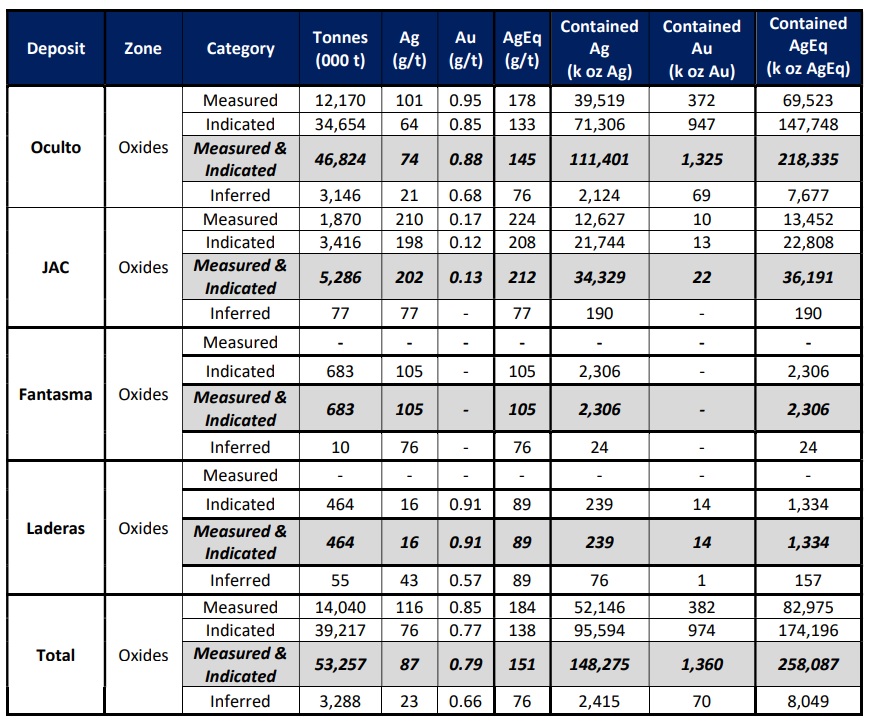

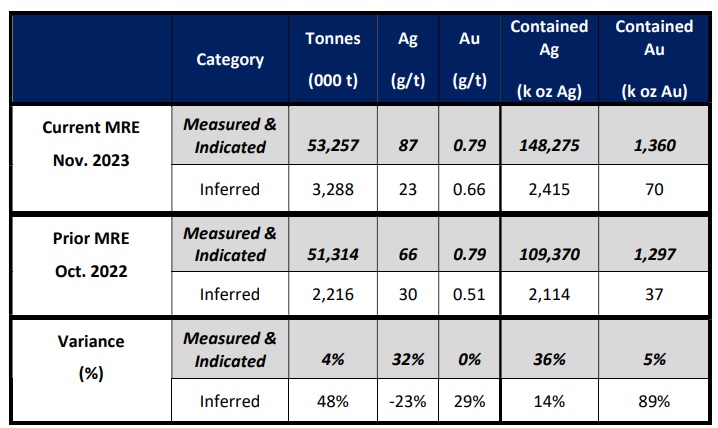

AbraSilver (ABRA.V) released a resource update at the end of November on its flagship Diablillos project and that updated resource now contains 258 million ounces of silver equivalent in the measured and indicated resource categories with an additional 8 million ounces in the inferred resource for a global resource of 266 million ounces of silver equivalent.

As the table above shows, approximately 60% of the silver-equivalent resource actually consists of silver with the 1.4 million ounces of gold representing the rest of the silver-equivalent calculation. And although the total tonnage in the measured and indicated resources increased by just 4%, the silver grade came in much higher resulting in a 36% increase in the silver resource.

As expected, the entire resource at Diablillos is hosted in oxides. And although silver recovery rates in oxides are traditionally pretty weak, AbraSilver’s recovery rates are pretty strong with almost 87% for the gold and a very strong 82.6% for the silver. This will obviously compensate for the relatively low grade of the resource as the average silver-equivalent grade comes in below 5 ounces per tonne.

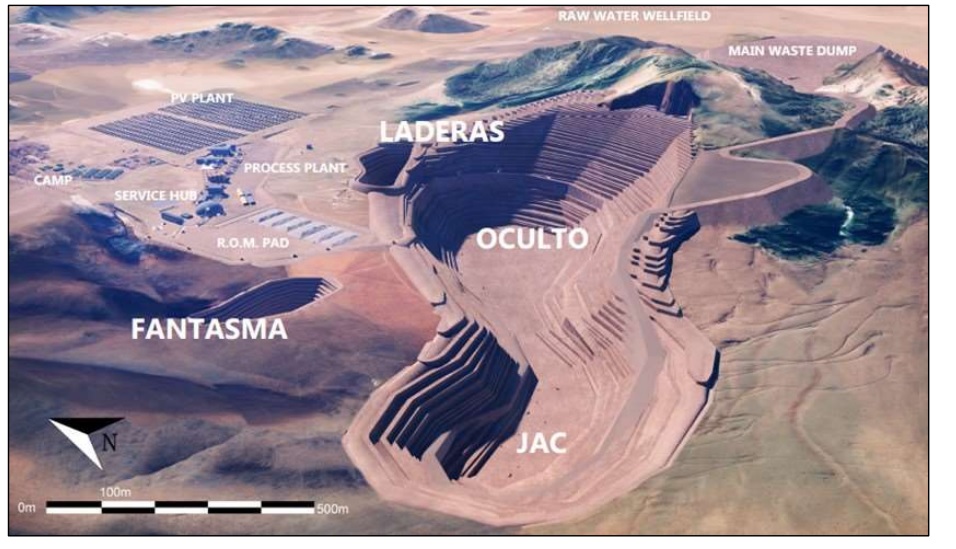

The company is now moving ahead with the pre-feasibility study and that study should be completed within the next few weeks. The PEA indicated an after-tax NPV5% of US$364M using a silver price of $24/oz and a gold price of $1,650/oz using just 37.4 million tonnes of rock in the mine plan and a recovery rate for the silver of just over 73% over the life of mine. It will be interesting to see the updated NPV calculations which will likely assume a higher gold price which will hopefully compensate for a likely higher capex. The real value-adding element will be an extension of the mine life to produce more silver and gold compared to the mining scenario in the PEA.

Disclosure: The author has no position in AbraSilver. Please read the disclaimer.