Sandfire Resources (ASX:SFR) has been a very steady performer in the past few years as even during the copper crisis (when the copper price fell below $2 per pound) the company’s share price remained very stable and barely dropped below A$4 on the Australian Stock Exchange.

This strong performance was mainly due to Sandfire’s DeGrussa copper-gold mine in Australia where it’s mining a very high-grade deposit, generating positive cash flow even at $2 copper. But alas, mine lives are per definition ‘defined’, and Sandfire needs to start thinking about its future after DeGrussa. An important pillar of this strategy will be the Black Butte copper project, currently owned by Sandfire Resources America (SFR.V), the new name of Tintina Resources which emphasizes the link with the well-respected parent company Sandfire Resources.

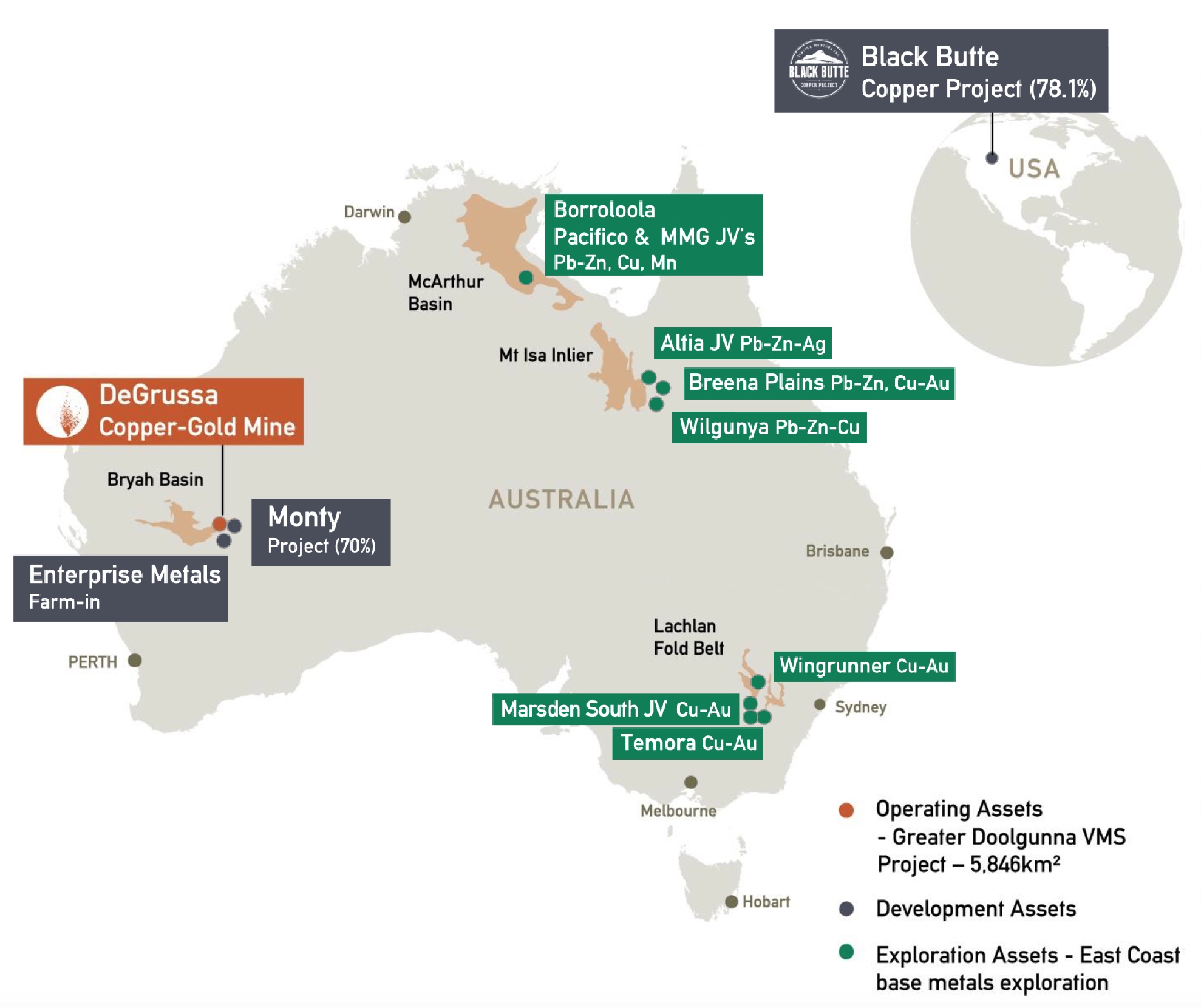

In this report we will discuss the DeGrussa (and Monty) project, the regional exploration program and the Black Butte copper project in Montana. Because contrary to what some people and analysts seem to think, Sandfire has its future in its own hands as its net cash position (and continuously incoming cash flow) will allow it to ‘buy its future’.

The flagship asset: the DeGrussa copper-gold mine in Australia

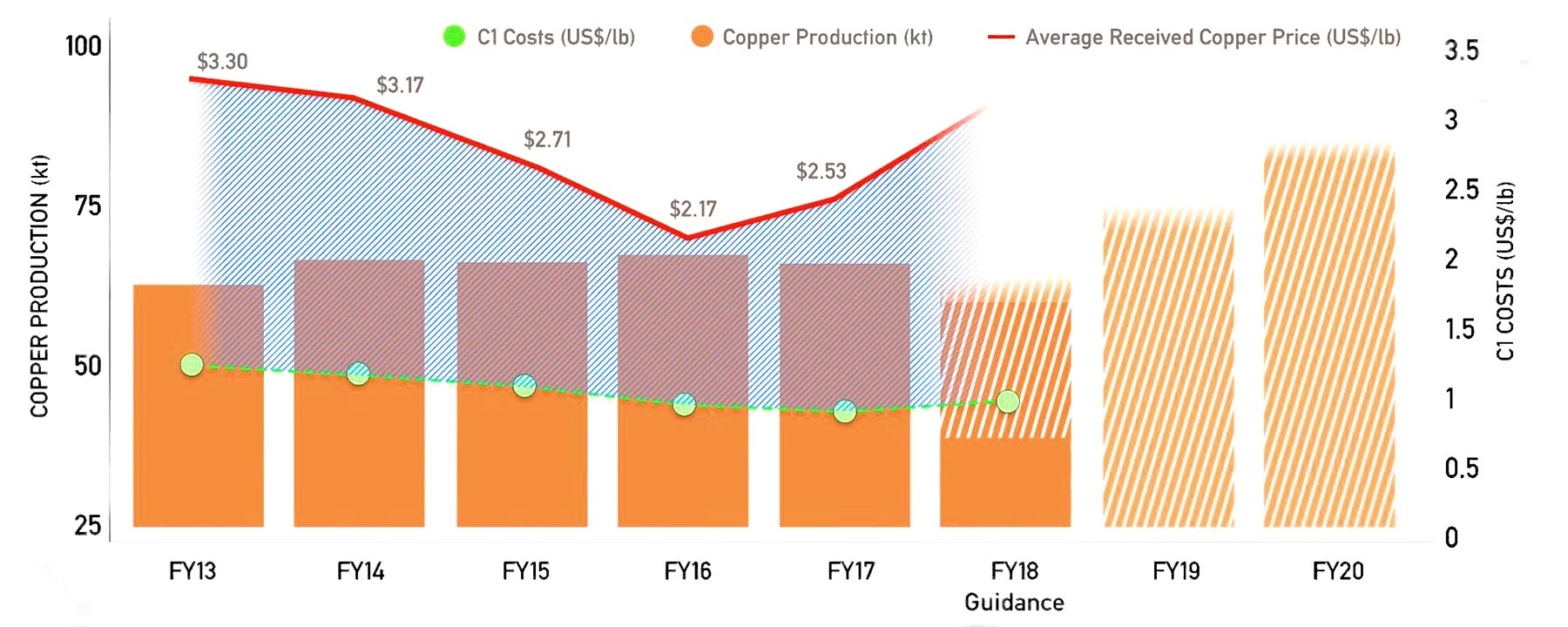

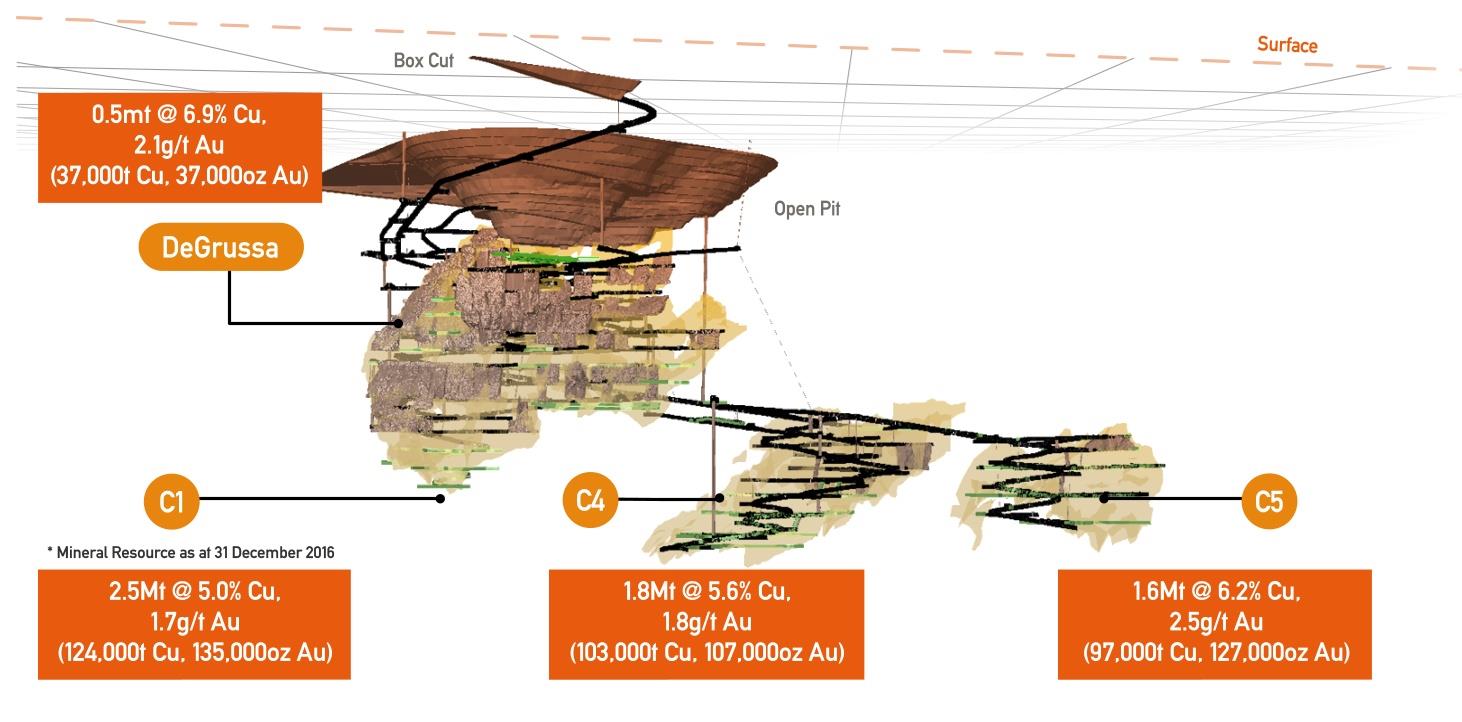

Sandfire’s main asset is the DeGrussa copper-gold mine in Western Australia, where high-grade mineralization has allowed the company to remain profitable, even when the copper and gold prices weren’t cooperating. Sandfire was able to move very quickly on the discovery and opened the DeGrussa mine in 2012. Throughout the past years, the production profile and production expenses remained very stable, confirming a well-designed mine plan.

The production guidance for FY 2018 (which ends in June) calls for a production of 63,000-66,000 tonnes of copper and 35,000-38,000 ounces of gold. Thanks to the gold price, the C1 operating cost is expected to be just US$1-1.05 per pound with the all-in sustaining cost estimated at less than US$1.80 per pound (we used the A$23M in capital expenditures incurred in FY 2017 as well as the 2017 royalty, transportation and refining expenses (A$145M)). As the copper price is now continuously holding its ground above US$3 per pound, the total revenue will also increase pretty fast as Sandfire received an average price of just US$2.53 for the copper it sold in the previous financial year.

Despite the fact DeGrussa is an underground mine, Sandfire is able to keep the production costs this low thanks to the high-grade nature of the resource, whilst it’s also selling quite a bit of gold as a by-product. The 35,000 ounces of gold to be produced in the current financial year will result in a revenue of approximately US$45M and this will result in a by-product credit of just over 30 cents per pound of copper coming out of the DeGrussa mine.

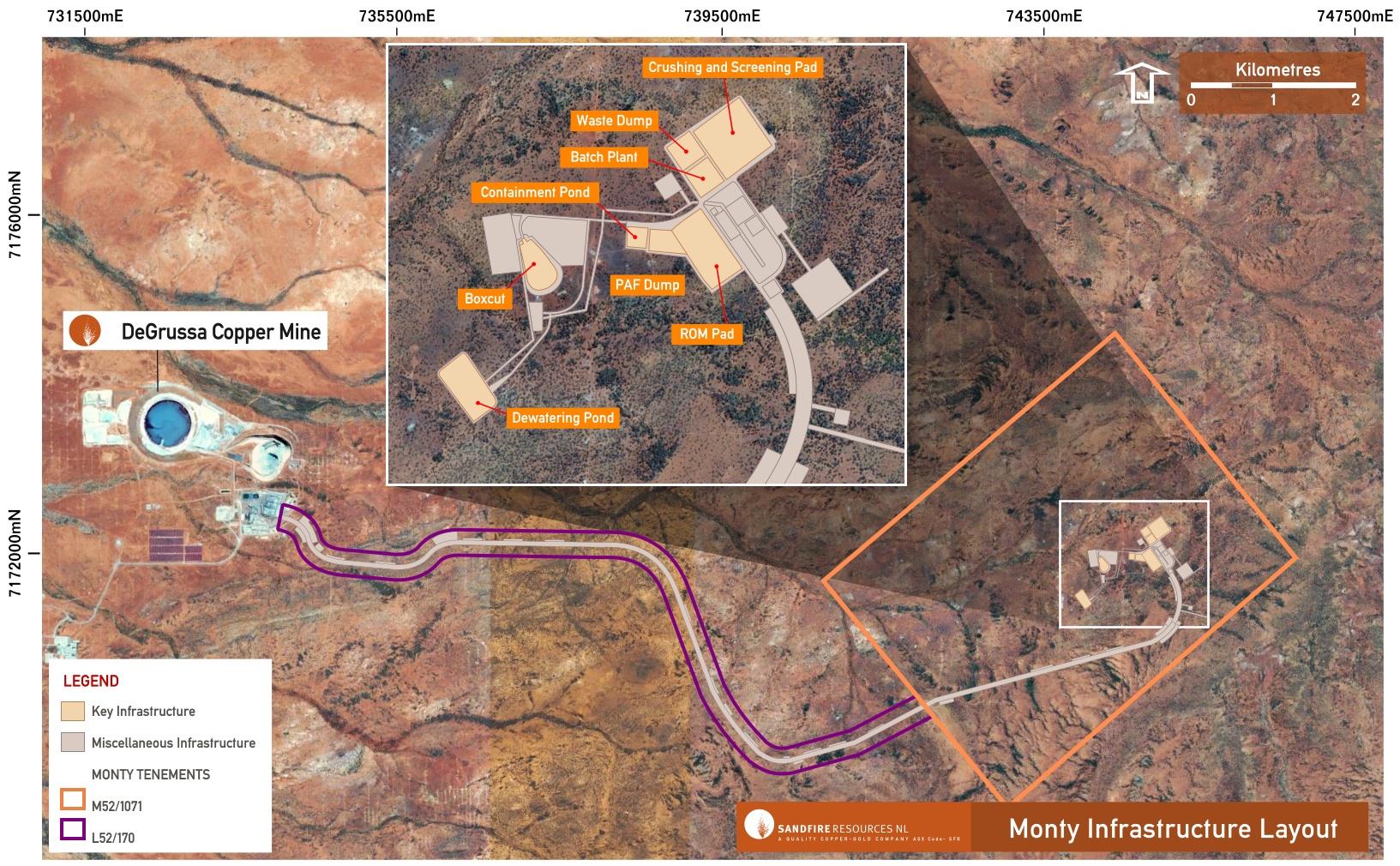

From next year on, the production rate will increase again as Sandfire will blend the ore from the DeGrussa mine with the ore coming from the Monty zone, a nearby satellite deposit (just 10 kilometers away from the DeGrussa processing site) which is currently being developed in a 70/30 joint venture with ASX-listed Talisman Mining (ASX:TLM).

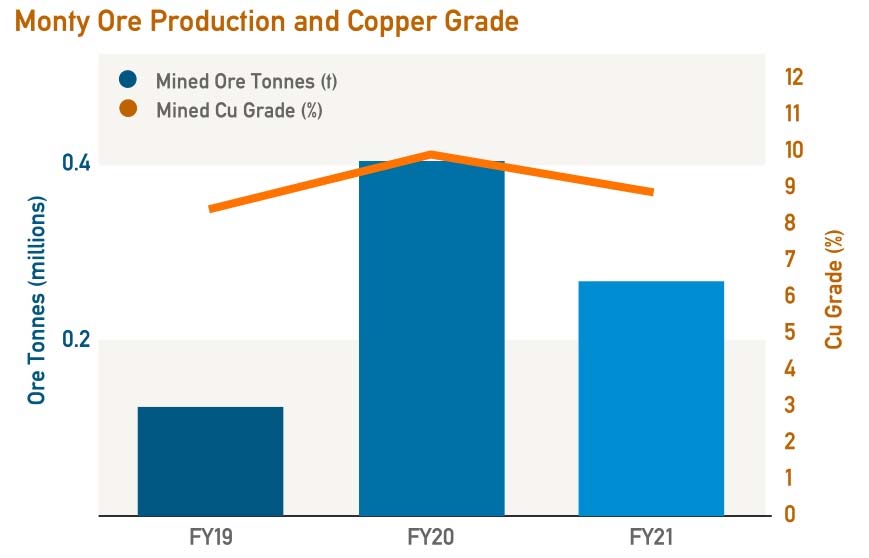

Monty is a small deposit (less than 1 million tonnes) but has an incredibly high-grade profile with an average grade of in excess of 8% copper and 1.4 g/t gold. The 920,000 tonnes of ore contain approximately 150 million pounds of copper, and although this is a pretty small resource, the definitive feasibility study completed on Monty was good enough for Sandfire’s board to greenlight the development of the project.

A decline will be constructed in preparation of a production start by the end of this year. The production will be ramped up to an average of 0.3-0.4 million tonnes per year, which will use 25% of the DeGrussa production capacity during its 3-year mine life. The total recovered output will be just over 150 million pounds of copper and 21,000 ounces of gold. Unfortunately no NPV calculations were shared with the market but as the initial capex was very reasonable (estimated at US$63M) and the average grade is much higher than the DeGrussa orebody, our back-of-the-envelope calculations indicate a pre-tax NPV8% of approximately US$150M (on a 100% basis, using a copper price of $2.75 and a gold price of $1300/os), so Sandfire’s attributable NPV would be approximately US$100M. Note – these are our own calculations and should not be considered to be Sandfire’s official guidance.

Using the average milling rate in the most recent quarter, the DeGrussa and Monty operations will allow DeGrussa to continue for at least 4 more years. This means Sandfire will continue to take cash to the bank until the end of 2021 when both DeGrussa and Monty are expected to be depleted.

There’s an additional 2.8 million tonnes of oxide ore stockpiled on site at an average grade of 1.2% copper and 1 g/t gold. Oxide mineralization requires a different flow sheet and Sandfire is currently developing a new flow sheet in an attempt to recover as much of the 77 million pounds of copper and 84,000 ounces of gold as possible. Sandfire seems to be focusing on a heap leach operation, so we are curious to see the results of a pre-feasibility study which will probably be released in the current calendar year.

Regional exploration to extend the DeGrussa operations

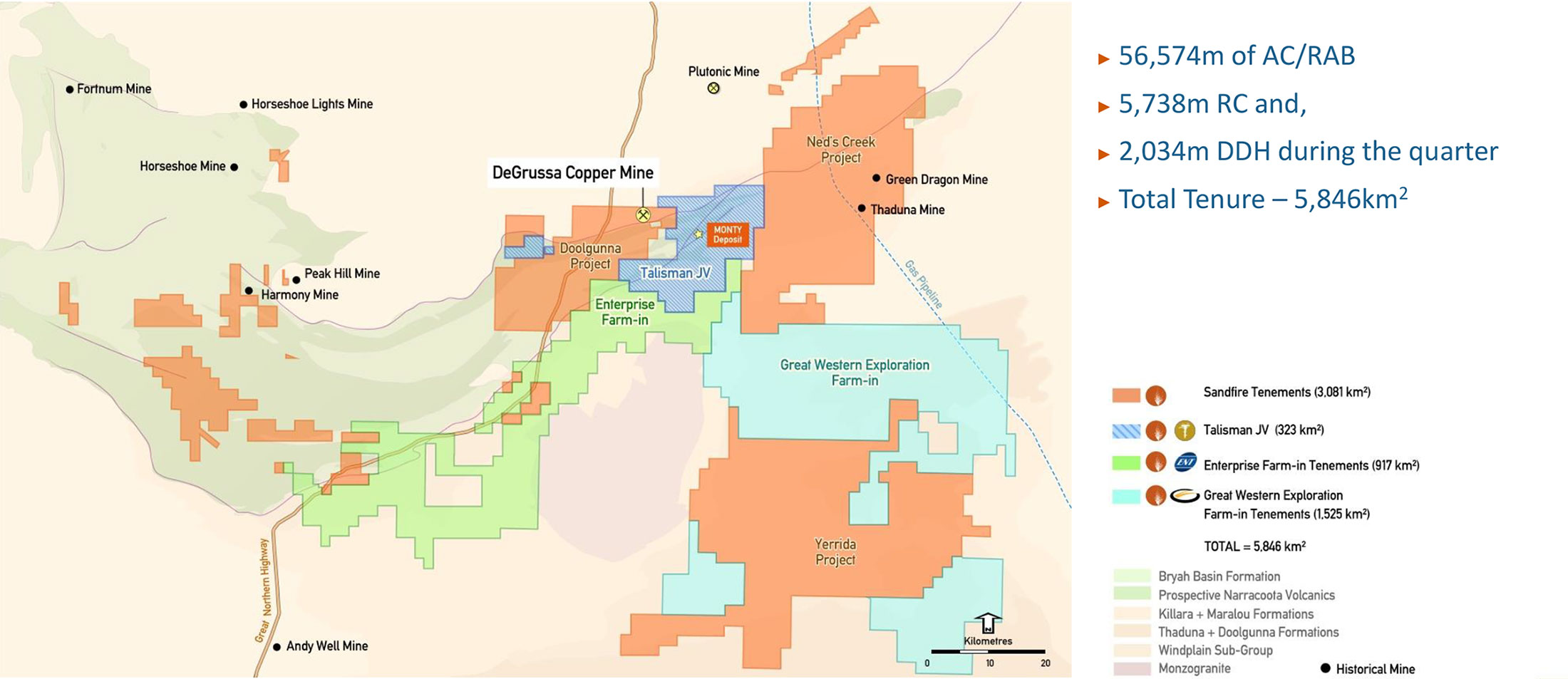

DeGrussa (and Monty) are just two high-grade mineralized zones in the greater Doolgunna area and Sandfire is convinced there’s more to be found in the wider Doolgunna region. That’s why it has entered into joint venture and earn-in agreements with companies owning the land surrounding DeGrussa.

Sandfire Resources has plenty of exploration agreements in the greater Doolgunna region (see image below) and has drilled a total of 140,000 meters on the Ned’s Creek, Springfield and Enterprise land packages which are part of a joint venture deal (or, as in Ned’s Creek, are the property of Sandfire Resources). Whilst we don’t want to underestimate the potential of these joint venture agreements and the merits of this regional exploration program (after all, that’s how Monty was discovered and developed), we won’t attribute any value to the potential projects at this point in time, just to err on the side of caution.

Strong cash flows provide optionality and flexibility

The combination of a well-defined orebody and high-grade mineralization usually results in strong cash flows, and Sandfire Resources is no exception.

During the previous financial year (which ended in June 2017), Sandfire reported a total operating cash flow of A$216M and after taking care of the A$83M in capex and A$1.2M in interest expenses, approximately A$132M was added to the balance sheet (partly in cash, partly by repaying an A$50M tranche of debt. Keep in mind this performance was based on realizing an average copper price of US$2.53 per pound, so we had high hopes for Sandfires first semester of 2018.

And the company didn’t disappoint us. It released its financial results on February 20th and despite selling just 30,200 tonnes of copper (in concentrate), its revenue increased by a double-digit percentage to A$281M. We were more interested in Sandfire’s free cash flow performance and fortunately the company didn’t disappoint there either.

As you can see in the previous image, Sandfire reported an operating cash flow of A$106M and after deducting the A$43M in capex, the free cash flow result was an acceptable A$63M. Again, this is based on selling just 30,200 tonnes of copper (and Sandfire will produce more copper in the second half of this year), indicating it generated A$1 per pound of copper in free cash flow. As all the debt has been repaid the cash was spent on the semi-annual dividend (A$21M), the additional investment in Sandfire Resources America (A$7M) whilst the remaining cash was added to the bank account. The result? A net cash position of A$164M.

Also keep in mind the A$63M actually included an A$5.7M cash expense on the Monty project (with an additional A$20M spenton plant and equipment at both DeGrussa and Monty), whilst it also included A$19M in underground development activities at DeGrussa. So, the A$63M net free cash flow is a ‘pure’ result as it even includes the expansion capex as well as A$15M on exploration.

This means we expect the free cash flow result in the current semester to be even stronger. Although Sandfire will continue to invest in Monty (which will weigh on the ultimate free cash flow result this semester), Sandfire should definitely be able to add A$25-40M in free cash flow to the balance sheet in the current six-month period (note; the amount could be higher depending on the payment schedule related to the construction of Monty).

But once construction at Monty will have been completed, Sandfire will experience a double advantage. Not only will its cash costs decrease and output increase due to the higher grade nature of the Monty ore, it will also incur lower capital expenditures.

Sandfire Resources America: the next stepping stone?

After acquiring the stake of Electrum and participating in the recent rights issue, Sandfire Resources now owns 78% of Sandfire Resources America (previously called Tintina Resources; we will from here on refer to Sandfire Resources America as ‘SFRA’).

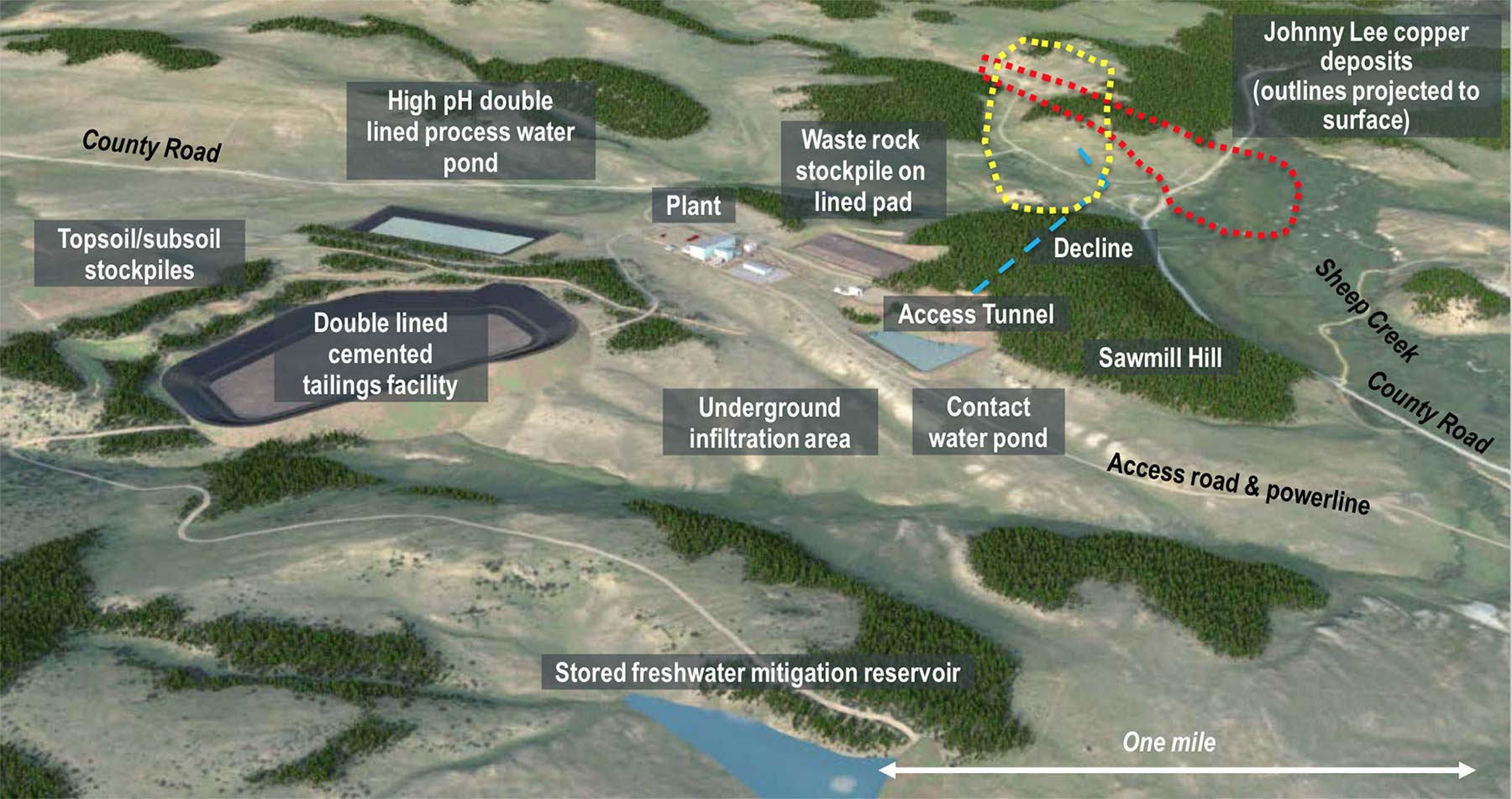

SFRA owns the Black Butte copper project in Montana, which is currently in the middle of the permitting process. The company received a draft operating permit in September 2017 and has submitted its application to obtain an environmental permit. After touching base with SFRA CEO John Shanahan, it now looks like the draft EIS could be received as soon as the middle of this year, which keeps the company on track to receive the final EIS approval by the end of this year (there will be a public comment period after the draft EIS, so this comment period as well as the company’s answers will take some time).

Should the Record of Decision indeed be granted by the end of this year, there’s nothing preventing SFRA to start building the Black Butte mine (obviously Sandfire Resources will have to bankroll the construction phase). This actually paves the way for Sandfire to get an even tighter grip on SFRA, or why not, acquire the 22% of the shares it doesn’t own yet. Then it will acquire full ownership of the Black Butte project and if it would launch a takeover offer in an all-share deal, it would simultaneously obtain a TSX listing. That would probably help to increase investor awareness in North America, but it would also create the need for Sandfire to (re-)publish its DeGrussa technical reports to comply with the Canadian NI43-101 format. That could be a hurdle, but we don’t think an A$1B+ company would mind spending a few hundred thousand dollar on a technical report to ‘officialise’ things.

Just as a reminder, the pre-tax NPV8% of the Black Butte copper project is approximately US$218M (A$278M), so the project would definitely make sense for Sandfire Resources as its 78% stake currently has a market value of just A$35M.

Granted, Black Butte is a ‘waiting game’ but with John Shanahan as head of the company, Sandfire Resources America has a good shot at effectively obtaining all necessary permits to build this mine. Shanahan (and Sandfire) are known to do everything the right way, avoiding any shortcuts which might derail the entire permitting process.

Conclusion

Sandfire Resources isn’t cheap, but it has one major advantage: a net cash position on the balance sheet. When all is said and done, we would expect Sandfire to end up with a pro-forma net cash balance of A$550-700M (assuming it will still pay an attractive dividend) based on the current mine plan (and thus excluding the potential contribution from the regional exploration program.

This doesn’t mean the company is only worth the A$700M it will end up with. First of all, shareholders will continue to benefit from a dividend which could be seen as a direct transfer from company cash to personal cash.

The remaining A$700M will provide the company with one thing: optionality. It already owns 78% of Sandfire Resources America where the Black Butte copper project has an after-tax NPVX% of A$278M, and we think it’s a fair assumption Sandfire will try to own 100% of the project. And as SFR wouldn’t even need to blow its entire cash position on the Black Butte construction it is able to keep its options open to acquire more projects.

So rather than seeing the end of the DeGrussa mine life as a ‘finish line’, it could be the start of a ‘New Sandfire’ as the company has its future in its own hands. At A$8 per share, Sandfire is pretty expensive. But it might be worth to keep an eye on its developments as it continues to add cash to the balance sheet.

The author has no position in Sandfire Resources but could initiate a long position in Sandfire Resources America. Please read the disclaimer