The metal prices are very volatile, and senior producers have seen their run come to an abrupt halt (for now?). But there is a sweet spot in the base metals segment of advanced stage exploration companies that appear to have a promising asset, and are on a quest to ensure ‘critical mass’ can be achieved before commencing economic studies.

Element 29 Resources (ECU.V) is one of those companies. The 2022 resource estimate already contains a pit-constrained resource of in excess of 300 million tonnes of rock using a 0.20% Cu cutoff grade. The almost 322 million tonne inferred resource estimate has an average grade of 0.32% copper, 0.029% molybdenum and 2.6 g/t silver. And with copper trading at close to $6/pound and molybdenum trading strong as well, the pricing of Element 29’s primary metals is good.

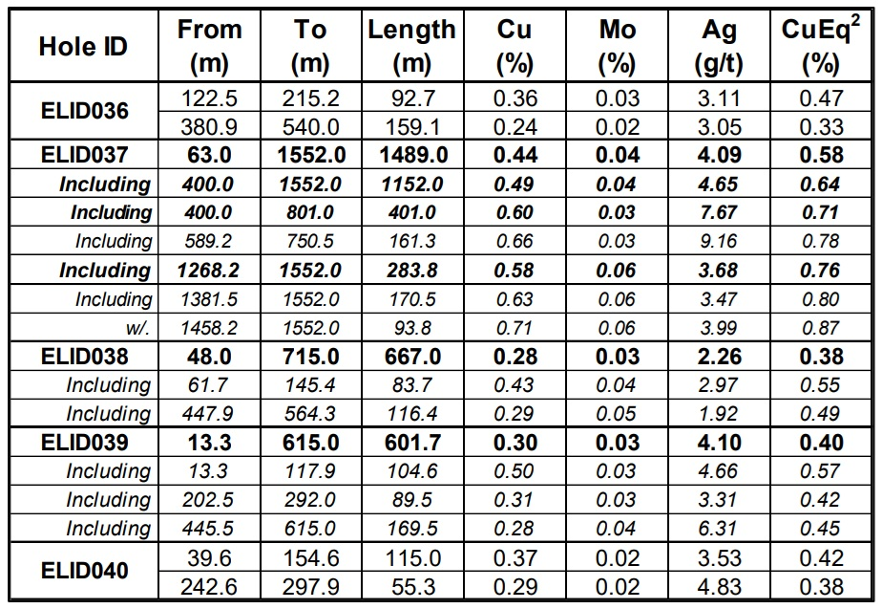

The company recently released the assay results from the first batch of its drill results at Elida, and one of the holes revealed a jaw-dropping interval of 1,489 meters containing 0.58% copper-equivalent (0.44% copper, 0.04% molybdenum and 4.09 g/t silver) while ending in mineralization.

While more drilling is required, this could change the perception of the Elida project as the mineralization appears to be running deeper than initially anticipated. This means that 1) we are optimistic about increasing the open pit tonnage and 2) the deeper mineralization could potentially open up the project for an underground development scenario.

Of course, both elements are just our interpretation of the results, and investors should only rely on official resource calculations and statements by the company. We expect to see Element 29 to publish an updated resource calculation by the end of the year, and not only do we hope to see in excess of 500 million tonnes of rock across all categories, it would also be great to see a portion of the total tonnage upgraded to the measured and indicated resource categories. Again, these are just our thoughts, and they will have to be confirmed (or disproven) by a 2026 resource update.

Looking back at the recent drill results

The drill bit delivered. The headline result was delivered by hole ELID037 at Elida, which intersected 1,489 meters (that’s just under 1.5 kilometers) of continuous mineralization with 0.44% copper, 0.04% molybdenum and 4.09 g/t silver for a copper-equivalent grade of 0.58%.

Not only is this an excellent interval which clearly demonstrates the continuity of the mineralization, it’s also important that 1) the mineralization starts close to surface at just 63 meters down-hole and 2) the hole actually ended in mineralization, at a depth of 1,552 meters. This means Element 29 Resources still hasn’t found out how deep the mineralization extends.

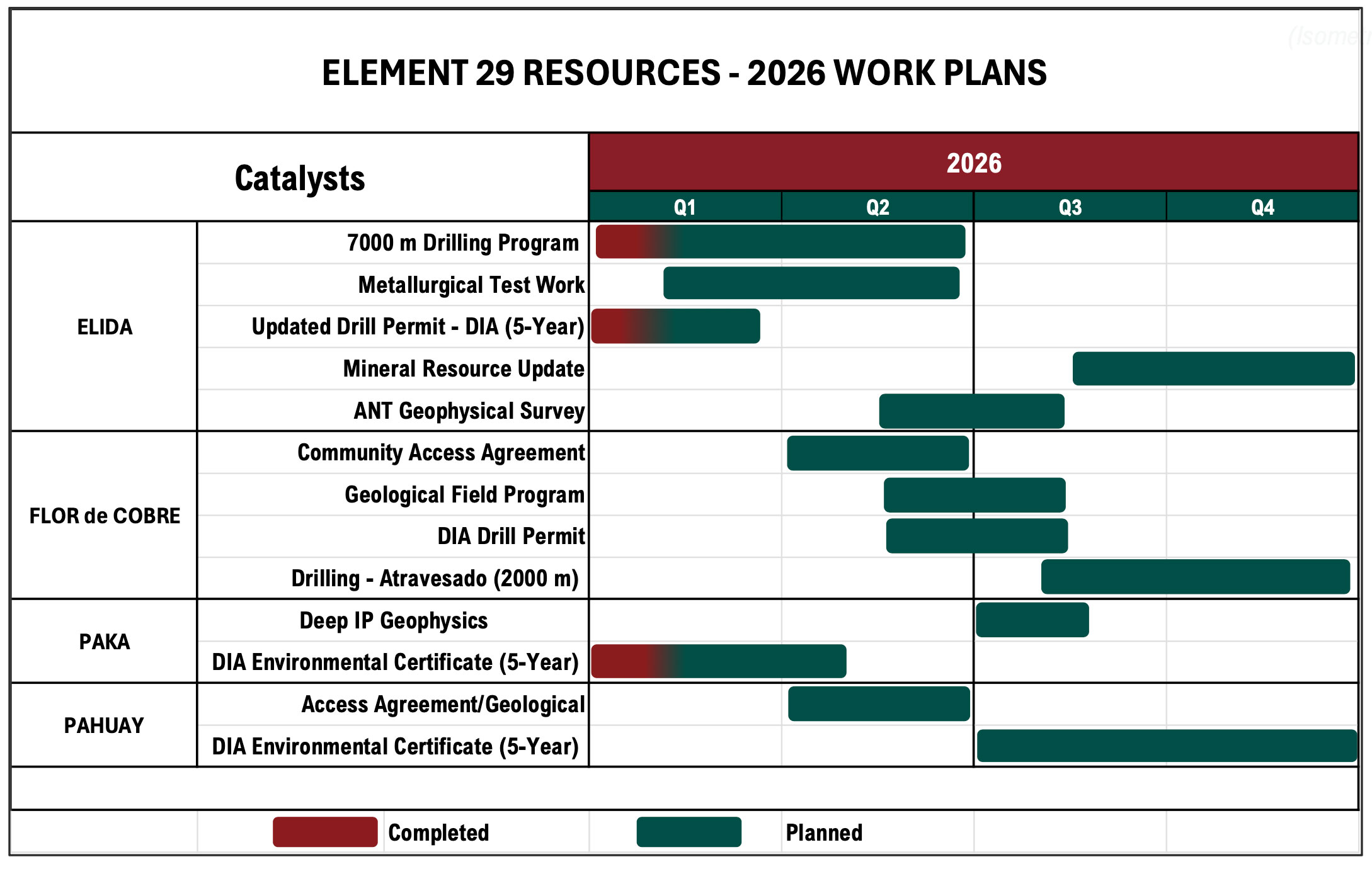

It’s understandable the other holes could not replicate this very strong result, but with the other holes returning 667 meters of 0.38% copper-equivalent and 602 meters of 0.40% copper-equivalent in holes 38 and 39, it is clear that Element 29 Resources was successful in ‘building tonnage’. Metallurgical test work (is expected to be completed in the second quarter of this year, and the data from that program, in combination with all the assay results from the 2026 drill program, will end up in an updated resource calculation at Elida.

Location, location, location

As it has been a while since we discussed the excellent access to infrastructure of this project it’s perhaps worth to revisit and re-emphasize why Elida’s strategic location is important.

The Elida project (which is 100% owned by the company) consists of almost 20,000 hectares in the Cajatambo and Ocros provinces in Peru. The project is accessible by road from Lima, the capital, via the Pan American Highway before taking an exit to the east and follow a section of paved roads over a 75 kilometer distance. The main drill target at Elida is found near the bottom of a steep valley at approximately 1,200-1,400 meters above sea level. That’s important as this means the deposit is located at a relatively low elevation which makes the working circumstances so much better resulting in a lower-cost and more efficient exploration and mining effort. The main issue the company has to deal with is the rainy season during their summer (November-March) but exploration can continue year round making the Elida project an excellent location. The rainy season mainly has an impact on accessing the project but is not a major deterrent to the actual exploration activities.

Water shouldn’t be a major issue either as the local river has a flow rate of 12,000 liters per second in the dry season and 236,000 liters per second in the rainy season (with an average flow rate of 48,000 liters per second on a year-round basis). The river runs down to the Cahua hydroelectric plant which is located just 14 kilometers downstream from the property and produces approximately 300 GWh of electricity per year. Another hydroelectric power plant about 45 kilometers to the southeast produces 837 GWh per year.

It’s also important to note the project is located near an active mining district and the surrounding area is sparsely populated while agricultural activities (apples, mangos, avocados,…) are limited to the river valley bottom. While Element 29 isn’t even close to developing the project and building a mine (the exploration programs are designed to reach ‘critical mass’ before kicking off the economic studies on the project), we consider the accessible location without having too many neighbours a clear positive for the project.

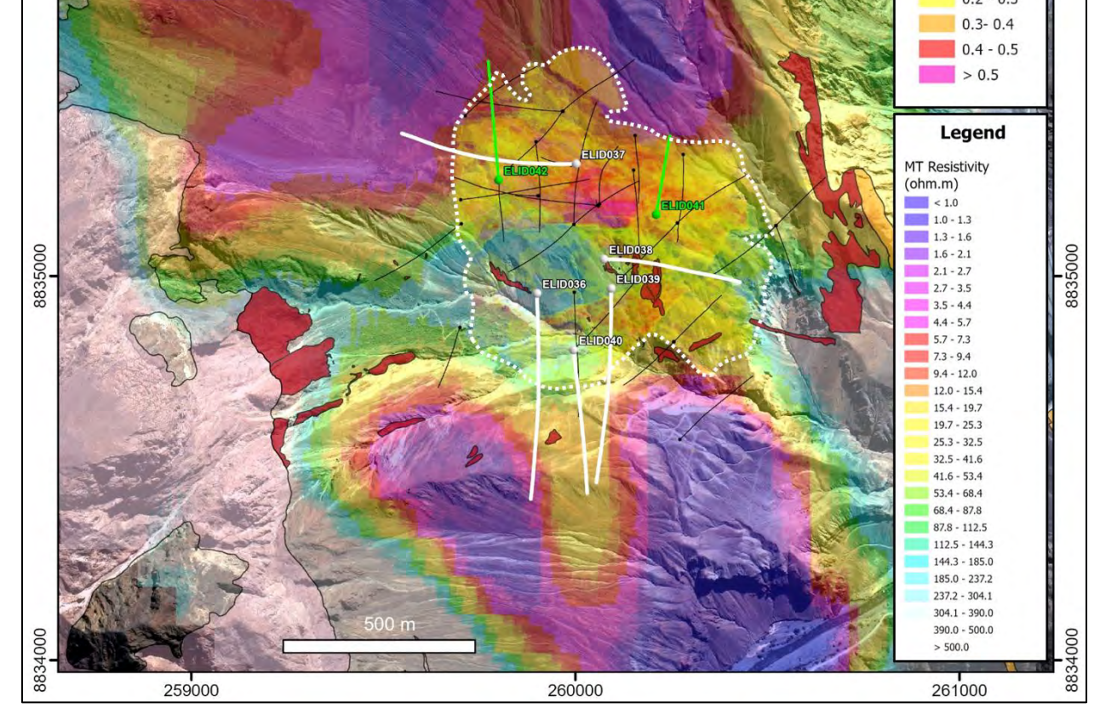

The two drill rigs are currently working on holes 41 and 42

Drilling at Elida is continuing with two rigs, which are currently working on holed ELID041 and ELID042. The location of these two holes is interesting, as they are clearly aiming to gather more data on the northern end of the current resource shell.

Drilling is ongoing, and it may take a while before we see the assay results.

What’s next for Element 29?

We are already looking forward to seeing the assay results for holes 41 and 42 but considering these are relatively deep holes that will need to be fully analyzed as the mineralization starts close to surface, we’re likely still a few months away from seeing the assay results and we do not anticipate seeing anything before the end of March.

That’s fine as the company has plenty of other things to do. We’re also looking forward to seeing a more detailed metallurgical test program as this, in combination with an updated resource calculation which is slated for the end of 2026, will provide a lot of useful data points before perhaps committing to complete a maiden preliminary economic assessment on the Elida property.

We also expect to see an update on the drill permit at both Elida and the Paka project. This does not mean we expect the company to change gears and start drilling Paka but it certainly is a positive element to work towards securing the required permits for Paka as well, but Elida remains the main focus.

The updated drill permit for Elida should also be issued relatively soon (March/April?) and as previously discussed, this will allow the company to drill the Elida mineralization in a more efficient way. Element 29 has already received environmental certification under a Declaracion de Impacto Ambiental from the relevant authorities, which will now allow the company to apply for a new PIA (‘Programa de Inicio de Actividades’). The current PIA permit was approved under a different certification which is set to expire in the second quarter of this year and has to be renewed (this time related to the DIA application process).

This has additional advantages: the company will be permitted for up to 40 drilling platforms, and this will enable Element 29 Resources to continue its exploration efforts beyond the current pit-constrained mineral resource by drill-testing the large alteration footprint. In order to work towards a new PIA drill permit, Element 29 has also executed a new five year access agreement with the host community, while it continues to work on a Collective Impacts Report.

The balance sheet

The company of course still has to publish its full year financial results but at the end of September, Element 29 Resources had a positive working capital position of approximately C$9.8M.

Drilling long and deep holes of course isn’t cheap and we should expect the cash position to have dwindled down by now. But let’s also keep in mind that there are still approximately 19 million warrants outstanding of which the first 13 million expire in August 2027. These warrants have an exercise price of C$0.50 which means that if they get exercised an additional C$6.5M in cash will hit the company’s treasury. And the recently issued 6.3M new warrants as part of the August 2025 financing with an exercise price of C$0.70 (and an August 2028 expiry date) are now also in the money which could yield an additional C$4.4M if and when exercised.

So while these two series of warrants are deeply in the money, there is no acceleration clause attached to them so Element cannot accelerate the expire date of the warrants. Additionally, as we saw with the other warrants that were exercised throughout 2025, the majority of the warrant holders seems to prefer to wait until closer to the expiry date before exercising them. While it’s a useful type of ‘secondary funding’, we are not banking on the majority of those warrants to actually be exercised before 2027.

Once the current drill program has been completed we expect the company to be opportunistic and strike the iron while it’s still hot. After all, the previous financing was priced at C$0.50 And we cannot imagine anyone would be upset if the next raise happens at a substantially higher price level.

Conclusion

There are a handful of advanced stage copper exploration companies with promising projects in decent regions. Element 29 Resources is one of them. The drill bit is delivering on the company’s promise to add tonnes to the current 322 million tonne pit-constrained resource, and the recently released hole that encountered continuous mineralization over a length of almost 1,500 meters (while ending in mineralization) speaks to the potential of this copper porphyry system.

With copper and molybdenum, the two main metals at Elida, trading strong, this appears to be the perfect time to advance the project as fast as possible. Drilling deep holes takes time, but given the initial results, it is worth the wait and the effort. With a resource update on the table for later this year, incorporating all data gathered since 2022, Element 29 Resources is advancing towards reaching critical mass on its flagship project.

Disclosure: The author has had a long position in Element 29 Resources since its IPO in 2020. Element 29 Resources is a sponsor of the website. This report is for educational purposes only; be mindful that investing in junior mining stocks is risky, and you may lose your entire investment if things go wrong. Please read our disclaimer.