We attended a site tour hosted by Sierra Madre Gold & Silver (SM.V) earlier this month, spending two days on the company’s flagship La Guitarra silver-gold mine in Mexico. But before we could even publish our site visit report, the company announced the acquisition of the Del Toro mine from its largest shareholder, First Majestic Silver (AG.TO, AG).

This is an interesting development, not just to backfill the valuation of Sierra Madre (although at $75 silver even La Guitarra should spit out a generous amount of free cash flow once the expansion has been completed), but because it also lends more credibility to the company’s plans to build out a silver producer in Mexico, still the world’s premier silver destination. It also highlights the company’s excellent relationship with First Majestic and perhaps this could pave the way for further ‘drop downs’ in the future.

The Del Toro Project

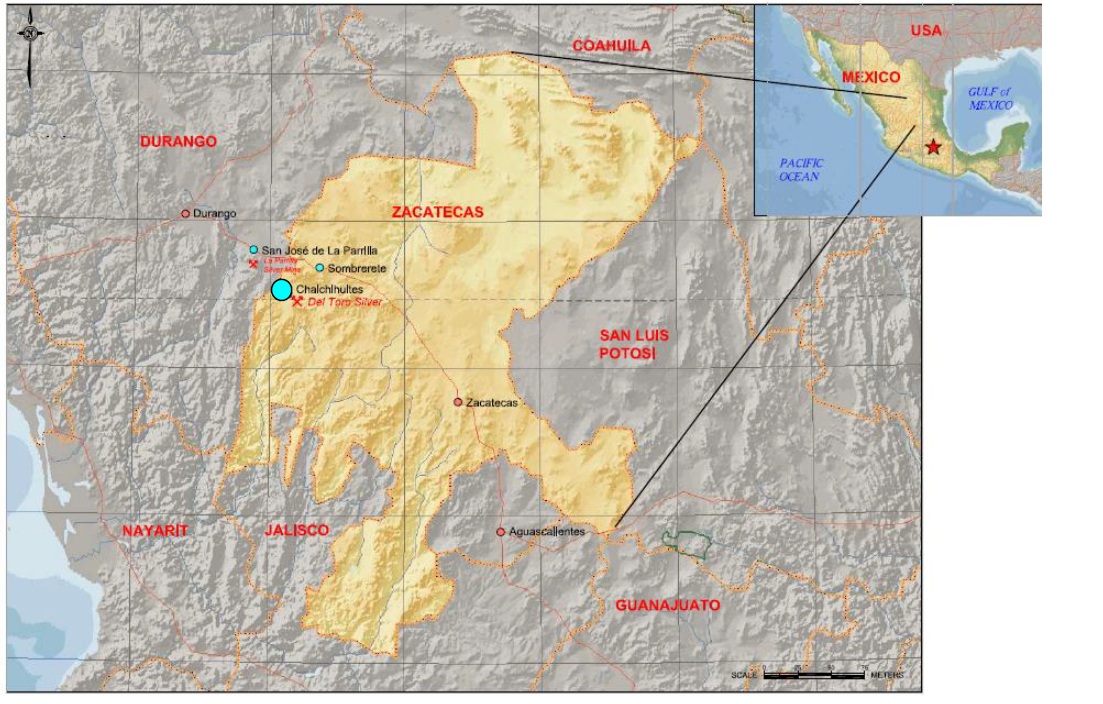

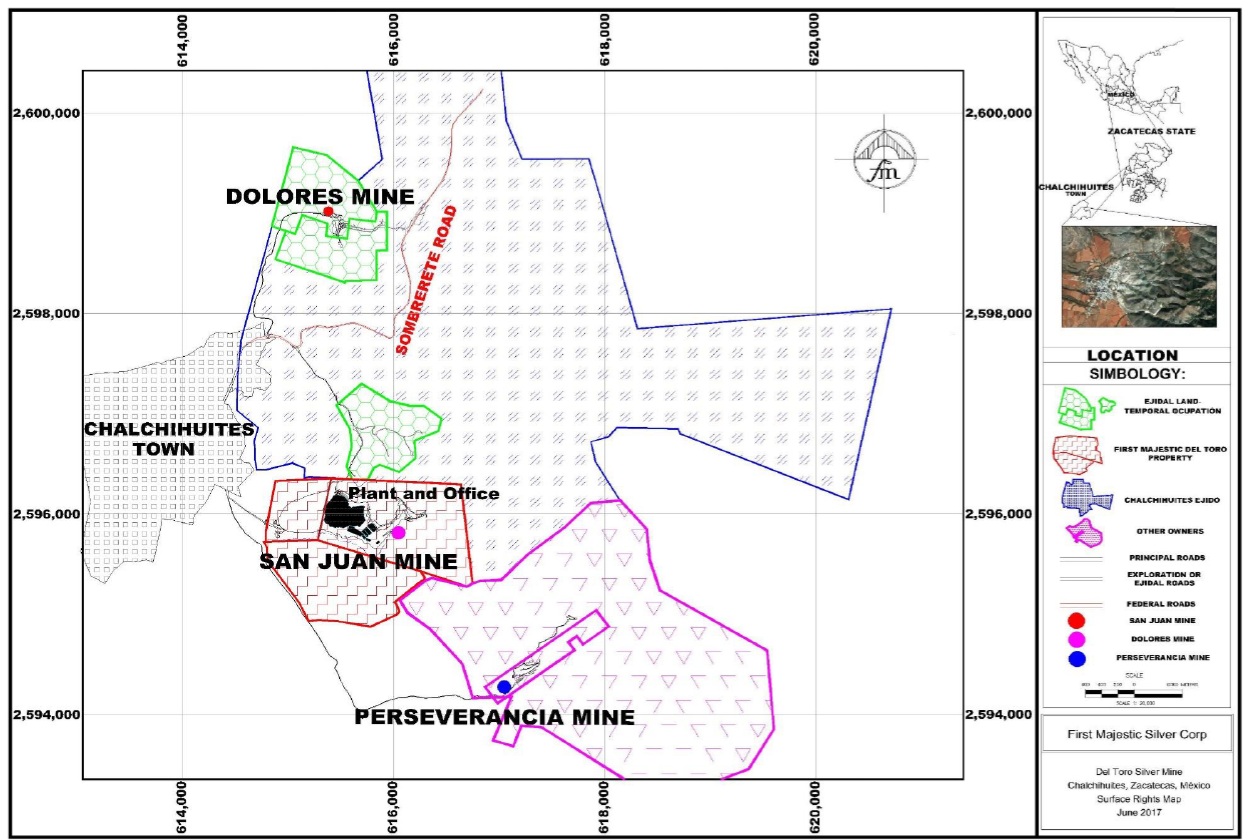

The Del Toro project is located in northwestern Zacatecas, approximately 150 kilometers from the state capital Zacatecas. The project consists of three underground mines on a total land package of roughly 4,000 hectares, one paste tailings management facility and a processing plant. The existing infrastructure consists of a 2,000 tonnes per day flotation circuit and a 2,000 tpd cyanidation circuit (Sierra Madre Mentions a 3,000 ton per day operation in its press release but we think the company is underestimating the true capacity of the existing infrastructure as the 2000 tpd + 2000 tpd is mentioned in First Majetic’s filings). There is also a lab on site.

This location breathes mining; the nearby town of Chalchihuites was founded during the Spanish colonial period in the 1500s with several small scale mining operations in the neighborhood. First Majestic started production at Del Toro in 2013-2014 after it acquired the property in 2006, producing silver in a lead concentrate. Although there is some arsenic in the rock (and in the concentrate) First Majestic has generally been able to keep the impurity levels below penalty thresholds. That’s important to ensure the payability levels of the concentrate remain high, as that will ultimately be the driver of the mine’s profitability.

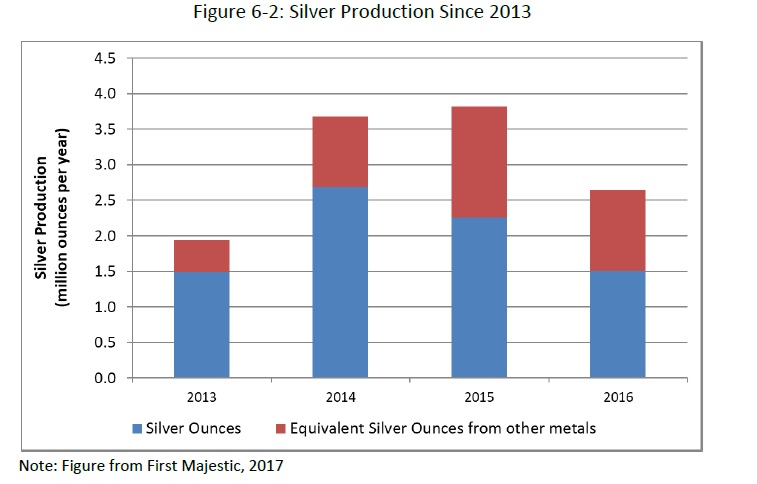

We had a look at the results from back when First Majestic was operating the mine. The last full year of operations was 2019, but in that year the throughput already decreased by 60% versus 2018, so we are considering 2018 to be the most recent year of ‘full operations’ at Del Toro.

As you can see below, in 2018, the mine processed 267,000 tonnes per year at an average grade of 132 g/t silver and just under 3% lead, resulting in an AISC of $27.50/oz.

It is clear that the main issue at Del Toro was the underutilization of the processing facilities. Although the capacity of the existing infrastructure could handle more ore, the utilization rate dropped to less than 50% in 2018 before dropping down further to just 1/5th of the capacity in 2019. You don’t need to be an economist to understand the lack of economies of scale killed the project.

Although First Majestic has completed almost 140,000 meters of drilling in in excess of 600 diamond drill holes, the low resource base and the current status whereby the mine has been placed on care and maintenance likely means we should look at Del Toro as an exploration project with the potential to restart mining rather than a mining operation. When First Majestic shut down the mine in Q1 2020, it had plans to complete in excess of 22,000 meters of exploration and resource drilling to drill out a resource that would support reopening the mine, but we are not sure if the company ever completed that drill program as just a few months later the COVID pandemic brought the world to a screeching halt.

We’re glad to see that Sierra madre isn’t trying to run before it can walk and rather than focusing on bringing the project back into production, COO Greg Liller mentioned the company would kick off a 50,000 meter drill program which should result in an updated resource estimate in the first half of 2028. And it’s only after that updated resource will be completed, that the company will make a decision to restart production at Del Toro.

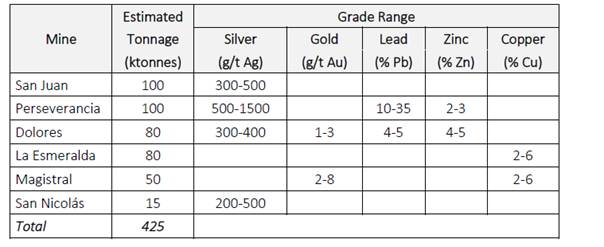

Sierra Madre also highlighted the Carbonate Replacement Deposit potential in its press release and that CRD potential appears to be an interesting angle. Surveying volumes of old stopes feeds the assumption initial mining operations were chasing rock with an average grade of 700 g/t silver, 10-35% lead and 2-3% zinc. And even more recently, in the 1990s, there are production records of a very small-scale mining operation with grades of 1,500-3,000 g/t silver and 20-40% lead. As this was a very small operation that hand-sorted ore it may not be representative for the entire district, but it does indicate the prospectivity for high-grade base metal zones, as shown below in the table (copied from the First Majestic technical report on Del Toro).

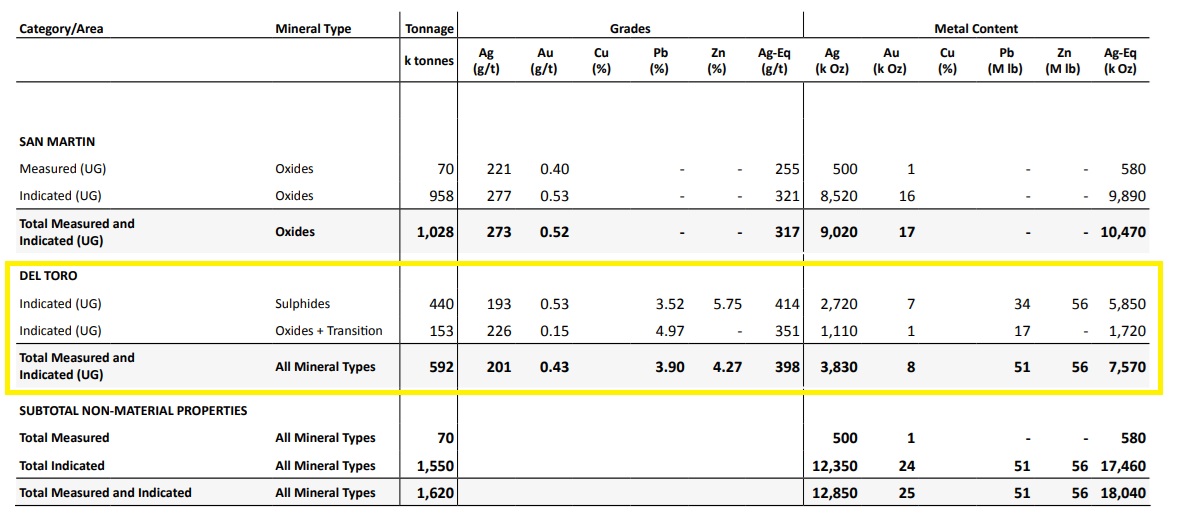

At the end of last year, Del Toro was listed as a non-core property by First Majestic with just under 600,000 tonnes of rock in the measured and indicated resource categories, with an average grade of 201 g/t silver, 0.43 g/t gold and in excess of 8% ZnPb, resulting in 3.8 million ounces of silver (and 7.6 million ounces of silver-equivalent in total). This resource has an effective date of December 2020 as virtually no activities have taken place since.

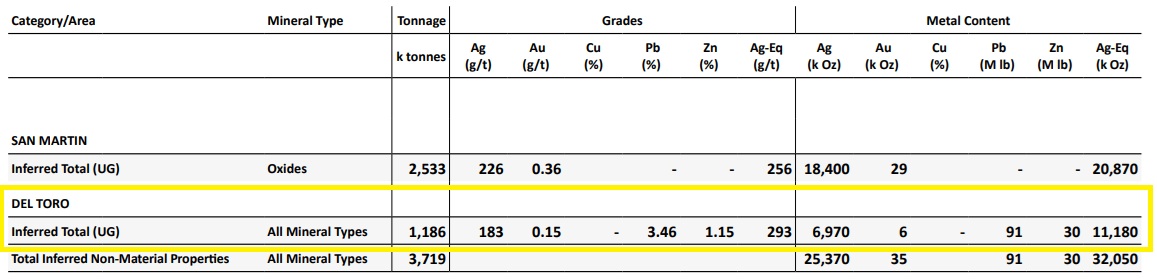

The inferred resource category (shown below) is larger with approximately 1.2 million tonnes of rock at 183 g/t silver, a little bit of gold and approximately 4.5% ZnPb, for a total silver content of just under 7 million ounces and a silver-equivalent resource of just over 11 million ounces.

As mentioned, the mine has been placed on care and maintenance, and this is costing First Majestic approximately US$2.5M per year. These costs will of course transfer to Sierra Madre Gold & Silver as well, though the company may find efficiencies once it assumes control, as it did at La Guitarra.

The acquisition terms

Thanks to the excellent relationship between First Majestic and Sierra Madre, the latter is able to acquire the assets for an initial amount of US $30M. US$20M will be payable in cash upon closing the transaction while the remaining US $10M will be payable in new shares of Sierra Madre at a deemed price of C$1.30 per share.

There are also additional milestone payments included in the purchase agreement, and after an 18 month period Sierra Madre will have to pay an additional US$10 million either in cash or in shares, subject to a maximum of 10.6 million shares to be issued.

Additionally, if Sierra Madre discloses a total resource of in excess of 100 million ounces silver-equivalent within the first four years after closing the transaction, First Majestic will be entitled to receive an additional US$10M in cash or stock with the same limits as before, limiting the maximum amount of new shares to just under 10.6 million shares.

It goes without saying we would have absolutely no problem for Sierra Madre to pay an additional US $10M if it adds 80 million ounces silver equivalent to the resource base, as that milestone payment would equate to just US$0.125 per silver equivalent oz that was added to the resource (or lower, in case the updated resource exceeds 100Moz AgEq).

A final milestone payment is related to bringing the project back into production. If Sierra Madre is able to bring Del Toro back into production within five years from the closing date, processing at least 4,000 tons per day for 30 consecutive days (which again indicates Sierra Madre’s mention of a 3,000 tpd facility may be underestimating the true potential of the infrastructure), Sierra Madre will have to make an additional 10M payment which once again can be in a combination of cash and stock with a maximum of 10.6M shares to be issued.

This means the fixed purchase cost is US$40M, with an additional $20 million payable upon meeting certain milestones that would be an absolute positive feature for Sierra Madre. If the company does not reach the 100 million oz silver equivalent mark and does not reach the 4,000 ton per day production rates within the aforementioned timeframe, the full purchase price remains limited to US$40M of which half could be paid in stock.

The concurrent financing

Sierra Madre obviously doesn’t have US$20M just kicking around and in order to fund the initial payment to First Majestic Silver as well as to ensure it can complete the planned 50,000 meter drill campaign at the Del Toro project, it has announced a C$50M financing with Beacon Securities as lead agent.

The financing is structured as a subscription receipt financing which means the shares will only be issued if and when Sierra Madre successfully completes the acquisition of the Del Toro silver mine. As part of the agreement with First Majestic, Sierra Madre has to raise at least C$40M before the planned acquisition takes effect.

The financing is priced at C$1.30 per subscription receipt, and it’s encouraging to see that every subscription receipt will be converted into one common share. No warrants will be issued as part of this financing. As the silver price exceeded $65 per ounce when the news was announced, it will be interesting to see if the over-allotment option — which would enable Sierra Madre to raise an additional C$7.5M — will be exercised by the agent.

The offering is expected to close in mid-January while the transaction is expected to close within 120 days from the closing date of the sub receipt financing.

Conclusion

It goes without saying that the current silver and gold prices are a massive tailwind for Sierra Madre, and this should provide additional financial breathing room to continue to build out the La Guitarra mine and swap leased equipment for owned equipment.

The acquisition of the Del Toro mine could very well provide the next leg up in its production strategy. Although this is a past-producing mine with all permits in good standing and with all infrastructure still in place, Sierra Madre will first embark on a thorough exploration program. This 50,000 meter drill program will hopefully underpin a major resource upgrade which will back stop the company’s plans to reopen the mine.

While the la Guitarra mine will be ramping up in 2026 to reach its increased nameplate capacity, the company’s technical team will be busy advancing both the la Guitarra underground mine as well as kicking off the first thorough exploration program at Del Toro in over half a decade.

Disclosure: The author has no position in Sierra Madre Gold & Silver. Sierra Madre currently is not a sponsor of the website, but has been one in the past. We may be reimbursed for some of our travel expenses to the La Guitarra mine site. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.