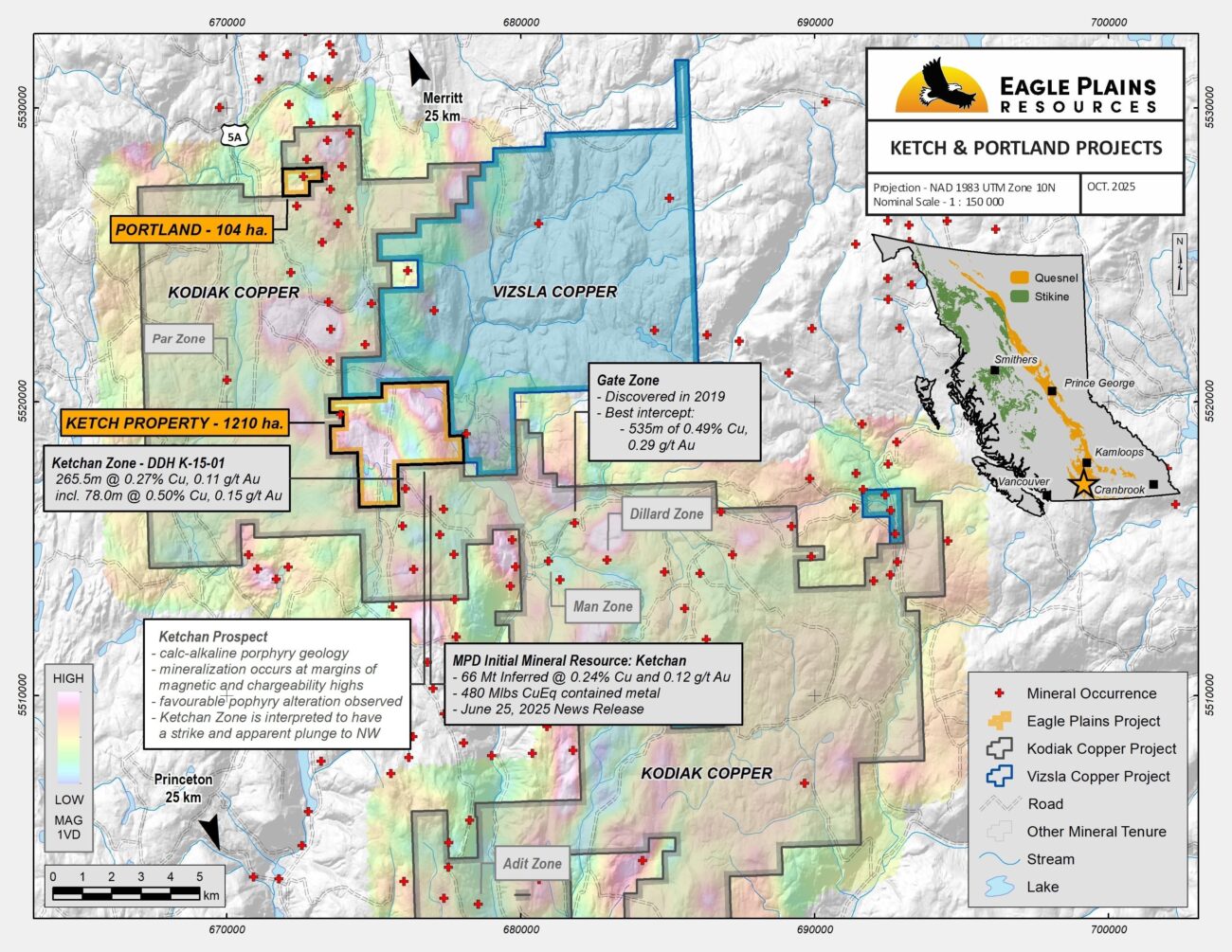

Eagle Plains Resources (EPL.V) has announced it has signed an agreement with Kodiak Copper (KDK.V) whereby the latter will acquire the Ketch and Portland projects from Eagle Plains. Both projects are located in close proximity to Kodiak’s flagship MPD copper project, so the acquisition by Kodiak should be seen as a consolidation of the land package around its own flagship project.

As consideration for the acquisition, Kodiak Copper will issue 300,000 shares of Kodiak and will grant a 2% NSR on the claims. Kodiak does retain the right to repurchase half of the NSR for C$1.75M in cash. By being paid in shares, Eagle Plains retains exposure to the project ànd the MPD copper project in British Columbia. Subsequent to this deal, we expect Eagle Plains’ portfolio of marketable securities to be worth in excess of C$2M.

Disclosure: The author has no position in Eagle Plains Resources. Eagle Plains is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.