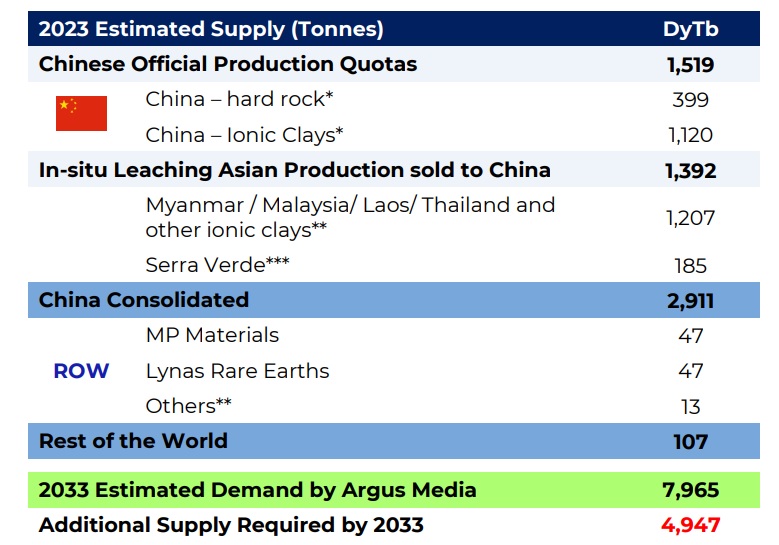

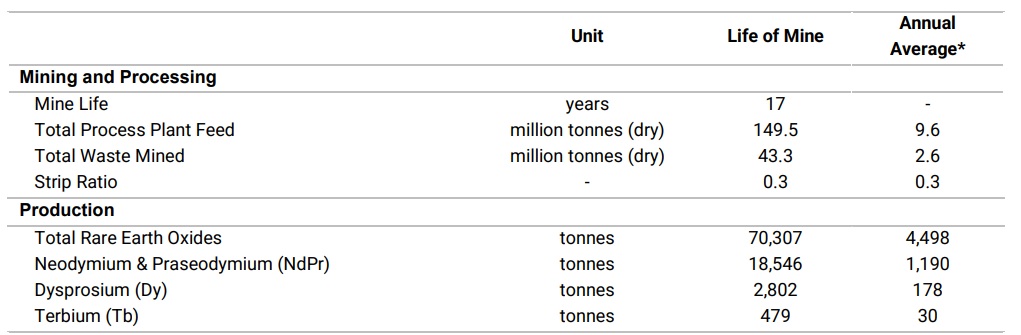

Aclara Resources (ARA.TO) has published the outcome of a Preliminary Economic Assessment it conducted on its Carina REE project in Brazil. The project could become an interesting source of REEs to reduce the reliance on China as the anticipated annual production is 1,190 tonnes of Neodymium and Praseodymium and 208 tonnes of Dysprosium-Terbium with the latter accounting for approximately 1/7th of the total Chinese production. About 30% of the total concentrate output will consist of DyTb and NdPr.

The initial capex of the project is estimated at US$576M which is relatively low. And considering t he annual EBITDA is anticipated to be US$340M, the payback period is relatively short at 3.6 years on an after-tax basis. The after-tax IRR is 28.6% while the after-tax NPV8% is estimated at US$1.19B. The production costs are relatively low at US$13/t thanks to the very low strip ratio of 0.3. Approximately 150 million tonnes of the 168 million tonne inferred resource was included in the PEA.

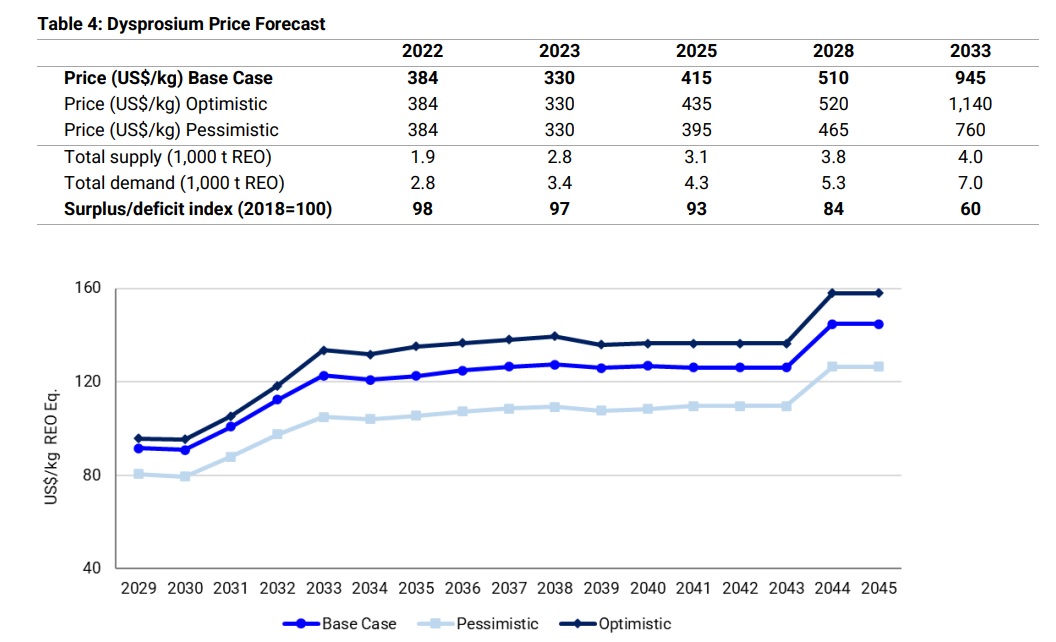

As you can see above, the base case dysprosium price used in the study was approximately $510/kilo or 2028, resulting in an average basket price of just under $90/kilo, increasing towards $120/kilo in the early 2030s. Of course REE pricing is very difficult to determine, especially that far out (the current timeline anticipates initial production in 2029 but as this is the mining sector that time line will likely slip), but the PEA also includes a sensitivity analysis.

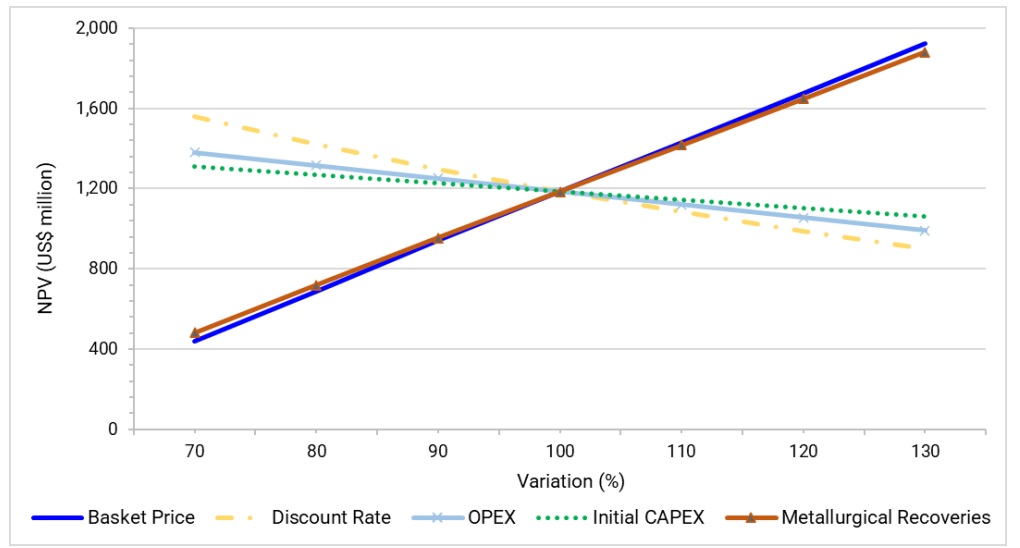

The image above shows that if the average basket price is 20% lower than the base case scenario, the after-tax NPV8% is still a respectable $700M. And in an optimistic scenario where the real pricing exceeds the base case scenario by 10%, the after-tax NPV8% jumps to approximately US$1.4B. Meanwhile, the unique selling point of the company and project is obviously to feed the world’s REE hunger with metals sources outside of China.

Disclosure: The author has a small long position in Aclara. Please read the disclaimer.