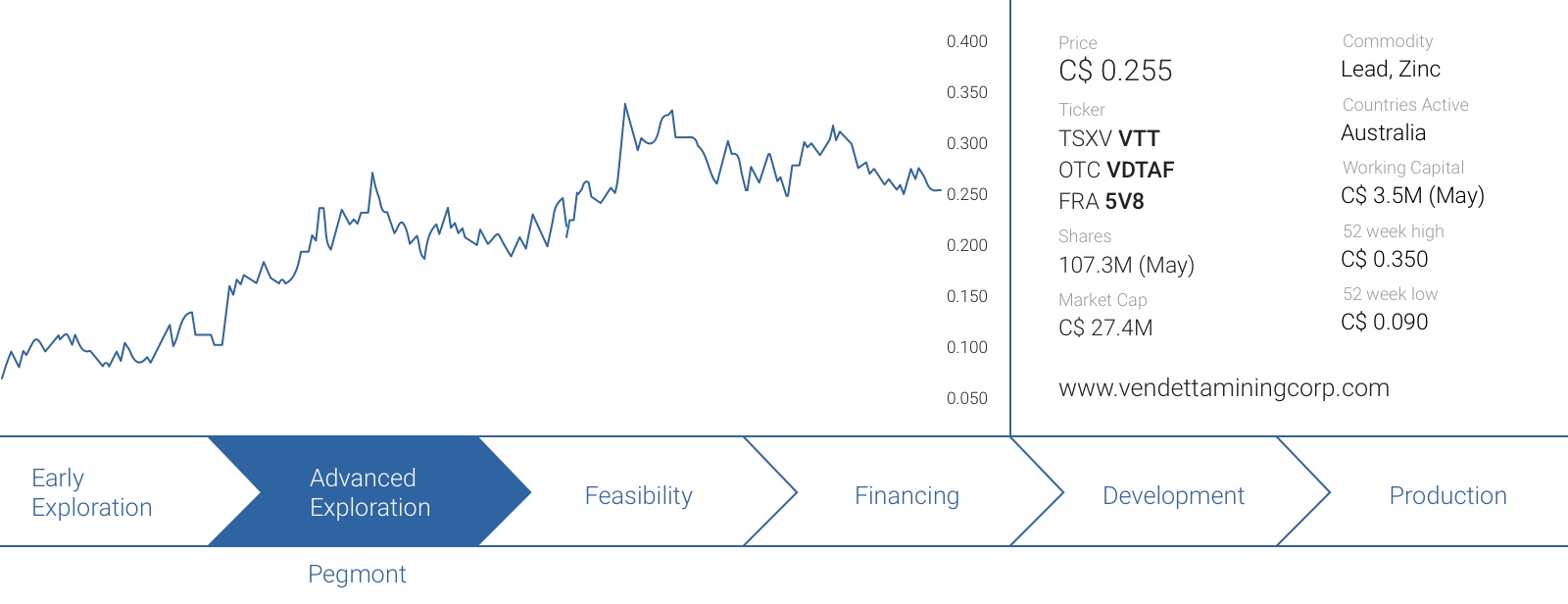

How times have changed! Just 18 months ago, during PDAC 2016, Vendetta Mining (VTT.V) announced that it was raising capital at C$0.05 to advance its lead-zinc project in Australia. That was way before the zinc price started to increase, and we think it’s fair to say the first few weeks of the placement weren’t a walk in the park for Vendetta Mining. Fortunately, the company was able to raise C$2.2M by bringing some strong (institutional and strategic) shareholders on board. It also solidified Vendetta’s position as one of the ‘first movers’ in the zinc space.

These C$2.2M were probably the most important dollars raised in the base metals sector in the past few years as it allowed Vendetta Mining to complete another exploration program which was pivotal in the interpretation of the geological structure at Pegmont. Once the Broken Hill model was confirmed, it was easier for Vendetta to advance the project at an even faster pace.

After having raised an additional C$4.2M in May, Vendetta Mining is on a straight path towards completing an additional resource estimate, and more importantly, a Preliminary Economic Assessment which should be published at some point next year.

In this report, we will ty to build an economic model based on the currently known parameters (or our realistic assumptions).

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

The background of Pegmont – a brief recap

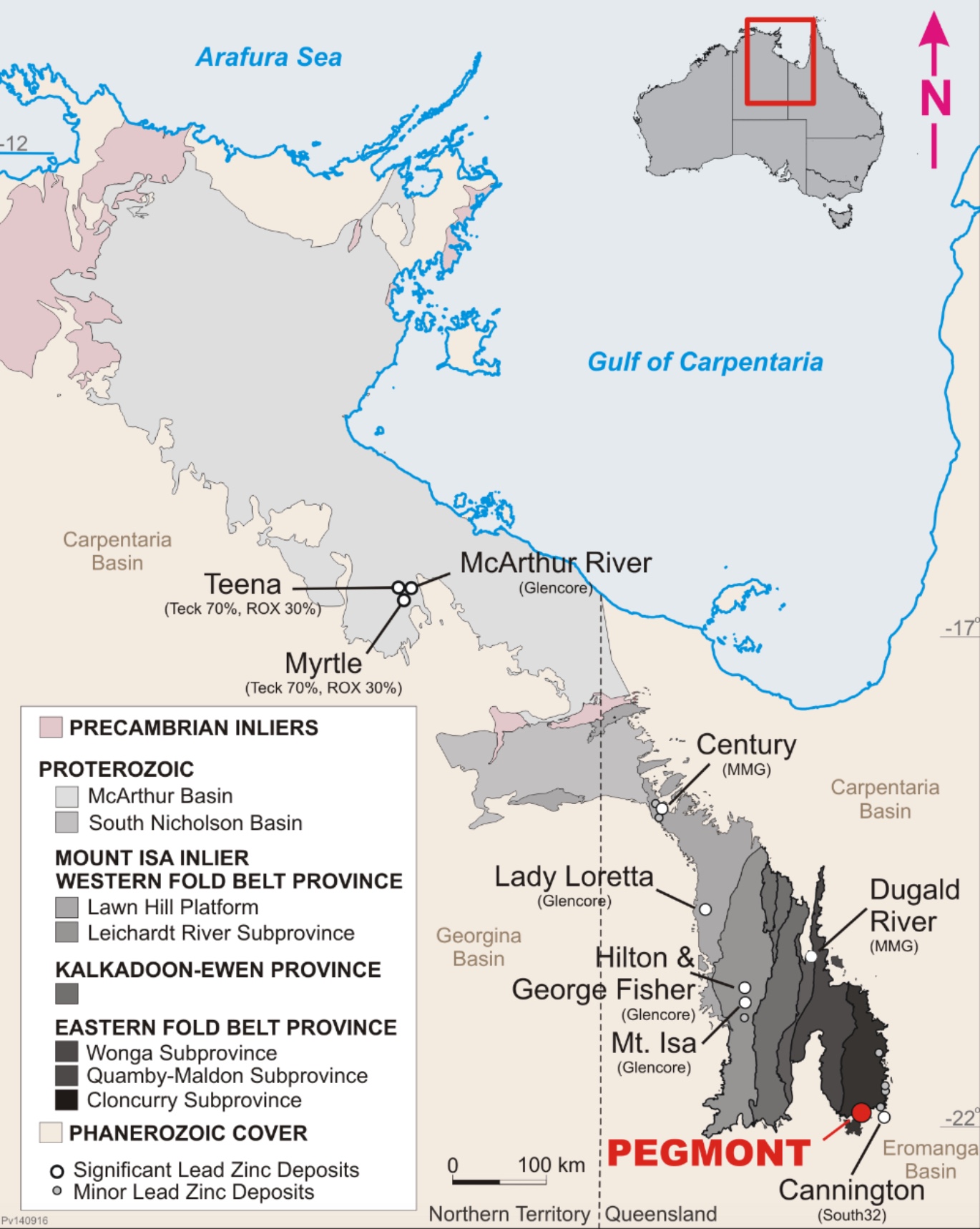

Vendetta’s flagship project is the Pegmont Lead-Zinc project (despite the higher zinc price, and fortunately for Vendetta, the lead dominant mineralization in the open pit shells should lead component of the project will generate more revenue than the zinc dominant underground mineralization). The deposit is located less than 200 kilometers southeast of Mount Isa in Australia’s Queensland province. As you can see on the next map, the project is part of the Mount Isa Mineral Province and according to historical data, this exact region hosts in excess of 25% of the world’s reserves in lead and zinc (so it definitely is the right place to explore for base metals).

The Pegmont project has been around for quite a while after outcrop was discovered in the 70’s, but nobody really understood the geology of the Pegmont project until Vendetta Mining was able to confirm its Broken Hill theory based on last year’s drill results.

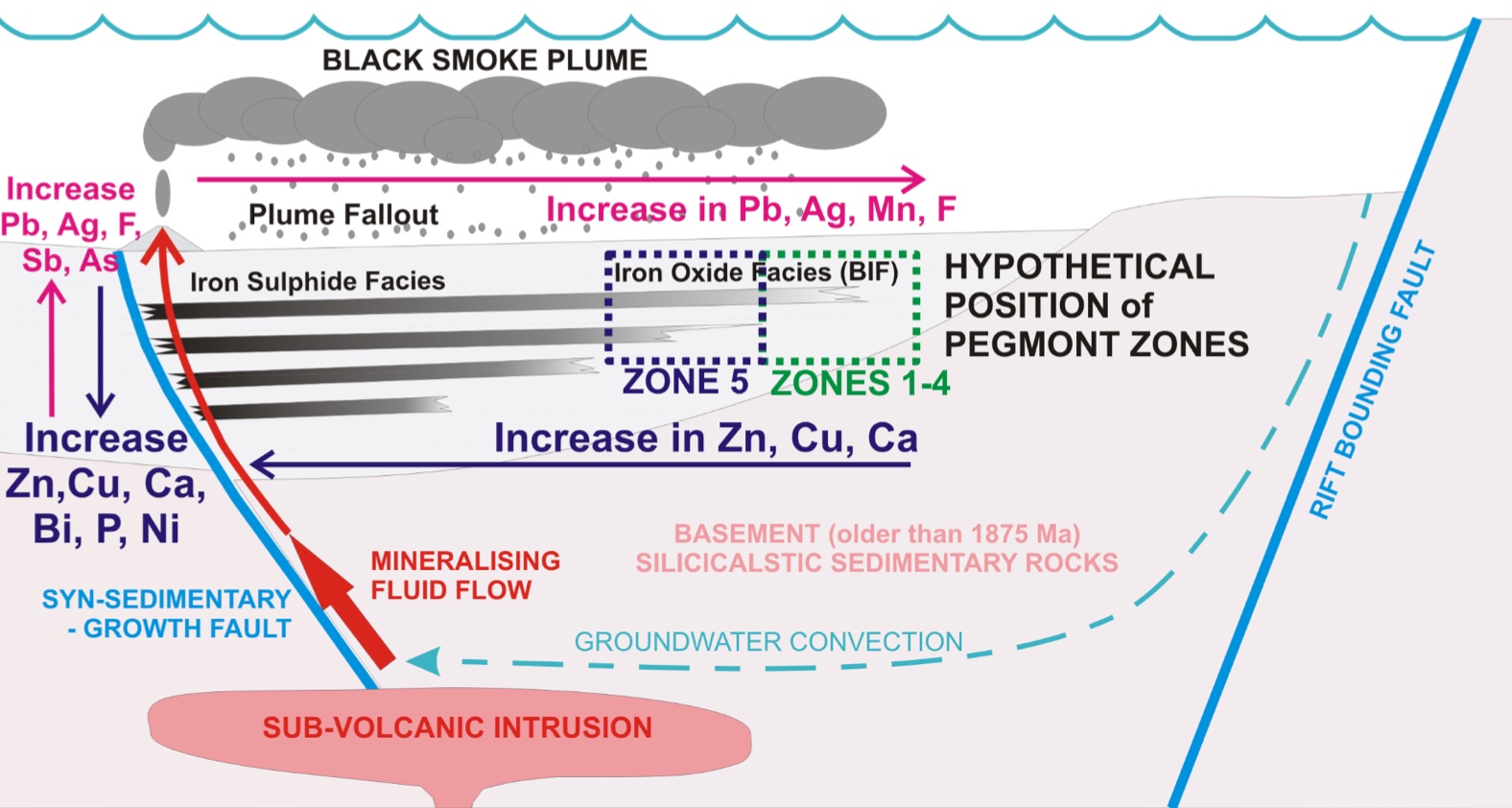

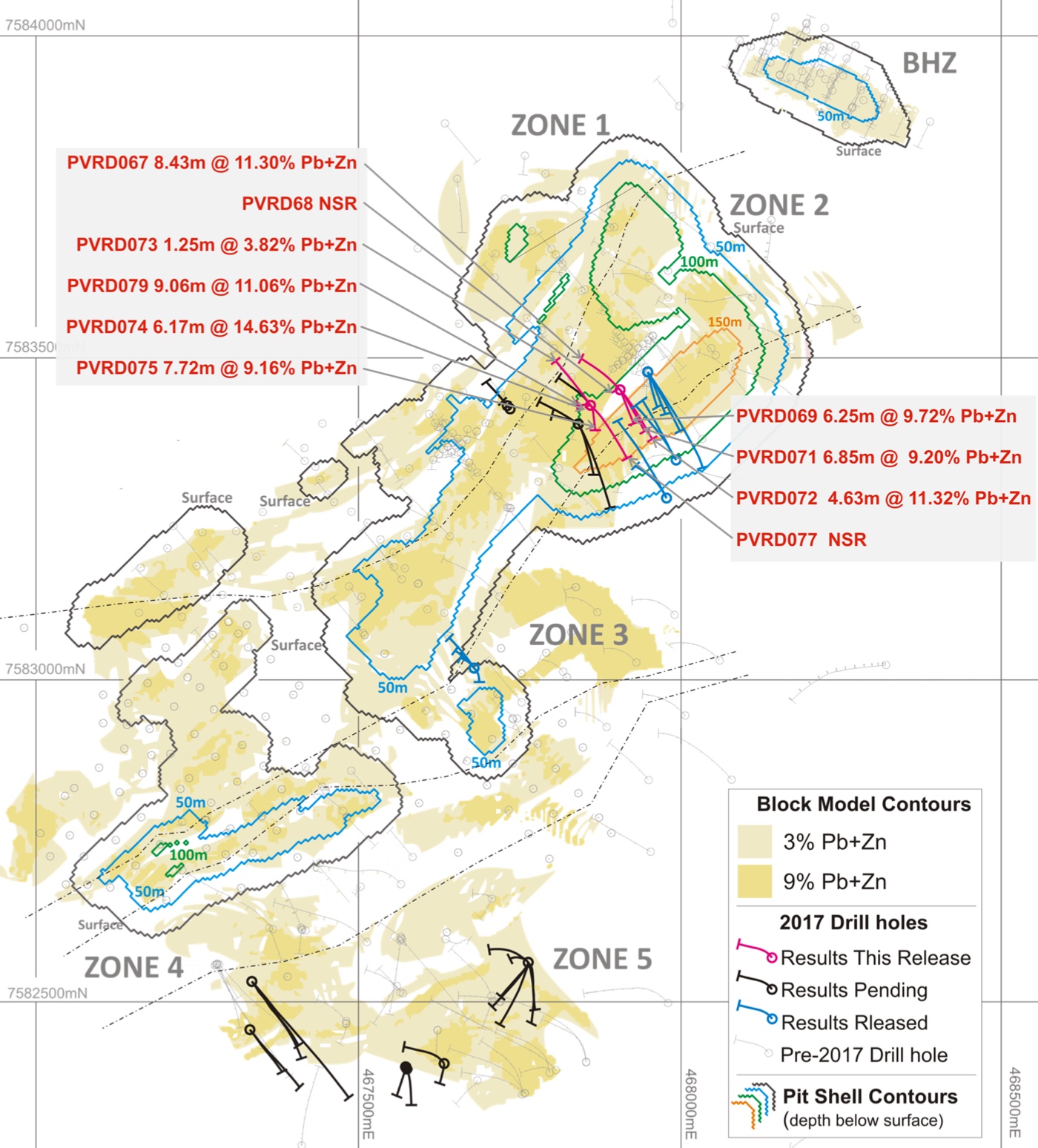

Without getting too technical, the Broken Hill model contains stacked lenses (rather than the single lens theory the previous owners of Pegmont were basing their exploration models on) whilst the type of mineral occurrences changes as you move further away from the source of the volcanic event. As shown on the next image, Vendetta Mining has now been able to classify its different mineralized zones at Pegmont based on this model, and the zinc-rich Zone 5 was located closer to the volcanic event, hence the higher zinc grades.

Confirming Pegmont essentially is a Broken Hill type deposit was essential for the development of the property. Not only did this provide Vendetta Mining with more insight allowing it to design a more focused exploration plan, it also undoubtedly attracted the interest of other companies in the region as South32’s (ASX:S32) Cannington lead-silver mine is a Broken Hill type deposit as well.

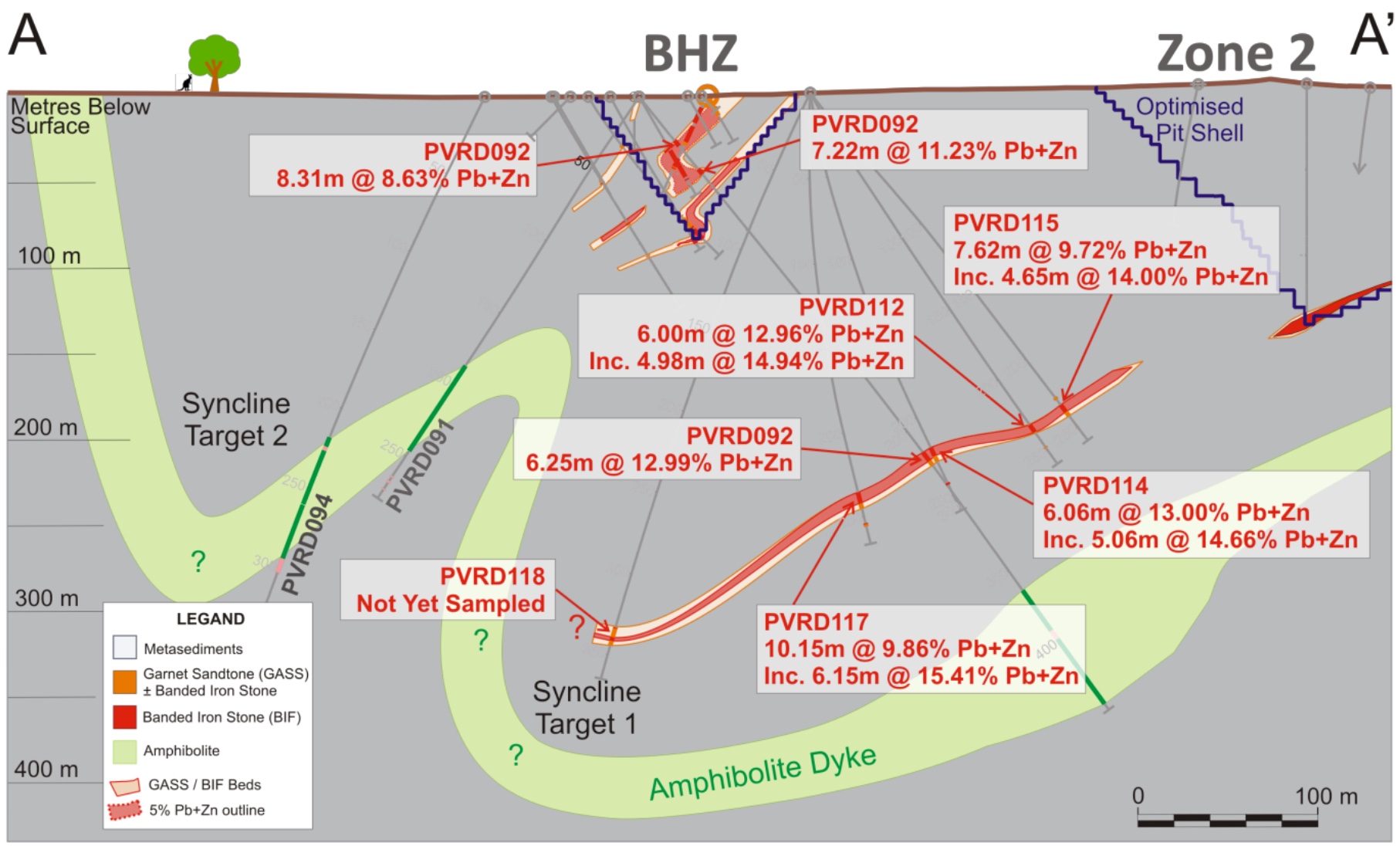

Once an updated resource estimate was completed earlier this year (see later), Vendetta Mining was able to start ‘drilling for grade’. The model has now been established and whilst exploration still isn’t an exact science, Vendetta’s success rate increased tremendously as has been shown in the company’s continuous drill updates.

More importantly, the recent discovery of the mineralized ‘Bridge Zone’ is an additional important step for the Vendetta Mining as it shows the company now has a really good understanding of the geology at Pegmont. This Bridge Zone was previously unexplored but now seems to host a sizeable underground mining target as the drill bit has intersected high-grade lead-zinc intervals (with, as expected based on the Broken Hill model a particularly lead-heavy content).

This will definitely be an underground target, but as it seems to be a continuation of the Zone 2 mineralization, we wouldn’t be surprised to see Vendetta ‘chase’ this zone after having completed mining at Zone 2. Then it could just build a decline from the pit wall to reach the bridge zone, which is less than 100 meters away, as you can see on the previous image.

A quick calculation based on an average true width of 6.25 meters, a length of 300 meters and a width of 170 meters (based on an expected continuation for at least 85 meters on both sides of the series of ‘discovery’ holes) and a bulk density of 3, it’s easy to see at least one million tonnes of ore at the Bridge Zone. With a recoverable rock value of US$215/t and an anticipated production cost (mining + processing) of less than US$75/t, you could be expecting a pre-tax undiscounted net cash flow of $140M right there.

The metallurgical test work and updated resource estimate are important steps

After having confirmed Pegmont effectively as a Broken Hill type deposit, Vendetta still had to complete several important steps. One of them was obviously the necessity to reach the ‘critical mass’ size as soon as possible. Vendetta never made a secret of its goal to find 15 million tonnes of rock, of which the best 10 million tonnes would be included in the mine plan.

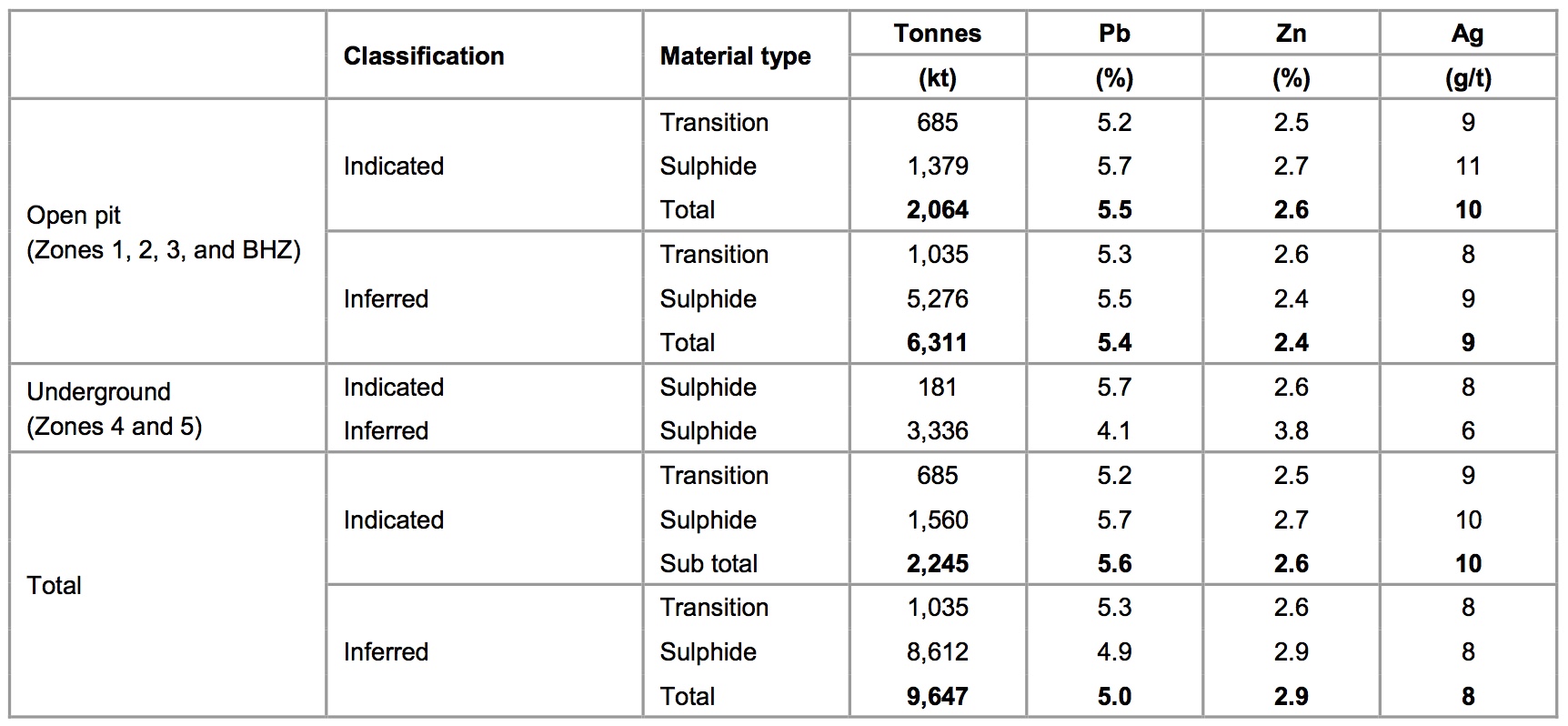

Right before the summer holidays, Vendetta Mining also released a long-awaited resource update which included almost 13,000 meters of additional drilling since the previous estimate was released. Whereas the average expectations were hoping for a total tonnage of 10 million tonnes, Vendetta Mining did much better as its resource contains almost 12 million tonnes. But what’s even more important is the fact the total open pit resources came in at 8.4 million tonnes of ore.

And suddenly, the scope of Pegmont changed from ‘an underground mine with a small open pit component’ to ‘an open pit with an underground component at the end of the open pit mine life’. The meaning of the word ‘game changer’ has been diluted recently, but this updated resource estimate truly is a game changing event for Vendetta’s Pegmont project.

Not only does this mean the total size of the project could be much larger than the original expectations (which were calling for a ‘mine the best 10 of 15 million tonnes), the larger open pit resource also means the capex to go underground can now be deferred until year 6 of the mine life. Not only will this result in an important boost to the mine’s economics (spending $50M on underground development in year 6 only counts for $32M in the NPV calculations using an 8% discount rate), the company can now pay for the underground mine using the cash flows from the open pit operation. This boils down to one thing; the initial capex will be much lower as well, as Vendetta now only needs to build the plant and perhaps complete some pre-stripping activities to get Pegmont up and running.

Keep in mind the resource estimate was based on a lead price of $0.90 per pound and a zinc price of $0.95 per pound which is extremely conservative (especially compared to the current zinc price of $1.40/lb and lead price of $1.05/lb). Should the company use a lead price of $1.05 and a zinc price of $1.15, we would expect Vendetta Mining to be able to include more tonnes in the open pit scenario as the NSR cut-off (in dollars) would require a lower minimum grade of the ore.

Considering the low commodity prices used and the successful 2017 exploration program, we feel very confident the amount of tonnes in the open pit model will increase in the next resource update, and this bodes very well for the PEA.

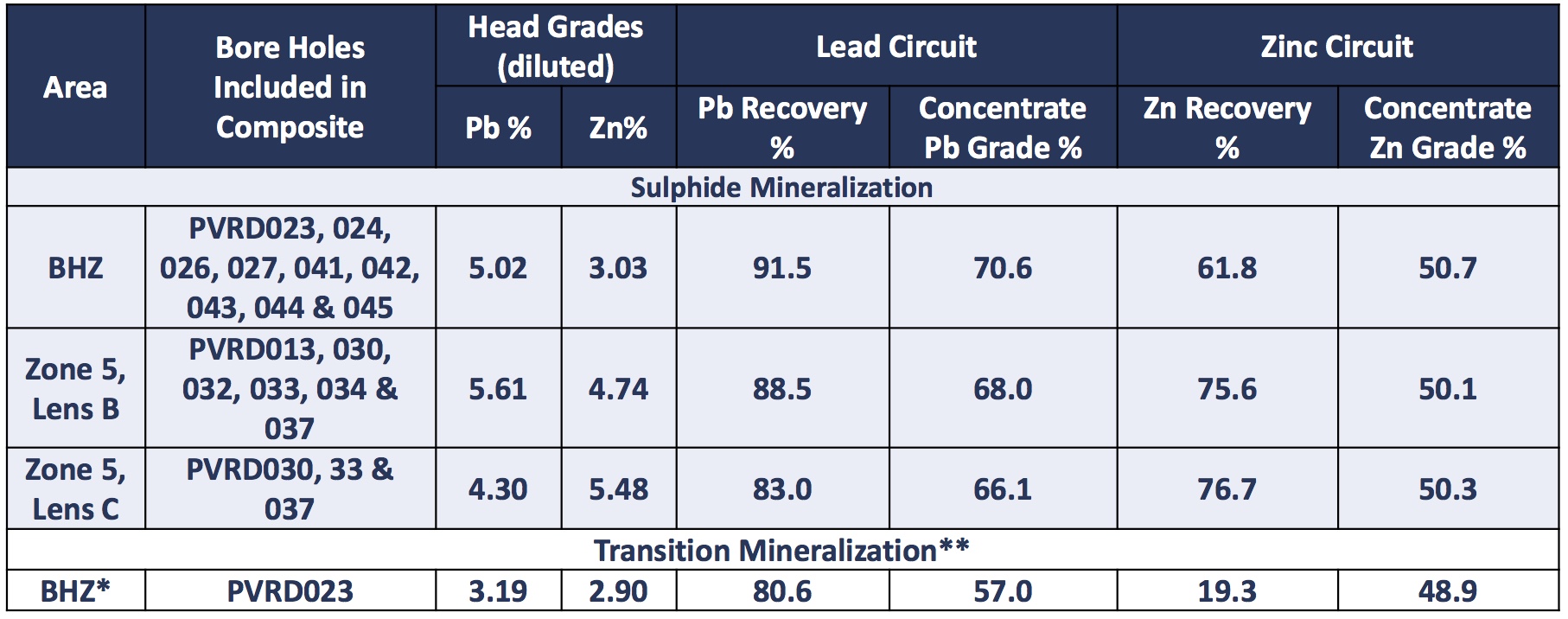

But apart from determining whether or not the necessary critical mass is there, metallurgy still was a huge question mark. A question mark which changed to an exclamation mark when the company released the results of the preliminary metallurgical test work. Whilst only three zones were used for composite samples (Burke Hinge, and the B and C lenses at Zone 5), these first test results already provide us with a good indication of the anticipated recovery rates and concentrate grade. Heavy Media Separation was useless, so the Pegmont rock will be processed using a very simple Lead-Zinc differential flotation circuit.

At the Burke Hinge open pit zone, the metallurgical test work indicated a recovery rate of 62% for the zinc resulting in a concentrate grade of 50.7% zinc, whilst the recovery rate of the lead was much higher than we anticipated at 91.5% resulting in a concentrate grade of in excess of 70%.

The Zone 5 underground targets showed higher zinc recovery rates (76%) whilst the average recovery rate for the lead dropped was reduced to 86% . Both the lead concentrate and zinc concentrate were marketable without requiring any additional cleaning.

The results of the metallurgical test work were perhaps even more important than the substantial resource update (after all, having a large resource doesn’t matter if you can’t recover the metals from the rock). As this was just a first attempt to define the metallurgical recovery rates, we have no doubt the percentages will still increase as Vendetta hasn’t even started to fine tune the reagent mix to reach an optimal combination, maximizing the recovery rate. Every additional 1% increase of the recovery rate would increase the average annual zinc production by 0.5 million pounds per year, whilst the average lead production rate would increase by more than 1 million pounds per year. So it’s definitely worth to put some effort into fine-tuning the metallurgical process. We are also looking forward to see metallurgical test work on the zones 1-3 which will be open pits. We expect the recovery rates to be closer to the Zone 5 recovery rates as the mineralization is located deeper than at the Burke Hinge Zone.

A very preliminary back of the envelope economic model

Before starting our calculations, we need to establish our base parameters; which we summarized here below. Keep in mind these are our own expectations and assumptions and are not the official guidance of the company, as Vendetta Mining still needs to complete a maiden PEA.

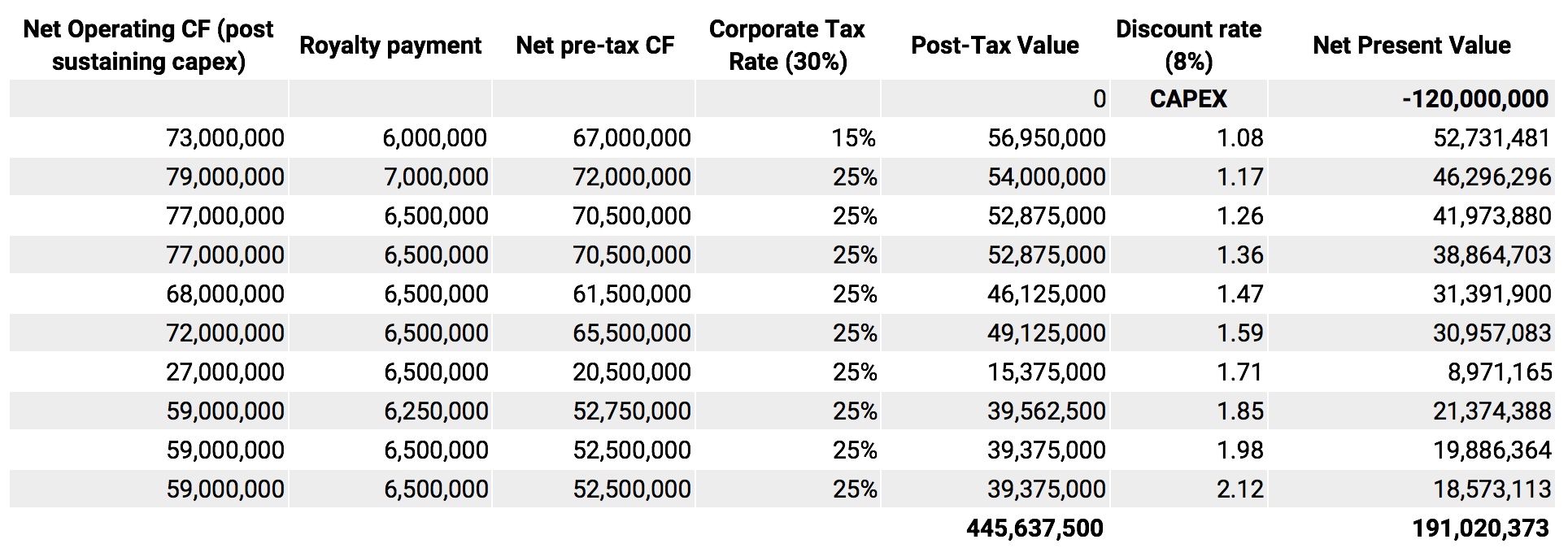

We will use a total royalty cost of 5%, consisting of a 3.5% NSR payable to the government of Queensland (the 3.5% is a mixed average of the expected zinc and lead prices. There also is a 1.5% royalty payable to the vendor of the property.

We will use a zinc price of $1.20/lb and a lead price of $1/lb. For now, we are keeping the potential silver credit out of the calculation. The used average payability ratios are 90% for the lead and 82% for the zinc (taking the discounts for lead reporting to zinc concentrate and vice versa into account).

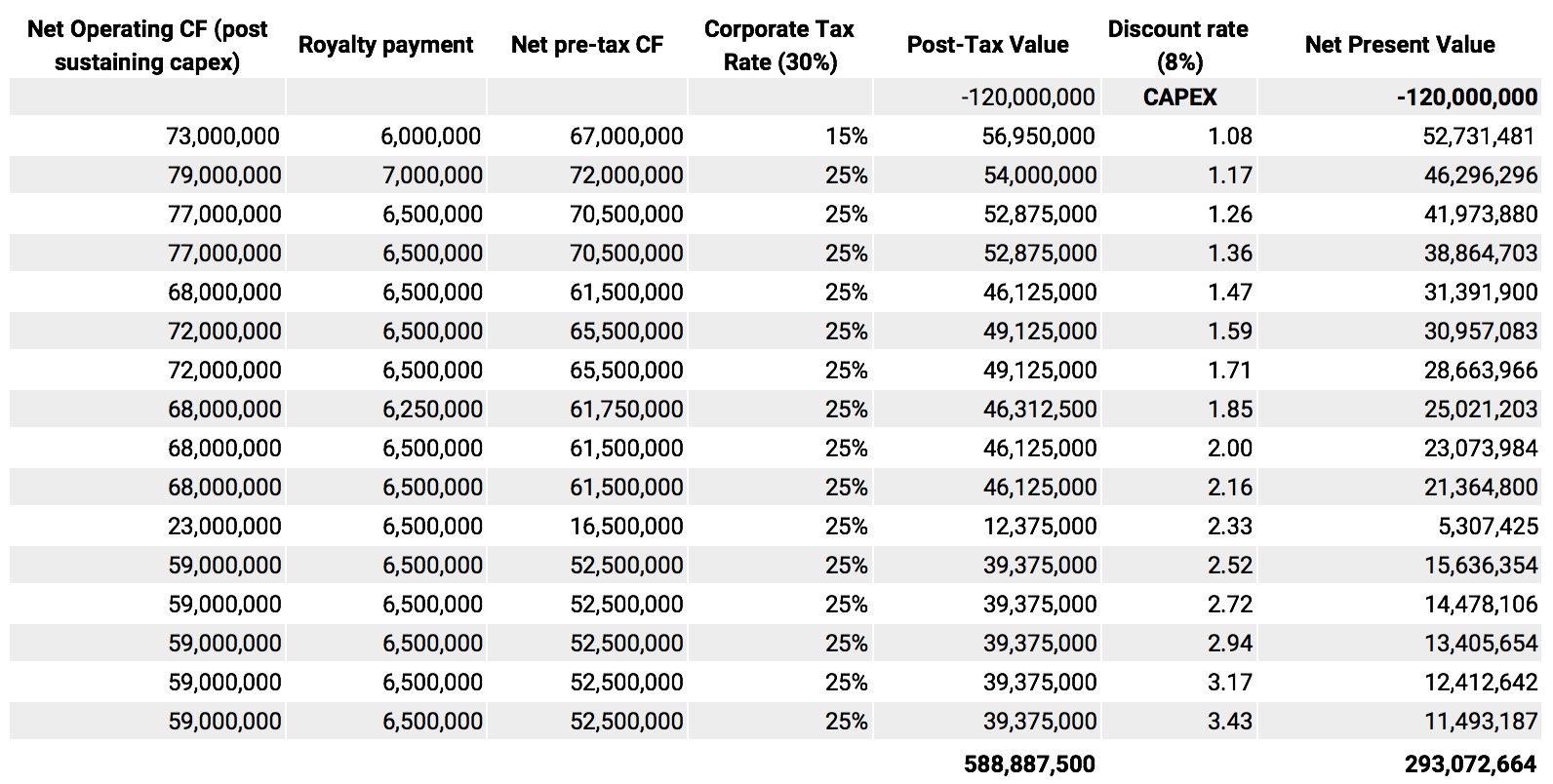

We expect an average interest expense of $4M for 5 years and will take an average sustaining capex of $5M/yr into account, which will offset the depreciation charges on the project (which in our calculations is important to calculate the taxable basis). The corporate tax rate in Australia is 30%, but we are expecting a lower tax bill in the first year, as well as a lower effective tax rate (as the initial capex will obviously have to be depreciated).

In this calculation we will only take the sulphide material into account and will ignore the majority of the 1.7 million tonnes of transition ore for now (we did include 0.5 million tonnes of transition ore in the first year of the economic model. Whilst the recovery rate of the zinc is low (19.3%), almost 81% of the lead would be recovered. The grade of the lead concentrate is relatively low at 57%, but we would expect Vendetta to be able to blend the lower grade concentrate with the higher grade concentrate from the other open pit zones.

The used recovery rates are 45% for the zinc and 85% for the lead mined at BHZ I year 1 (assuming some transition material will be included), increasing to an average recovery rate of 63% and 90% in year 2, and 70% and 85% in the subsequent years. The average grade we are using in our model is 5.5% lead and 2.5% zinc.

The calculation process will include an average strip ratio of 10:1 (using3:1 in year 1 as we will attribute a part of the capex to pre-stripping activities, 8:1 in the subsequent 3 years of the mine life, increasing to 12:1 in the final 3 years of the open pit operations). As per the technical report, we will use a mining cost of US$2 per tonne of waste and US$3 per tonne of ore and a US$7/t handling & G&A expenses. The processing cost was estimated at $25/t in the technical report but we think this could be reduced. Solitario Zinc (SLR.TO , XPL) used a processing cost of less than $13/t (which seems to be too optimistic) for its Florida Canyon PEA. We will use a processing cost of $22/t in our model.

We will use an initial capex of US$120M (which includes a 1Mtpa processing plant and pre-stripping activities). The discount rate used in our calculations is 8%.

1. Standalone – current resource estimate 7 million tonnes open pit & 3 million tonnes underground

We will allow for an $45M capex in year 7 to initiate the underground development at Pegmont. We would assume the company will reach Zone 5 using a decline/drift from a side of the open pit. The assumed underground grade is 4.2% lead and 3.9% zinc. We will use a recovery rate of 76% for the zinc component and 85% for the lead. We are using a mining cost of US$40 per tonne of ore (the current triple digit mining cost for the underground calculations at Cannington aren’t really representative for normal underground operations). Note, the calculations are prepared in US Dollar.

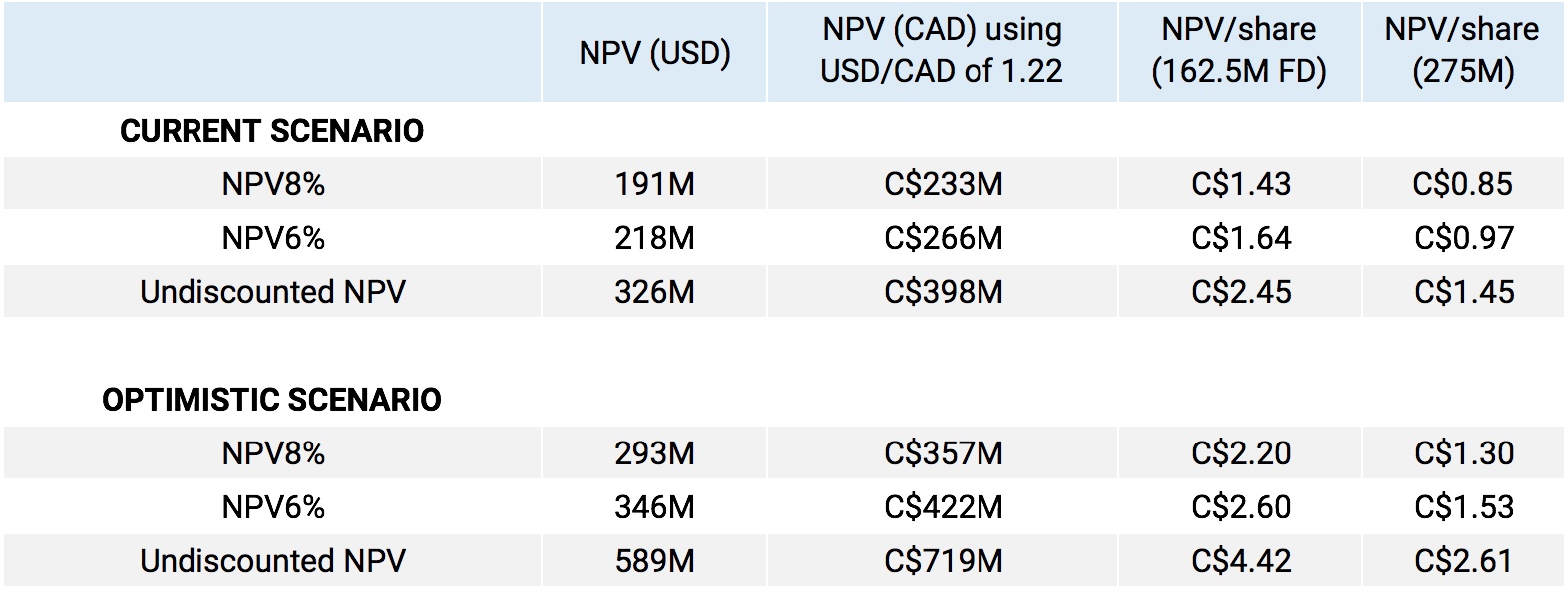

This scenario would result in an after-tax NPV8% of US$170M. We believe we have been very conservative with our assumptions. Our assumed underground mining cost (US$40, which is approximately A$51) is approximately 13% higher than the estimate provided in the technical report (AU$45/t). Using a discount rate of 6%, the after-tax NPV would increase to US$218M.

2. A more optimistic scenario – 11 million tonnes open pit and 5 million tonnes underground

As more tonnes will be included in the open pit (due to A) continued exploration success and B) the higher lead and zinc prices allowing a lower cut-off grade to be used), we will use a strip ratio of 14:1 in the additional 4 years of the mine life.

Using a 6% discount rate; the after-tax NPV would increase to US$346M from $293M.

What does this mean for Vendetta?

First of all, you should realize this is just a very rough back of the envelope calculation based on either known parameters or what we think are reasonable assumptions. There will obviously be fluctuations in the annual cash flows based on the strip ratio throughout the years, grade variability, contract price fluctuations, processing transition ore during the mine life or at the end, etc… This calculation was merely meant to provide you with some sort of idea of our expectations for the upcoming PEA in 2018.

Based on a P/NPV ratio, Vendetta is one of the cheaper lead-zinc companies out there. Even if we would take the fully diluted share count of 162.5 million shares into account (the 4.3M C$0.35 warrants have expired), the after-tax NPV8% of Pegmont represents a value of C$1.43 per share of Vendetta Mining.

Should all remaining warrants and options (excluding the 2021 options priced at C$0.15) be exercised, a total of C$7.55M would flow into Vendetta’s treasury which would take care of its funding needs until a construction decision has been reached (excluding the option payments and advance royalty payment). Taking everything into consideration, we think it’s fair to assume Vendetta Mining should be able to keep its share count below the 250-275M mark post construction financing (note: this will have a positive impact on the NPV of the cash flows. Should Vendetta raise C$40M in equity for construction funding (with the remainder financed with debt), we would need to take this into consideration as ‘net cash’ and add it back to the NPV again).

This means that on a fully diluted post-financing basis, Pegmont could have a value of C$0.99 per share of Vendetta Mining (based on 275M shares).

This is based on just the current resource estimate, and we have no doubt Vendetta Mining will be able to add several more years to the mine life. The next table summarizes al results, and provides a NPV per share calculation based on the aforementioned current FD share count of 162.5M shares as well as an anticipated 275M outstanding shares.

If we would now apply a 40/60 weighing to see the current scenario and the optimistic scenario coming to fruition (we are giving the optimistic scenario a weight of 60% due to the recent exploration success), we would expect the fair value of the project to be C$307M (using an 8% discount rate) and C$359M using a 6% discount rate.

The next steps: completing the earn-in, an updated resource estimate and a PEA

Vendetta is currently drilling Pegmont (once again) focusing on infill drilling inside the existing resource as well as increasing the total tonnage at Pegmont. This should allow the updated resource to support a 10 year + mine life in the Preliminary Economic Assessment, which is planned for 2018.

That being said, due to the size of Pegmont and the proximity of two plants capable of processing the Pegmont ore, we aren’t convinced Vendetta Mining will be around long enough to effectively complete a PEA. After all, larger companies like a South32 don’t care about NI43-101 compliant resources or mine plans at all, as they simply use in-house resources to design a mine plan themselves.

Looking at South32’s open pit resource of 20 million tonnes, the average grade is just 3.12% lead and 2.06% zinc, which means Pegmont’s average grade is substantially higher than the Cannington open pit grade making it a particularly interesting target for S32 which could just truck the Pegmont ore to its processing plant at Cannington. As South32 could use ‘road trains’, we would anticipate the trucking cost to be very low, at less than US$15/t allowing Pegmont to become a ‘excavate & truck’ satellite project to Cannington.

Conclusion

With in excess of 10 million tonnes of rock (soon to be called ‘ore’ upon the completion of economic studies) in an open pit (a number which we still expect to increase based on the data from this year’s drill program), Vendetta Mining’s Pegmont project is a juicy carrot dangling right in front of South32 and Chinova.

Even if South32’s willingness to pay would be just 0.35 times the weighed NPV8% of both Pegmont scenario’s as a standalone operation (where S32 would be able to remove the plant capex but incur a higher operating expense due to trucking the ore), a price tag of C$108M for Pegmont would actually be a feasible target and a win-win situation for all parties. Using the fully-diluted share count of 162.5M shares (no project financing dilution will be incurred), this results in a fair value of C$0.66 per share of Vendetta Mining. Using a discount rate of 6% would increase this to C$0.77 per share.

Of course, our calculations should be seen as a back of the envelope calculation and are just a starting point to do your own due diligence. But we think it’s fair to say the current market cap of C$27M (fully diluted: C$42M) isn’t doing the company any justice.

The author holds a long position in Vendetta Mining. Vendetta Mining is a sponsor of this website. Please read the disclaimer

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.