Just a few days after Callinex Mines (CNX.V) disclosed the purchase of the Point Leamington project from Newmarket Gold (NMI.TO), the company has now announced it has signed a binding purchase agreement with Slam Exploration (SXL.V) to acquire the Superjack and Nash Creek VMS projects.

Nash Creek has a total resource estimate of 9 million tonnes containing approximately 535 million pounds of zinc as well as 100M lbs lead and just over 5 million ounces of silver. The average grade is quite low at just 2.7% zinc and even though the proceeds from selling the lead and silver will generate by-product revenues, Nash Creek seems to be a call option on the zinc price.

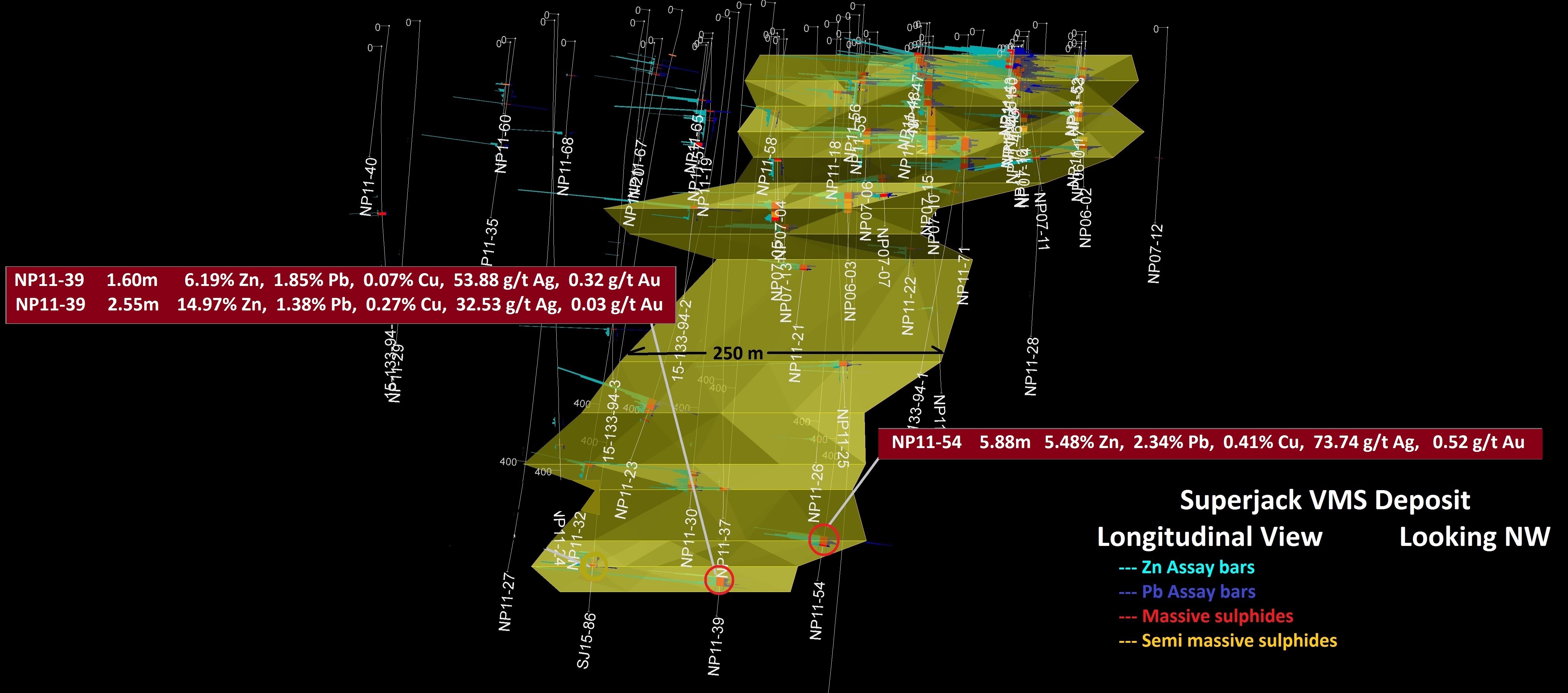

At Superjack, the total resource is just 2.9 million tonnes at a grade of 4% ZnPb, almost 1 ounce of silver per tonne of rock as well as 0.23% copper. Once again a relatively low-grade project, but Callinex is acquiring the projects on the cheap as it has to pay just C$100,000 right now followed by C$525,000 (in cash or shares at a deemed value of C$0.50 per share) within 36 months followed by an additional C$125,000 cash/share payment after a PEA has been completed for Nash Creek.

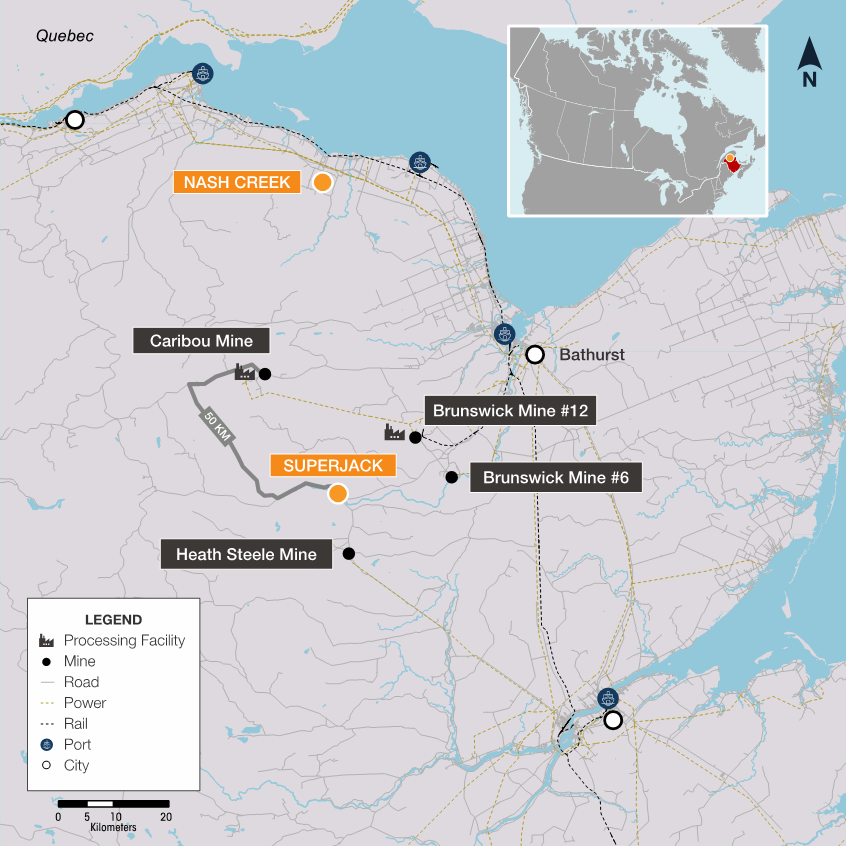

What’s important here is the fact Nash Creek and Superjack are located close to existing processing plants. Superjack is just 50 km by road from Trevali Mining’s (TV.TO) Caribou mine, whilst the Brunswick #12 Mine site, previously operated by Glencore (GLEN.L) is located towards the northeast of the property. Focusing on processing the Superjack ore at the Caribou mill might be a viable option, as Callinex would be able to avoid building its own plant, whilst Trevali Mining could maximize the potential of its plant.

Whereas Callinex Mines was focusing on the Flin Flon Belt in Manitoba until last week, the company has now acquired three zinc projects and it looks like CEO Max Porterfield is convinced the zinc price is ready to shine. We will review the technical reports of the acquired projects and will release an in-depth report in due course.

Go to Callinex’ website

The author has a long position in Callinex Mines. Callinex Mines is a sponsor of the website. Please read the disclaimer