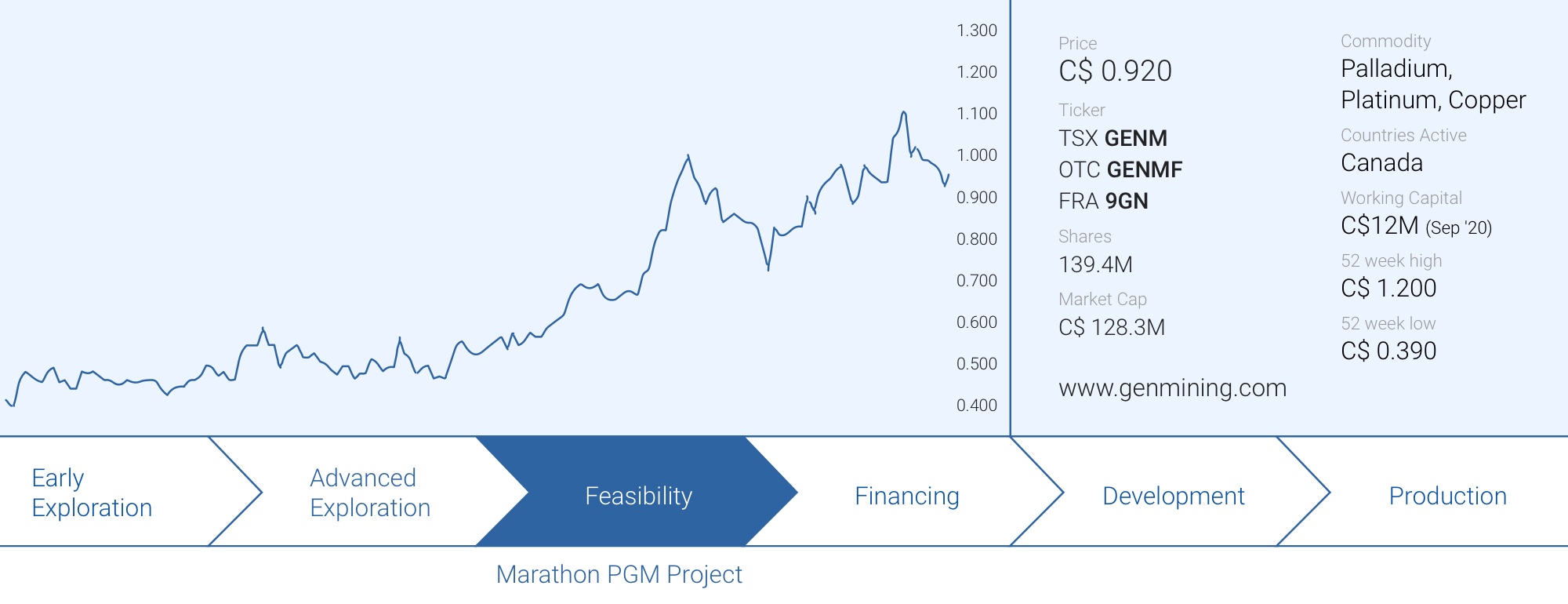

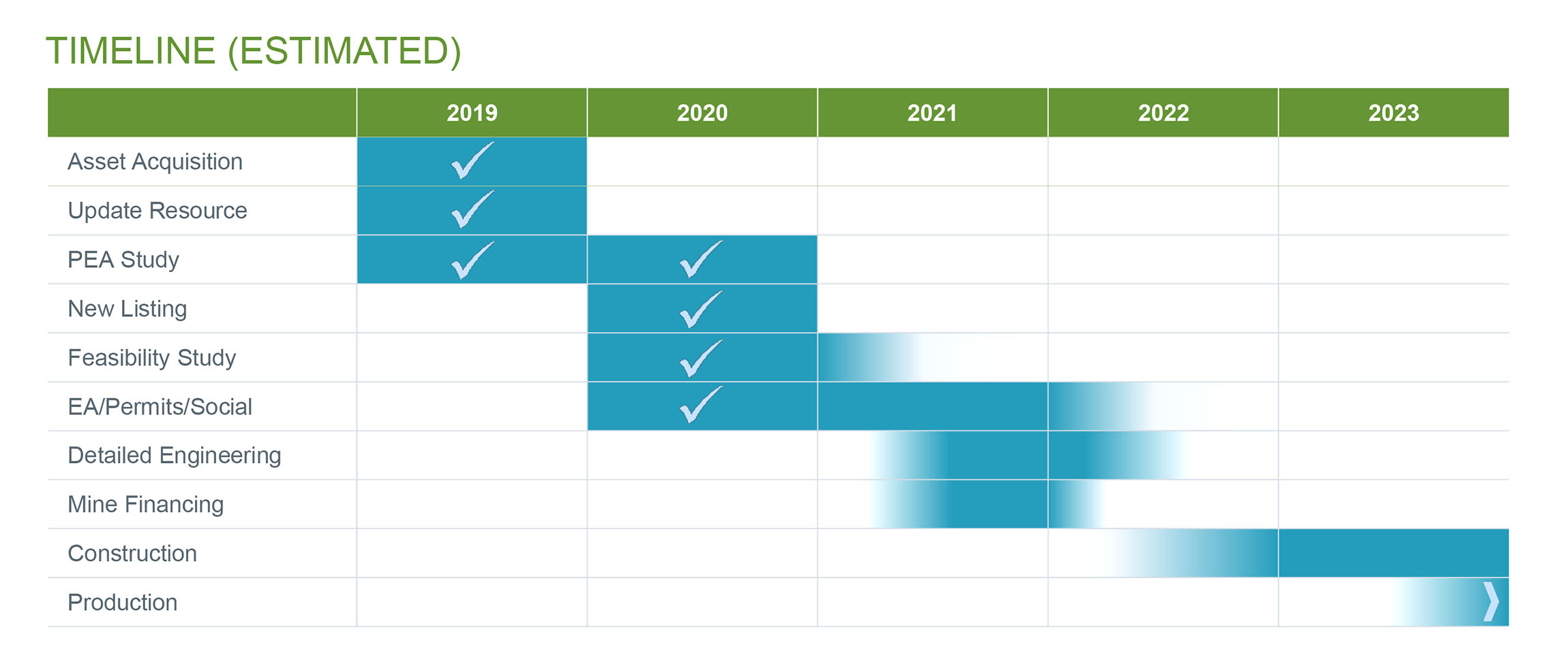

Generation Mining (GENM.TO) published the results of its long-anticipated feasibility study on the Marathon PGM project which means the company went from project acquisition to the publication of a FS in less than 18 months, a remarkable pace.

The results of the feasibility confirmed the findings of the Preliminary Economic Assessment. As feasibility studies tend to be more conservative than PEAs (after all, a feasibility study needs to be credible as that will be the document a company needs to raise the cash to fund the construction of a project), seeing similar economics as in the PEA is a clear win.

The market reacted slightly disappointed but this likely is just a case of a ‘sell on the news’. Completing a very robust feasibility study which is pretty similar to the results of the PEA is a clear win, and this further derisks the project by a substantial margin. With plenty of cash in the bank and a bunch of warrants that are in the money, Generation Mining is in a great shape and can now start to focus on permitting and building this thing.

A quick glance at the initial results of the feasibility study

Generation Mining was guiding for the feasibility study to be released at the end of February or early March, and we’re pleased to see the company was able to meet its guidance as the feasibility study was released in the first few days of March.

While most companies see their feasibility study results come in substantially lower than the Preliminary Economic Assessments (where the used parameters are less strict compared to a feasibility study), Generation Mining did the opposite, despite using Tier-1 consultants like G Mining and Ausenco which tend to be some of the more conservative firms. This means you won’t see overly optimistic scenarios or corners being cut as these firms clearly don’t tend to humor the client but deliver credible and reliable studies.

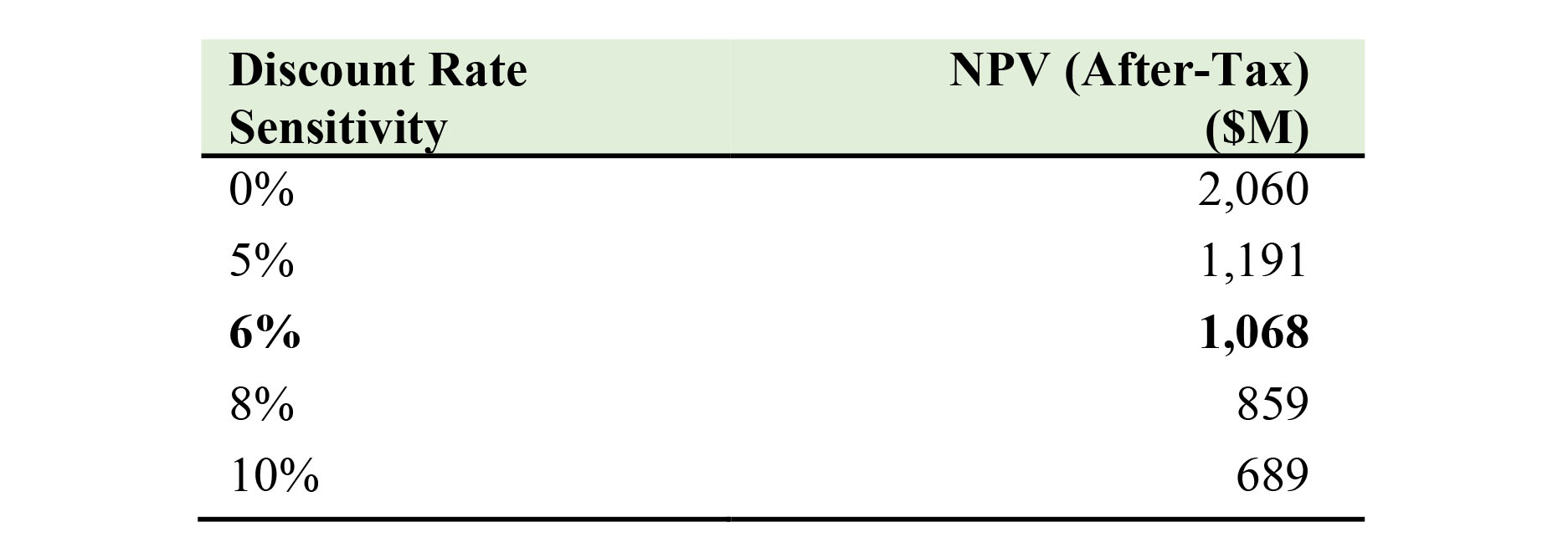

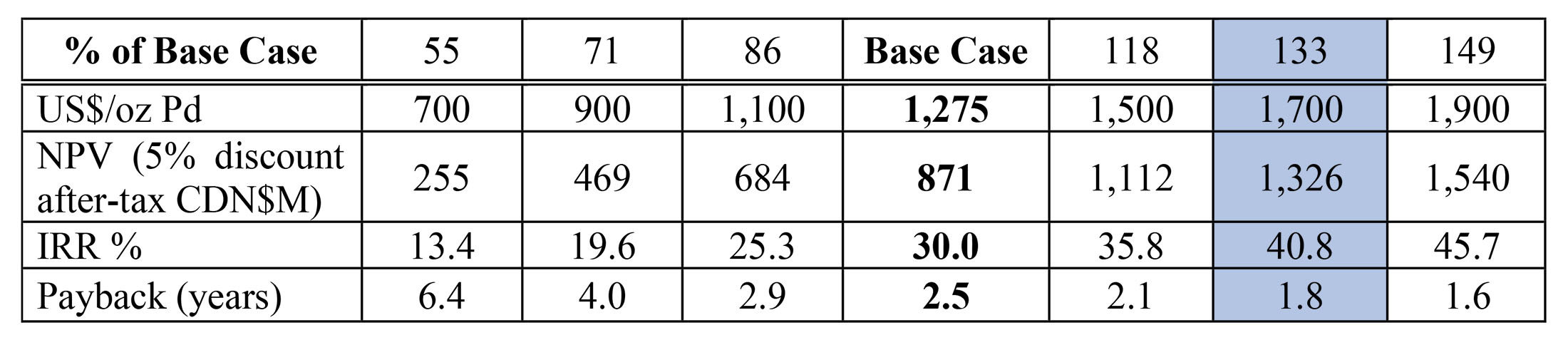

On a like-for-like basis (using roughly the same palladium price and discount rate), its feasibility study came in ahead of expectations. Using an updated base case scenario with a palladium price of $1725/oz, the NPV6% came in at C$1.07B with an IRR of just under 30%. This makes the comparison with the PEA (which used a 5% discount rate and a $1275/oz palladium price) difficult.

But looking at the NPV sensitivity table, using the 5% discount rate which was used in the PEA, the after-tax NPV would have been a very solid C$1.19B.

To make sure we’d be comparing apples to apples, we also pulled up the sensitivity analysis in the January 2020 PEA. Using the $1700 palladium scenario, the after-tax NPV5% in the PEA was about C$1.33B.

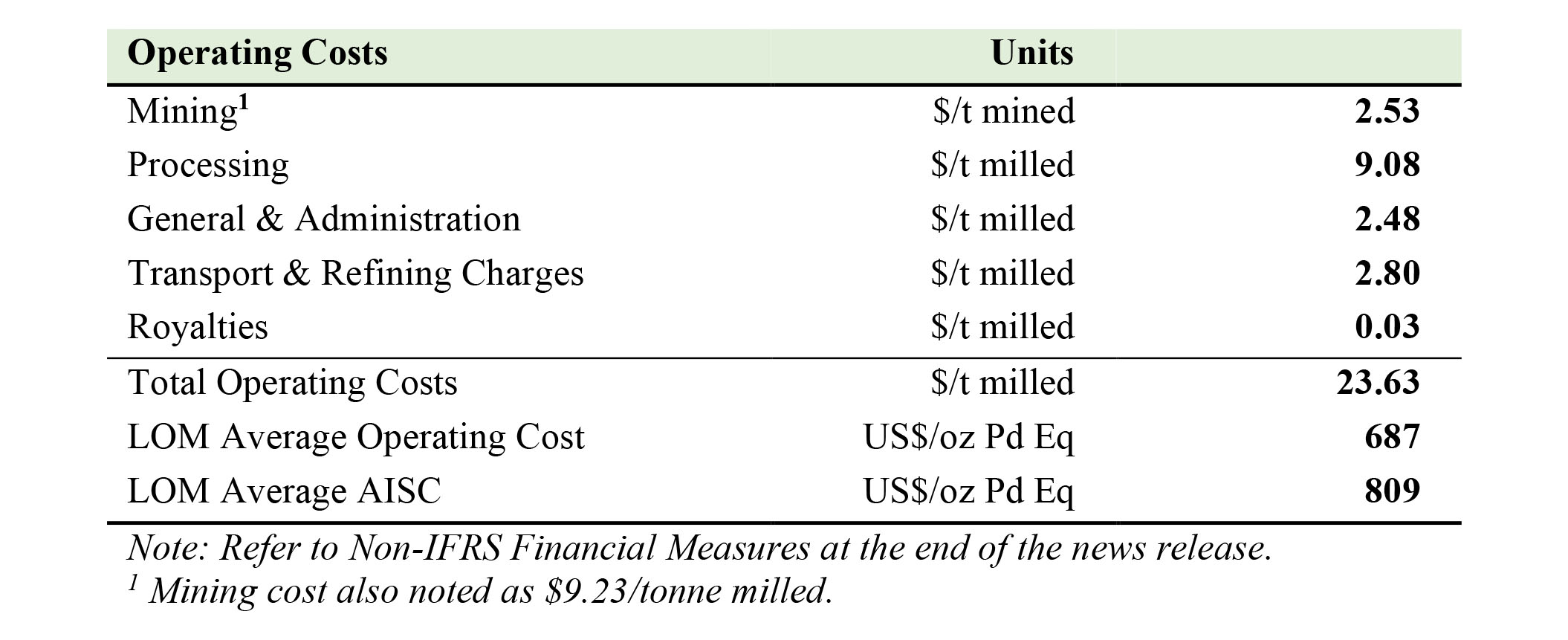

While the NPV and IRR in the feasibility study came in below the PEA-equivalent results, the fact the NPV came in just 10% lower actually is a pretty good result considering the capital expenditures increased to C$665M and the AISC per produced ounce of palladium-equivalent jumped from US$586/oz to US$809/oz.

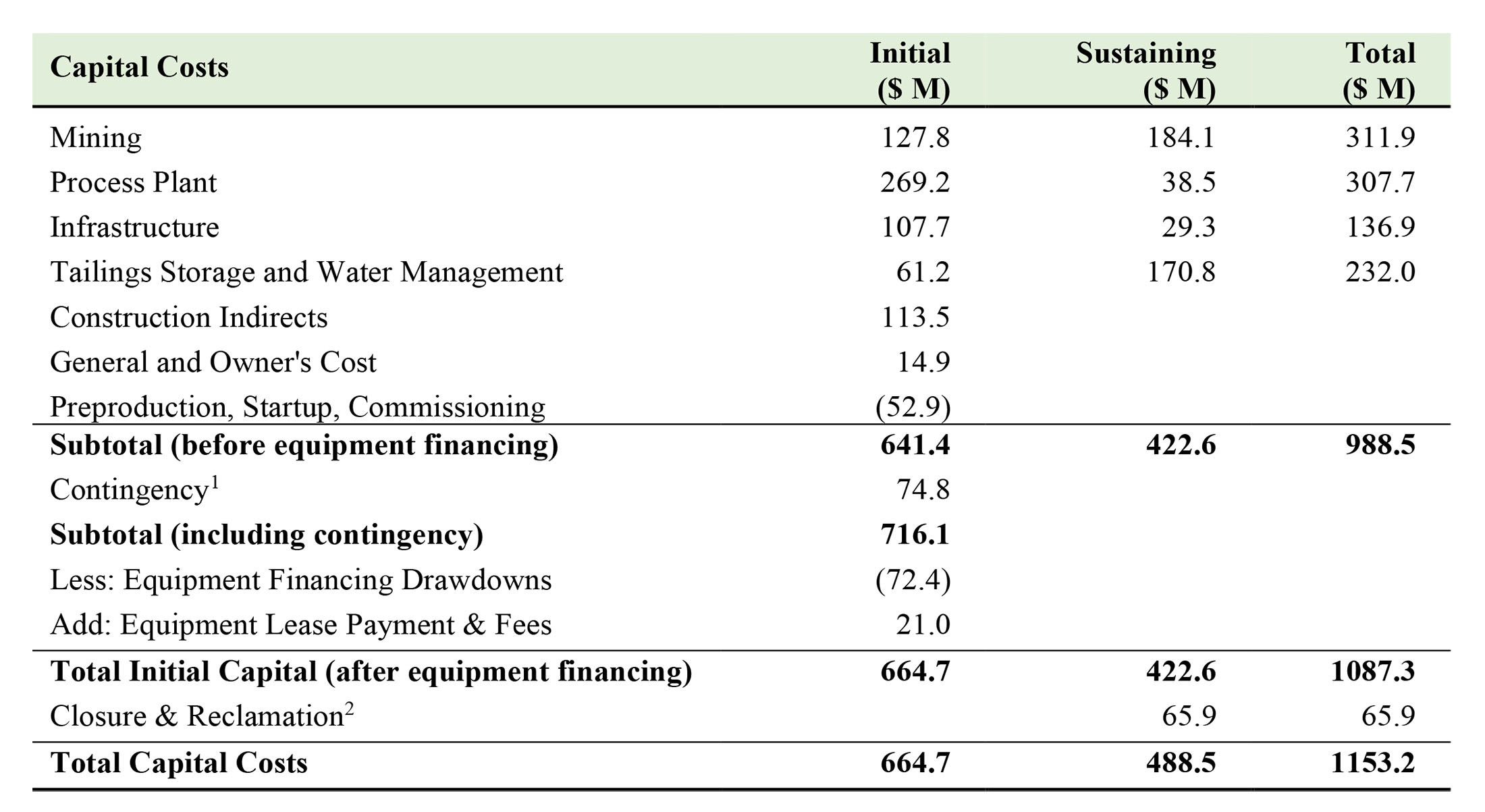

But looking at the breakdown of the capex, we see some interesting updates compared to the PEA. The initial cost related to the processing plant is actually coming in lower than in the PEA and the components that drove up the initial capex were mainly related to the cost of the tailings facilities (which more than four-folded to C$61M), and the site infrastructure (which doubled to in excess of C$100M). Subsequently, the higher costs pushed up the contingency allowance and that’s what really pushed the initial capex to in excess of C$650M.

And that’s fine. CEO Jamie Levy had made it very clear he didn’t want to cut any corners when it comes to the mine safety and its environmental record, and the tailings management cost was already expected to increase. In our opinion, the current budget for C$61M in the initial capex and an additional C$170M in the sustaining capex for just the tailings (compared to C$14M and C$67M in the PEA) paints a worst case scenario and it’s not unthinkable a few million dollars could be shaved off from the total tailings cost of C$230M. Given the total palladium production of 1.9 million payable ounces, the sustaining capex related to only the tailings represent almost C$100/oz and that’s very high.

We see a similar opportunity when looking at the site infrastructure expenses (which include camps and other infrastructure-related expenses). The C$54M in the PEA sounds more reasonable compared to the C$108M + C$29M in the feasibility study. The truth will likely be somewhere in the middle but even if the total site infrastructure capex comes in at C$100M (and thus 80% higher than budgeted in the PEA), that would still mean a total cost saving of C$37M (undiscounted) compared to the budgeted capex requirement in the feasibility study.

And this brings us to the main takeaway of Generation Mining’s feasibility study. It’s roughly in line with the results of the PEA (the after-tax NPV5% is about 10% lower at $1700 palladium compared to the PEA which is an excellent conversion rate for a project going from PEA to feasibility study), but the Marathon PGM feasibility study appears to be very robust. No corners were cut and no capex was optimized and the C$230M increase in the initial capex and the C$150M increase in the sustaining capex are the main drivers behind the higher AISC and the slightly lower NPV. We are convinced some of those expenses may actually come in lower than budgeted.

The clock will start to tick for Sibanye

Generation Mining currently owns 80% of the Marathon PGM project, but as you know, Sibanye-Stillwater has the right to re-acquire 31% (to boost its stake to 51%) by funding 31% of the capex followed by 51% of the remaining capex.

Now we have the final capex number in hand, we can work with the definitive numbers. The initial capex is estimated at C$665M. So in order for Sibanye to exercise its clawback right, it needs to spend 31% of C$665M= C$206M. Of the remaining capex of C$459M, Sibanye will have to fund 51% (C$234M) while Generation Mining will be on the hook for its 49% share (C$225M). So if Sibanye exercises its clawback right and forms a 51/49 joint venture with Generation Mining, GENM will only have to contribute C$225M to the capex.

This also allows us to calculate the attributable NPV to Generation Mining. We know the after-tax NPV6% comes in at C$1.068B. We need to add the initial capex of C$665B back to this number to derive the discounted after-tax sum of the cash flows generated by the project (C$1.733B). Should Sibanye exercise its clawback right, the sum of the cash flows attributable to Generation Mining will be 49% of that amount, or C$849M. After deducting the C$225M attributable capex, the net after-tax NPV6% attributable to Generation Mining is approximately C$625M, assuming Sibanye exercises its back-in right. Using the economics based on the spot price, the attributable NPV increases to C$1.09B.

And that’s great news. While the 80% stake in the current NPV of C$1.07B means the NPV attributable to Generation Mining is approximately C$805M (and higher than the C$625M it would end up with in case Sibanye exercises its buyback option), retaining an 80% stake also means it has to cough up 80% of the capex, and that would exceed an amount of C$500M and would likely lead to more dilution and perhaps a lower NPV/share as the share count would increase by a higher amount than in the clawback scenario.

Which scenario would the best one for Generation shareholders fully depends on the metal prices. At $1725 palladium we would argue Generation Mining will be better off on a NPV/share basis with Sibanye exercising its clawback option. However, if the palladium price will continue to trade over $2000/oz beyond 2025, Generation’s optimal scenario would be retaining the 80% stake in the project.

There is no ‘one correct answer’ to the question whether it would be good or bad for Generation should Sibanye exercise its back-in right. That question cannot be answered without taking the palladium price projections into account. We estimate the ‘sweet spot’ to be around $1850 palladium. If the palladium price exceeds that level, Generation Mining is better off retaining 80% ownership. If the palladium price decreases to under $1850/oz, seeing Sibanye exercising the clawback clause would be better for the Generation Mining shareholders.

Is Sibanye interested in palladium at all?

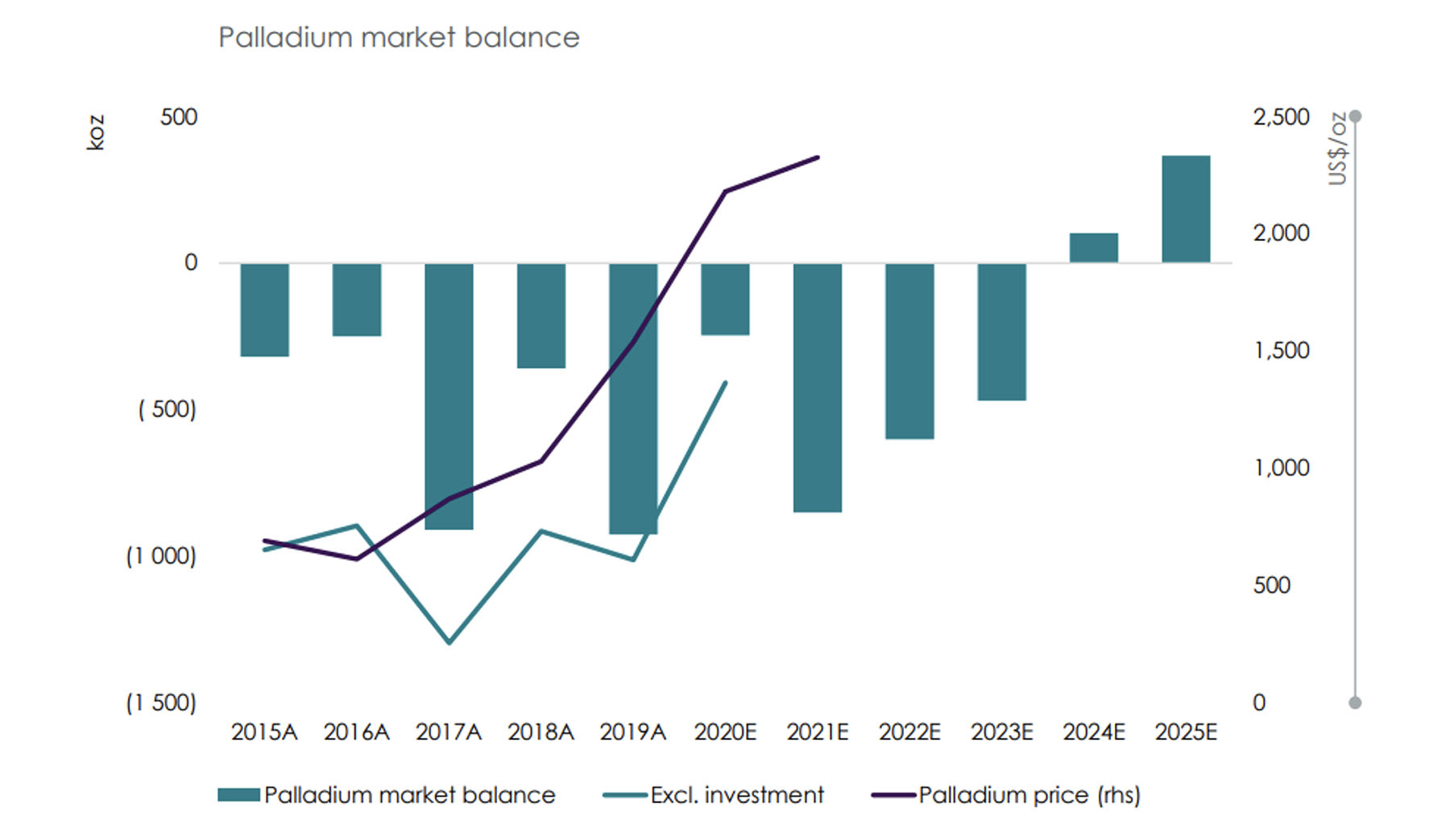

In its recent Q4 update presentation, Sibanye did provide an update on the palladium market which it expects to be in deficit for the next three years. However, Sibanye seems to be expecting the market to be balanced out again by 2024 followed by a surplus of a few hundred thousand ounces of palladium per year from 2025 on. We don’t know if the anticipated output from the Marathon PGM project is included in the supply/demand chart in the Sibanye presentation. And of course, a lot of things can still go wrong in the world, so it’s perhaps dangerous to make predictions for 2025 already as several projects (including palladium recycling projects) could still be held up and delayed.

We can interpret this in both ways. Either Sibanye Stillwater is interested in obtaining a larger market share in low-cost palladium production (as a consistent surplus will push the higher cost producers out of the market first). However, if the image above truly shows what Sibanye thinks, its best decision is to pass on the clawback clause, contribute its 20% share of the development expenses and perhaps consider taking out Generation Mining once it has a better grip on the 2024-2025 supply/demand for palladium.

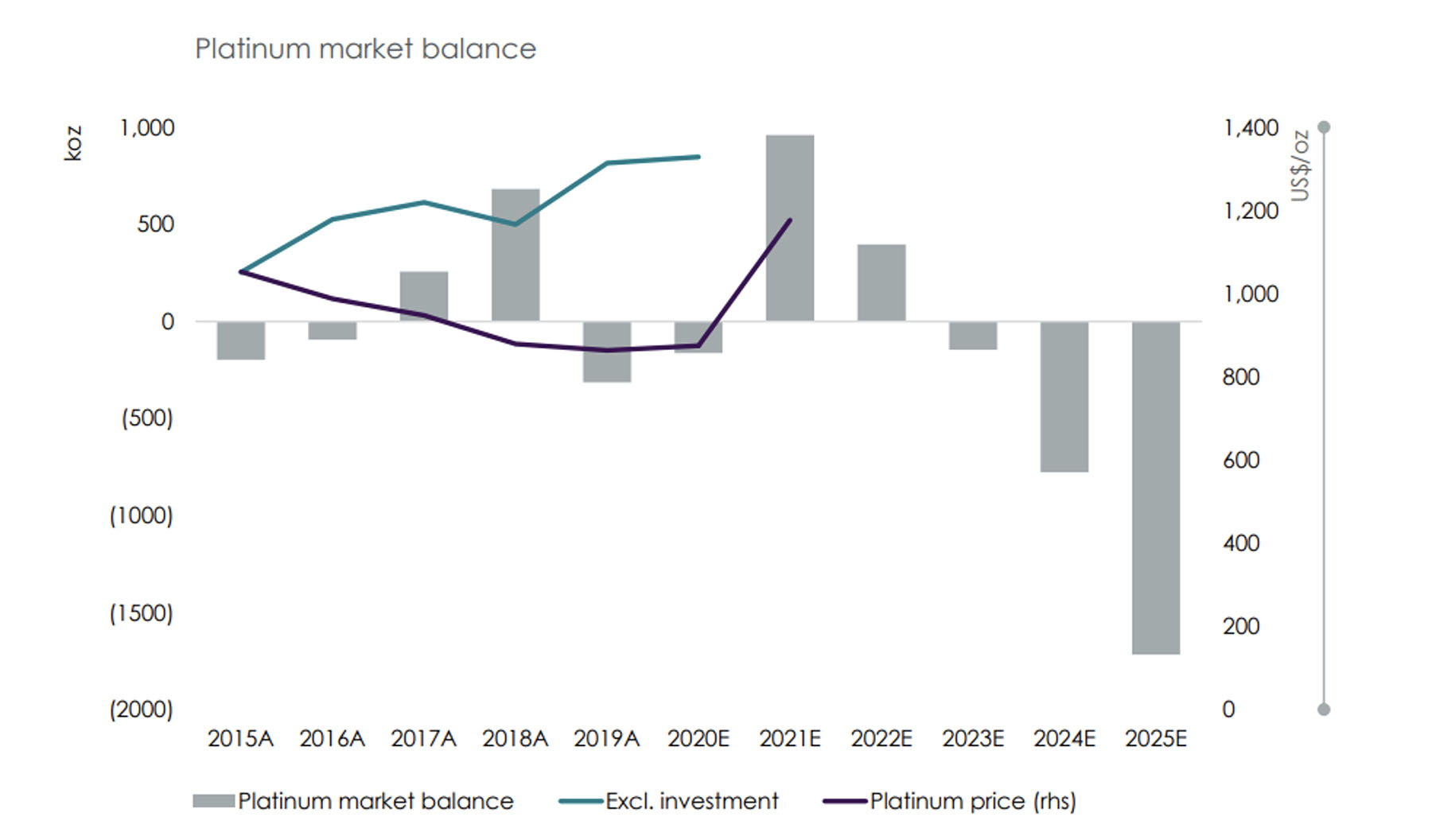

While the main metal to be produced at Marathon PGM is palladium, we should not forget about the platinum component. And Sibanye seems to be much more positive about the supply/demand for platinum as the company expects to see a deficit going forward.

And this is why Sibanye’s interpretation of the project will decide on its decision to push forward to earn a 51% stake in Marathon PGM. Generation Mining is marketing it as a palladium project with various by-product credits, including platinum. However, Sibanye could also interpret Marathon PGM as a platinum project with palladium (and other metals) as a by-product credit. The value of Marathon PGM is in the eye of the beholder and while GENM is correct to position it as a palladium project as that clearly is the main driver of the economics, Sibanye could reverse-engineer the study to figure our how profitable the production of platinum could be.

While Platinum is just a minor element with a total of 537,000 ounces of platinum expected to be recovered during the 13 year mine life. This works out to be less than 50,000 ounces of platinum per year. This will clearly not have a meaningful impact on the market as Sibanye is anticipating a deficit of 1.5 million ounces of platinum per year from 2025 on. But due to the high value of the palladium, we also ran the numbers on what the production cost of platinum would be if we would move palladium to a by-product credit (this is just a theoretical thinking exercise, as Marathon PGM clearly is a palladium project, Generation Mining should and will always present the data from a palladium point of view).

According to the feasibility study press release, the total operating costs including the sustaining capex and closure & reclamation expenses will be around C$3.22B.

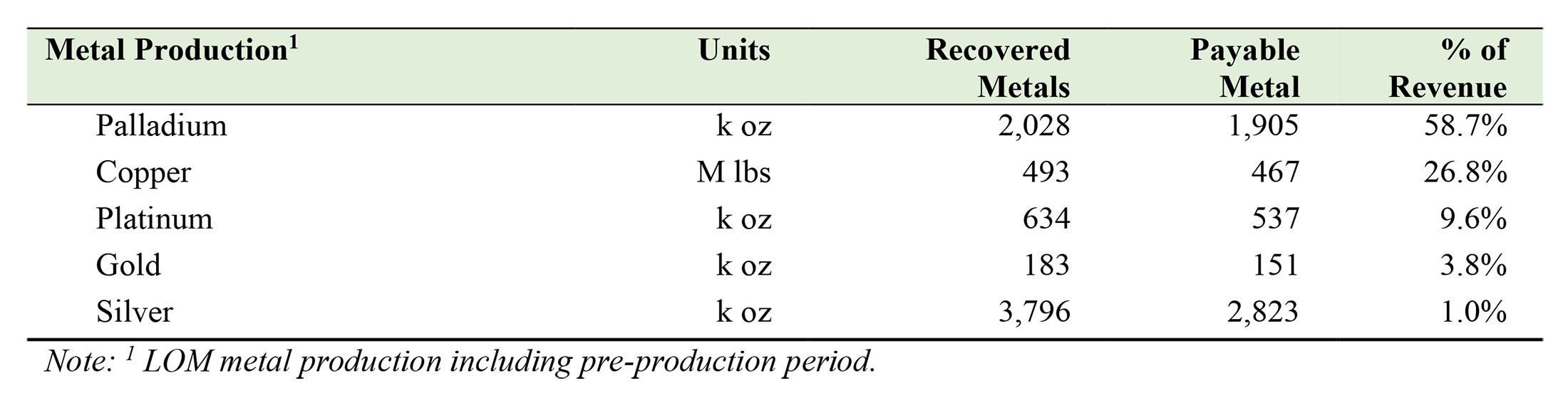

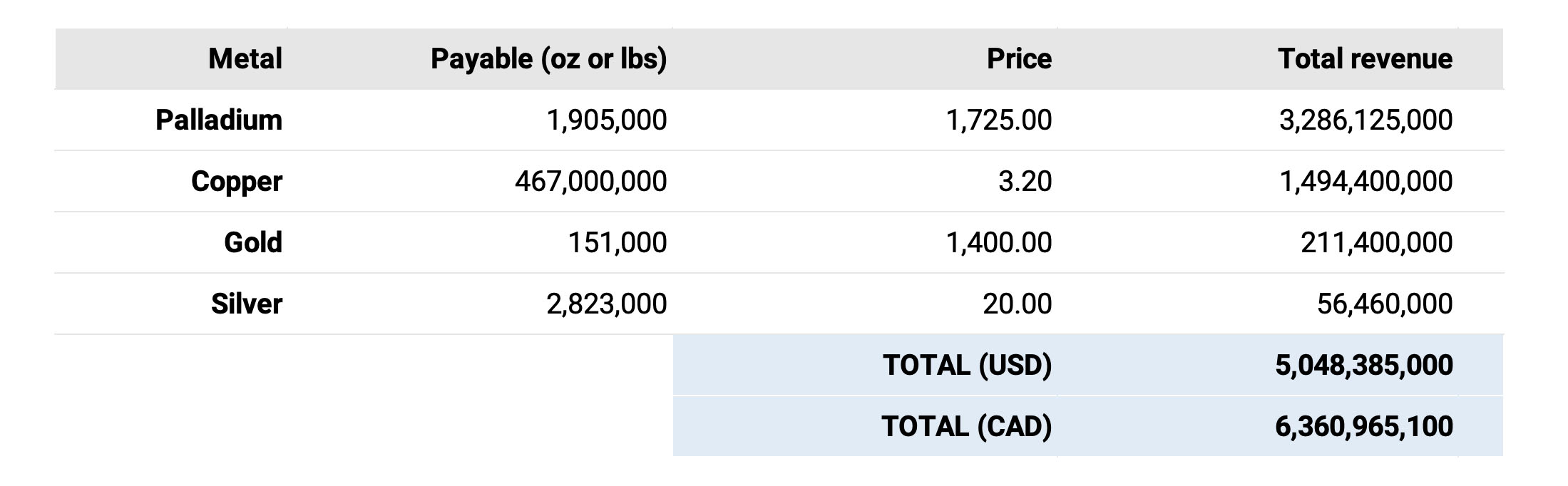

We also know the total amount of payable metals:

Using the same price as used in the feasibility study, this results in the following total net payable revenue from the non-platinum output:

Deducting the LOM AISC from the C$6.36B in net payable revenue results in a negative AISC for the platinum. Dividing the negative C$3.136B by the expected output of 537,000 payable ounces of platinum results in a hugely negative AISC for the platinum.

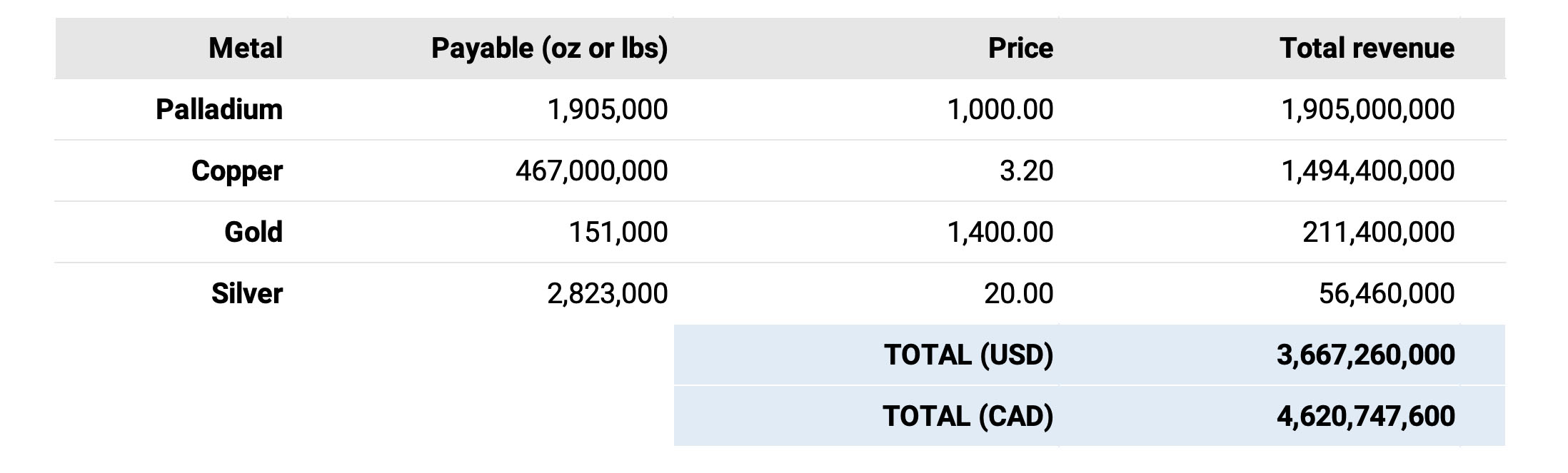

And if Sibanye is bearish on Palladium, let’s have a look at what would happen if we put the palladium price at $1000/oz.

Again, this is just a theoretical thinking exercise as this first and foremost is a palladium project. But there’s more than one way to skin a cat. Even if Sibanye is bearish on the palladium price but bullish on the platinum price, the Marathon PGM project could still be attractive on a holistic basis. According to the feasibility study, the project makes a whole lot of sense, even if you are bearish on Palladium and use $1000 palladium (60% lower than the current palladium price). Sibanye being bearish on the palladium supply surplus doesn’t mean the project doesn’t work.

According to the feasibility study, this project is very robust. And that’s a fact, not an opinion.

Copper as the knight on the white horse?

While the attention clearly has been focusing on the PGMs at Marathon as Generation Mining rightfully considers the project to be a palladium project and Sibanye Stillwater is one of the biggest producers of palladium and platinum in the world, one would almost forget copper will also be one of the main contributors to the NPV and the annual cash flows.

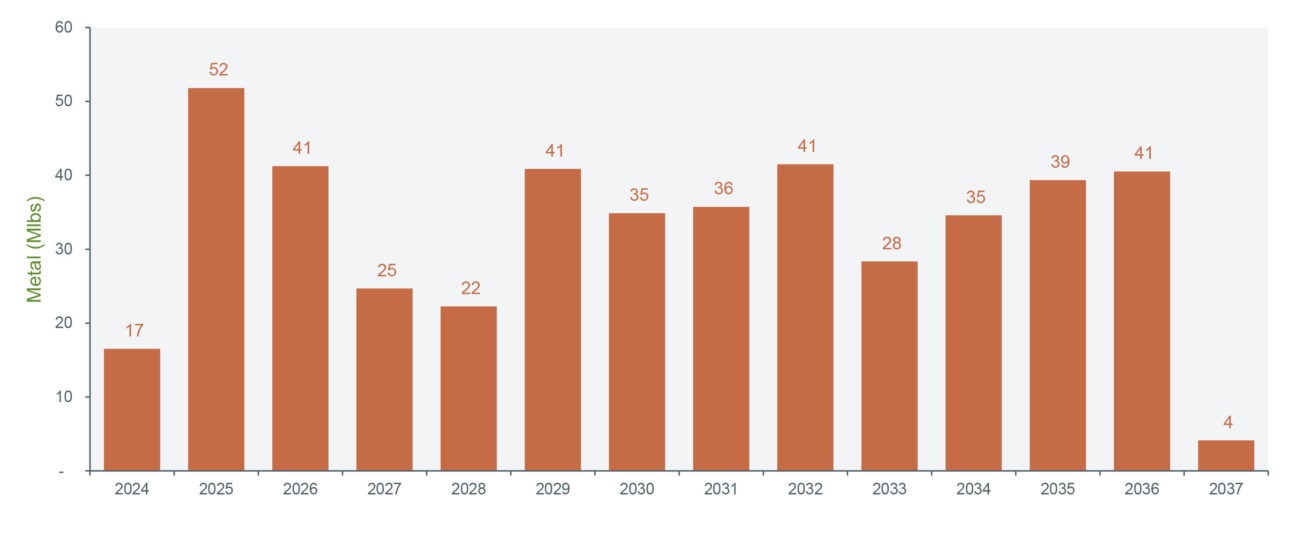

Using a copper price of US$3.20 per pound, copper is expected to contribute over a quarter of the total revenue at Marathon PGM as the project will produce about 467 million pounds of copper during its 12 year mine life. This works out to be around 40 million pounds of copper per year.

There will be quite a bit of variation throughout the mine life, as you can see in the image below.

While copper obviously isn’t even close to being as important as the palladium output at Marathon, we also shouldn’t outright dismiss the copper production. In an era where funds and fund managers seem to be paying outrageous valuations for anything that’s even remotely connected to ESG, copper as a ‘green metal’ could spark additional interest in the project.

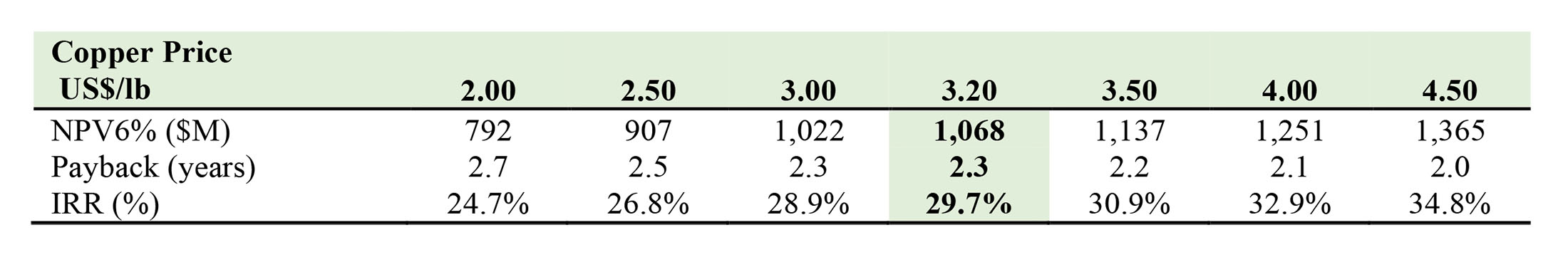

While the used copper price of US$3.20 per pound seems reasonable for a feasibility study (we clearly shouldn’t be using the current spot price), the NPV of the Marathon PGM project should react nicely to an increasing copper price. According to our back of the envelope calculations, for every $0.10 increase of the copper price, the after-tax NPV6% increases by around C$22M. That’s confirmed in the copper-focused sensitivity analysis provided by Generation Mining:

So even more so than platinum, copper seems to be the ‘swing component’ in the Marathon feasibility study. A copper price of $2.50/pound would reduce the NPV by 15%, but a copper price of $4 per pound would add 17% to the NPV and boost the IRR by in excess of 3% to almost 33%.

While we would like to emphasize we are perfectly happy with Generation Mining using $3.20 copper and would perhaps even err on the cautious side by using $3 copper, there still is some upside potential to be unlocked if the palladium ànd the copper price remain high. Just to give you an example, at $2000 palladium and $4 copper, the after-tax NPV6% of the project would come in close to C$1.5B. That’s about 40% higher compared to the base case scenario in the study.

Generation Mining is in a very strong financial position

Whereas most exploration stage companies tend to use the publication of a feasibility study as an opportunity to raise cash, Generation Mining is a very comfortable position. The company will likely publish its year-end financials in a few weeks so we will have to rely on the filings from the September quarter. At that moment, Generation Mining had a working capital position of approximately C$12.7M, including C$11.3M in cash.

Obviously, Generation Mining will have spent quite a bit of cash in the past six month, but the company also tapped the equity markets as Generation Mining closed a C$3.3M flow-through financing on December 31st. A total of 4.3M flow-through shares were issued at a price of C$0.77 per flow-through share and this likely means Generation Mining currently still has about C$10M cash on its accounts.

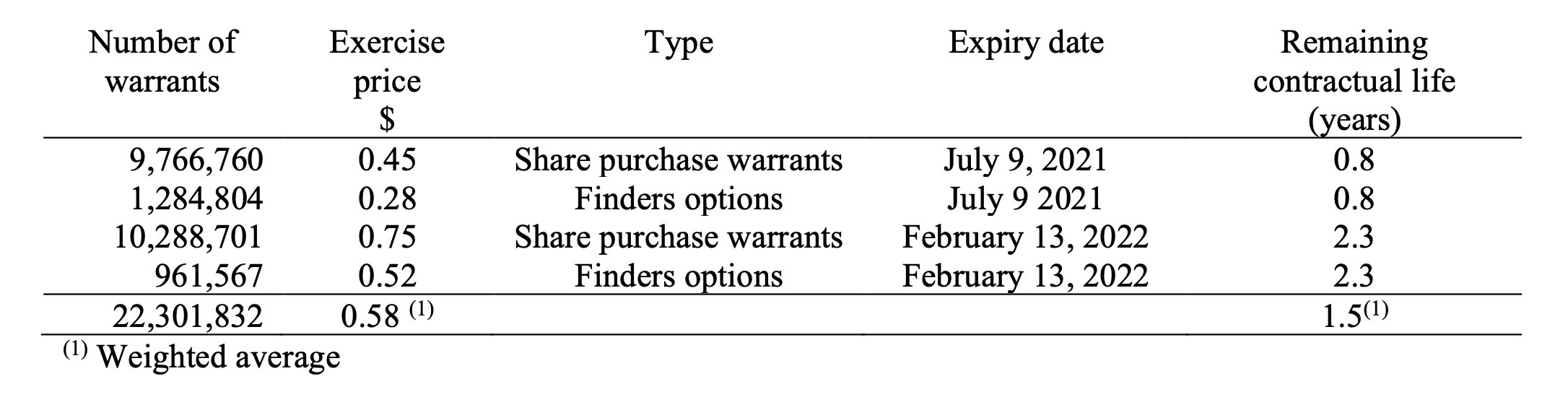

Additionally, we can expect a steady cash inflow this year. About 11 million warrants are expiring in less than four months from now. The almost 9.8 million warrants at C$0.45 will bring in in excess of C$4M while the 1.28 million warrants at C$0.28 should be good for an additional C$350,000. This, in combination with the existing cash balance should be more than sufficient to cover this year’s work program.

And as you can see on the image above, we are now less than 11 months from the 2022 warrant expiry date. The share price is now comfortably trading above the C$0.75 exercise price, so we should expect some of those warrants to be exercised as well. If all February 2022 warrants would be exercised, an additional C$8M would hit Generation Mining’s treasury.

And that’s important. With the current cash balance of an estimated C$10M and the C$12.5M in potential warrant proceeds within the next 12 months basically means Generation Mining won’t have to tap the equity markets anytime soon, unless it really wants to do so. Thanks to smart cash management in the past few years, Generation Mining is in a great shape and the company won’t be pushed into a corner.

Conclusion

As the 60% of the net revenue to be generated at Marathon PGM will come from palladium sales, Generation Mining just HAS to present the project as a palladium project. As Sibanye seem to be bearish on the future supply/demand ratio of palladium, they should walk away. However, Sibanye could also look at the project from the platinum perspective. While adding 45,000 ounces per year of platinum to its existing consolidated output of about 1.1 million ounces of platinum per year will hardly be noticeable, it would be able to benefit from the tightening platinum markets. Additionally, Sibanye also produces about a million ounces of palladium per year, so it could certainly deal with the palladium component as well.

Sibanye has 90 days to decide what it wants to do, and the official Day Zero is the day on which the management committee of the joint venture makes a positive commercial production decision There’s no rush for Sibanye to do anything at all and as Sibanye has proven to be a good partner to Generation Mining we also don’t expect Generation to put pressure on Sibanye. Purely based on the numbers and the size of the project,we expect the South African company to take a back seat to see how Generation Mining deals with the permitting process and the financing structure of the project. Sibanye may also be interested in selling its 20% stake back to Generation Mining as well as it looks like the company is chasing bigger targets these days with the rumored interest in Gold Fields and AngloGold Ashanti (two $10B+ gold producers, which could indicate Sibanye Stillwater wants to reduce the ratio of palladium and platinum in its output mix).

With Drew Anwyll as COO, Generation Mining has started to build a team to move the project forward by itself if it has to. The company can now dig into the financial side of the construction activities. Selling a royalty now would kill any potential M&A deal, but once we get closer to the final permits and once it becomes clear no suitor shows up, we expect selling a stream on the anticipated gold and/or silver production at Marathon PGM could keep the share dilution to a minimum.

The main takeaway for investors here is that Generation Mining delivered a robust feasibility study which greatly derisks the project and which can now use to finalize its permitting process and to figure out the funding structure for the construction of the mine. Fortunately GENM is in an excellent financial shape as the balance sheet is very strong.

Disclosure: The author holds a long position in Generation Mining. Generation Mining is a sponsor of the website. Please read the disclaimer.