Montage Gold (MAU.V) has announced an agreement with African Gold (A1G.AX) whereby Montage will acquire the latter in an all-share deal whereby each share of African Gold will be converted into 0.0628 shares of Montage Gold. This provides a pro forma value of US$170M for African Gold. Montage already owned a 17.3% stake in African Gold so it is doubtful another bidder will emerge.

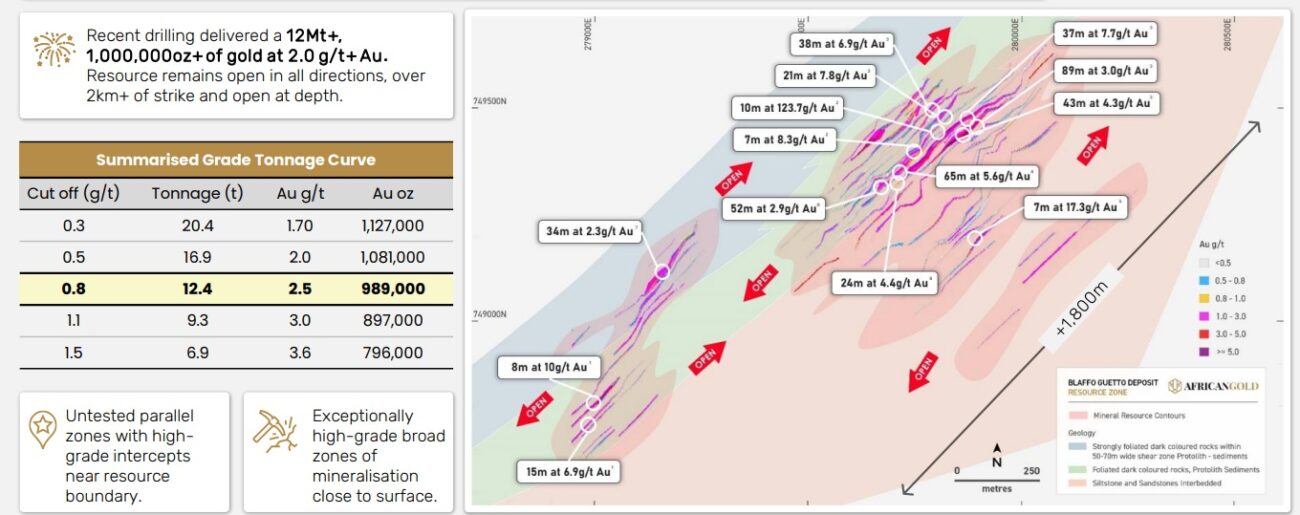

African Gold’s flagship asset is the Didievi gold project which currently contains just under 1 million ounces of gold in 12.4 million tonnes of rock at an average grade of 2.5 g/t gold. This means the total Didievi resource has more than doubled from the 459,000 ounces of gold since Montage acquired its initial stake in the company. Earlier this year, Montage became the operator of the exploration program which allowed the company to get a better understanding of the deposit, and this triggered the decision to acquire African Gold.

Disclosure: The author has no position in either African Gold or Montage Gold. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.