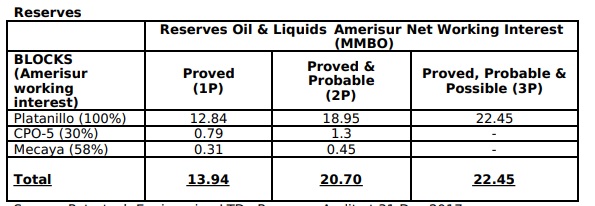

In what could definitely be described as a surprising update, Amerisur Resources (AMER.L) confessed its total oil reserves actually decreased compared to the previous year. Whilst companies are usually able to grow their reserves even after taking the depletion into consideration, Amerisur’s lower reserves are definitely a disappointment.

On a 1P basis, the total reserves decreased from 15.11 million barrels of oil-equivalent to just 12.84 million barrels of oil-equivalent. On a 2P basis, Amerisur had to be satisfied with 18.95 million barrels which is more than 5 million barrels lower than the almost 24.5M barrels as of at the end of 2016. The lower reserve estimate was caused by the poor performance of two wells that were drilled on the Platanillo structure, which jeopardizes the expected total production performance from these wells.

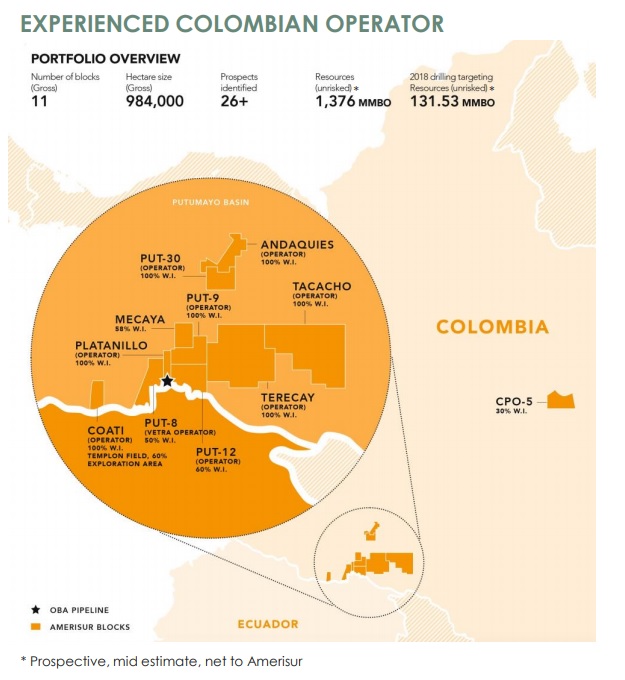

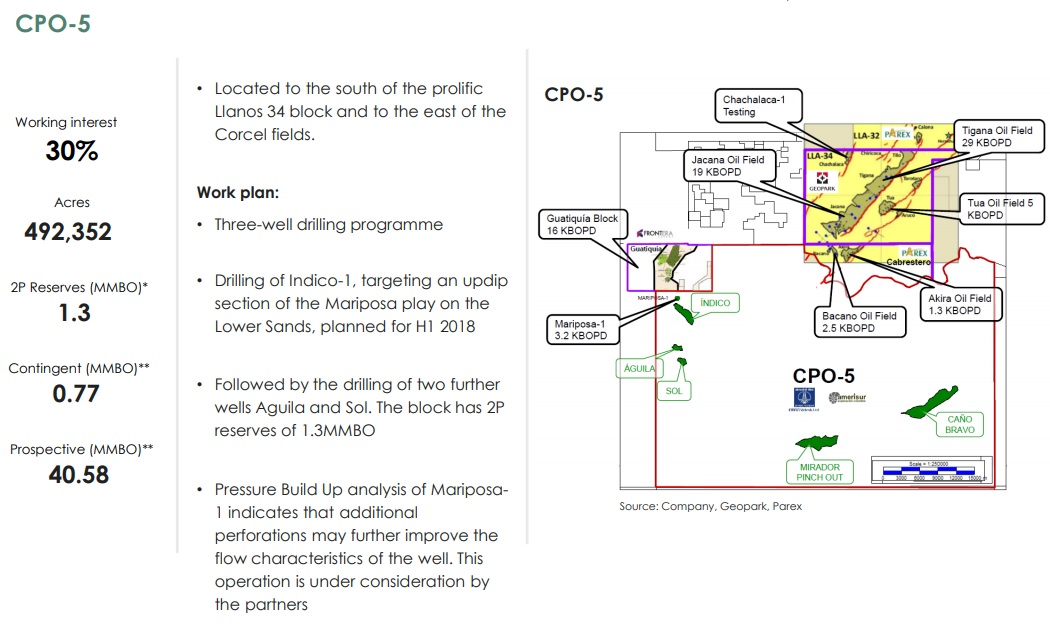

The 2P reserves of not even 19 million barrels clearly are a disappointment, but we do hope Amerisur has now been ultra-conservative with its reserve estimates to avoid a second negative surprise later on. It should now focus on adding more reserves to its global overview in 2018, and the recently completed reserve estimate at the CPO-5 well resulted in a 2P reserve of 1.3 million barrels attributable to Amerisur Resources. These 1.3 million barrels weren’t included in the year-end reserve estimate yet, so it shouldn’t be too difficult for Amerisur to reach a reserve of 22-25M barrels in the 2P category by the end of this year, even after taking depletion into account.

Amerisur is currently valued at US$15/barrel in the 2P reserves (and $14/barrel when you take the CPO-5 well into consideration), and perhaps Parex Resources (PXT.TO) and/or Gran Tierra Energy (GTE) have a better idea of how to deal with these types of wells in the Putumayo basin.

Go to Amerisur’s website

The author has no position in Amerisur Resources. Please read the disclaimer