Andrada Mining (ATM.L) has confirmed it received the US$25M in funding it previously agreed to with Orion Mine Finance. The entire package consists of a US$10M convertible loan, a US$2.5M equity investment and a US$12.5M royalty on the production of its Uis mine in Namibia. The initial royalty rate is 5.13% but as the production rate increases, the royalty rate will decrease. Should the annualized tin production increase to 1,600-2,000 tonnes per year, the royalty rate will decrease to 4.50-3.61% depending on the actual production numbers. The proceeds of the royalty financing will be used to increase the tin production at Uis. Having a staggered royalty rate will keep the company properly incentivized to indeed focus on production increases.

The unsecured convertible loan for US$10M has a 12% coupon which is not unreasonable for an African project in the current high interest rate climate. The loan note will mature in four years from now.

And finally, the US$2.5M equity investment was completed by issuing 30.5 million new shares at a price of 6.39 pence per share. This represents just under 2% of the total share count.

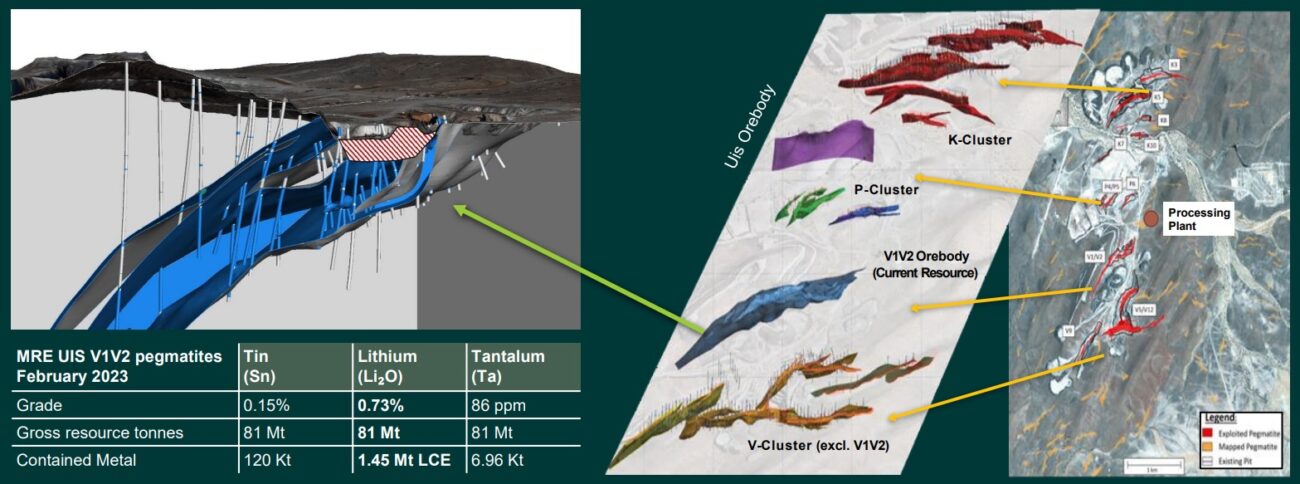

The proceeds of the loan note and equity investment will be used to fund exploration with a specific focus on the Uis project as well as the known lithium-bearing assets including the completion of metallurgical test work. Additionally, the company is still optimizing the tantalum circuit to make sure the tantalum output meets the specifications of AfriMet, the offtake counterparty of the company.

Disclosure: The author has no position in Andrada Mining. Please read the disclaimer.