over 46% of the Molo deposit contains the premium-priced large (+80 mesh) and jumbo flake (+48 mesh) product and only 21% contains the smaller flake size (-200 mesh) at over 98% purity being achieved with standard flotation alone.

All 13 tonnes of SuperFlake® (now a registered trade mark) concentrate were sent to various potential off take partners and name-brand end users across all demand markets for extensive evaluation. NextSource is the only company that – as far as we know – has been able to send multi-tonne samples to potential off-takers for product testing and verification, a requirement for final quality assurance testing by third-parties.

The previous feasibility study was focusing on a large graphite operation

We won’t waste your time by discussing an already outdated feasibility study, but we just wanted to provide you with a brief overview, which will make it easier for you to compare both studies.

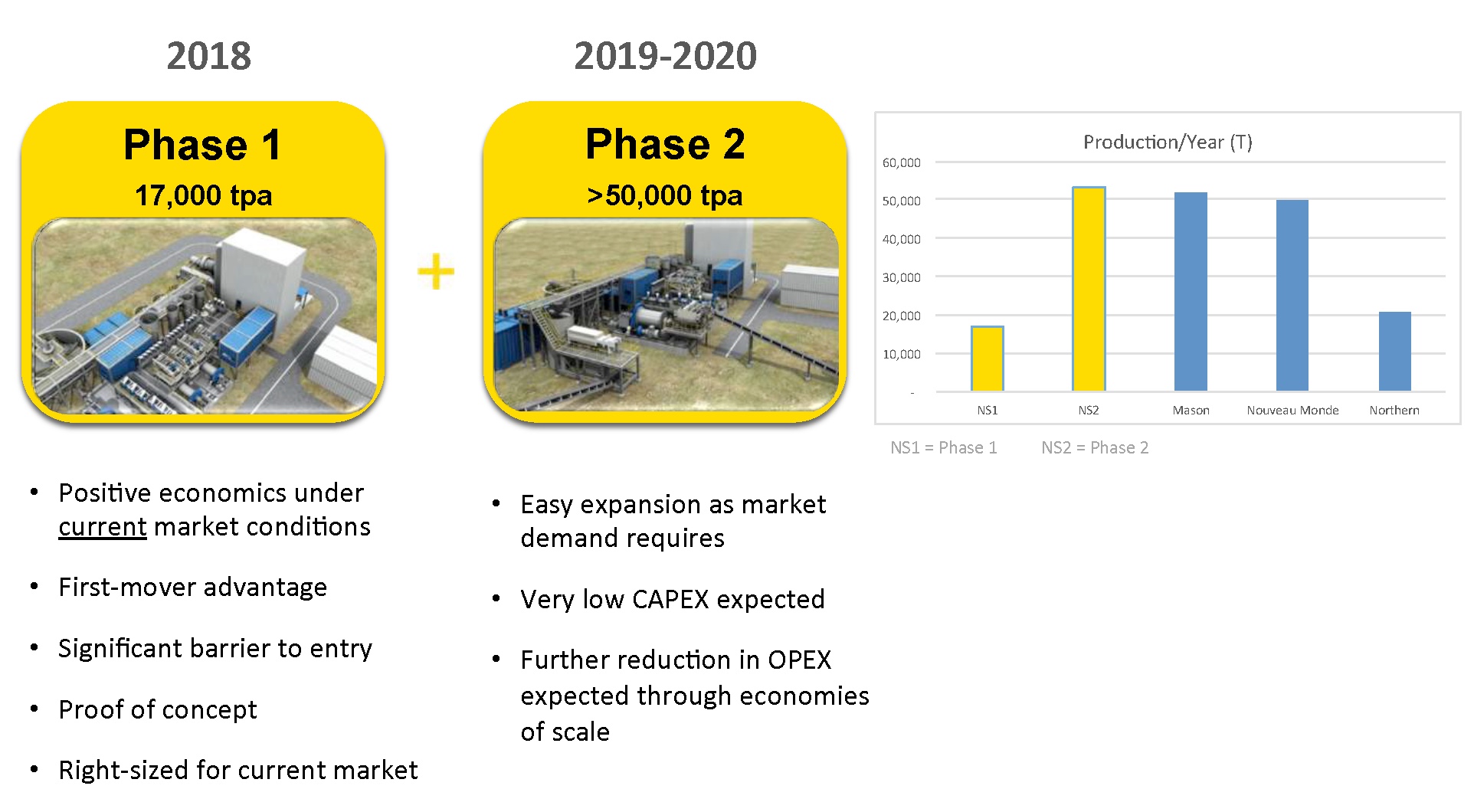

The 2015 feasibility study discussed the potential to build a mine with an average production rate of 53,000 tonnes per year over a mine life of 26 years based on a total reserve statement of 22.5 million tonnes (which is less than a quarter of the total resource estimate at Molo). Whilst the initial capex of US$150M was very reasonable given the average production rate and the operating margin of almost exactly $1000/t (which resulted in a payback period of less than 5 years and an average annualized operating cash flow of $53M), things changed dramatically when the graphite price turned south.

If we would apply the currently anticipated sale price of $1014/t, the project would generate an operating cash flow of just $15M, which would barely be sufficient to cover the interest payments, sustaining capital expenditures and the G&A on the corporate level.

Needless to say the project, and every other competing one, would be dead in the water. Unfortunately the market realized that although NextSource’s Molo project is very high in quality, it would have had no chance in attracting the needed mine equity. But a lot has changed now, since that 2015 study.

The new, modular approach, a “game-changer” in low graphite price environment

Big isn’t always better, and that’s what NextSource Materials realized as well. Whilst a net present value of almost $400M (based on a 10% discount rate) might sound attractive for NPV investors, a key issue arose; the graphite price started to decrease, which made it more difficult to fund the initial capital expenditures.

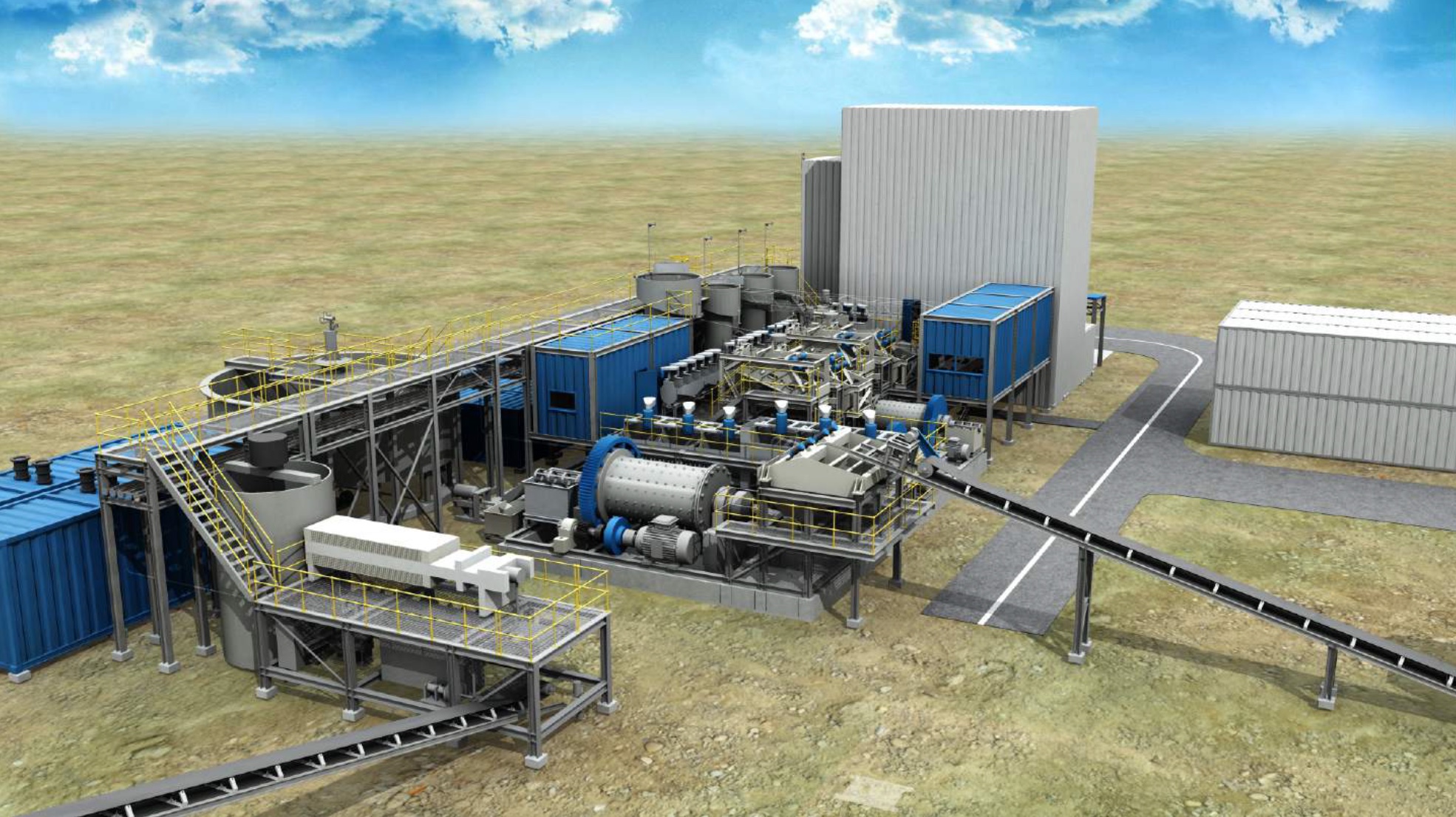

The company realized very early on that facing these negative market conditions, it needed to go back to the drawing table and look at an entirely new concept to mining – a 100% modularized build approach. Instead of immediately trying to build a sizeable mine, NextSource considered a more pragmatic approach by building the mine in two stages, with the initial stage being a 17,000 tonne module.

Not only would it be much easier to finance a much lower initial capex, it would also allow NextSource to enter into the market quickly, create a barrier to entry for other projects behind it and provide to potential buyers a crucial proof-of-concept. By going this route, buyers would be encouraged to try NextSource as a new supplier and then have the confidence to increase their purchase commitments when additional production modules are eventually added to the processing sequence.

The results of this updated feasibility study were released to the market this past June and the technical report was filed in July. In this new scenario, NextSource’s mine plan is now a two-phased plan, with Phase 1 having a production rate of 17,000 tonnes of SuperFlake® concentrate per year as its base case scenario with an initial mine life of 30 years and a second phase, which is the expansion to over 50,000 tonnes.

And the best part of the update? The initial capex for Phase 1 has now been reduced to just US$18.4M, the lowest capex of any junior graphite project globally and with just a 9-month build time. Not only is this financeable, the low capex hurdle and the ability to be in production in 2018 has catapulted NextSource into the pole position for offtake contracts and potential strategic partnerships. This updated feasibility study has shown the market it can actually reach production and accomplish this faster than any other graphite hopefuls behind them.

The operating expenses for these 17,000 tonnes per year were estimated at $433/t, and the company has based its economics on a total cost of $688/t upon insured delivery in the Port of Rotterdam (we think NextSource might be able to reduce these transportation expenses further, which would increase the operating margin). As the company uses an average selling price of $1014/t, the operating margin is approximately $325/t, resulting in a net cash flow of approximately US$5-5.5M per year and a payback period of less than 4 years once the full production rate has been reached (and 4.8 years on an after-tax basis including the ramp up period).

An after-tax IRR of 21.6% and NPV of US$25.5M might seem to be ‘ho-hum’ at first sight, but we would like to make two remarks here. First of all, the updated feasibility study was focusing on cutting the capex whilst keeping the economics sufficiently attractive to secure funding. The final mine plan remains at the approximate 50,000 tonnes per annum (tpa) but NextSource is doing a very smart thing by executing its production plan in two phases. The initial Phase 1 production of 17,000 tonnes is a realistic and sensible production rate and not small by any means, as it is 50% more than the average global operating graphite mine (11,000 tpa) and would rank the Molo among the top graphite producers in the world. Secondly, due to the 8% discount rate, the cash flows generated from Y10 on are discounted by a factor of 2.15, 2.33, 2.52 and so on. This means that even if NextSource’s Molo project generates a free cash flow of US$5M in year 12, it would only count as less than $2M in the NPV calculation. In fact, the pre-tax total net cash flow of the project is in excess of US$100M so the impact of the discount rate is very clear.

Considering the (initial!) mine life is estimated to be 30 years, we could argue NextSource should not only be valued based on net present value result. It could be more fair to use a cash flow multiple and even if we would use a multiple of just 10, NextSource could command a valuation of US$50M. This is just based on the first phase and it is worth repeating again that the 17,000 tpa scenario most definitely won’t be the final production rate as NextSource’s plan is to reach the 50,000 tonnes per year as quickly as market demand requires, using the same modular approach.

The next steps will now be to secure the final few permits and offtake agreements, which will facilitate the negotiations to secure equity and debt funding.

What we just described is the value of Molo as a ‘normal’ graphite project and excludes the additional potential related to further processing the SuperFlake® graphite through for instance purification, spherodization and thermal expansion. However, NextSource has already confirmed to the market that its SuperFlake® concentrate meets or exceeds all quality requirements for lithium-ion batteries, expanded graphite (foil) applications, graphene inks and of course refractories for the steel industry which remains the number one demand driver for flake graphite, accounting for 65-70% of the global consumption for flake graphite. With the company currently investigating all of these possibilities as additional value-add opportunities for its SuperFlake® concentrate will further increase the overall value of the product and thus the project and company.

View of the Molo Project area showing the nature of the vegetation (left). Trenching for the Bulk Sample on Molo, May 2013 (right).

About Madagascar

We thought it could be useful to have a look at how the country is being perceived. As with any third world country, Madagascar is not without its problems. While known as one of the poorest countries in the world, it is starting to be recognized internationally as a mining destination and one of the few places left on earth that is relatively unexplored for its mining riches. Mining, textiles and agriculture are Madagascar’s three most important industries for tax revenues and the government has aggressive mandates to grow those along with tourism. Among the global graphite buyers, Madagascar is renowned for its large size and high-quality flake and has been exporting graphite for more than a century, but never in large quantities. NextSource’s Molo project is poised to change that and could vault Madagascar into one of the world’s largest producers.

Since the nation’s return to democratic rule in 2014, Madagascar has been on a bit of a roll with the international community in its efforts to attract foreign investment into the country. In 2015, then U.S. President Obama reinstated Madagascar to the African Growth and Opportunity Act, or AGOA which reinstated Madagascar’s eligibility as a preferred trading partner to the United States. It is predicted that the reinstatement could increase exports to the United States by as much as 70 percent and create thousands of local jobs.

That proclamation on Madagascar from President Obama was the latest in a string of positive validations from world governments and organizations since the democratic election in January 2014 of the Canadian-trained chartered accountant President, Hery Rajaonarimampianina. Recognition of his commitment and progress to date in rebuilding Madagascar’s economy has brought public endorsements of the government by the African Union, the IMF, the EU, the World Bank and the UN’s own Secretary-General, Ban Ki-moon.

The Government of Canada also officially engaged Madagascar’s government in 2015 to rebuild economic and strategic resource ties, sending its Minister for Department of Foreign Affairs, Trade and Development to Madagascar and publically stated that Canada is committed to work toward the signing and ratification of the Canada-Madagascar Foreign Investment Promotion and Protection Agreement and is now identified as a priority market in the Canadian government’s Global Markets Action Plan. Needless to say this puts NextSource Materials as a Canadian company in a good position with the Madagascar government.

Canada’s Department of Natural Resources classifies trade between the two countries as “moderate”, however Canadian investments in the mining sector in Madagascar are significant. Both Sheritt International’s US$8.5 billion Ambatovy Nickel Project and NextSource’s Molo Graphite project have been cited as the most notable mining operations in the country.

As a large part of Madagascar’s GDP is created by the large Ambatovy mine, the country is definitely familiar with mining and metals, and understands it’s an excellent sector to A) employ people and B) get foreign currency inside the country. The other very large mining project on the island and proximal to NextSource’s Molo project is Rio Tinto’s US$1 billion ilmenite sands project. These two projects have codified the mining laws in Madagascar and have opened the country to interest from other major mining companies looking to expand operations in African jurisdictions.

A final advantage of the project’s location could be the easier access to French banks. We think French banks understand mining and Madagascar (as an ex-colony) and this experience and expertise could result in French banks offering superior deal terms on debt funding.

The initial capex and mine size are what sets NextSource apart from the others

Sure, there are plenty of graphite hopefuls in this world, but we are pretty certain most of them will never reach the production phase as they are either too capital intensive (a high initial capex per tonne of concentrate production) whilst others are way too large. Without pointing fingers, there’s absolutely no way any company could sell hundreds of thousands of tonnes of graphite concentrate in the market and effectively receive the prices they used to build their feasibility studies on.

And you don’t have to just believe us. Just wonder why all those other companies which completed a feasibility study years ago still haven’t been able to secure construction funding or binding offtake agreements…

Corporate information

NextSource Materials is no doubt readying itself to go back to the market shortly to raise the mine construction financing package. Currently, the company has a total share count of almost 461 million shares, giving it a market capitalization of approximately C$32M based on the closing price of C$0.07. The company has no debt.

Craig Scherba – President and Chief Executive Officer

Mr. Scherba was appointed President and Chief Operating Officer in September 2012 and has been a director since January 2010. Previously, Mr. Scherba served as Vice President, Exploration of the Company since January 2010. Prior to joining the Company, Mr. Scherba was a managing partner for six years with Taiga Consultants Ltd. (“Taiga”), a mining exploration consulting company. Mr. Scherba has been a professional geologist (P. Geo.) since 2000, and his expertise includes supervising large Canadian and international exploration programs. Mr. Scherba was an integral member of the exploration team that developed Nevsun Resources’ high grade gold, copper and zinc Bisha project in Eritrea. Mr. Scherba served as the Company’s Country and Exploration Manager in Madagascar during its initial exploration stage, discovering both the Molo Graphite and the Green Giant Vanadium deposits.

John P. Sanderson – Chairman (Non-Executive)

Mr. Sanderson has served as Chairman of the Board of Directors of the Company since March 2016 and prior to that, was the Vice Chairman of the Board since October 1, 2009. Mr. Sanderson is a mediator, arbitrator, consultant and lawyer called to the Bar in the Canadian Provinces of Ontario and British Columbia and brings many years of legal and mediation expertise from various industries. He has acted as mediator, facilitator and arbitrator in British Columbia, Alberta, Ontario and the Northwest Territories, in numerous commercial transactions, including insurance claims, corporate contractual disputes, construction matters and disputes, environmental disputes, inter-governmental disputes, employment matters, and in relation to aboriginal claims. He is a member of mediation and arbitration panels with the British Columbia Arbitration and Mediation Institute, the British Columbia International Commercial Arbitration Centre and Mediate BC. Mr. Sanderson also currently serves as the Chairman of the Board of MacDonald Mines Exploration Ltd., a publicly listed resource exploration company headquartered in Toronto, Canada.

Robin Borley – Senior Vice President, Mine Development

Mr. Robin Borley is a Graduate mining engineering professional and a certified mine manager with more than 25 years of international mining experience building and operating mining ventures. He has held senior management positions both Internationally and within the South African mining industry. He has most recently served as Mining Director for DRA Mineral Projects and was instrumental as the COO of Red Island Minerals in a developing a Madagascar coal venture.

His diverse career has spanned resource project management, evaluation, exploration and mine development. Robin has completed several mine evaluations including operational and financial evaluations of new and existing operations across a diverse range of resource sectors. He has experience in the management of underground and surface mining operations from both the contractor and owner miner environments.

From 2006 through to 2012, Robin participated in the BEE management buy-out transaction of the Optimum Colliery mining property from BHP, through its independent listing and its ultimate sale to Glencore in December 2012.

Brent Nykoliation – Senior Vice President, Corporate Development

Mr. Nykoliation joined the senior management team at NextSource Materials as Vice President, Corporate Development in 2007 and oversees the fundraising and investor relations for the Company. He brings over 16 years of management experience, having held senior marketing and strategic development positions with several Fortune 500 corporations in Canada, notably Nestlé, Home Depot and Whirlpool.

Mr. Nykoliation holds a Bachelor of Commerce (Marketing) with Honours degree from Queen’s University and also serves as a director of Red Pine Exploration Inc., (TSX.V:RPX) a publicly listed gold resource exploration company headquartered in Toronto, Canada.

Conclusion

Whilst a mine based on the previous study would not be feasible in the current graphite price climate, NextSource has done what no other junior graphite project has yet been able to do – demonstrate an economic project using both current graphite prices and a realistic production volume – all thanks to a new, modular approach. Yes, the annual cash flows will be lower for this initial phase, but with a total capex of less than $20M, the returns remain relatively attractive as the company demonstrates proof of concept to the market. If successful, their unique modular approach could very well revolutionize how mines are built.

Granted, a 21% IRR based on the current graphite price isn’t something to get wildly excited about, but the NPV is entirely based on 30 years of 17,000 tonnes per year and does not take a production increase into account. And that’s where the real ‘hidden’ value of NextSource Materials could be. Phase I of Molo is nice to get things going, but the ultimate target is still to develop a 50,000 tpa graphite mine which would then generate US$16M in operating cash flow per year. Even after taking sustaining capex and taxes into consideration, an annual free cash flow of C$14-15M would still be achievable, which would indicate a FCF/share of C$0.03/share (based on the current share count). We noted that the company has already received shareholder approval to consolidate the shares up to a 10:1 basis and we would assume the consolidation would take place simultaneously as part of the capital raise.

Of course, it could take a few more years to get to that 50,000 tpa ‘sweet spot’, but at least NextSource’s management is doing whatever it takes to get things going to create shareholder value, instead of waiting for a higher graphite price.

The author has a long position in NextSource Materials. The company is a sponsor of the website. Please read the disclaimer