It’s been almost six months since Oroco Resource Corp (OCO.V) released the outcome of the Preliminary Economic Assessment on the Santo Tomas project in Mexico’s Sinaloa state. The outcome of the economic study was weaker than we’d expected (a 17.3% after-tax IRR was below our hurdle) but it also confirmed the tremendous upside potential of the project if/when the copper price would go up.

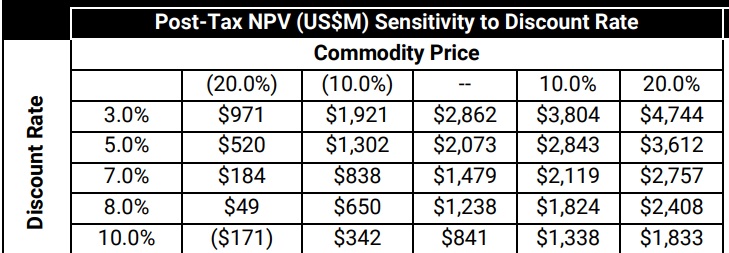

And copper is back in favor these days. Whereas the base case scenario of the PEA was using $3.85 per pound as copper price, the copper price is now trading more than 10% higher at in excess of $4.20 per pound. This means the sensitivity analysis provided in the PEA comes into play and if we look at the +10% scenario for the commodity prices, the after-tax NPV8% increased by almost 50% to US$1.82B. As you can see below, a further increase of the copper price to $4.60 per pound would add an another US$584M in after-tax net present value. Granted, we are still a ways away from $4.60 copper, but the sensitivity analysis shows the torque on the copper price provided by the project.

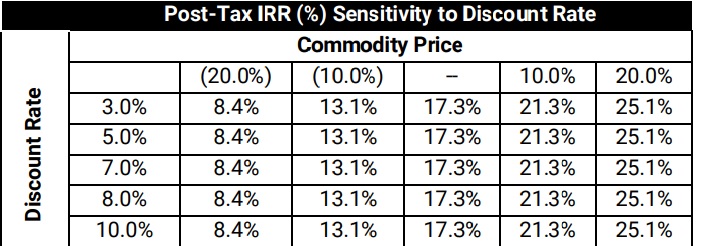

Looking at the after-tax IRR sensitivity analysis, we see a copper price of $4.24 (the +10% scenario) would push the IRR above the oh-so-important 20% hurdle as the after-tax IRR increases to 21.3% and even 25.1% in the $4.24/pound and $4.62/pound scenario.

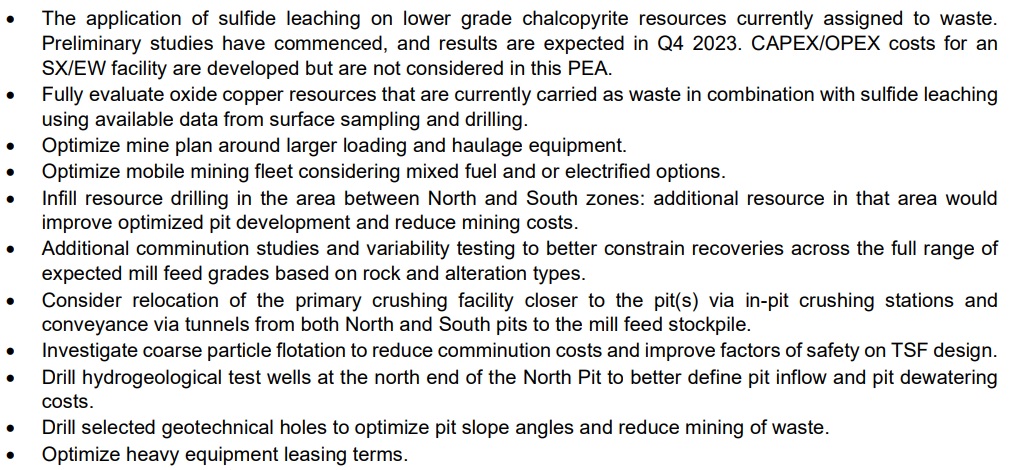

It’s our understanding Oroco Resource Corp is working on an updated PEA which should incorporate some of the potential improvements the company already identified at Santo Tomas. As a reminder, Oroco’s PEA announcement contained about a dozen bullet points with potential improvements and implementing the low hanging fruit could and should improve the current economics of the project.

The higher copper price definitely helps. But the updated PEA should contain improvements on some other fronts as well, further positioning Santo Tomas as a valid candidate to help solve the looming copper deficit.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read the disclaimer.