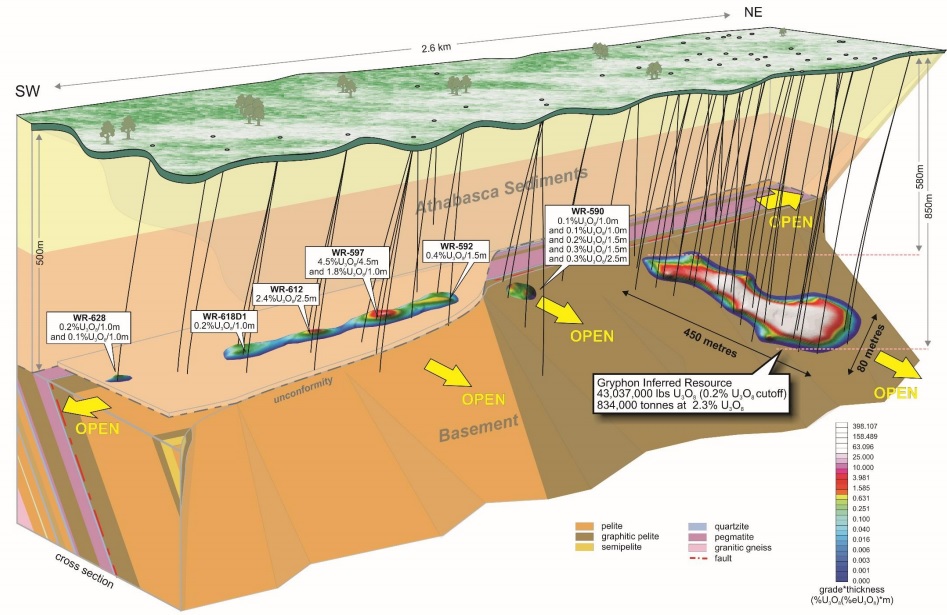

Denison Mines (DML.TO, NYSEMKT: DNN) has released the summary of its Preliminary Economic Analysis to determine the viability of the Wheeler River uranium project, in Saskatchewan’s Athabasca Basin. As Denison aims to use the McClean Lake Mill to process its ore, the initial capital expenditures remain quite low at C$560M on a 100% basis (including C$131M as contingency). The project will produce a total of in excess of 100 million pounds of uranium and according to the mine plan, the company will first target the conventional Gryphon deposit before tackling the Phoenix zone.

Using the current long-term uranium price of $44/lbs, the pre-tax NPV of the property comes in at C$513M (but keep in mind this is based on an USD/CAD exchange rate of 1.35, and applying the current exchange rate would result in a NPV of C$495M), increasing to C$1.42B (C$1.37B) using a long-term uranium price of US$62.60/lbs. Keep in mind Denison owns just 60% of Wheeler River, so its attributable pre-tax NPV at the current exchange rate is C$297M and C$823M.

That’s not bad for an uranium project as it provides a very nice leverage on the uranium price but the investment case stands or falls on whether or not the Wheeler River ore could indeed be processed at McClean Lake. If that’s indeed the case, this project will be a ‘go’ once the uranium price exceeds the $50/lbs mark.

Go to Denison’s website

The author has no position in Denison Mines at this time. Please read the disclaimer