At the PDAC conference in March in Toronto, we were introduced to Feisal Somji’s newest company, Prize Mining (PRZ.V). Prize had been halted for an extended period of time whilst it was completing a property acquisition in British Columbia.

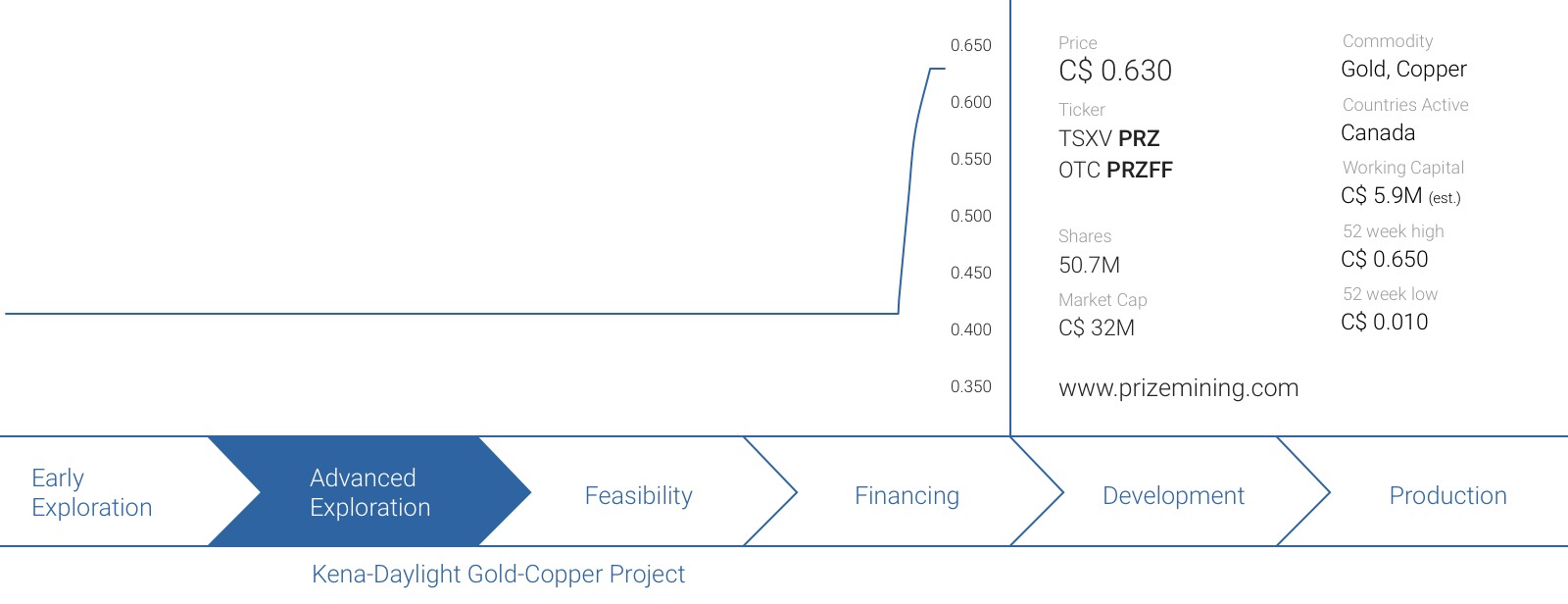

The company is now trading again, and in this report, we have a closer look at Prize’s property and plans for the near-term and longer term future.

Feisal Somji has a good track record

As mentioned in our introduction, perhaps Feisal Somji as ‘human’ asset was the main reason for us to dig a bit deeper into Prize Mining and its Kena project.

Somji has several decades of experience in the mining sector and whilst he started as a manager of a mine development services company, he got involved with the corporate side of mining businesses as well. After gaining this invaluable experience he became the founding president and CEO of Rio Alto Mining, a Peru-focused gold producer whose La Arena project produced in excess of 100,000 ounces of gold per year and was the stepping stone to build the company out to become a mid-tier producer. Rio Alto credited Somji for identifying and acquiring the property which grew out to be the La Arena mine.

Unfortunately (or, fortunately for the Rio Alto shareholders!), the company was unable to execute all its plans as Tahoe Resources (TAHO, THO.TO) took Rio Alto out for $1.1B in 2015. By that time, Somji was no longer involved with Rio Alto after having served as it’s Vice President Corporate Development and CEO from 2007 to 2011.

Other management

Feisal Somji, Bsc, Mba – CEO and Director

Mr. Somji has 20+ years of experience ranging from grassroots exploration to mine development. Mr. Somji started his career managing an exploration and mine development services company with over 100 employees and divisions including diamond drilling, ground and airborne geophysics, geological consulting, geochemical analysis and laboratory services. He has acted as an officer and director of several public companies involved in gold, diamond, silver, copper, base metal and platinum assets in North America, South America, Asia and Africa. Most recently Mr. Somji was the founding President and CEO of Rio Alto Mining Ltd, with it’s La Arena gold/copper mine in Peru, having achieved commercial production in 2011, with a current annual production rate of approximately 150,000 ounces of gold from 4,000,000 tonnes of ore. Rio Alto was acquired by Tahoe Resources in 2015 for approximately $1.3 Billion. Mr. Somji also provides expertise in areas of corporate finance and governance where he has raised over $125 million and helped several projects go public. Mr. Somji has a B.Sc. from the University of British Columbia and an MBA from Queens University.

David Schmidt – Director

Mr. Schmidt completed his Bachelor of Applied Science (Mining) at the University of British Columbia in May, 2000, and since then has been working as a self-employed consultant to mineral exploration companies. He assists with financings, corporate and financial disclosure and corporate development. Mr. Schmidt is also currently a director of several other public companies

Tim Bergen – Director

Mr. Bergen has over 25 years of entrepreneurial experience including 21 years in mining. Mr. Bergen was the CEO of CanAm Corp (TSX-V: COE) from 2006-2012. Mr. Bergen has acted on a number of public boards since 1997, and was also founder and lead developer of Vindt Resources, a wind energy company that was amalgamated in 2008 with Shear Wind (TSX-V: SWX) where he acted as a director, SWX was bought out by Sprott Power in 2012 . Prior to getting involved in public company business Mr. Bergen grew up working in family owned alluvial gold mines in British Colombia and over the years has sold two of his privately owned companies to large international corporations including a fortune 500 corporation. Mr. Bergen currently sits on the board of Prize Mining Corp (TSX-V: PRZ-H)

Anthony Jackson – CFO

Mr. Jackson brings experience in corporate compliance, financial advisory and financial reporting activities to public and private companies with Jackson & Company. Mr. Jackson spent a number of years working at Ernst & Young LLP and obtaining his CA designation before moving onto work as a senior analyst at a boutique investment banking firm. Mr. Jackson holds a bachelor of business administration degree from Simon Fraser University and the professional designation of chartered professional accountant (CPA and CA), where he is a member of the B.C. and Canadian Institute of Chartered Professional Accountants. Most recently, Mr. Jackson has had extensive experience as a director and officer of numerous publicly traded corporations.

The right people with the right project: the Kena project

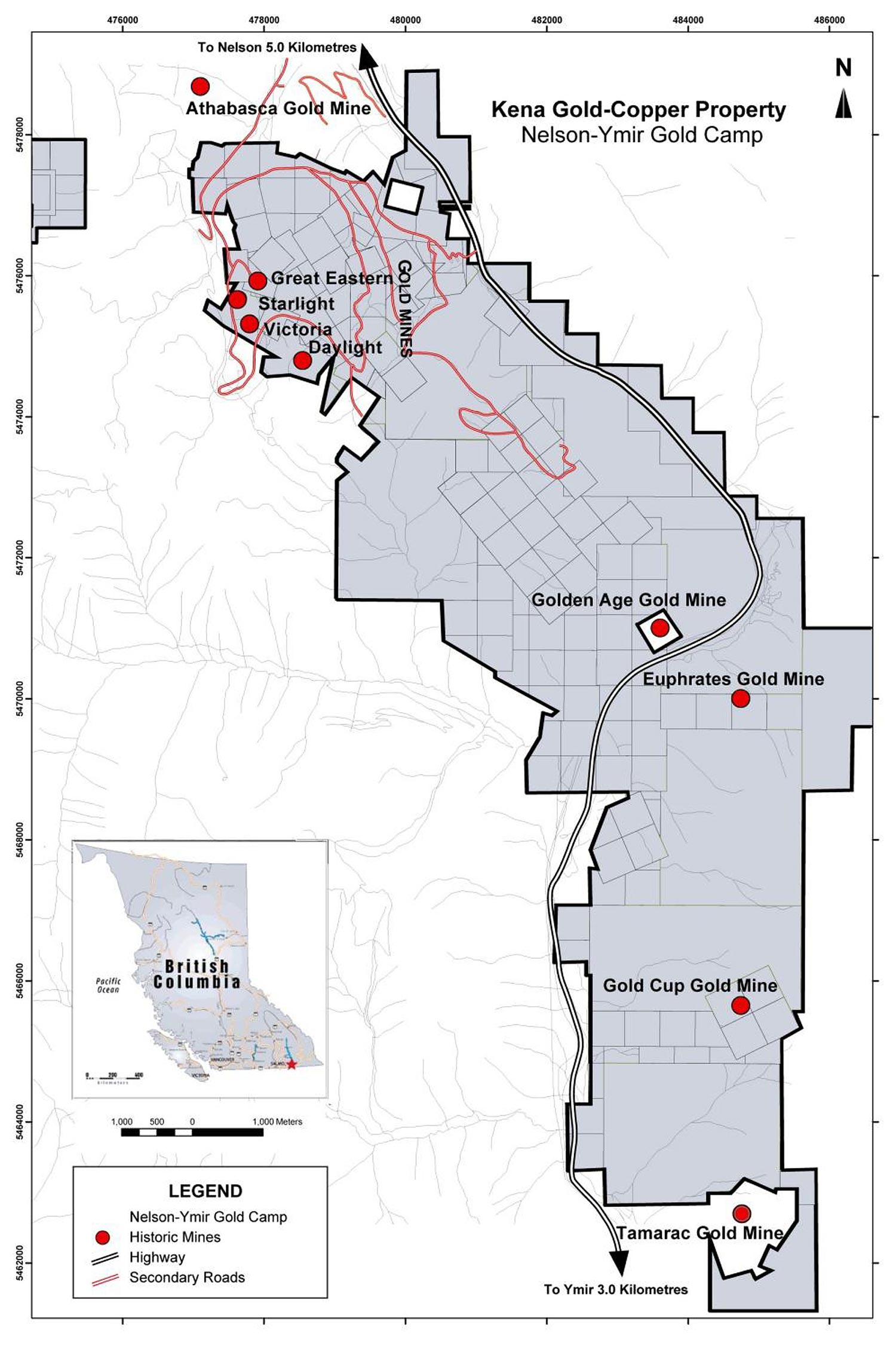

The Kena project has a total surface area of approximately 8,000 hectares in the Nelson region of British Columbia.

It’s very easy to access the property as you can basically drive (or walk!) from Nelson along Highway 6 for 6-7 kilometers which brings you to the northern part of the Kena project. The project has been historically known for its gold occurrences (and the Daylight property hosted several small historic gold mines) as back in the 1800’s, a prospector commented on the Kena property in the Geological Survey of Canada report. Despite the lyrical description (‘the gold mineralization is located within pyritized material which appears to be practically unlimited in size’) it took an additional 80 years before someone got some boots on the ground and completed some ‘modern’ exploration work.

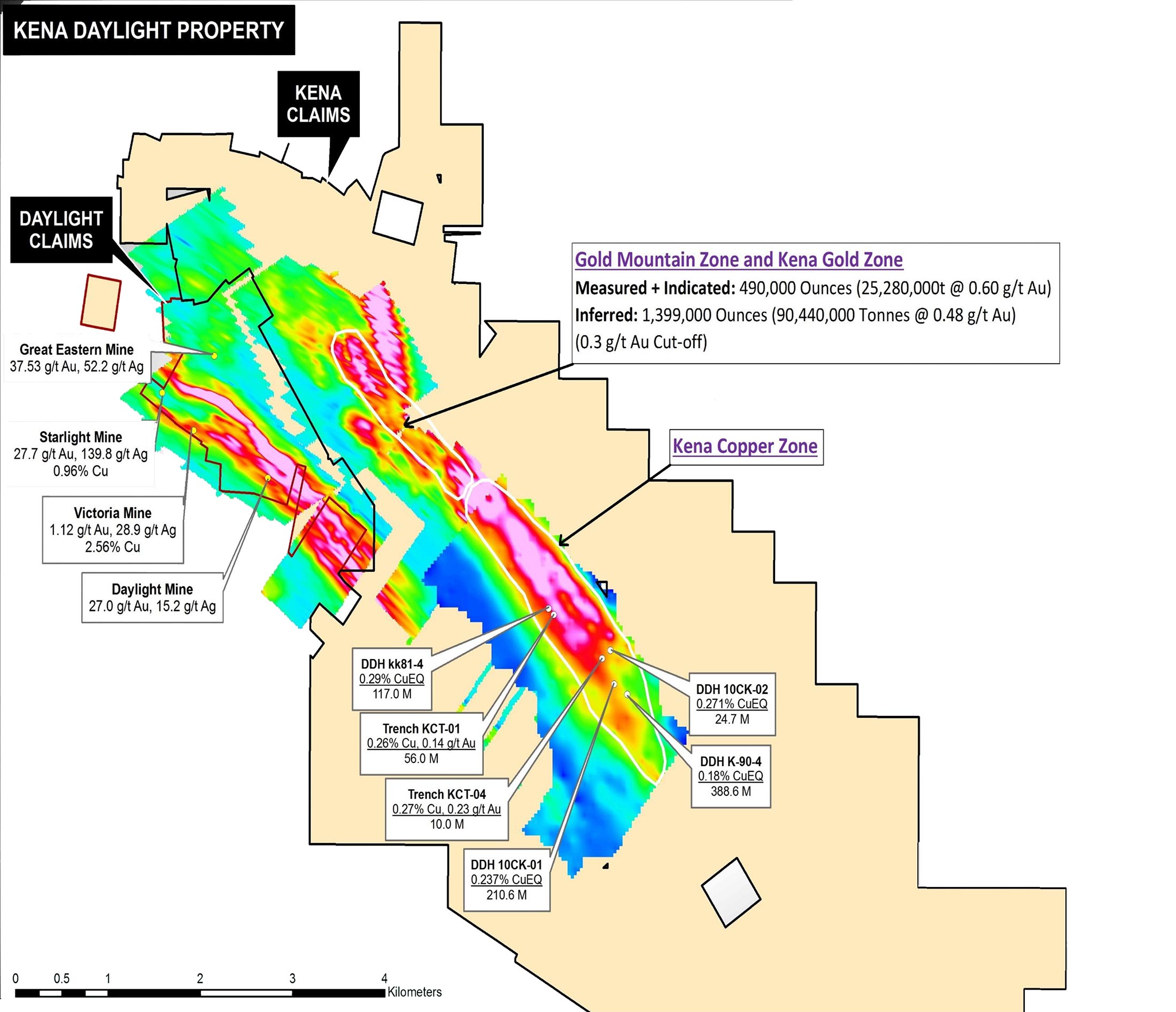

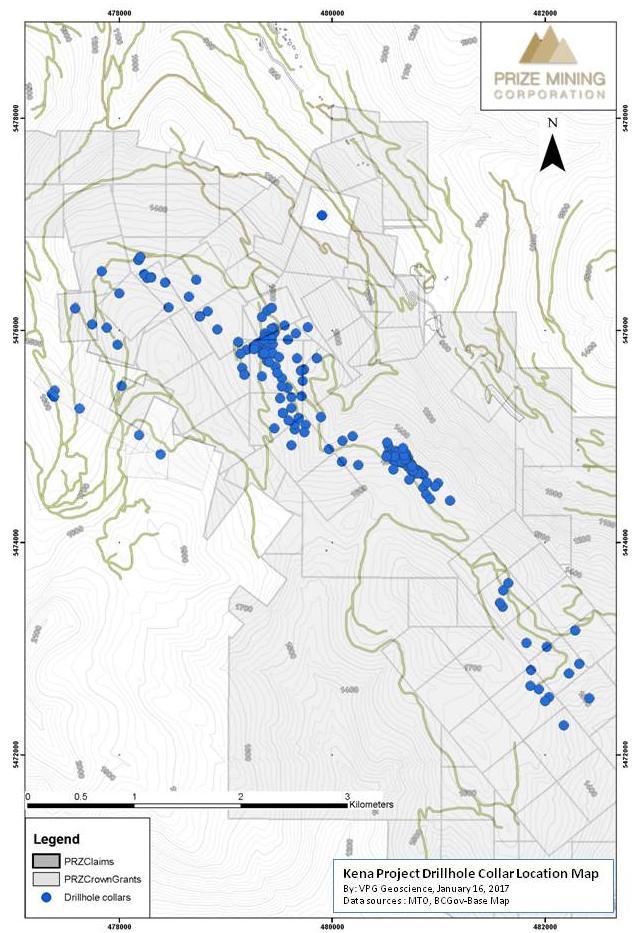

The previous operators were mainly focusing on sampling, and the first drill program on the property was only conducted in the early 80’s when Kerr Addison Mines drilled three holes on the Kena gold zone which were sampled for copper and gold. The preliminary results seemed to indicate a copper-gold system with 0.18-0.2% copper and 0.3 g/t gold, but when another company drilled a few holes at the northern end of the Kena Gold zone, high-grade gold mineralization was (finally) detected with almost 5 meters containing in excess of 6 g/t gold and 9 meters of almost 4.8 g/t.

Several operators have tried to figure out the mineralization at Kena and Daylight in the eighties and nineties, but it was Sultan Minerals which was able to advance the property to where it is now. Sultan completed almost 30,000 meters of drilling at Kena and Daylight, which resulted in three resource estimates of which the most recent one in 2013 confirmed the existence of half a million ounces of gold in the measured and indicated resource categories with an additional 1.4 million ounces of gold in the inferred resource.

So why is the Kena project so interesting?

Granted, the average grade in the current resource estimate is relatively low (0.6 g/t in the M&I categories and just 0.48 g/t in the inferred category), but the project is interesting due to its size. It’s well-hidden in the technical report, but there are two sentences we would like to highlight here:

Four gold-bearing targets, the Great Eastern Porphyry Gold Zone, the Starlight Shear Zone, the North Star Shear Zone, and the Silver King Gold Corridor, require further exploration. Geological indications suggest the potential for more than 3.0 million ounces of gold in the four target areas.

Does this mean there will be an additional three million ounces on this property? Not necessarily. But this does mean the exploration potential at Kena is there, and the current 1.9 million ounce resource is very likely just the beginning.

Additionally, the specific gravity of the rock at Kena is slightly higher than average, as a specific gravity of 2.9 has been used (with intrusive rocks having a SG of 2.73 and the volcanic rocks averaging just over 3). That’s important, because the resource estimate at the GMZ zone assumed a specific gravity of 2.78, and using 2.9 could increase the tonnage (and gold resource) by 5-6%.

As a third point, even if we would play around with the cutoff grade and increase it to 0.4 g/t instead of 0.3 g/t, the average grade would increase by approximately 20%. That being said, you would lose approximately 29% of the total gold resource, and Prize will have to figure if it would make sense to plan a scoping study with a higher cutoff-grade.

Additionally, the Silver King gold corridor might play a really important role in the potential development of Kena, as this zone hosts veins with an average grade of 5-80 g/t. Needless to say finding more high-grade zones could provide a real boost to the average grade. These gold grades weren’t just ‘lucky samples’, as historical records indicate the Starlight, Daylight and Great Eastern mine were recovering rock with an average grade of 27-38 g/t gold. The production volumes from these zones were extremely low, but these gold grades (combined with a silver credit) definitely indicate there’s ‘something’ there.

And finally, not only is Kena located in a safe jurisdiction, it doesn’t happen very often that there’s a highway running through your property whilst you also have the potential to connect to the power grid (and take advantage of British Columbia’s low energy cost) and to tap in the available labor pool at Nelson.

Rock Geochemistry Copper (left) – Rock Geochemistry Gold (right)

The road to earn full ownership of Kena

Prize Mining has issued 28.5 million shares to 1994854 Alberta Ltd., a privately-owned company which owned an option to acquire 80% of the Kena property from Apex Resources. 1994854 was owned by insiders of Prize (which have entered into a voluntary three year lock-up on the 28 million shares) and Pat DiCapo amongst others, and we expect to see a large insider ownership position in Prize Mining now this deal has been completed.

According to Prize, approximately 26.95 million of the 50.7 million shares will be in the hands of management and insiders which means 55% of the total share count will be sitting in strong hands.

To earn an initial 80% stake in the Kena property, Prize Mining will have to pay an additional C$750,000 in cash to Apex Resources in the next 29 months, whilst an additional 1.125 million shares will have to be issued in the same time frame (September 2020).

Prize is also required to spend a minimum amount on exploration on the property on an annual basis. For the first year, the company will have to spend C$100,000 on exploration (we think Prize has to incur the total C$100,000 as it looks like 1994854 didn’t spend any cash on exploration). In the second year, Prize will have to spend C$400,000, increasing to C$1M in the third year and C$1.5M in the fourth year of the option agreement.

If Prize meets all these requirements, it will earn an initial stake of 80% in the property, which could be boosted to 100%.

In order to acquire the final 20% stake in Kena, Prize will have to make a C$2M cash payment to Apex, whilst also granting it a 1% Net Smelter Royalty. Half of this NSR can be repurchased for C$5M (which isn’t cheap but would make sense if in excess of 1 million ounces could be recovered at Kena. If that’s not the case, it would be better to not repurchase the NSR, or negotiate a lower buyback price).

Prize Mining is now fully cashed up, and ready to hit the ground running

On the back of the acquisition of the option agreement to earn an 80% stake in the Kena and Daylight properties, Prize Mining also completed a substantial C$6M financing.

The company has issued 14.3 million non-flow-through units at C$0.35 and 2.22 million flow-through units at C$0.45 per unit to raise a total of C$6M. Each unit consisted of one share and one half of a purchase warrant allowing a warrant holder to purchase an additional share at C$0.75 (per full warrant, obviously). These warrants are subject to an acceleration clause, and if Prize Mining is trading at in excess of C$0.85 per share for at least ten consecutive trading days, these warrants will be subject to an accelerated expiration.

Should all warrants be exercised, an additional C$6.2M would flow right into Prize’s treasury, which would cover its cash needs for an extended period of time whilst the share count would increase to just 59 million shares.

The author of the technical report has proposed a C$150,000 exploration program to advance the property, and moderate amount includes the verification of historic data, as well as building a conceptual mine plan and a scoping-level capex and opex study.

Not only will this be an excellent use of the C$150,000, it will also ensure Prize meets the minimum expenditure of C$100,000 before September of this year to keep its option to acquire the property in good standing.

Conclusion

Prize Mining will be the newest company trying to define a multi-million ounce gold deposit in British Columbia. The average grade of the Kena property is still quite low (the rock value is approximately C$27/t using US$1280 gold), so we would expect Prize to focus on selective mining when it completes its scoping study, whilst the past producing high-grade mines will also play an important role to boost the average grade. Fortunately the preliminary metallurgical test results are indicating an average recovery rate of 95%+, which is really good and gives this low-grade project a decent shot at success, especially because it’s also located in proximity to existing infrastructure.

More work needs to be completed on the Kena property but with C$6M in cash (and a potential additional C$6.2M should the C$0.75 warrants be exercised), Prize should have the financial means to continue to advance Kena.

Disclosure: Prize Mining is a sponsoring company, we have a long position. Please read the disclaimer

Pingback: Explorer in British Columbia Has Lots of Potential to Increase Grade | ValuBit News

Pingback: Explorer in British Columbia has lots of potential to increase grade – test

Pingback: Explorer in British Columbia has lots of potential to increase grade | ValuBit News

Pingback: Explorer in British Columbia Has Lots of Potential to Increase Grade - StockSocial

Pingback: Explorer in British Columbia Has Lots of Potential to Increase Grade | ForexMegaTraders