Whenever a company pretends to be able to fund the construction of a new mining project, we are always a bit skeptical. We were also skeptical when Almonty Industries (AII.TO) said it would be able to fund the construction of its new Sangdong tungsten mine in South Korea without any dilution, but we are extremely pleased to see the company coming through on that promise.

Almonty has now disclosed the KfW IPEX Bank out of Germany is the lender that’s prepared to issue a senior project finance loan to the tune of US$73M at very attractive terms. Almonty Industries will be benefiting from a cooperation between KfW IPEX and the Oesterreichische Kontrollbank which is currently evaluating the possibility to provide a finance cover guarantee based on the fact the ‘existing customer’ that previously entered into a 10 year offtake agreement with Almonty Industries will ship the tungsten concentrate to Austria for processing.

The existing agreement with the KfW IPEX bank will now be converted into a binding contract within the next three months, and Almonty expects the main considerations to remain the same: the credit facility will have a term of 8.25 years with an initial repayment holiday (which is normal, the interest payments and repayments of the principal amount will only start once the project is in production), at what’s described as ‘very attractive terms’.

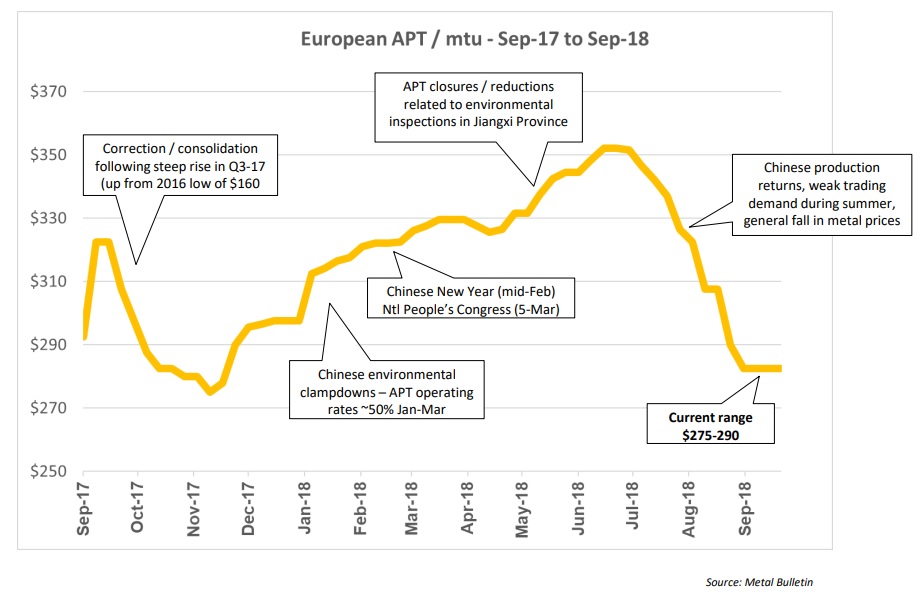

Getting a cheap loan is an incredibly important step for Almonty Industries’ growth process, as it now puts the company in a position to immediately start working on developing Sangdong to reconfirm its position as the most important primary independent tungsten producer on the financial markets. Unfortunately the tungsten APT price has lost approximately 15-20% over the summer but has regained some ground and is currently trading at approximately $285/mtu.

A higher tungsten price is obviously preferred, but as the Sangdong mine will be a low-cost producer, the margins will remain very healthy. The most recent economic study anticipates a production cost of less than $125/mtu, and with a current concentrate price of $222/mtu (78% of the APT price), the operating margin would still be $100/mtu. This would indicate the Sangdong project will be generating an operating cash flow of $35M per year (before capex and taxes), which is the equivalent of almost C$45M. And that’s not too shabby for a company with a current market capitalization of less than C$150M!

Go to Almonty’s website

The author has no position in Almonty Industries. Almonty is not a sponsor of the website, but a third party is. Please read the disclaimer