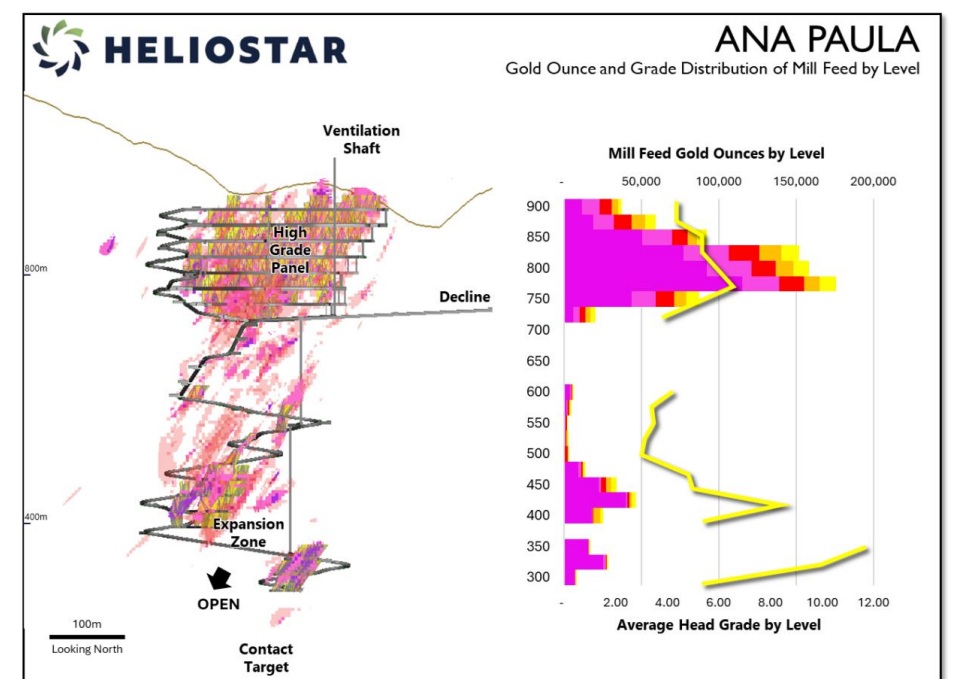

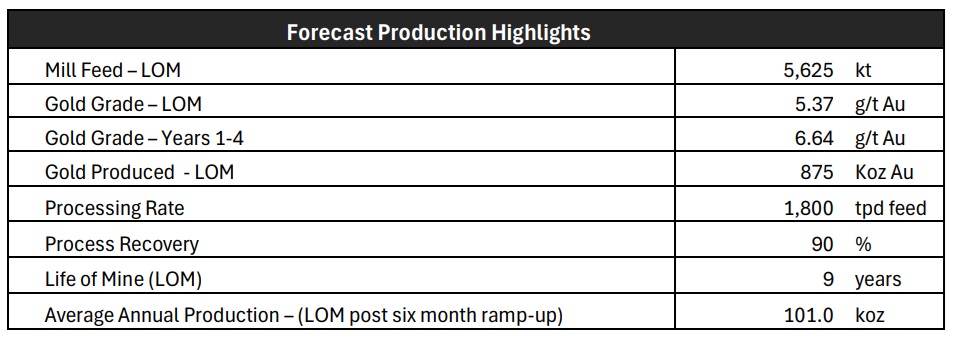

Heliostar Metals (HSTR.V) announced the results of the Preliminary Economic Assessment conducted on its flagship Ana Paula gold project in Mexico’s Guerrero state. The initial capex for a 1,800 tpd operation is estimated at US$300M and given the nice grade and robust production profile of just over 100,000 ounces of gold per year, the anticipated AISC per produced and payable ounce is approximately $1011/oz. This means that at the current gold price, the net margin (on a pre-tax basis, of course) at Ana Paula would exceed $3000/oz. Years 2-4 of the mine life will be important for the mine as the average production rate in those three years will exceed 130,000 ounces per year thanks to an above-average grade of just under 7 g/t gold.

Using a base case gold price of $2400/oz, this results in an after-tax NPV5% f US$426M while at a gold price of $3800/z, the NPV jumps to just over US$1B while the IRR increases from 28.1% to 51.3% on an after-tax basis. At $3200 gold we are talking about a US$761M after-tax NPV5%, which represents almost C$1.1B at today’s exchange rate.

The metallurgical flow sheet indicates the importance of the BIOX plant, as that’ll boost the recovery rate to around 90%, compared to the conventional flotation and CIL processing which would have resulted in a much lower recovery rate. This means the $46M in additional capex to build the BIOX plant likely has a payback period of less than a year given the substantial increase in gold recovery versus the higher upfront capex.

The full technical report will be filed soon, and we’ll discuss the additional details in a separate report.

Disclosure: The author has no position in Heliostar Metals. Heliostar is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.