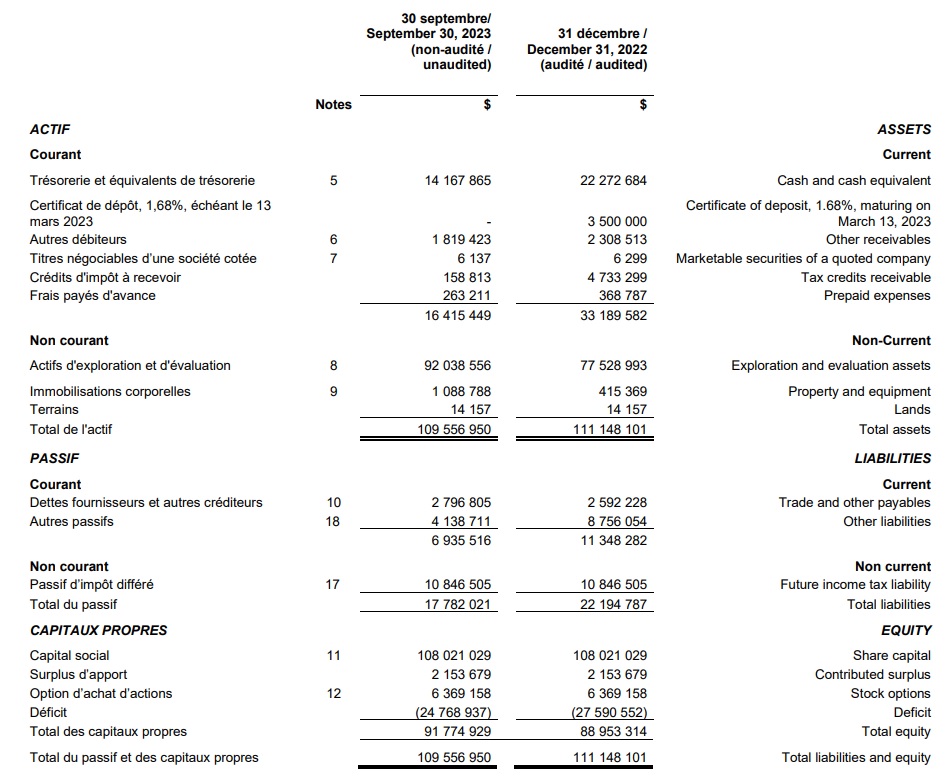

Amex Exploration (AMX.V) has published its updated financial statements. At the end of the third quarter, Amex had a positive working capital position of approximately C$9.5M, including C$14.2M in cash.

A substantial portion of the current liabilities is represented by the ‘other liabilities’ and that’s likely related to the flow-through liability. The majority of the cash is held in GICs that are cashable at all times. The current interest rate on these GICs is 5.20% which indeed means the company is generating a nice interest income which likely covers the G&A expenses of Amex Exploration.

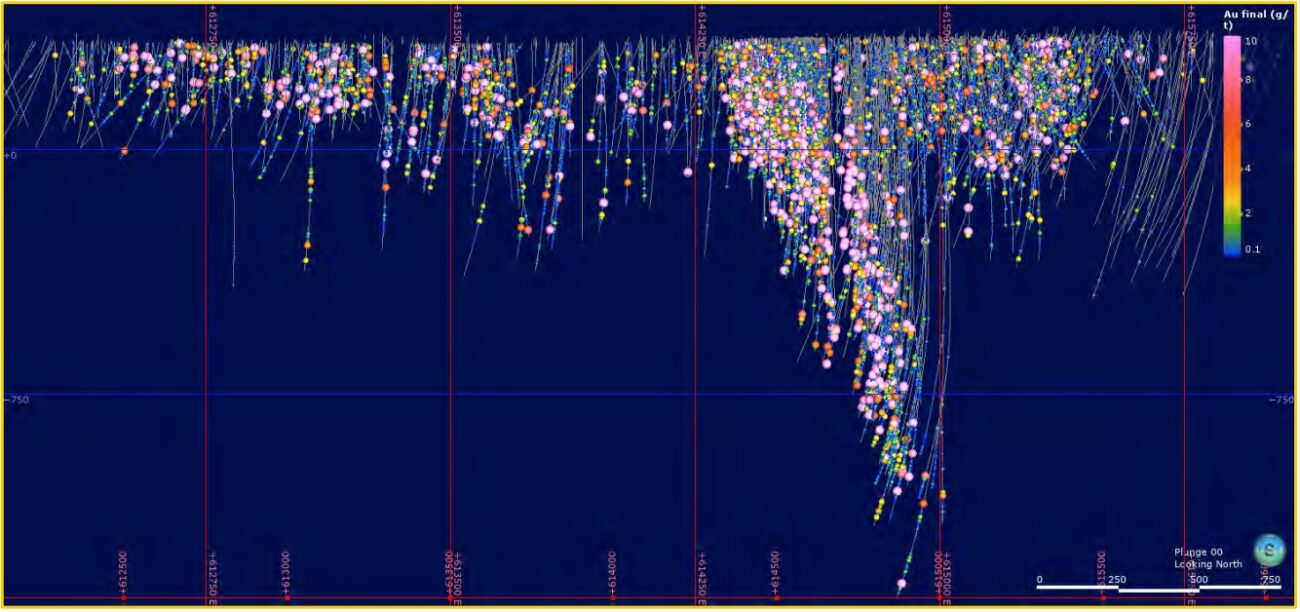

The company is obviously still actively exploring its flagship Perron project and has elected to postpone its maiden resource calculation as the company wants to complete more drilling to fully understand the mineralized system that hosts the multiple high-grade zones at Perron.

Disclosure: The author has a long position in Amex Exploration. Please read the disclaimer.