Approximately two years ago, Red Eagle Mining (R.TO) was fighting off Batero Gold (BAT.V) in an attempt to gain control over CB Gold which owned the high-grade Vetas gold project in Colombia. Fortunately for both companies, an amicable solution was reached and Red Eagle Exploration (XR.V) was born.

This company should be seen as the ‘exploration division’ of Red Eagle Mining, whose management and technical team will now apply its extensive experience on the three exploration projects in Red Eagle Exploration’s portfolio.

The Vetas Gold project

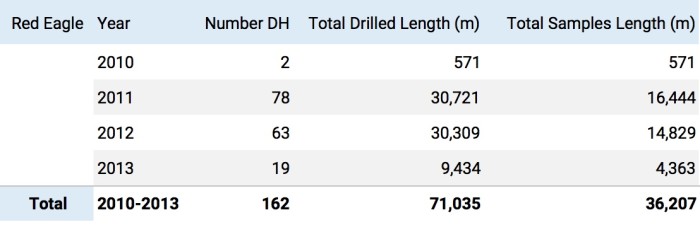

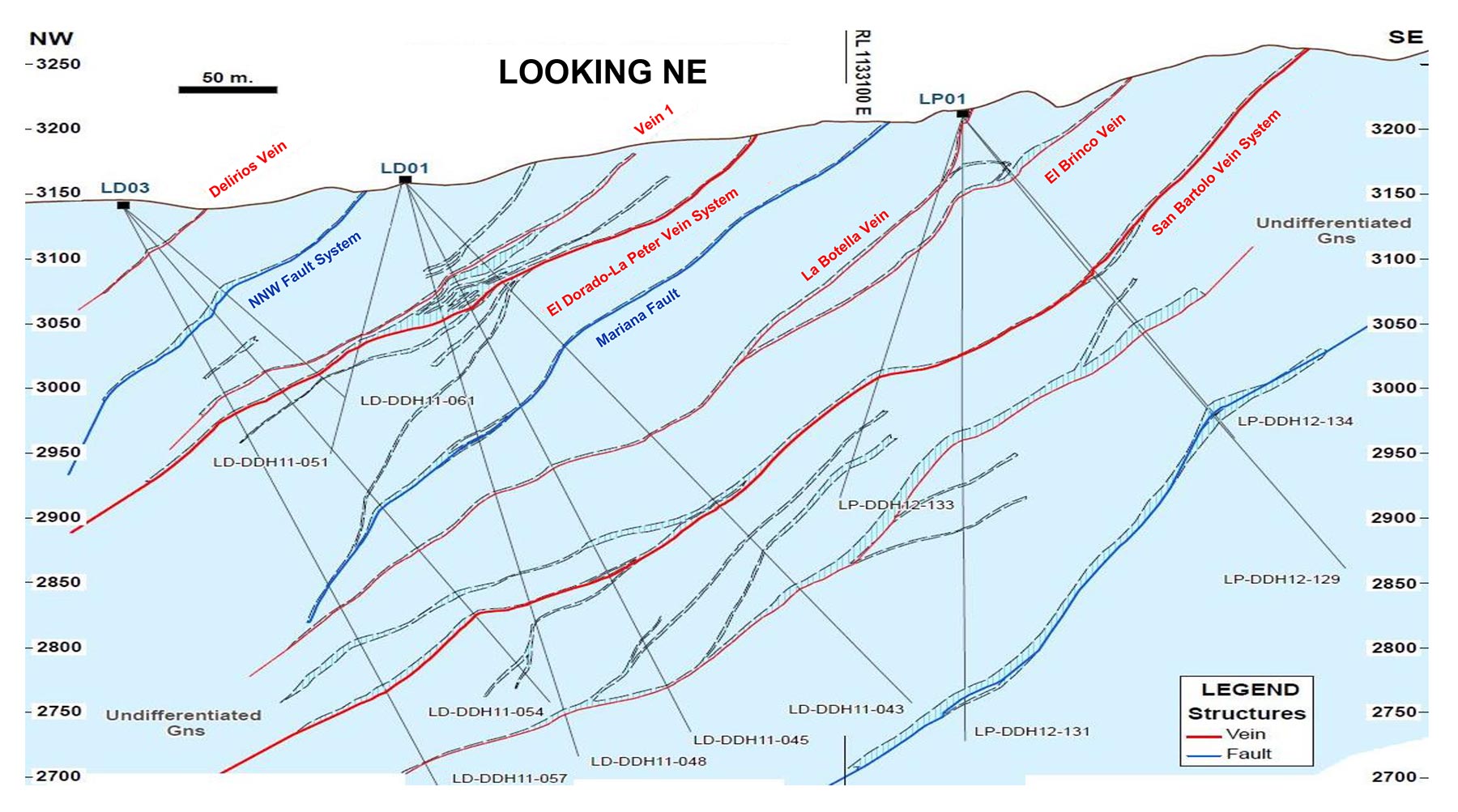

The Vetas gold project was CB Gold’s flagship project and was subject to in excess of 70,000 meters of drilling between 2010 and 2013 for a total exploration investment of almost C$70M. Needless to say this project is actually in a relatively advanced stage and Red Eagle Exploration continued to advance the property with an additional mapping and sampling program at underground workings.

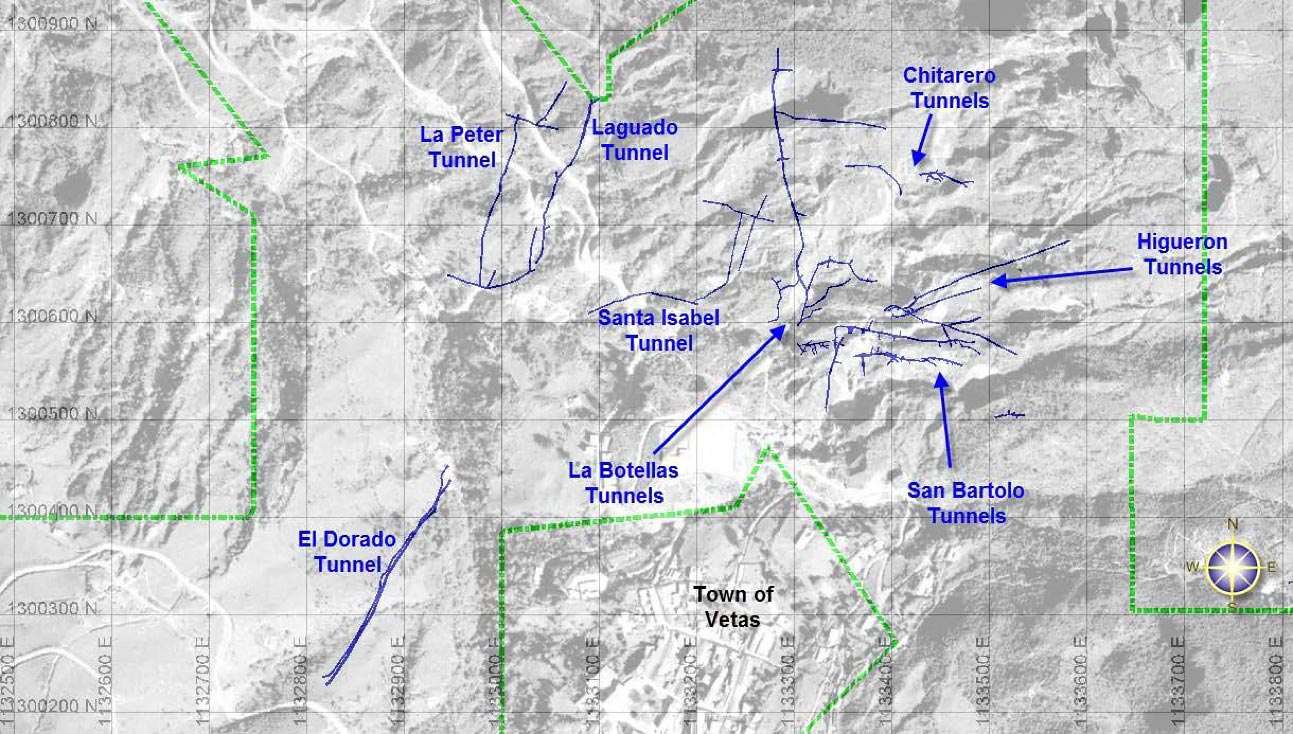

These underground workings are the remains of no less than 11 mines which were previously active on the property. In fact, the entire region has a very rich history as gold was already discovered before the middle of the 1500’s when the Spanish conquistadores took (manu militari) possession of the veins (in the greater California-Vetas district) which were subsequently mined for hundreds of years until the first world war broke out.

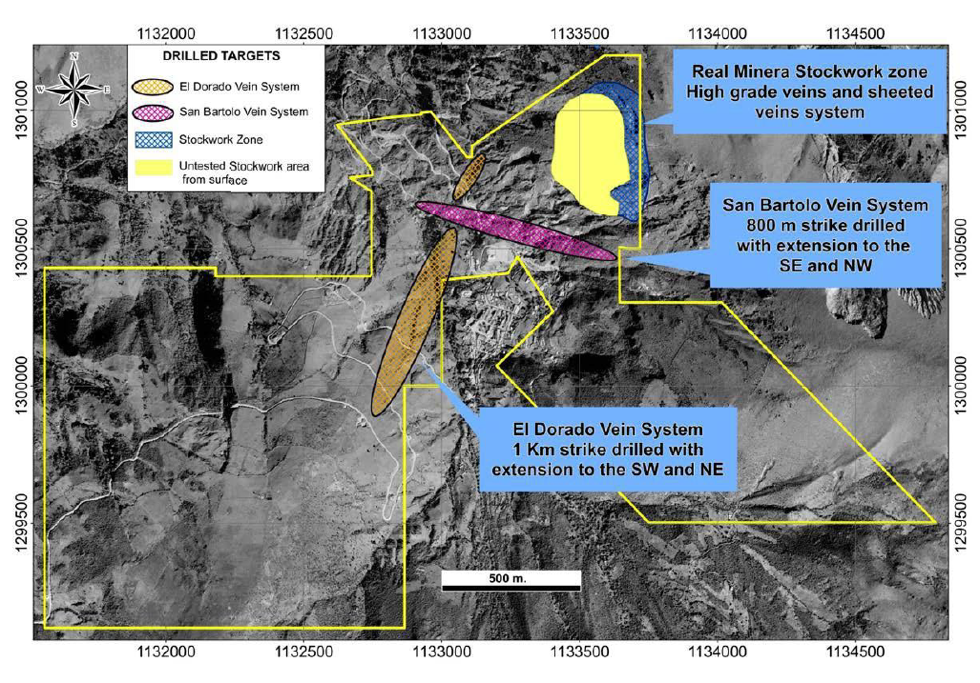

Although there are no ‘official’ records from this period, the total historical production from the veins in the Vetas area was estimated at 1-2 million ounces, mined and recovered from high-grade ore. As you can see on the previous map, there are plenty of old workings on the property, as several veins are running throughout the Vetas property.

It wasn’t a huge surprise to see the use of modern exploration techniques allowed Red Eagle Exploration to discover much more gold and its 71,000 meter drill program intercepted several ultra high-grade intervals such as 2 meters at in excess of 300 g/t gold and 1.1 meter containing 228 g/t gold. In fact, as part of the 162-hole, 71,000 meter drill program, Red Eagle Exploration encountered 177 intersections with an average gold grade of in excess of 5 g/t, and no less than 33 intervals with an average grade of in excess of 30 g/t.

This really gives you a pretty good indication of how gold-rich these veins are. The yellow metal is there, the main question is now how much gold the Vetas concession contains, and if it will be economical to mine the veins.

The California Gold Project

The California project actually is the newest addition to Red Eagle Exploration’s project portfolio as this project was only (definitively) acquired in February of this year.

It consists of no less than 250 hectares of surface area located on 8 exploitation mining concessions which are directly adjacent to the La Bodega and Angostura gold projects. These projects are currently owned by Mubadala after Eike Batista’s gold company had to sell its assets to protect itself against a liquidity crunch.

Red Eagle Exploration (back then still called CB Gold) acquired the California concessions in February for a total commitment of US$5.7M in cash and US$7.6M in CB Gold (XR) shares. A first tranche was made available to the sellers (which were local miners), whilst the remainder of the purchase price will have to be paid within two years after the completion of the title transfer. Additionally, Red Eagle will have to complete a final payment valued at 1.5% of the gold and silver value in the measured and indicated resources within three years after the completion of the title transfer.

So if XR would define a total measured and indicated resource of 300,000 ounces gold-equivalent with the gold price trading at $1250/oz, the company would be required to make a final cash payment of approximately US$5.6M. Please note this example was just for illustration purposes and does not indicate an official exploration target.

A second land package was acquired in March, and the total consideration to own 100% of both land packages will cost Red Eagle a total of approximately US$9.4M in cash and US$11.3M in shares which will be payable within the first two years after the title transfer has been completed.

Keep in mind the 250 hectares of the California project are located at an altitude of just 2,400-2,700 meters above sea level which is way below the Paramo-level. That’s important as some of the projects located at higher altitudes are just unpermittable.

At the end of June, Red Eagle Exploration released the assay results from an underground sampling program at the Machuca zone, which is a part of the California project located approximately 300 meters south of the Pie de Gallo zone (and just 150-200 meters away from the planned portal to mine the Pie de Gallo zone!) and less than one kilometer away from the La Mascota zone. This definitely is the right region to be exploring in, as according to the July edition of the Colombia Gold Newsletter, the combined resources on Mubadala’s land package now total 12.2 million ounces at an average grade of 6.15 g/t gold which will see it produce approximately 450,000 ounces of gold per year (with additional copper and silver) for at least 23 years.

XR has completed an underground chip sampling program and as the results confirmed the existence of a mineralized zone with a strike length of approximately 45 meters (and open in all directions), we think the sampling program has proven its value as not only was the continuity of the mineralization confirmed, the average grades were pretty impressive as well with numerous samples which assayed a double digit gold value. The final results of the sampling program were the mineralization having been sampled over the aforementioned 45 meters with an average width of 2 meter and an average gold grade of 9 g/t. Not only does this zone remain open in all directions, Red Eagle Exploration wants to initiate a drill program this fall, and this should create quite a bit of excitement!

As the California project appears to be part of the exact same mineralized system as the La Bodega gold project owned by Mubadala, we think Mubadala will be very interesting to see what Red Eagle Exploration will pull out of the ground at California.

The Santa Ana Silver project

In the summer of last year, Red Eagle Exploration announced it acquired the Santa Ana Silver project from Condor Precious Metals for a total consideration of just C$250,000 in cash, 8.1 million shares as well as a 2% Net Smelter Royalty. The land package consists of almost 700 hectares.

This was a very reasonable acquisition cost considering the history of Santa Ana which, just like Vetas, has already been mined in/since the middle ages as the very high-grade silver values on the property caught the attention of the Spaniards. Contrary to the Vetas project, there effectively are historical reports from the silver production at Santa Ana as 430 year old reports indicate a grade of ‘4 marcos per quintal’, which would be the equivalent of almost 20,000 g/t silver (not a typo) as 1 marco is 230 grams whilst one quintal is 45.9 kilograms.

The previous owner completed a sampling and drill program on the property and although the drill program consisted of just 8 holes (for a total of 1,170 meters drilled from just one drill platform) which were testing the potential deeper extension of the known silver vein, the assay results were simply astonishing. How else would we describe 0.85 meters at 1.3 g/t gold and 667 g/t silver, or for instance 3 meters at 3.68 g/t gold and almost 1.5 kilos of silver per tonne of rock?

Of course, this was just a small drill program specifically targeting the zone where mineralization could be expected but it’s clear the average grades encountered during this drill program (and the average grade of historical production) are very exciting, especially knowing the mining width in the middle ages were a very respectable 1.5 meter.

Doing business in Colombia

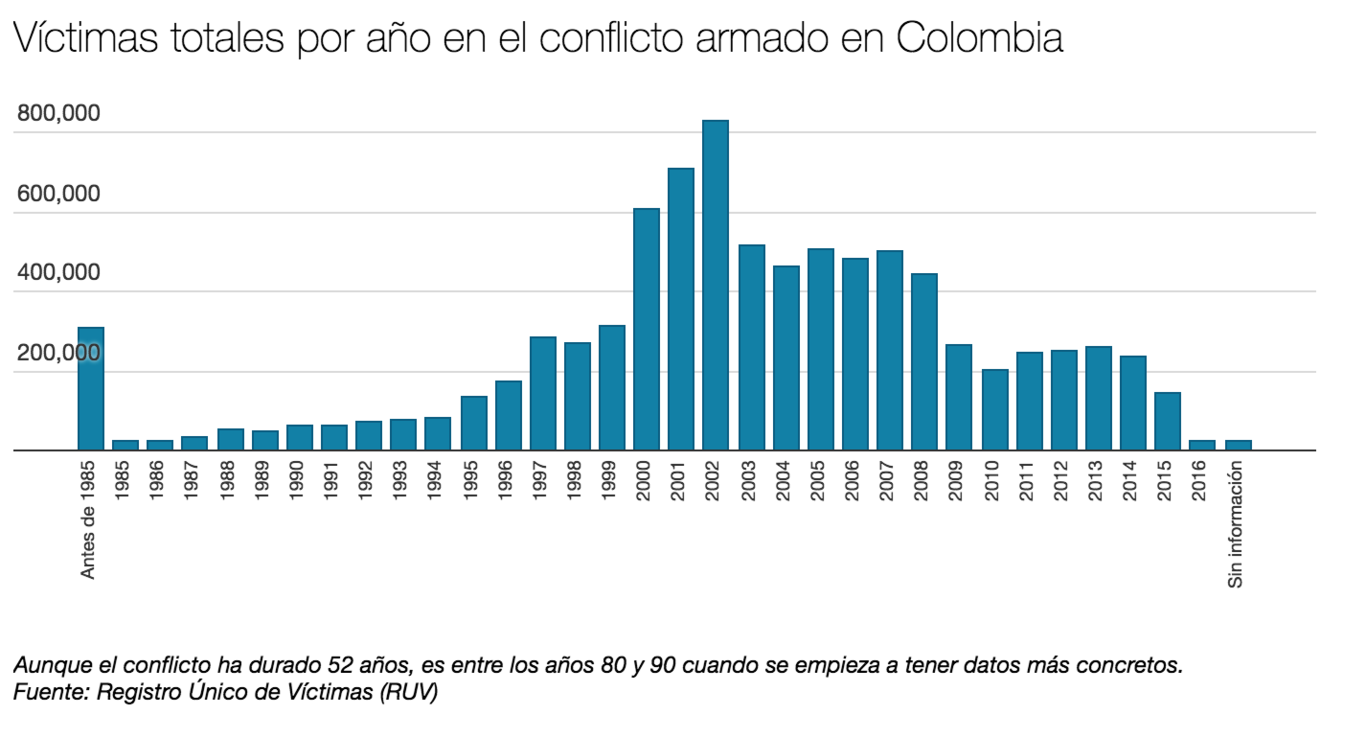

When we covered Red Eagle Mining a few years ago, we received some emails about the political situation and safety issue in Colombia, which we would like to put to rest now. Colombia is no longer the country it used to be in the seventies and eighties and even though certain Netflix-series might take you back to that era, the country has definitely quietened down after the huge armed conflicts. That’s clearly visible on the next chart which shows you the amount of ‘victims’ of armed conflicts in Colombia. Note the term ‘victims’ covers every victim in this case, including refugees and material damage.

The page was turned halfway the previous decade, and since armed conflict with the FARC (finally) came to an end in the past few years, the country is now positioning itself as an attractive country for foreign investment.

This strategy has been paying off and this resource-rich country is definitely welcoming Canadian expertise and investment. In 2015, Colombia exported a total of $37.5B of goods, of which 70% is commodity related (with the export of crude oil as main contributor). Several other Canadian companies (Canacol Energy (CNO.TO), Gran Tierra Energy (GTE.TO, GTE) and Parex Resources (PXT.TO) to name just a few) are already operating in the country, and Red Eagle Mining (R.TO) was the front-runner in opening a modern gold mine in the country with more gold projects expected to be brought into production over the next few years.

Colombia’s ranking on the Corruption Perception index has also improved and in 2016, the country ranked before Mexico, Peru, Argentina and Guyana, which is already a good indication of how serious Colombia is to position itself to attract more foreign investment. We have been in Colombia several times (both on site visits as well as just being a ‘tourist’), and can confirm the risk of walking around in Medellin or Bogota is not higher than in any other large city in the world).

Corporate overview

As of at the end of March, Red Eagle Exploration was running low on cash as the balance sheet was showing a working capital position of just C$20,000 as of at the end of March which is the main reason why the company launched a private placement to raise cash by issuing new units at C$0.15 per unit. Red Eagle Exploration website hasn’t provided an update on this offering since it was announced on June 1st, but XR’s SEDAR filings confirmed the company raised approximately C$1M by closing a placement consisting of 6.85 million units. Each unit consisted of one common share and a full warrant exercisable at C$0.25 per share for a period of five years and after executing some payments during the quarter, XR ended Q2 with a working capital position of approximately C$184,000.

Even though Red Eagle Exploration isn’t directly impacted by the issues at the San Ramon mine operated by Red Eagle Mining, XR seems to be ‘guilty by association’ and that’s very likely the only reason why the company’s share price has been sliding to less than 10 cents per share despite XR recently having raised cash at 15 cents per share.

Having Red Eagle Mining as its main shareholder will definitely be advantageous for Red Eagle Exploration as the ‘Mining’-team now has plenty of experience in Colombia. On top of that, Red Eagle Mining could provide financial assistance as well as the San Ramon mine should be restarted before the end of this year when the construction of the paste backfill plant will have been completed.

Vetas Gold Property

Conclusion

With three intriguing exploration projects, a stable main shareholder (whose cash flowing operations should restart by the end of this year) and the expertise of doing business in Colombia make Red Eagle Exploration a very interesting exploration-stage company.

Whilst a current market capitalization of C$39.3M indeed isn’t cheap, it’s worth noting that all three projects have confirmed mineralization whilst both California and Vetas are located within walking distance of a multi-million ounce development-stage gold project. On top of that, virtually no pure silver projects have been developed in the past 5-10 years, so if Red Eagle (Exploration) would be successful in figuring out the geological features of the Santa Ana silver project, the company has a good shot at becoming Colombia’s premier silver developer.

We expect the Machuca drill program this fall to generate a lot of interest as the high grade sampling results and the proximity to the Mubadala zone should ensure a pretty high exploration success rate. There definitely seems to be some low-hanging fruit at Machuca, and now it’s up to Red Eagle Exploration’s technical team to harvest.

The author has a long position in Red Eagle Exploration. The company is a sponsor of the website. Please read the disclaimer