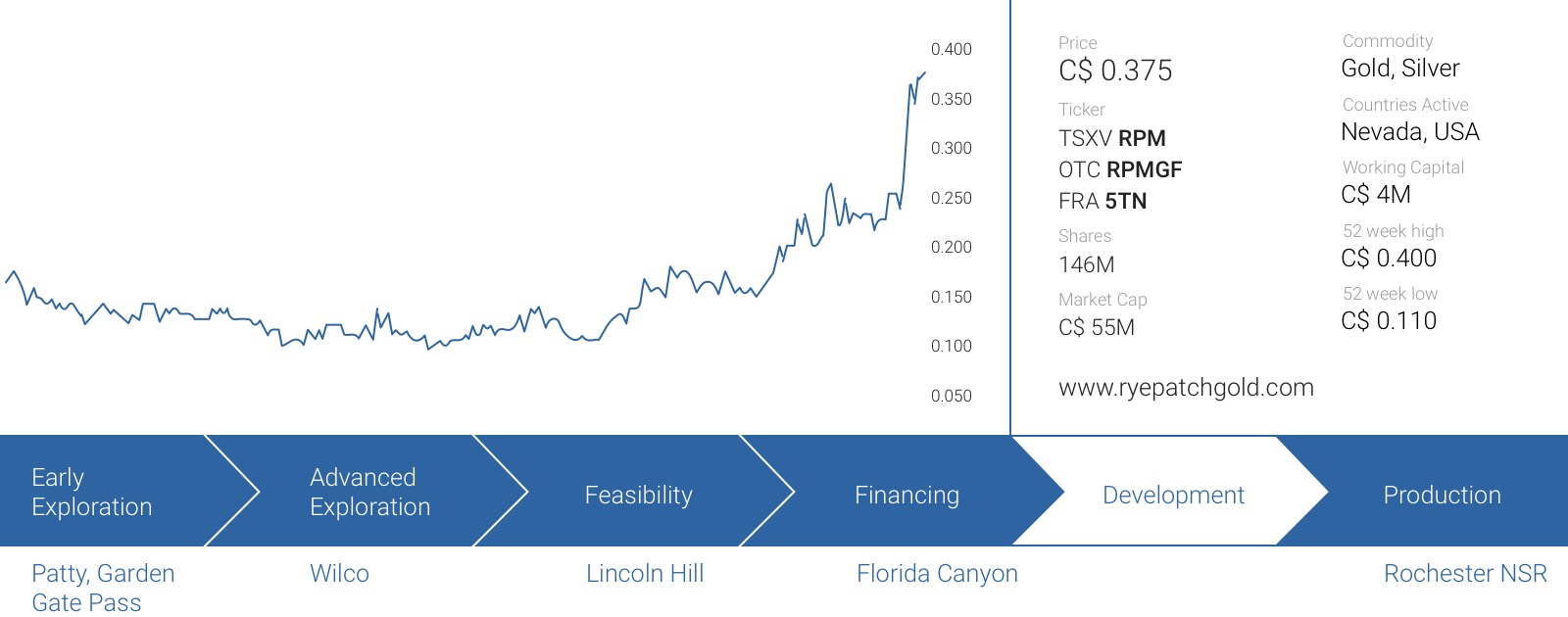

About two weeks ago, Rye Patch Gold (RPM.V) announced it entered into a binding agreement to acquire the Florida Canyon mine in Nevada, which would catapult the company into the ranks of gold producers rather than an exploration and development company. This should result in a re-rating of the company as Rye Patch will be free cash flow positive in the next 12 months.

The Florida Canyon mine, a reliable producer, bought for a song

Rye Patch has never made it a secret it wants to become a gold producer sooner rather than later, but we didn’t expect the company to be able to start producing the yellow metal before the end of this decade as the most advanced project, Lincoln Hill, is still moving through the feasibility stage.

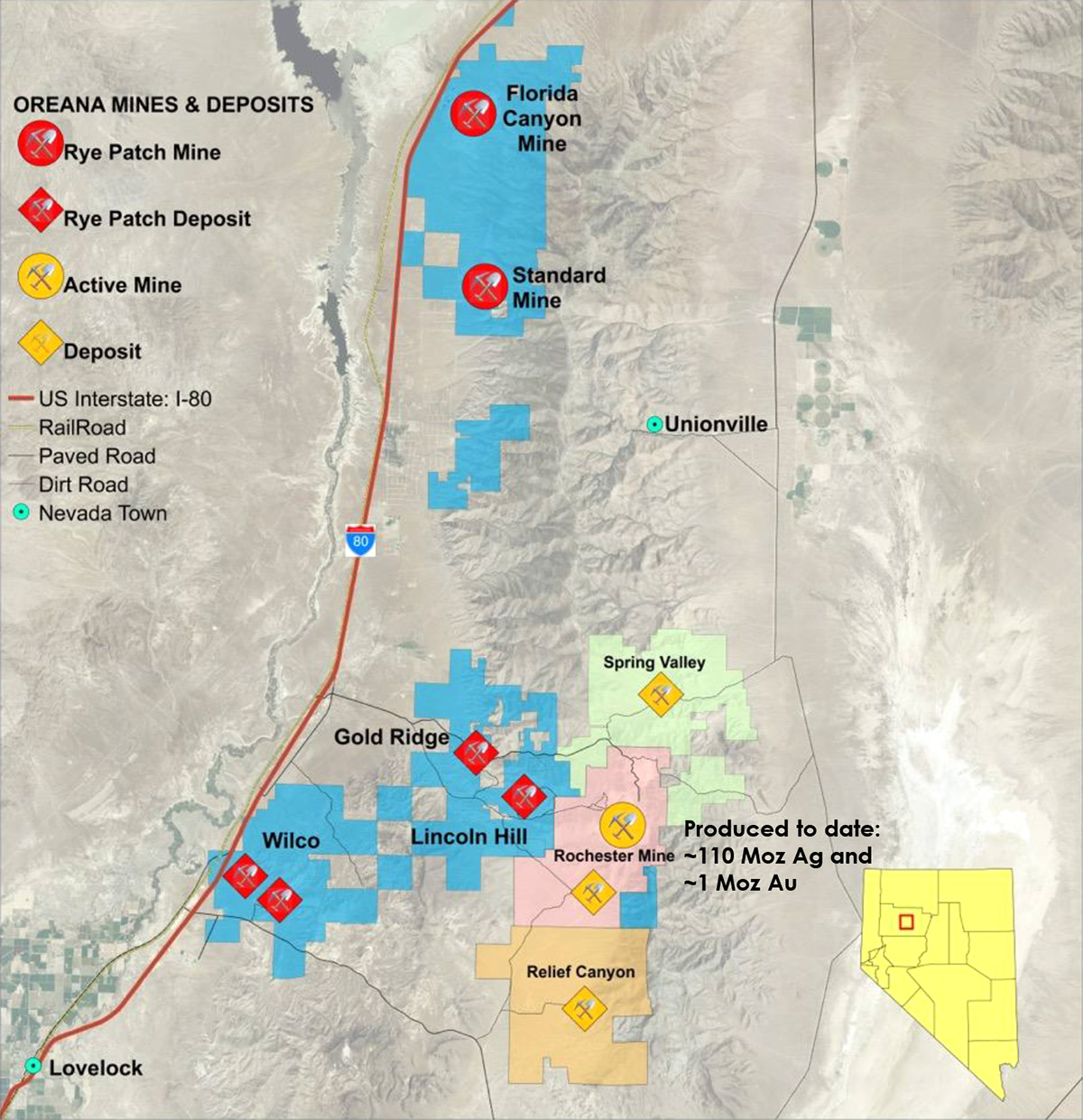

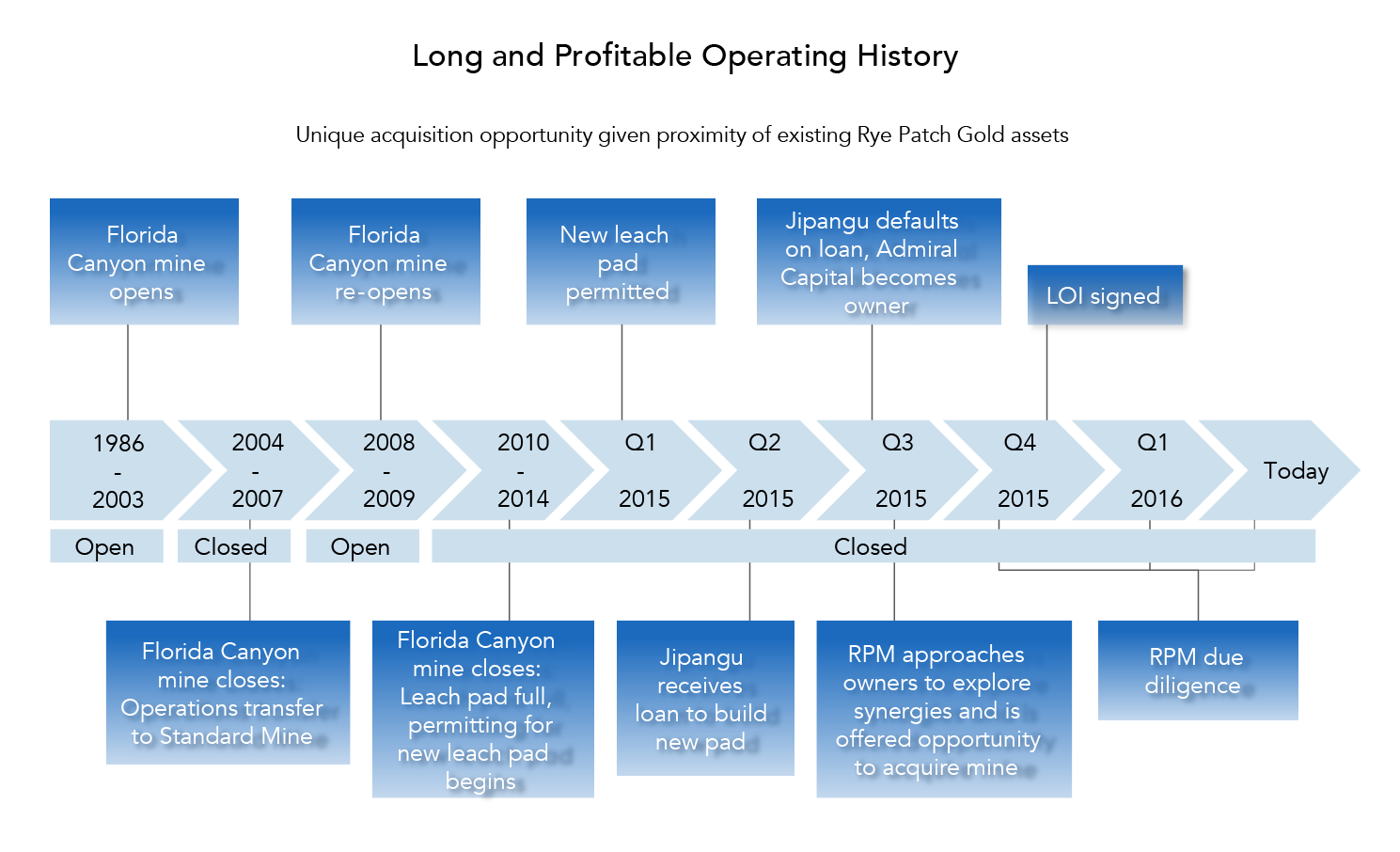

We were positively surprised to see Rye Patch entered into a definitive agreement to acquire the Florida Canyon mine in Nevada, which has been in production since 1986 (producing approximately 2.3 million ounces of gold). The mine is located approximately 30 kilometers north of the Wilco, Gold Ridge and Lincoln Hill projects that are already owned by Rye Patch Gold, so the potential synergy advantages are immediately popping up.

Not only is Rye Patch buying ounces on the cheap, it’s very important to keep in mind Florida Canyon is a fully-permitted mine and even the new leach pad that has been planned for a while is ‘ready to go’. Florida Canyon becoming available was a once in a lifetime opportunity, and it speaks volumes Rye Patch was able to immediately identify the opportunity and act on it in a relatively short period of time.

Right after the bank seized the asset from the previous owner, Rye Patch CEO Bill Howald flew to Japan to negotiate the acquisition of the project, and this resulted in a definitive agreement which was signed in May. The terms of the purchase agreement are pretty straightforward; Rye Patch is paying US$15M (C$20M) in cash and will issue 20 million shares of Rye Patch Gold to acquire Florida Canyon. A second tranche ofUS$5M will be payable when the company enters the commercial production phase at Florida Canyon, and Rye Patch will be allowed to either pay the $5M in cash, or to pay it as a combination of issuing $2.5M in shares and a subordinate loan which will mature in 2021. On top of that, the seller will receive 15 million warrants of Rye Patch Gold at a strike price of US$0.50 (C$0.65) per share. Should those warrants be exercised, Rye Patch Gold will receive a cash inflow of almost C$10M which is a nice additional bonus.

The fact the seller is accepting warrants with a strike price at a 200% premium versus the closing price right before the deal was announced is very interesting, as it does indicate there’s a strong belief the value of Rye Patch is much higher than what’s currently being reflected in the share price.

The PEA looks very promising

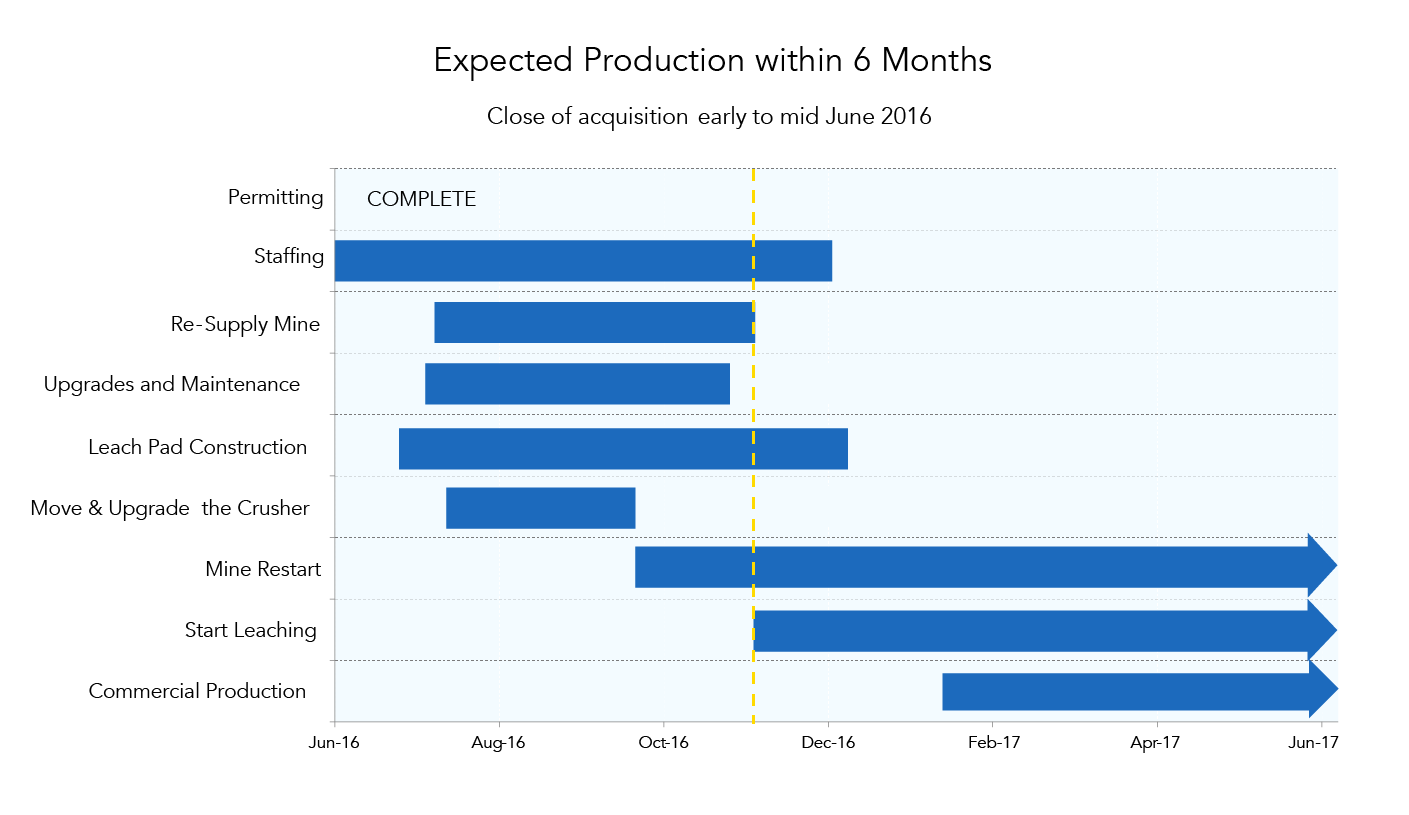

As part of the six month due diligence process, Rye Patch has engaged Mine Development Associates (MDA) to complete a Preliminary Economic Assessment for the Florida Canyon project to figure out what the value of the project would be. And as we already saw in the Lincoln Hill PEA, Rye Patch tends to be very conservative when it’s modeling a mine plan to make sure its studies are very robust, even at a lower gold price. That’s exactly what Rye Patch did with Florida Canyon as well, and the base case scenario is working with a gold price of $1000/oz during the first two years of the mine life, increasing to $1150 in the subsequent six years. As the cash cost is expected to be just $759/oz and the initial capex is just $28.9M (including contingency), the after-tax NPV7.5% in this scenario is US$45M, indicating Rye Patch acquired the asset for just 60 cents on the dollar (which is pretty good for a fully permitted project).

That being said, we do believe in a higher gold price, and if we have a closer look at the sensitivity analysis on the project, the scenario with a gold price of $1200/oz in Y1-2 increasing to $1380/oz in Y3-8 seems to be closer to reality and with an after-tax IRR of 73% and a NPV of US$115M we are pretty excited about this acquisition.

Also keep in mind Lincoln Hill is just 30 kilometers away from Florida Canyon, and the synergy advantages could be very substantial. It’s very likely Rye Patch Gold will be able to reduce the Lincoln Hill capex by $10M+ and combined with our expectations to see the recovery rates at Lincoln Hill increase.

It’s a little difficult to guesstimate the true value of both operations on a combined basis, but we would have expected the Lincoln Hill PEA (before taking the higher recovery rates into consideration) to be US$40M on an after-tax basis using $1200 gold. However, as the metallurgical test work has shown the company can unlock a tremendous amount of value by crushing the ore before leaching it, we would be surprised if an updated PEA would indicate an after-tax value of less than US$75M using $1200 gold.

Assuming an after-tax NPV of $115M at Florida Canyon, $15M in synergy advantages and an updated after-tax NPV of $75M at Lincoln Hill, the total value of Rye Patch’ most advanced properties (excluding Wilco and all exploration upside) is approximately US$205M (C$260M). Keep in mind these are our own guesstimates and (except for the official NPV of $115M at Florida Canyon) should not be seen as an official projection of the company.

The financing is in place

Rye Patch Gold went beyond expectations and not only did it announce the definitive purchase agreement to buy Florida Canyon, it also immediately announced it has signed an agreement with Macquarie whereby the latter will provide a $27M credit facility to build the new leach pad. This credit facility has an interest rate of LIBOR + 8% and will include a mandatory hedge of approximately 125,000 ounces (which will very likely be subdivided in hedging 25,000 ounces of gold per year). Hedging usually leaves a bad aftertaste in the investors’ mouths, but we don’t mind this, considering the gold price is now trading almost 25% higher than the price used in the company’s base case scenario and it’s never a bad idea to lock in a fixed price for a part of the output to make sure Rye Patch can meet its debt commitments. We expect the hedge to be very reasonable and reduce the pressure on the company.

The fact Macquarie was immediately willing to provide the capex financing does indicate the PEA completed by Rye Patch Gold is robust and credible as you can be sure the technical experts at Macquarie will have vetted the entire PEA and checked and double-checked all parts. It’s very rare to see a company receive in excess of 75% of the capital needs in debt, so the commitment from Macquarie to provide a credit facility covering in excess of 90% of the expected capex is a very strong signal.

But there’s more than what meets the eye here

We had a conference call with CEO Bill Howald to make sure we fully understood what the company had exactly bought, and we have the impression this acquisition might be even better than originally anticipated.

Not only does Rye Patch expect to start commercial production in the first half of 2017, apparently there still is gold being recovered from the existing leach pads which will help the company to generate a little bit of cash flow in the next few months before the new leach pad will be ready. Granted, this won’t be much, but we obviously wouldn’t mind Rye Patch getting a few million dollars from gold sales in the second half of the year.

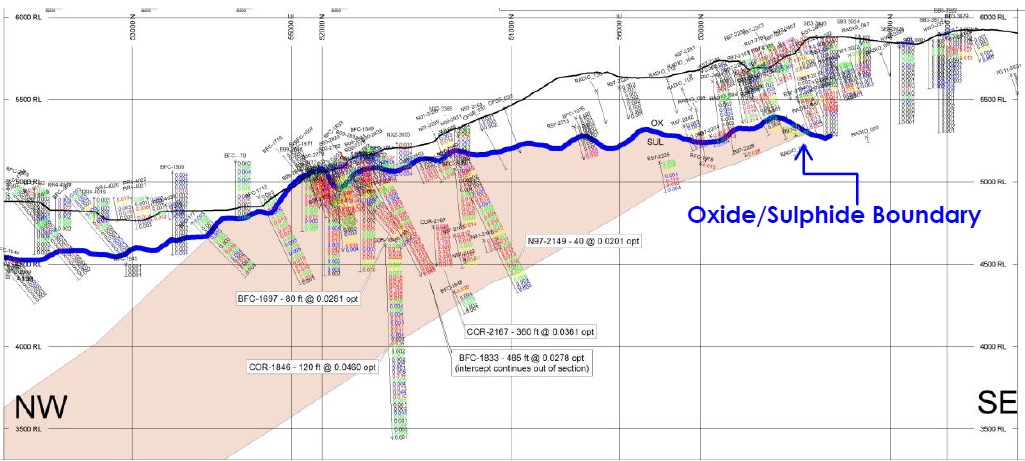

That’s great, but what might really move the needle and might make the acquisition of Florida Canyon like a huge win is the sulphide mineralization on the property. Rye Patch’ plan is obviously to mine the oxide ore and recover the gold through a simple heap leach operation, and with a mine life of approximately 8 years based on the 1.1 million ounces of gold in the measured and indicated categories, Rye Patch doesn’t need to worry about anything before 2025.

That being said, the Florida Canyon resource estimate also contains almost 400,000 ounces of gold in the sulphide zone at a grade of in excess of 1.5 g/t. That could be the icing on the cake as the previous owner hasn’t really done a lot of work to find out the true size of this sulphide zone as they only cared about mining the oxide stuff and recover the gold through a heap leach operation.

We do expect Rye Patch to have another closer look at the sulphide zone once it reaches the cash flow positive stage, because this zone does look quite promising. As you can see on the previous image, only a few holes have been drilled in the sulphide zone, and it should be fairly easy for Rye Patch to increase the existing resource estimate and perhaps trying to build a case to develop and mine the sulphides sometime further down the road. This obviously won’t happen overnight and Rye Patch will have to mine the oxide ore first anyway before it can reach the sulphide zone, but it’s pretty obvious there’s some real upside potential here.

Conclusion

The more details we got to learn about the acquisition of Florida Canyon, the more we like this acquisition. There’s a lot of value in the oxide zone at FC, and the sulphide zone underneath the oxidized layer is the real lottery ticket as it might contain several million ounces of gold. Rye Patch will obviously have to drill more holes to have a better understanding of the size of the sulphide zone, but we are pretty excited about the potential there.

Rye Patch is currently raising C$40M by issuing new shares at C$0.22 per share to fund the acquisition of the project as well as to increase its working capital position as it moves closer towards a status of being a producer. We expect the current value of the assets to be approximately C$260M (again, this is our own calculation and not an official company guidance), which would result in a NAV/share of C$0.75 (based on an expanded share count of 360 million shares). Again, this excludes any exploration potential and the sulphide zone at Florida Canyon, as well as the ‘excess’ cash position (raising C$40M is actually more than what Rye Patch will need in the foreseeable future).

Yes, the dilution will be quite high, but the question you need to ask yourself is ‘is this really dilution if Rye Patch is creating a lot more value?’. Our answer would be ‘no’. This is a good deal, and will allow the market to re-rate Rye Patch as a producer rather than an exploration company and there’s a very clear path towards creating more shareholder value.

Rye Patch Gold is a sponsor of the website, we hold a long position. Please read the disclaimer

Agree…and I like everything except the excessive dilution to provide “excess” cash. Don’t see the need for the “excess cash” at all. By all appearances, they could have gone for just what they needed now and let the markets re-rate the shares (price is already 50% above the issue price!!) before doing another share sale at a higher price, IF NECESSARY. That’s what would have made more sense and shown more concern for retail shareholders. It’s like eating your favorite nuts and the last one is rotten…great right up to the end, then you leave with a bad taste in the mouth. (Longtime shareholder)