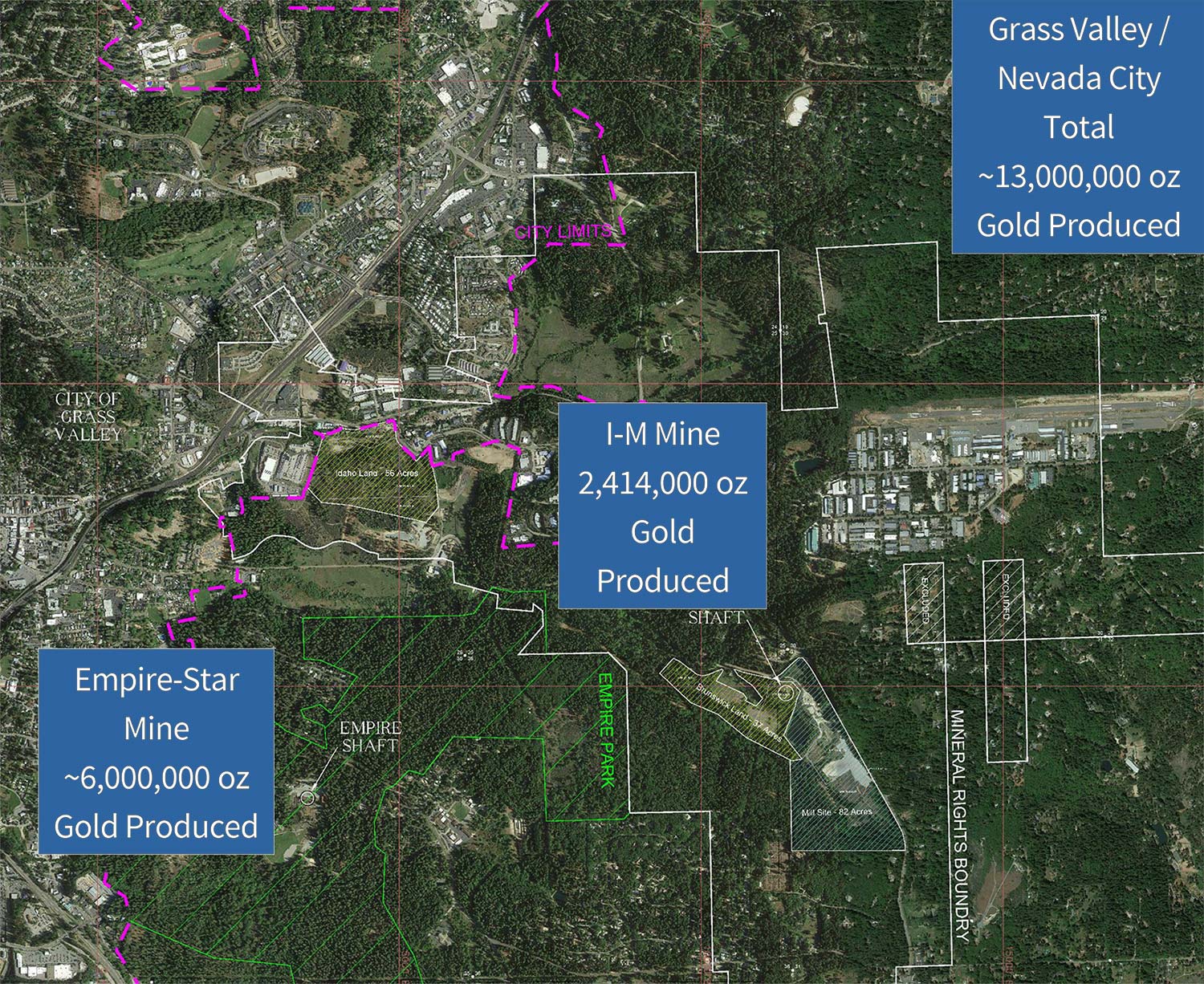

In 2017, Rise Gold (CSE:RISE) completed the acquisition of the past-producing Idaho-Maryland mine in California and started working through the vast amount of boxes containing all historical data. It took a while to comb through this data and digitize the most important parts but it really was a necessity to make sure the exploration plans at Idaho-Maryland would be designed to be as efficient as possible.

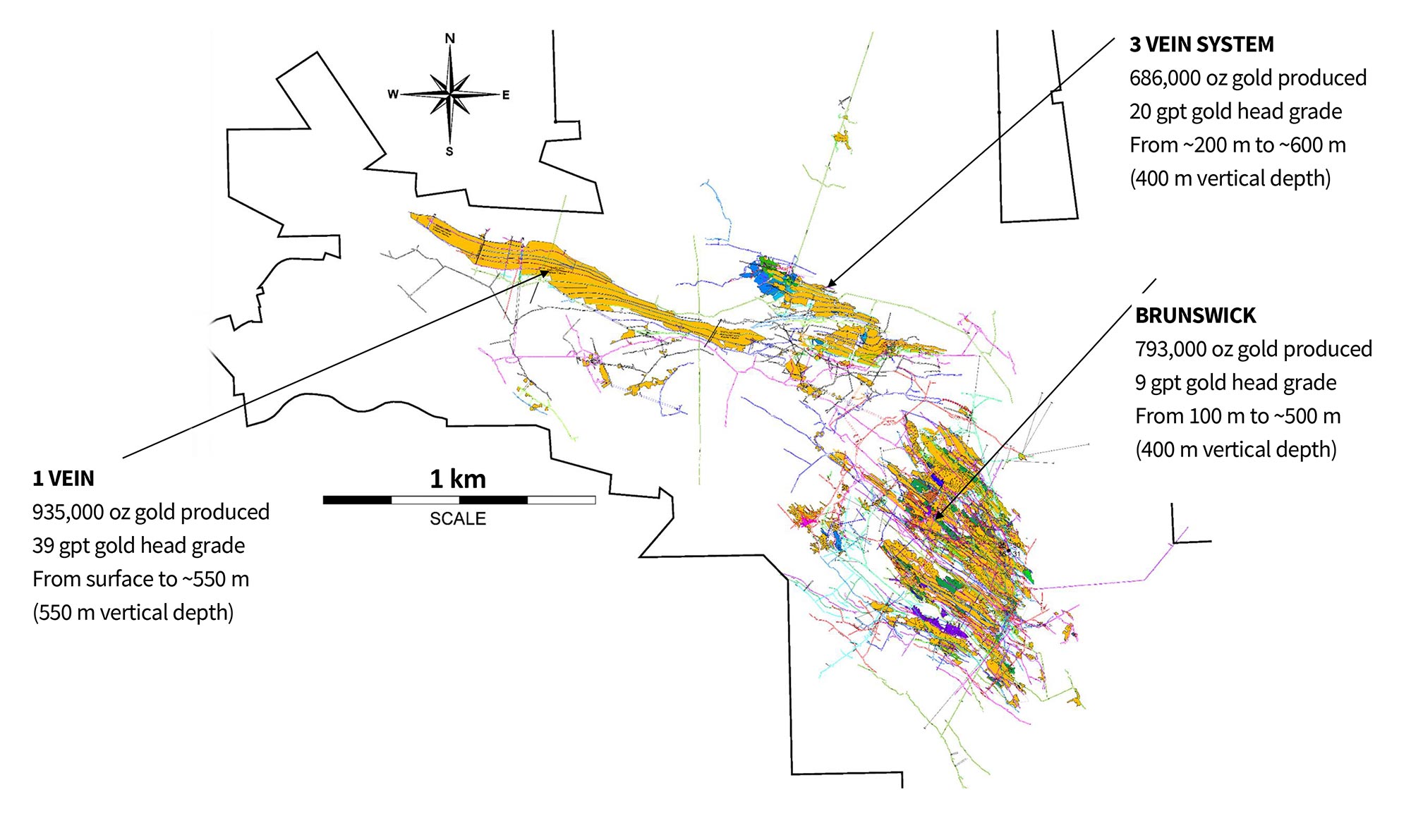

As a reminder, the Idaho-Maryland mine produced a total of 2.4 million ounces of gold from an underground mine delivering ore with a head grade of 17 g/t to the mill. The mine was shut down during the Second World War as the USA shifted its labor pool towards war-related commodities.

Waiting for the assay results

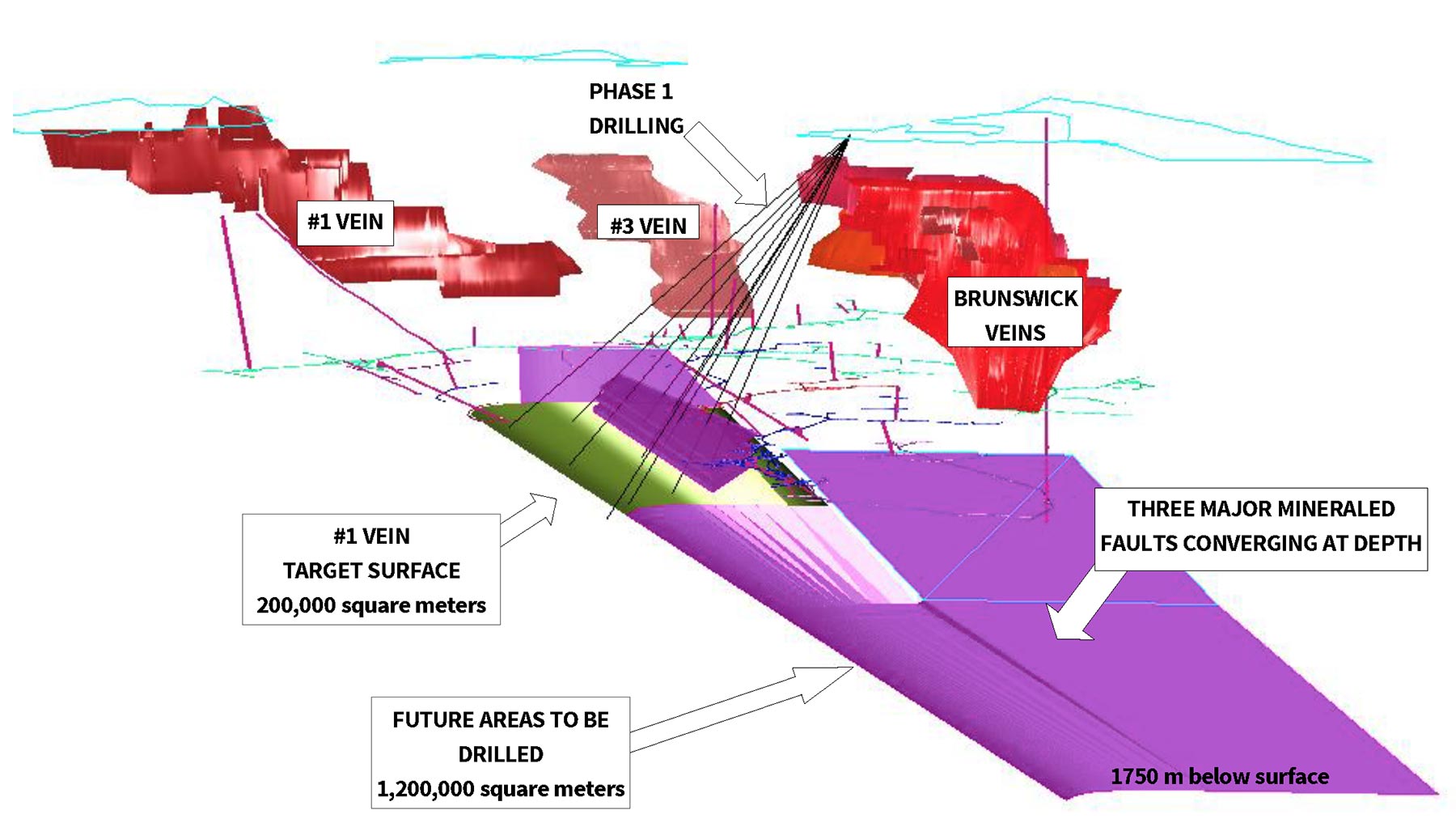

As we mentioned before, Rise Gold has started its drill program at Idaho-Maryland in October as it planned to complete one 1,230 meter deep pilot hole. This hole was planned to intersect the Brunswick Block, ending in the Idaho mineralization zone where it was supposed to target the Idaho #1 vein which produced almost 1 million ounces of gold from less than 1 million tonnes of ore as historical reports indicate the average grade at the Idaho vein was approximately 1.2 ounces of gold per tonne.

Besides this pilot hole, Rise Gold also planned to complete a few holes on the western end of the Idaho-Maryland deposit to check up on the potential gold-bearing mineralization below the zones which were previously mined in the first half of the previous century.

Both drill programs should be completed by now and despite the usual delays related to the holiday period, we would expect Rise Gold to soon be in a position to disclose the assay results of these holes. Although the size of the 2017 drill program was relatively small, it will be interesting to see the results as these will be used by Rise Gold to determine its exploration plans for 2018.

That’s also why the pilot hole will be very useful, as it will allow Rise Gold to drill secondary holes starting from this ‘mother hole’ which should be much cheaper compared to a normal drill program starting at surface.

As mentioned in a previous report, it’s always interesting to have a fresh set of eyes kicking the rocks at a past-producing mine as geological and structural interpretations might have changed since the mine was shut down, decades ago. You might remember the Idaho 1 Vein and 3 Vein were mined until a depth of 2,000 feet (almost 700 meters), but it’s a valid assumption to expect additional mineralization at depth. Newmont Mining’s (NEM) Empire gold mine reached vertical depth of approximately 3,500 feet but the mineralization has been ‘followed’ until a depth of almost 6,000 feet.

The second tranche of a C$0.15 financing has now closed as well

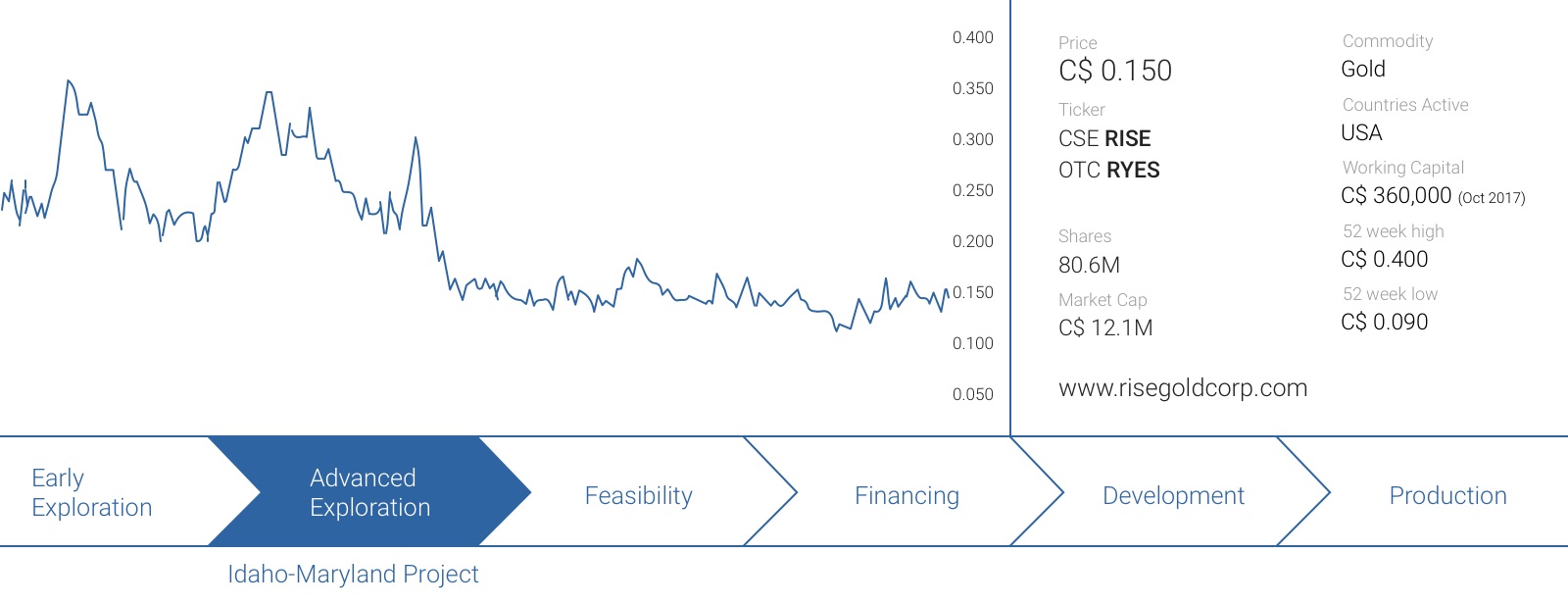

Back in September, Rise Gold closed a first tranche of a C$0.15 financing, raising C$1.06M by issuing 7.1 million units with each unit consisting of one common share and a full warrant. Each warrant allows the warrant holder to purchase an additional share at C$0.25 for a period of 2 years.

A second tranche closed on Friday as Rise Gold raised an additional C$962,000 by issuing 6.4 million new shares at C$0.15 per share. This additional cash inflow allowed Rise Gold to top up its treasury that contained C$412,000 in cash and a positive working capital position of approximately C$360,000 as of at the end of October.

Trading liquidity should improve with the acceptance of the S-1 filing by the SEC

Apparently some shareholders (and participants from the previous placement last winter) were surprised to learn Rise Gold effectively is an American company, and had to comply with the US regulations regarding mandatory hold periods and removing the legends on the share certificates. Instead of the usual 4 month + 1 day holding period, participants had to deal with a six month waiting period, where after it would cost a few hundred dollars to ‘remove the legend’ allowing them to trade in the shares. An additional cost which has to be paid every 3 months to renew the legend removal.

As this legend removal process could also take up to a few weeks, trading in Rise Gold was effectively a bit discouraged by the US regulations. This issue has now been solved as RISE confirmed its S-1 Registration document which it had filed with the Securities and Exchange Commission has now become effective. This basically allows the company’s US-based transfer agent to remove the legend on the share certificates, making the slow ‘traditional’ legend removal process obsolete.

This could increase the liquidity on the markets and will make it easier for Rise Gold to raise more cash in the future, as we can imagine a 6-month hold period and the additional expenses to (temporarily) remove the legend was (and would be) a deterrent.

Conclusion

2017 was a year of ‘information gathering’ and data mining for Rise Gold allowing it to interpret the historical data and design a first small drill program. Assay results are still pending but should be released soon and will provide more insight in the underground structures at Idaho-Maryland.

Disclosure: Rise Gold is a sponsor of this website, we have a long position. Please read the disclaimer