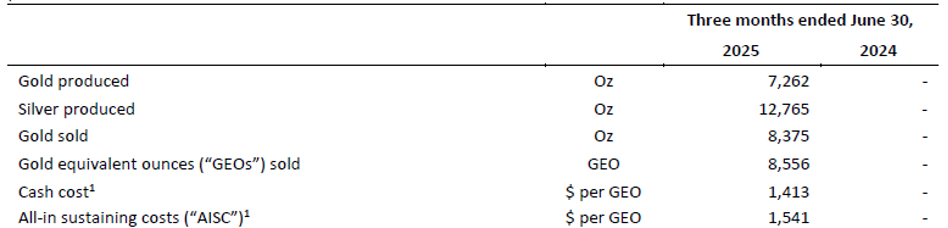

Heliostar Metals (HSTR.V) plans to produce 31-41,000 ounces of gold-equivalent at an AISC of around $2000/oz this year. During the second quarter, it produced just over 7,000 ounces and sold just over 8,000 ounces of gold, which helped to take advantage of the higher gold price.

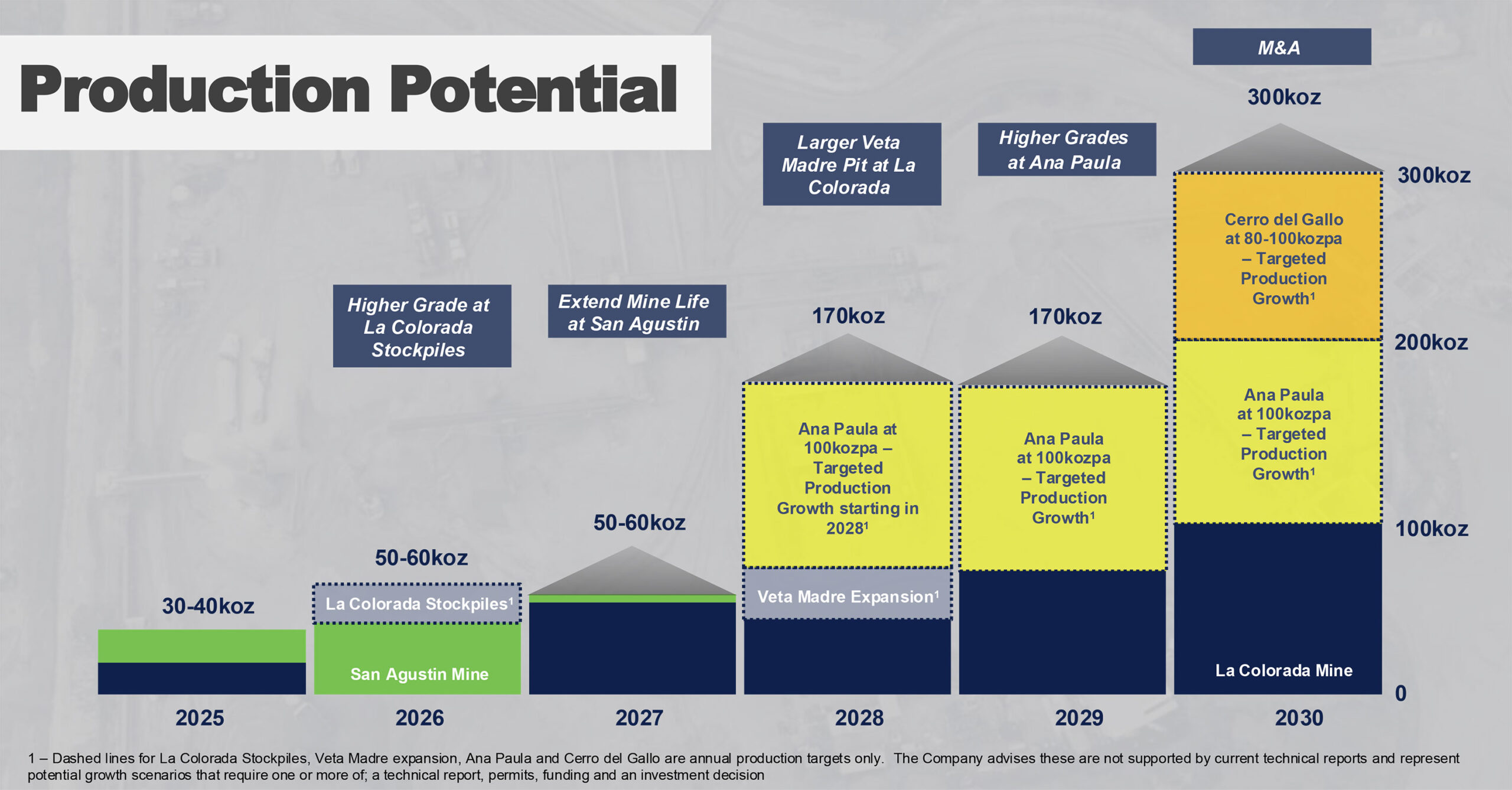

In this update we will have a look at Heliostar’s financial performance ahead of the Q3 results, the recent drill results at Ana Paula as well as the recently received permit to mine the ‘Corner Area’ at the San Agustin mine. These three items are all key elements that underpin the company’s growth plans in the next few years. After all, CEO Charles Funk is still on a mission to build Heliostar into a 500,000 oz producer by 2030. Developing the underground Ana Paula mine and the Cerro del Gallo project would go a long way towards realizing that ambition.

The second quarter of the year

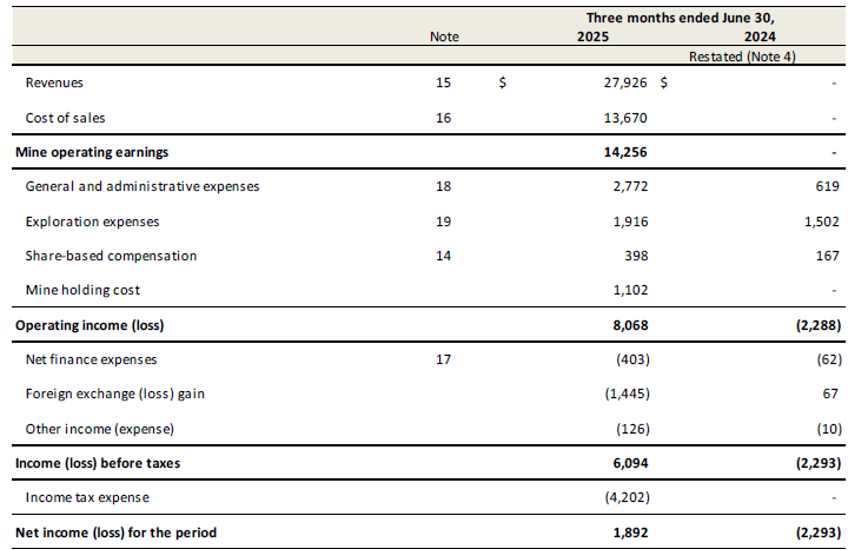

Looking at Heliostar’s operating performance, the company produced just under 7,300 ounces of gold and just over 12,700 ounces of silver for a total gold-equivalent output of just under 7,500 ounces. The revenue was boosted by the timing of gold sales, as Heliostar sold just under 8,400 ounces of gold, which is about 1,100 ounces more than it had produced. This resulted in a total revenue of almost US$28M, of which about 98% came from gold doré and the remaining 2% came from the sale of silver doré.

As the income statement indicates, the gold was produced at a very low cost, and the mine operating earnings came in at $14.3M, resulting in an operating income of $8.1M.

Perhaps the income statement above requires a bit of additional color. The G&A expenses are what they are, and adding two mines to the asset base obviously comes hand in hand with higher overhead expenses. A portion of the exploration activities were expensed rather than capitalized, and that’s the almost US$2M in exploration expenses you see in the image above. And finally, the $1.1M in ‘mine holding costs’ is related to the El Castillo mine. According to the footnotes in the MD&A report, the $1.1M incurred was related to indirect reclamation expenses and expenses related to keep the mine site in good standing. The $0.4M in share based compensation is the pro forma accounting value related to the issue of 700,000 options with an exercise price of C$1.05. The share-based compensation expense is a non-cash item and has no impact on the cash flow of a company.

Looking at the bottom line result of Heliostar in the second quarter, you see a net profit of US$1.9M (representing C$ 0.01 per share) despite also recording a US$1.4M FX loss and $4.2M in taxes.

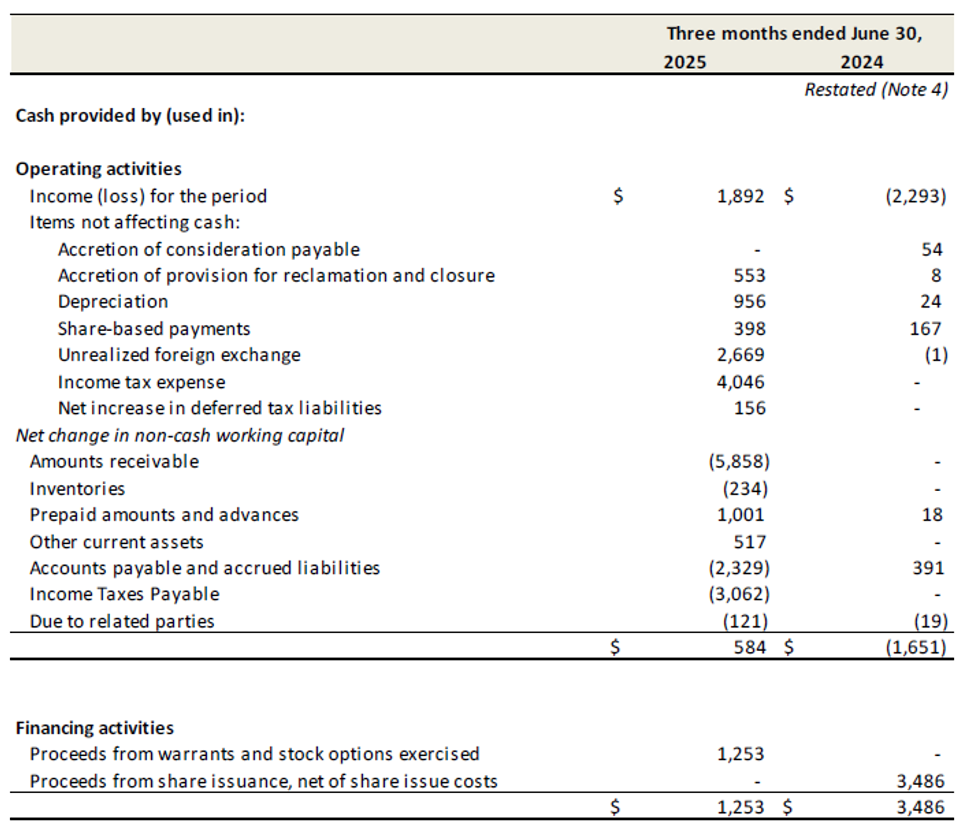

As mentioned earlier, some of the expenses (including the share-based compensation and the FX-related expense) are non-cash items.

The cash flow statement below shows Heliostar reported a positive operating cash flow of $0.6M, but this includes $10.1M in working capital changes that required cash. The item that absorbed the most cash were the accounts receivable and this is merely related to the payment terms for the doré shipped to the buyer. Those receivables have likely already been converted into cash before the Q2 financials were published.

This means that the underlying operating cash flow was approximately $10.7M, although there was a $3.1M in taxes that was owed that hasn’t been paid yet. So just to ensure we aren’t overly optimistic on the company’s earnings, we should work with the underlying operating cash flow of US$7.7M without taking tax-related working capital changes into account.

Surprisingly, the company has not listed a single dollar in investing cash outflow. This means that all incurred items were expensed rather than capitalized. This makes sense, as a business obviously wants to keep its taxable income as low as possible. Once the stripping of the Creston pit commences, accounting rules will dictate that a substantial portion of that expenditure will be capitalized rather than expensed. But for now, Heliostar is expensing all the (minor) investments required to keep its operations up and running.

The strong cash flow result means Heliostar ended the second quarter with a positive working capital position of almost US$52M, with almost US$30M in cash. Other than the usual operation-related liabilities and reclamation provisions, Heliostar has no financial debt or liabilities. This means it can dictate its own pace and focus where to deploy its cash.

Drilling at Ana Paula is going well

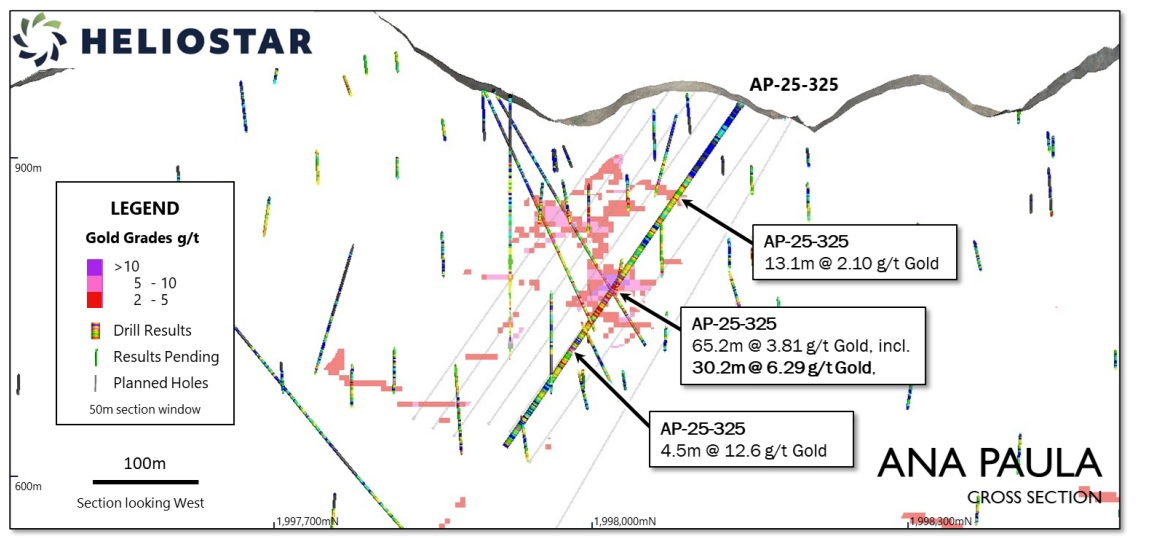

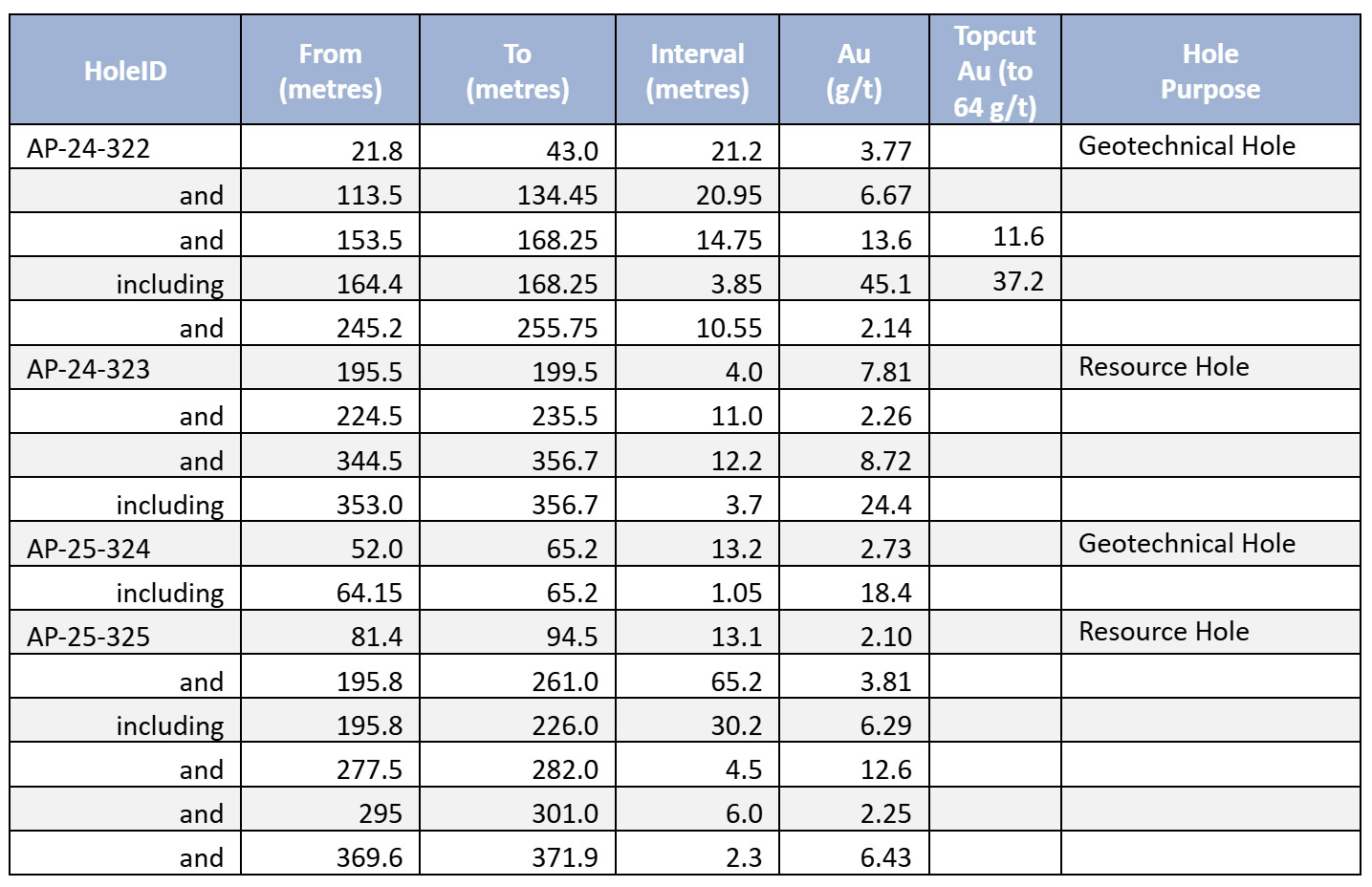

Although the market lately has been focusing on the producing assets of Heliostar Metals, we shouldn’t forget the company is currently working on a 15,000 meter drill program on its Ana Paula underground gold project in Mexico’s Guerrero State. The company has completed almost 40% of the anticipated program as it has completed 18 holes for a total of just over 5,500 meters. One drill rig is currently working on an infill drill program while a second drill rig is still focusing on resource expansion.

The bullet points below highlight the excellent grades encountered during this infill drill program, and the high-grade mineralization confirms the consistency of the mineralized area in the High Grade Panel.

As you can see in the table below, Heliostar also completed two geotechnical holes focusing on gathering more data for mine development planning.

Heliostar remains very active on the exploration front; Since the closing of the acquisition of the producing mines last year, the company expects to complete 40,000-50,000 meters of drilling before the end of this year. The producing mines are generating the cash flow to fund the simultaneous drill programs on the projects.

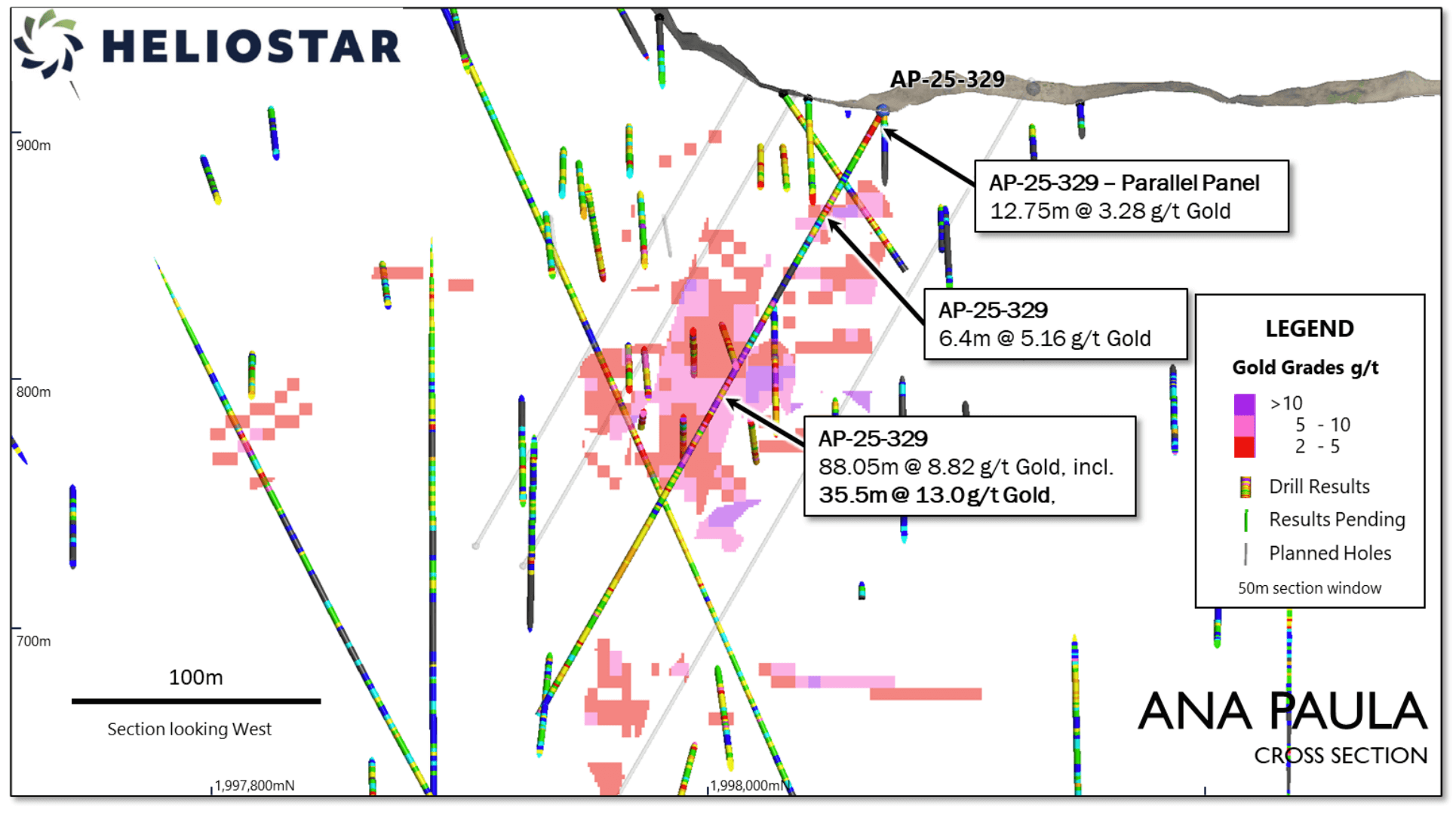

In a subsequent exploration update released just last week, Heliostar released additional assay results from the Ana Paula drill program. The company continues to hit high-grade gold mineralization over good widths, and one of the recently reported holes returned 88 meters of 8.8 g/t gold, including 35.5 meters of 13.03 g/t gold. That interval was obtained by drilling straight through the core of the high grade panel.

A third drill rig has now been added to the Ana Paula drill program to accelerate the pace. As of last week, the company had completed 6,529 meters of drilling in 24 holes, which means it still has to complete almost 60% of the anticipated 15,000 meter drill program. The results of the Ana Paula drill program will be used in an updated resource (and reserve) model which will be the basis of the anticipated feasibility study. Charles Funk and his team are still aiming to have Ana Paula in production in 2028. The company is still aiming for a production of 100,000 ounces of gold per year over a 10 year mine life.

A permit!

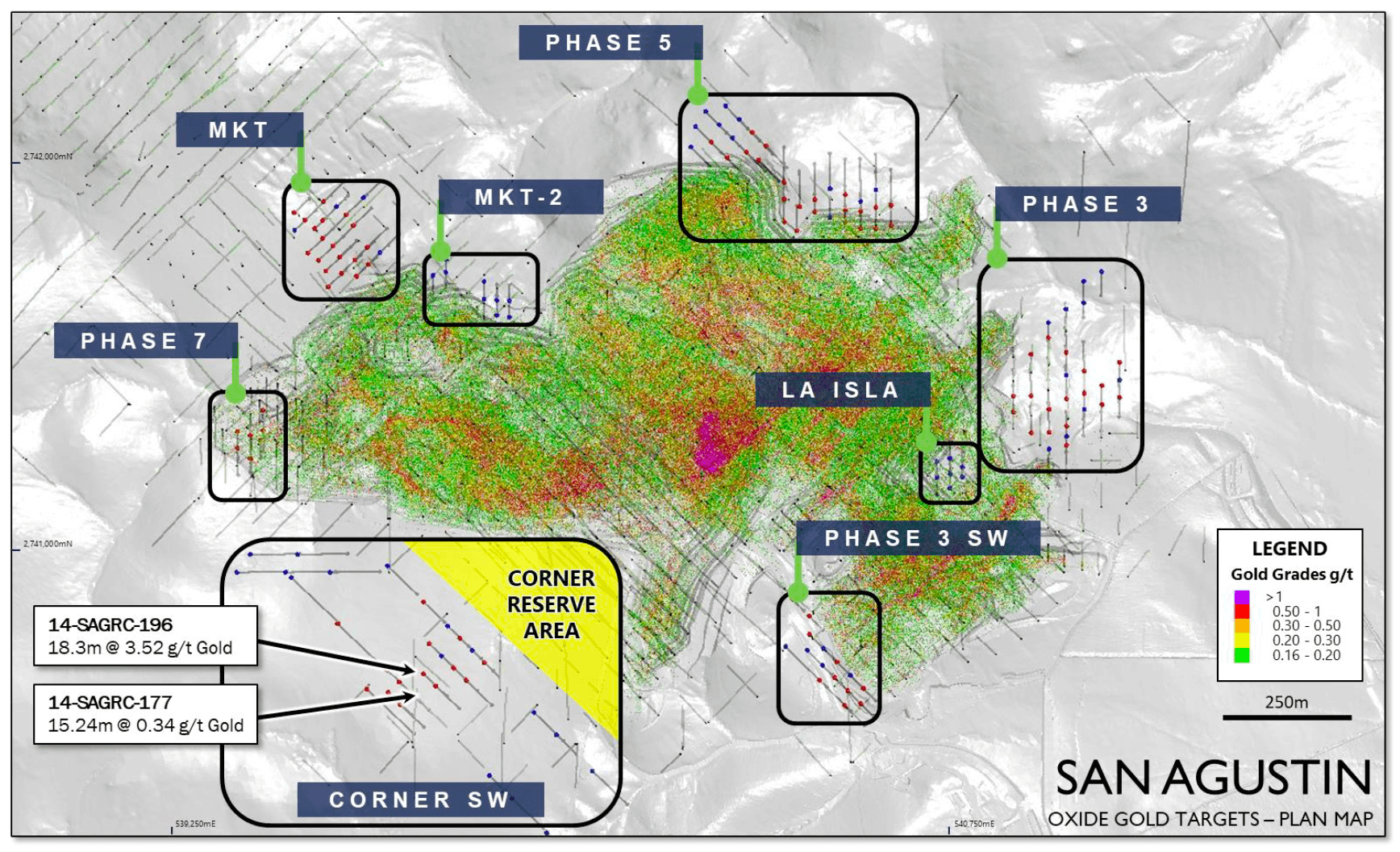

In July, Heliostar also announced it expects to commence initial production at the San Agustin gold mine in the final quarter of the year, as it received all approvals for the expansion of the open pit. The previous operator had already gained access to the ‘Corner Area’ but failed to secure the permits to actually mine that zone.

Heliostar submitted its application in the final quarter of last year and on top of the approval to mine the Corner Area, it also received the confirmation of a variance to its environmental impact assessment to increase the height of the San Agustin leach pad from 77 meters to 88 meters. This represents a US$5M cost saving as Heliostar can avoid constructing an extension to the leach pad.

The mine will produce approximately 45,000 ounces of gold from the current 67,000 ounces of gold in the probable reserves. According to Heliostar, the required capex to start mining this zone is just US$4.2M (which means the current cash position on the balance sheet can easily cover this anticipated capex), resulting in an IRR of a stunning 548% and an after-tax NPV5% of US$35M (around C$50M) at US$3000 gold.

While the anticipated capex may not sound very impressive versus the company’s current market capitalization, it once again is a testament to CEO Funk’s typical step-by-step methodological method.

We don’t expect a substantial amount of cash hitting the balance sheet, and we anticipate the majority of the cash flow will be used to drill-test some of the half dozen high priority drill targets. These drill targets are the extensions of mineralized corridors that were defined by grade control drilling and a Heliostar-led relogging and re-assaying program. And of course, the current gold price is very amenable to having another look at the mineralized zones that were previously deemed uneconomical at $1500 or $1800 gold.

As the image above shows, there are plenty of near-mine targets that could potentially provide additional material to be mined and processed. And as Heliostar has proven that it is able to obtain the required permits to extend existing mining operations, we don’t anticipate the company having much trouble in securing additional extensions should the drilling and subsequent resource and reserve calculations warrant that approach.

And some of the near-mine zones are known to host what appears to be economic-grade mineralization (based on the known cutoff grades for San Agustin mineralization). Just outside the planned pit extension at the corner area, previous drilling has intersected 18.3 meters of 3.52 g/t gold and 15.2 meters over 0.34 g/t gold. Plenty of smoke to follow up on while trying to locate the fire. And the cash flow from the restart of the San Agustin mine will go a long way to efficiently test those zones for additional mineralization.

Conclusion

It goes without saying the current gold price provides a massive tailwind to Heliostar Metals, and this provides the additional wind in the sails to fire on all cylinders. Heliostar anticipates to produce 30,000-40,000 ounces of gold this year (predominantly from the La Colorada mine), and we are already looking forward to seeing the guidance for next year.

We believe the combined production at La Colorada and San Agustin in 2026 will set the company up to make a final investment decision to expand the Creston pit at La Colorada and at $3500 gold ($4,100 now), we assume the cash flow from the existing mines will be sufficient to cover those investments as well as the comprehensive drill programs Heliostar is planning. We noticed Heliostar plans to complete a drill program at Unga as well, while an updated pre-feasibility on Cerro de Gallo is due before the end of this year.

Our focus (and we assume, the management’s focus) will remain on the producing assets in Mexico and to extend the respective mine lives to keep the production and the cash flow going which in turn will help to fund the development of the remainder of its asset portfolio towards the target of 500,000 ounces of gold per year.

Disclosure: The author has a small long position in Heliostar Metals. Heliostar Metals is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our full disclosure.