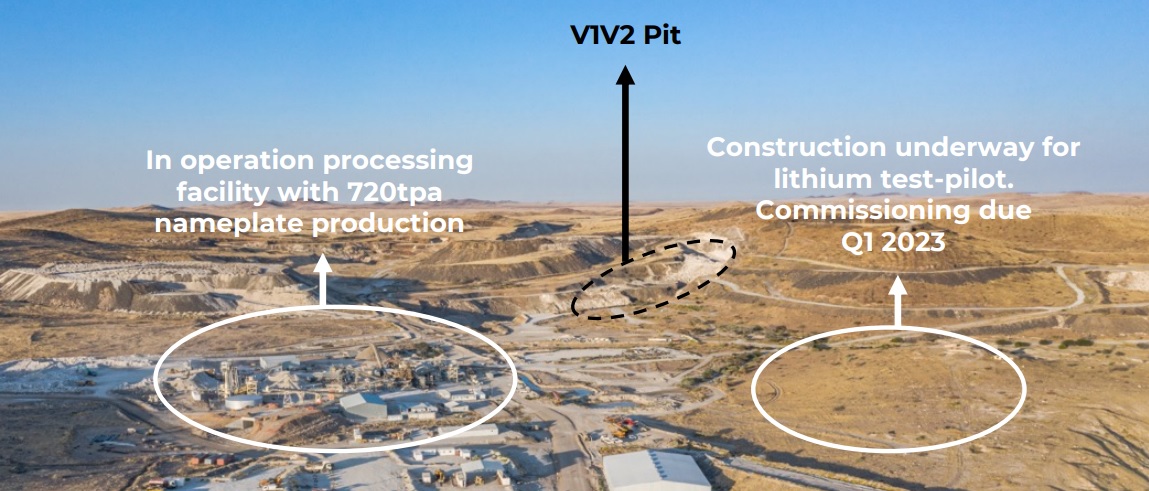

AfriTin Mining (ATM.L) recently completed the expansion of the Uis processing plant and commissioning started in the first month of the final quarter of 2022. The expanded plant will allow AriTin to produce up to 720 tonnes of tin contained in 1,200 tonnes per year of tin concentrate. This represents a 50% production increase.

The ramp-up period towards the new nameplate capacity shouldn’t be too long: the company anticipated a three month process which means AfriTin should be reaching its 60 tonnes per month of tin contained in the tin concentrate by the end of this month. The impact of the higher capacity was already clearly noticeable in November when the total production jumped to 88 tonnes of concentrate containing 53 tonnes of zinc, which means the company already reached 88% of its updated nameplate capacity. This also reduced the AISC per tonne of tin to just under $20,000 which means that at the current spot price, the company is generating a margin of $5,000 per tonne. Based on an anticipated 720 tonnes of tin in concentrate per year, AfriTin could generate almost $4M in net cash flow from its tin operations.

Additionally, the company is constructing a lithium pilot plant and a tantalum separation circuit. The pilot plant will process bulk samples into a lithium concentrate while the tantalum separation circuit will focus on producing a separate saleable tantalum concentrate.

Disclosure: The author has no position in AfriTin Mining. Please read our disclaimer.