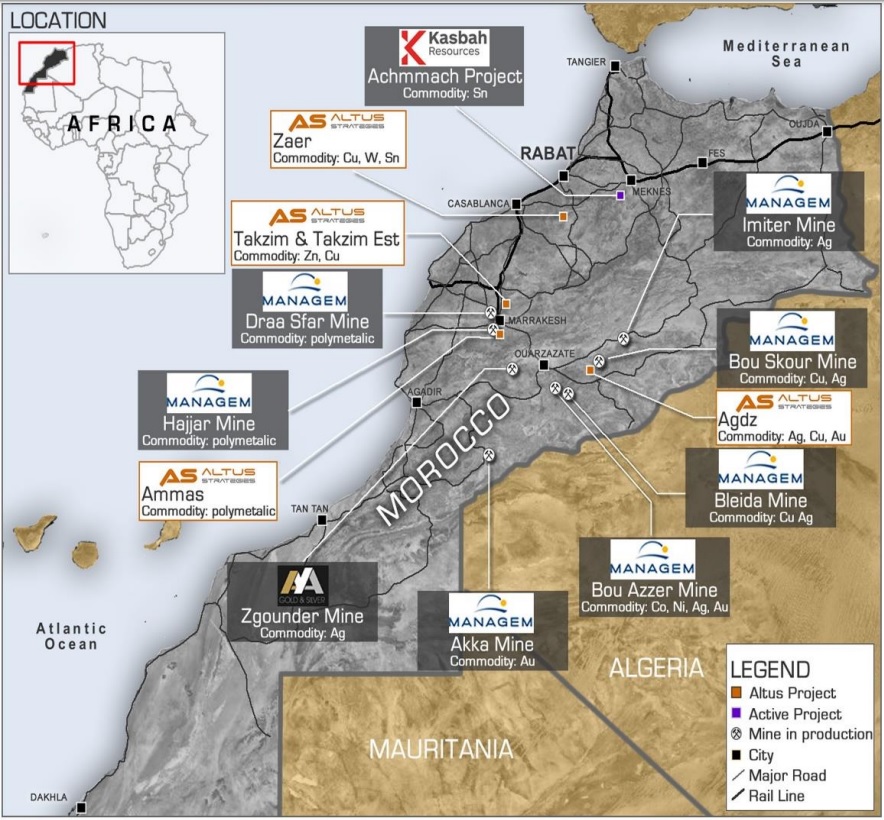

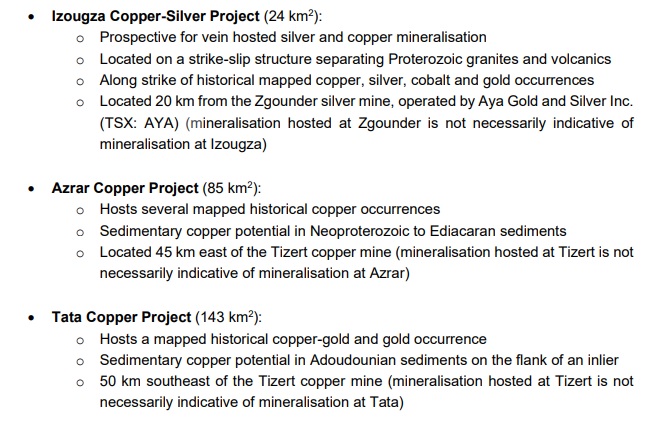

Altus Strategies (ALTS.V, ALS.L) announced last week it was awarded three new copper and silver exploration projects in Mexico as its fully-owned local subsidiary was awarded the 252 square kilometer concessions. The company already had four projects in Morocco, and these three additions will further boost its presence.

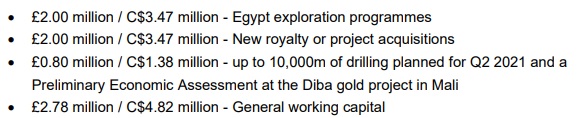

Although the company still had a positive working capital of just under 6.8M GBP (almost C$12M), the company decided to raise more cash and Altus has just completed a 7.7M GBP (C$13.35M) raise priced at 75 pence (C$1.30). The offering was oversubscribed, and strategic investor La Mancha subscribed for in excess of 35% of the offering. According to the company, its balance sheet now contains approximately 14M GBP (C$24M) in cash and share positions in listed entities. Now Altus is fully cashed up, the company can continue its project generation activities in Africa.

According to the use of funds above, the company will be spending the cash on a wide range of projects and we are mainly looking forward to seeing the results of an additional drill program at the Diba gold project. With a PEA around the corner and gold still trading at in excess of $1700/oz, the Diba project could be pretty attractive – even if you’d use $1250 gold in a more conservative scenario. With in excess of 14M GBP in the bank, Altus is in an enviable position to continue to work on its projects without having to worry about funds.

Disclosure: The author holds a long position in all stocks mentioned in this article. Please read our disclaimer.