Bravada Gold (BVA.V) has closed the second and final tranche of its financing, resulting in the company issuing just under 36 million units priced at C$0.03 for total proceeds of C$1.08M. Each unit consists of one common share and one full warrant allowing the warrant holder to acquire an additional share of Bravada for C$0.05 during a three year period.

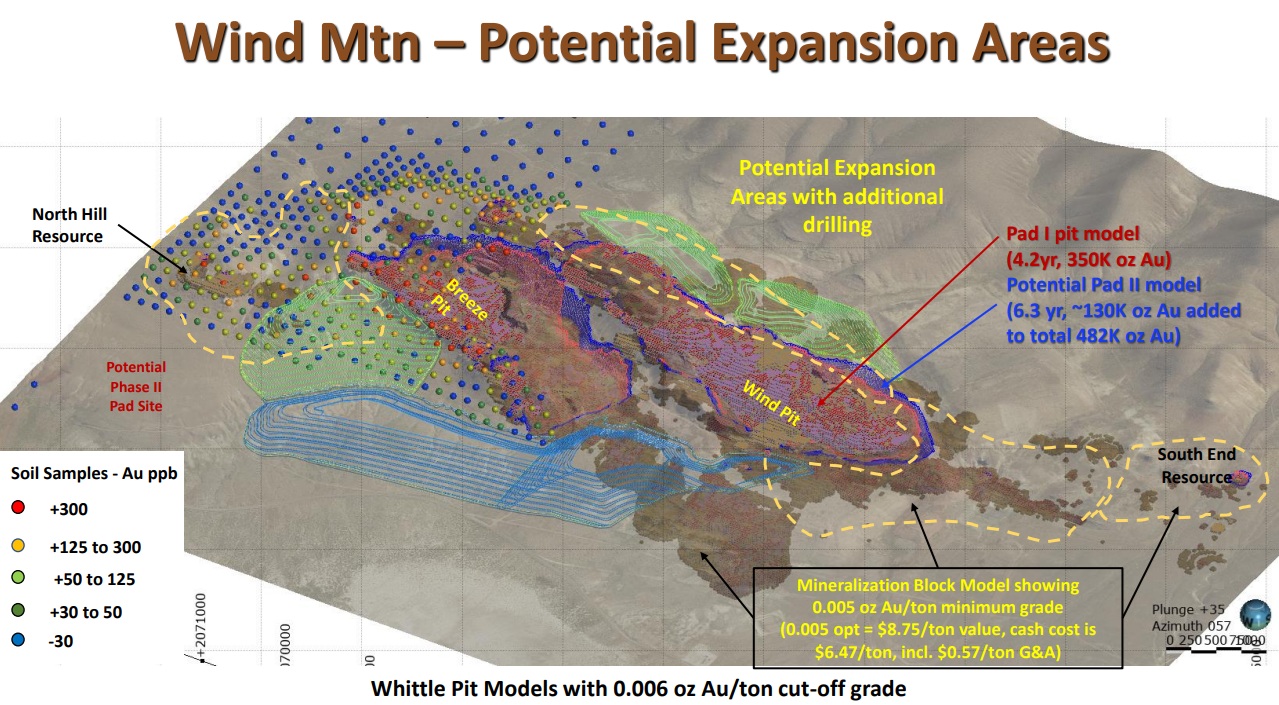

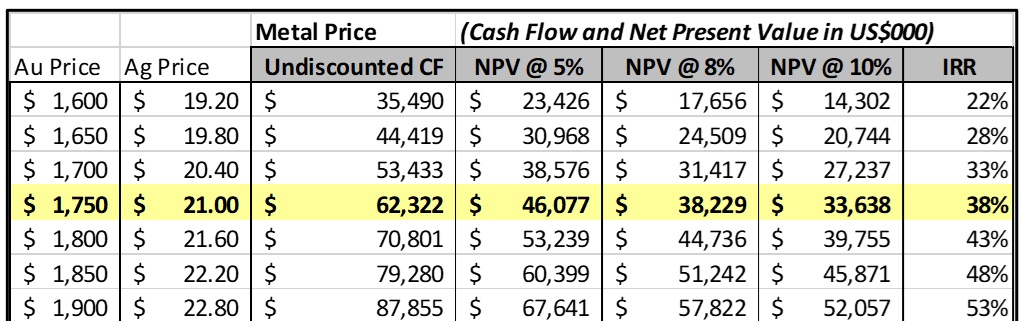

The proceeds of the offering will be used to work on a pre-feasibility study on the flagship Wind Mountain project in Nevada. The company has completed a PEA on this project which indicated Wind Mountain would be pretty marginal at $1750 gold, but as the gold price is currently almost twice as high, the economics of the project could change pretty drastically. At US$2500 gold, the after-tax NPV5% of the project is likely getting pretty close to US$150M so it will be interesting to see an update in PFS quality.

The image above shows the sensitivity of the after-tax NPV to the gold price. Of course Bravada will have to deal with a higher capex and opex (that’s just an assumption, the pre-feasibility study should provide more clarity), but the higher gold price should still have a net positive impact on the NPV of the project.

Disclosure: The author has a small long position in Bravada Gold. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.