The silver price is exceeding our expectations but unfortunately this doesn’t mean that all silver equities are performing well. In the case of Southern Silver Exploration (SSV.V) the current silver and zinc price does mean the main component of the project once again is silver, but the share price is still lagging a bit and has recently lost some ground after touching almost C$0.50 per share this summer.

While the share price did increase by 75% on a YTD basis, let’s not forget the difference between $45-50 silver and $23 silver (which was used in the base case scenario) has an even stronger impact on the economics of the project (as per the 2024 PEA).

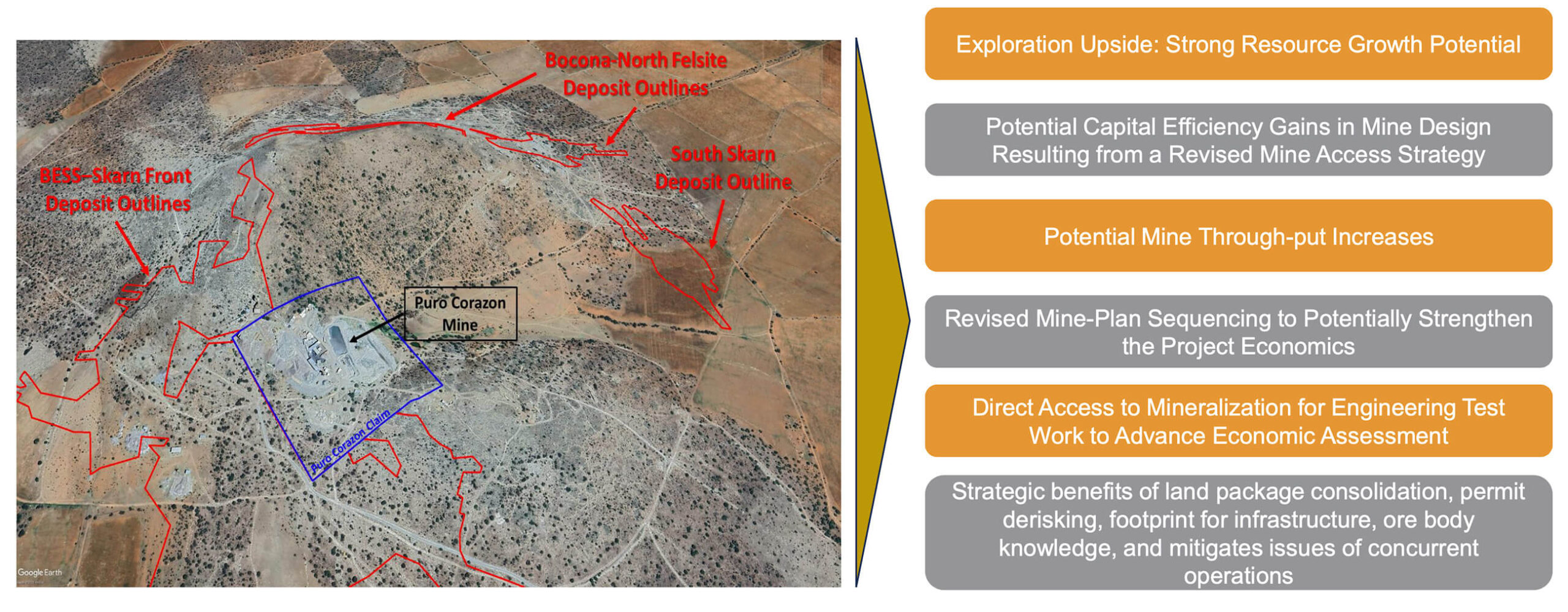

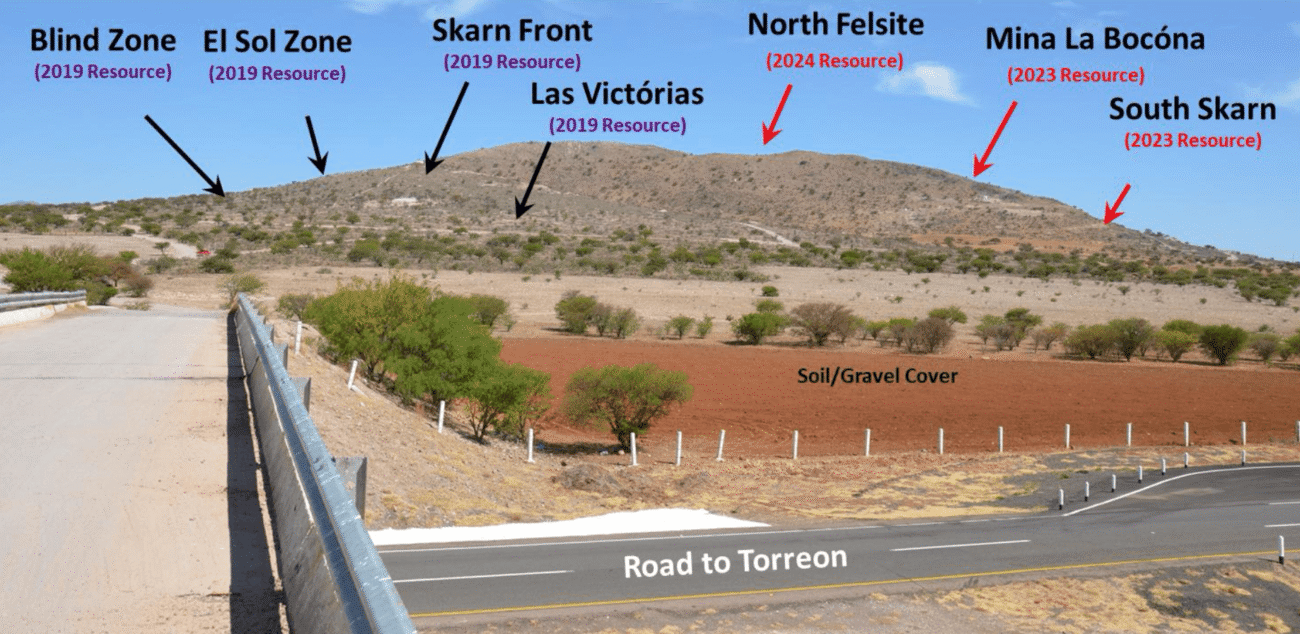

While the higher silver price of course provides a massive tailwind, Southern Silver is trying to add value to its flagship Cerro Las Minitas project by acquiring additional claims to consolidate the land package. It has entered into an option agreement to acquire the Puro Corazon claims (with a small-scale production of 60 tonnes per day) which are located in the heart of the project. The catalysts for 2026 are clear: we should see an updated resource calculation in Q1 2026 (including the impact of the Puro Corazon mine) followed by an updated Preliminary Economic Assessment in the third quarter, which will incorporate the resource update while also updating the capex and opex inputs in the economic model.

The Cerro Las Minitas economics at the current commodity prices

Before discussing the recently announced acquisition, we should take a step back and have a look at the 2024 PEA again (as that still is the ‘current’ technical report on Southern Silver’s flagship Cerro Las Minitas asset).

The main purpose of the 2024 PEA was to improve the economics of Cerro Las Minitas, and Southern Silver definitely achieved the desired result. As discussed in a previous update on the company, the mine plan was tweaked a bit and instead of focusing on a 4,500 tonnes per day scenario, the company and its consultants settled for a higher throughput of 5,300 tonnes per day. That obviously meant the anticipated capex decrease didn’t occur but on a pro forma basis, but the capital intensity (capex versus capacity) improved. Whereas the capex per tonne of annual capacity was US$210 in the 2022 PEA, this improved to US$201/t.

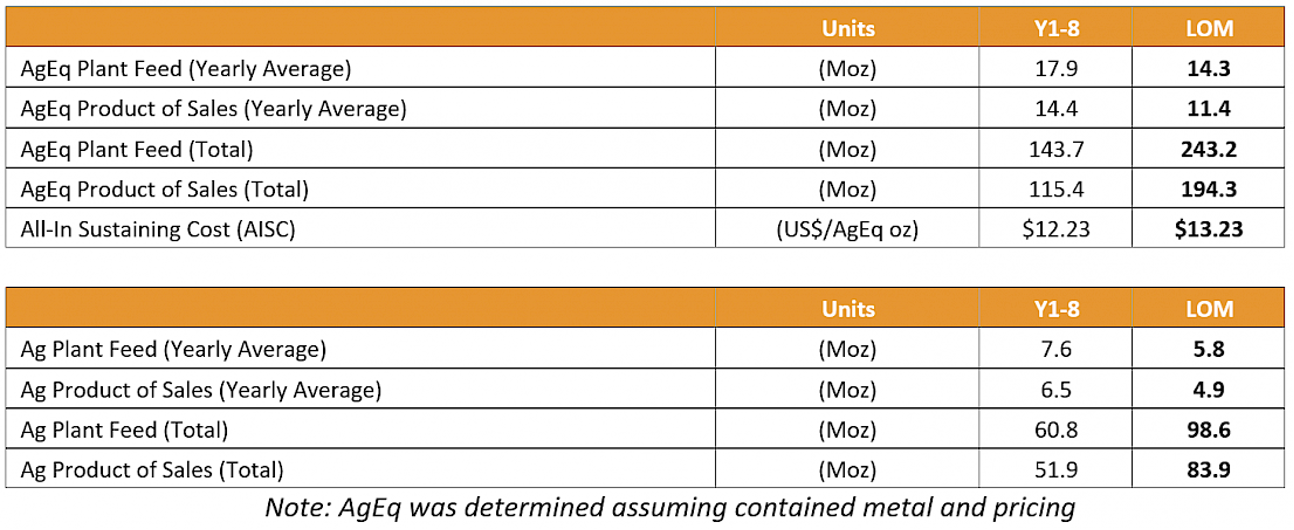

The average daily throughput of 5,300 tonnes per day indicates the mine will produce approximately 11.4 million ounces of silver-equivalent per year, including 4.9 million ounces of pure silver. This rises to 14.1Moz silver-equivalent per year, including 6.4Mozs silver over the first eight years of production.

Southern Silver presents the project and its operating costs on a silver-equivalent basis. While we are usually allergic to that, especially as the pure silver production of 4.9 million ounces per year is very respectable, we understood why, as silver represented less than 45% of the total revenue in the base case scenario. That has now changed as the zinc price is slightly lower while the silver price is substantially higher, so Cerro Las Minitas is now a more silver-dominant project than it was two years ago. This should enable Southern Silver to catch somewhat more of the traditional ‘silver premium’.

The total All-In Sustaining Cost (‘AISC’) is estimated at US$13.23 per ounce of silver-equivalent over the entire mine life.

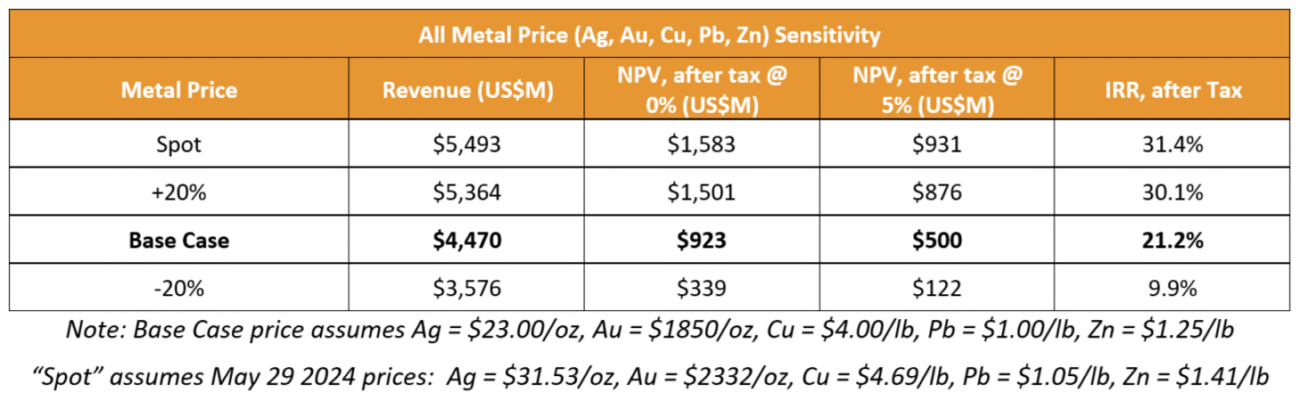

But what’s really interesting, is that the base case scenario in the 2024 PEA was based on a scenario with $23 silver and $1850 gold as main metal prices. The zinc price of $1.25 per pound is more in line with the current price ($1.28 as per the LME prices), but it goes without saying that applying the current metal prices would provide a tremendous boost to the NPV and IRR of the project. As part of its PEA, the company published the table below.

The ‘spot case’ scenario uses $31.53/oz for silver, $2332/oz for gold, $4.69 per pound for copper, $1.05 per pound for lead and $1.41 per pound as the main zinc price. Gold and silver are now obviously trading at higher prices than in the previous spot price scenario (74% higher and 59% higher respectively), while the zinc price is currently slightly lower. The higher copper price has a smaller impact on the economics as the anticipated average payable copper production is less than 5 million pounds per year as per the 2024 PEA. The current LME pricing for copper is about 3% higher than the pricing used in the PEA. Those 20 cents per pound won’t make a noticeable difference.

Adding the Puro Corazon mine could improve the economics

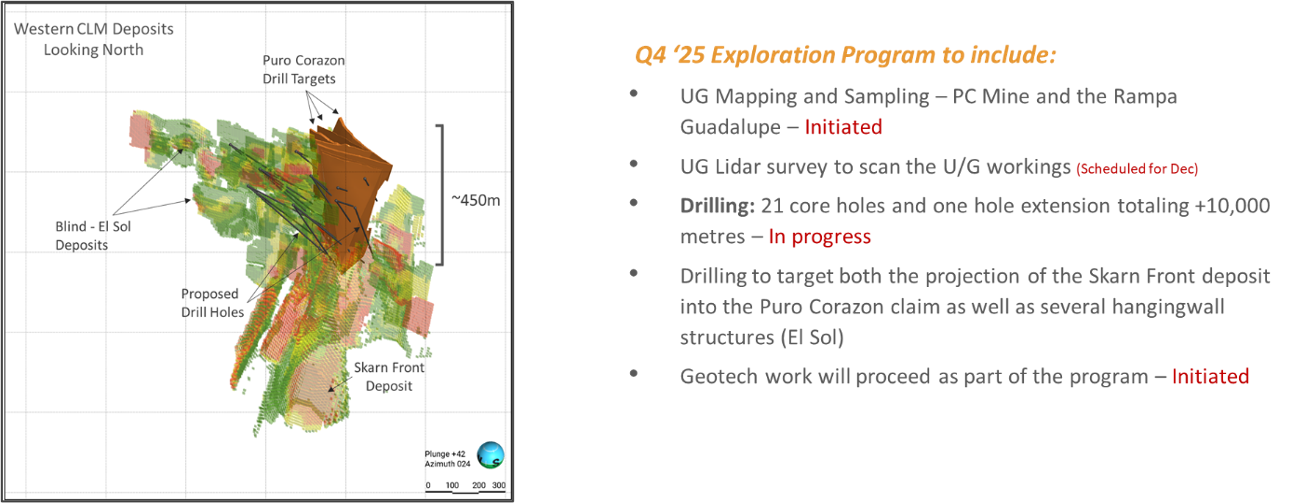

Just a few months ago, Southern Silver announced it has reached an agreement to acquire the Puro Corazon mining claim which is located directly adjacent to the Cerro Las Minitas project.

The mine is privately owned and produces a silver-lead concentrate as well as a zinc concentrate from its current operations which are running at a rate of 60 tonnes per day (it is a labor intense operation, which includes handsorting the ore). Sixty tonnes, indeed, so the Puro Corazon claims are definitely not acquired for the cash flow or the milling capacity, but it could be beneficial to the Cerro Las Minitas economics. Southern Silver clearly didn’t buy Puro Corazon for the production, but for the potential economies of scale.

After all, by acquiring ownership of the claims, the rock coming from the Puro Corazon zone could be fed to the Cerro Las Minitas mill earlier in the mine plan given its high average grade and the fact the mineralization occurs closer to surface.

Southern Silver of course won’t just blindly mine and operate the Puro Corazon claim, but the company has kicked off a 12,000 meter drill program which should allow the company to use the data (in combination with historical drill data) for a maiden resource calculation at PC. Southern Silver will likely report an updated global resource calculation with the CLM and PC resources included in one and the same technical report in Q1 2026. This should culminate in an updated PEA as well, combining the economics of both projects into one entity. The updated PEA should be ready in the third quarter of 2026.

An interesting intangible feature of this acquisition is that this could hopefully help the permitting process down the road as well. Additionally, having an additional source of mill feed could have an impact on the anticipated daily throughput. While it still is early days, it definitely makes sense to acquire the 20 acre claim that’s located within the Cerro Las Minitas land package.

In any case, a potentially interesting acquisition, subject to the terms of the agreement (which have not yet been disclosed).

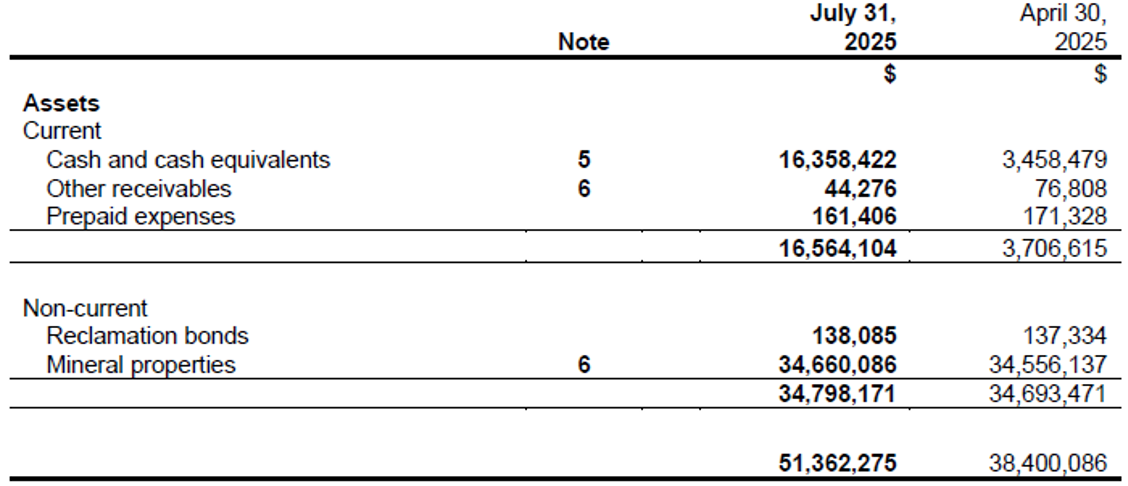

The recent capital raise means the company is cashed up

Southern Silver’s financial year ends in April, which means the Q1 result (for the quarter ending in July) provides the most recent financial statements we have access to. As you can see below, Southern Silver had in excess of C$16M in cash and a positive working capital position of around C$16M. The company has of course already spent some cash since then (as drilling at Puro Corazon has started and we estimate the current cash position to be around C$12-13M. And that of course puts the company in a very comfortable financial position to deal with the potential incorporation of the Puro Corazon claims in the mine plan.

It’s also important to note a total of 25 million warrants and 8.5 million options expired unexercised. While it would have been good to have seen the cash inflow from warrants and options that expire in the money, investors focusing on a fully diluted share count will be happy (although the lack of option & warrant proceeds of course just means an inevitable financing will come sooner).

Right now it doesn’t look like the 12 million warrants with an exercise price of C$0.75 that are maturing in June 2026 will be in the money either (although the situation can of course change quite drastically in the next six months), but perhaps Southern Silver will see some of the lower priced (but longer dated) warrants being exercised. Additionally, there are about 9.35 million options expiring in Q3 2026 (for total proceeds of C$2.9M) and perhaps we’ll see some early exercises there as well.

Conclusion

While all the lights are green for Southern Silver, its share price remains one of the laggards in the sector. We hope the catalyst-rich 2026 will change that as we can look forward to an updated resource estimate as well as an updated PEA. Southern Silver is fully funded for all these activities, and hopefully this will help the company to trade at a higher multiple to its NPV compared to where it’s trading at now.

Referring to the scenario in the PEA using a silver price of $31.53 while the zinc price is $1.41/pound with gold at $2332/oz and copper at $4.69 per pound, the after-tax NPV5% comes in at C$1.3B. This represents C$3.35/share which means the stock is now trading at approximately 10% of its NPV at a silver price that’s approximately 40% lower than the current spot price.

We hope the updated PEA in 2026 will confirm and improve the economics (including the impact of a higher silver price and the contribution from the Puro Corazon mine) and create a basis for the company to start working towards a pre-feasibility study, reducing the project risk.

Disclosure: The author has no position in Southern Silver. Southern Silver Exploration is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our disclaimer.