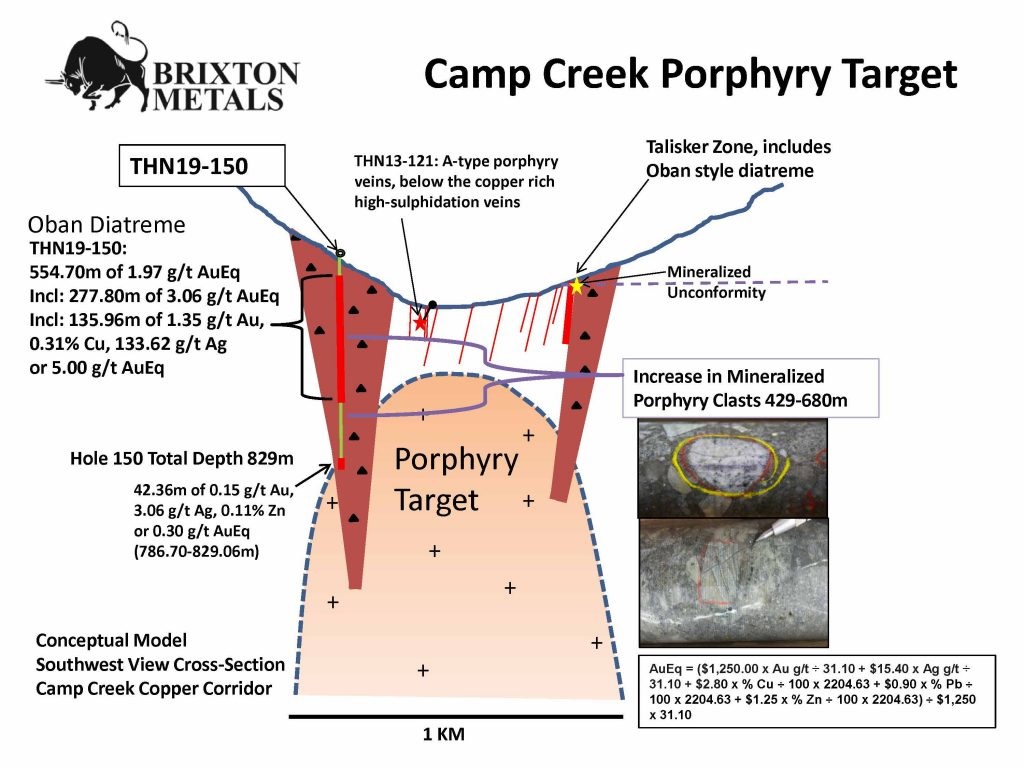

Brixton Metals (BBB.V) is taking advantage of the attention it recently received after drilling a very successful deep hole at Thorn, encountering economic grade copper-gold mineralization (along with some other metals) over an entire length of in excess of 550 meters.

Brixton has made sure its financing was ‘priced to sell’ with the hard-dollar units priced at C$0.18 consisting of one share and half a warrant whereby every full warrant can be exercised at a fixed price of C$0.25 for a period of two years. The flow-through funds will be raised at C$0.22 per share (and do not include a warrant) and will only contribute C$360,000 to the total of C$7.7M that’s being raised. Eric Sprott will invest C$4M in the hard dollar raise and will become the company’s largest shareholder with a 18.25% stake.

A large part of the proceeds will very likely be used on the Thorn project which is currently stealing the thunder from Atlin Goldfields which was supposed to be this year’s focus project. But with the excellent interval that was pulled out of the ground last month, Brixton cannot afford to not follow up on this now the discovery is still ‘fresh’.

Go to Brixton’s website

The author has a long position in Brixton Metals. Brixton is a sponsor of the website. Please read the disclaimer