Calibre Mining (CXB.V) has been in a trading halt for almost two months now as the company is working on closing a C$100M equity financing as part of its company-changing acquisition of the El Limon and La Libertad gold mines in Nicaragua from B2Gold (BTO.TO, BTG).

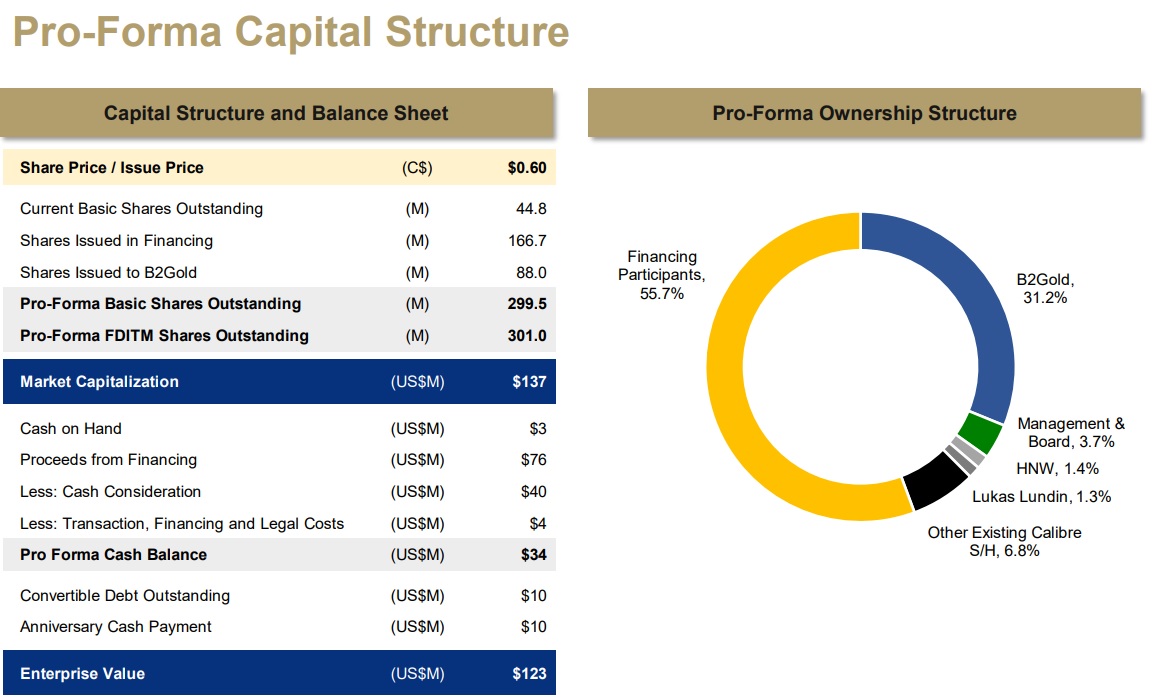

Calibre is acquiring the assets for a total value of US$100M of which US$40M will be payable in shares while an additional US$50M will have to be paid in cash (US$40M upon closing, US$10M after one year). The final US$10M will be covered by a debenture which will be issued upon closing the transaction, will have a 2% coupon and will mature two years after the transaction date. However, B2Gold has the option to elect the pay-out to happen in stock priced at 25% above the price used for the initial US$40M share payment (which will be C$0.60, which puts the conversion price for the debenture at C$0.75). Calibre can also force B2Gold to convert the debenture into stock if the shares are trading at in excess of C$0.81 for10 consecutive trading days.

Calibre is now working on closing a C$100M equity raise (also priced at C$0.60) which would take care of the initial US$40M (C$53M) cash payment and immediate working capital and upgrade needs in Nicaragua. Despite the current investment climate and momentum in the precious metals sector, it’s not easy to raise C$100M as a small company, but we see it as a positive that Calibre is raising (much) more cash than it needs, as the additional financial flexibility should allow Calibre to pursue all the upgrades to the mines and plants it deems necessary.

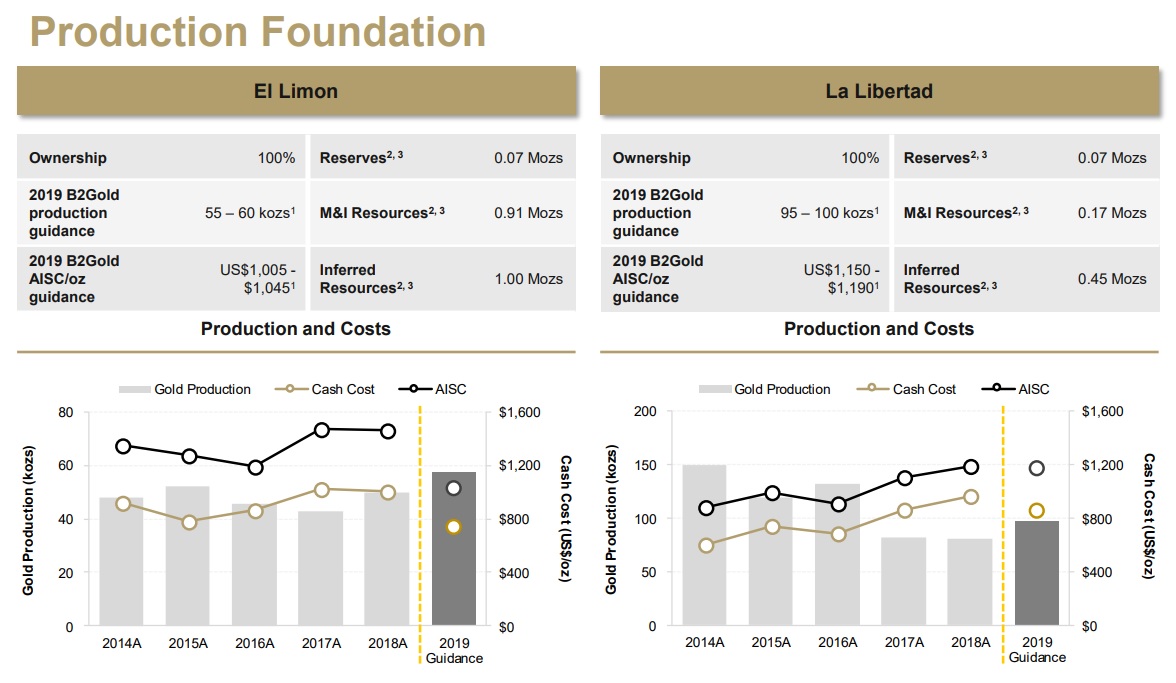

Calibre’s timing may actually be perfect as although the mines wouldn’t be generating much free cash flow based on B2Gold’s own guidance (100,000 ounces at $1170/oz on an AISC basis for La Libertad and up to 60,000 ounces at an AISC of around $1025/oz for El Limon) using a gold price of $1300/oz (the weighted margin would have been $175/oz). But it’s a whole different story at $1500 gold as the 160,000 ounces would have a net margin of in excess of $350/oz indicating the payback period of the purchase could be just over 2 years at the current gold price (and perhaps Calibre should consider hedging some of its gold at the current price levels, just to protect its near-term cash flows).

Disclosure: The author has a small long position in Calibre Mining