Aztec Minerals (AZT.V) confirmed it has decided to upsize its previously announced bought deal placement to C$8.7M. All terms remain unchanged; the no-warrant bought deal financing was priced at C$0.235 per share resulting in a total of just over 37M shares being issued. The underwriter (Stifel Canada) has been granted the standard greenshoe option to sell up to an additional 15% which would bring the total proceeds of the financing to C$10M if the entire overallotment option.

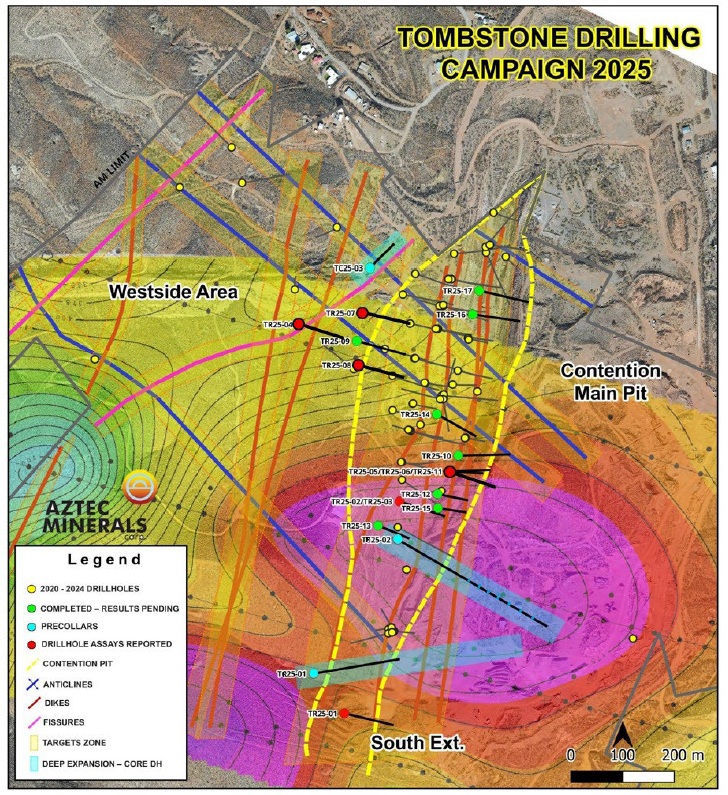

The offering will close in two weeks, and the proceeds will be used to continue its exploration activities on the Tombstone project in Arizona and the Cervantes copper-gold project in Mexico’s Sonora state.

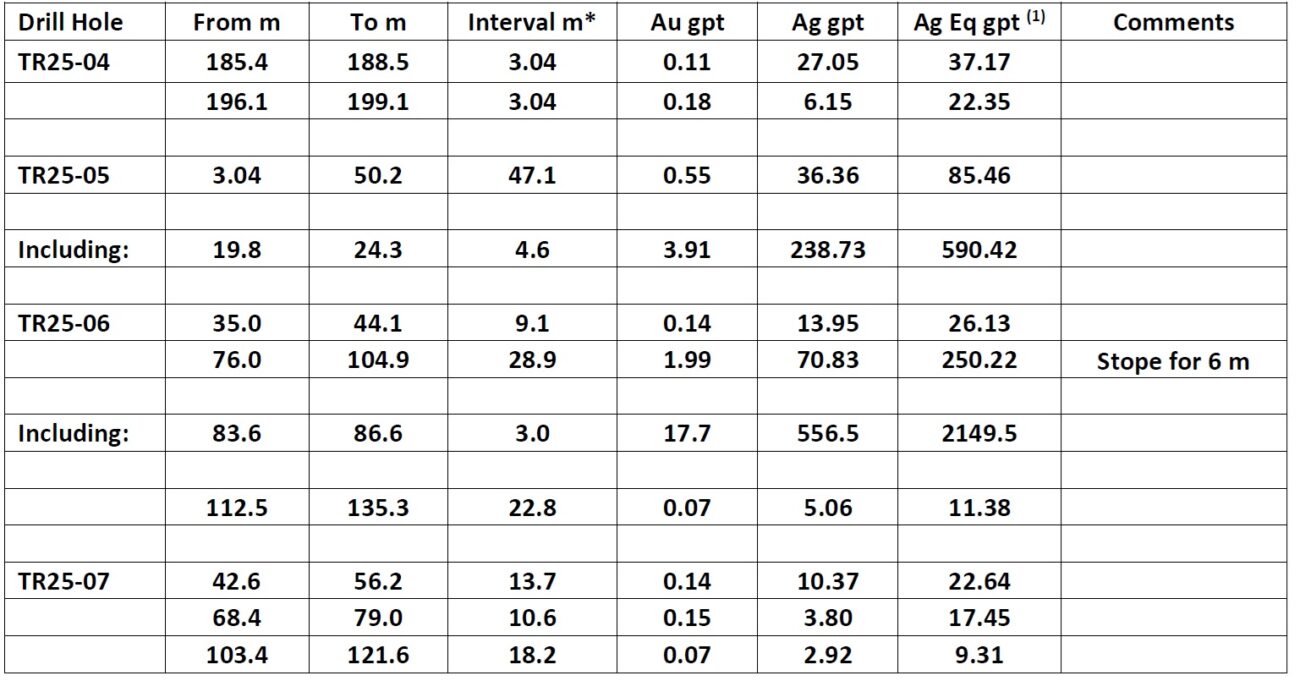

With this financing, Aztec Minerals is capitalizing on the strong exploration results at Tombstone, as the company announced high-grade drill results last week. Aztec disclosed the assay results of five holes, with some of the holes returning very strong gold-silver mineralization including just over 3 meters containing almost 2,150 g/t silver-equivalent encountered right above an old mining stope (within a broader interval of 28.9 meters of 250 g/t silver-equivalent). This means the residual 25.9 meters of the mineralized interval had an average grade of less than 1 ounce of silver-equivalent per tonne of rock, so the 28.9 meters is really ‘carried’ by the narrow but very high-grade interval. But as the mineralization in that hole started at a depth of just under 84 down-hole, even the lower grade material could be interesting at the current metals prices. It is also interesting to see this hole is located approximately 200 meters northeast of the high-grade assay result encountered last year.

Hole 5 (designed to test the mineralization in the eastern side of the Contention system of the main pit) also returned a high-grade interval of 4.6 meters of 590 g/t silver-equivalent within a wider interval of 47.1 meters containing 85.46 g/t AgEq. This means the 42.5 meters outside of the high-grade interval had an average grade of around 1 ounce of silver-equivalent per tonne of rock. The reported intervals are the apparent widths of the mineralization while the true width is expected to be 30-100% of the apparent width.

The company has now reported assay results on 10 of the 19 holes it has completed, and drilling will continue to the end of the quarter as Aztec has increased the size of its drill program from 5,000 meters to 7,500 meters.

Disclosure: The author has a long position in Aztec Minerals. Aztec is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.