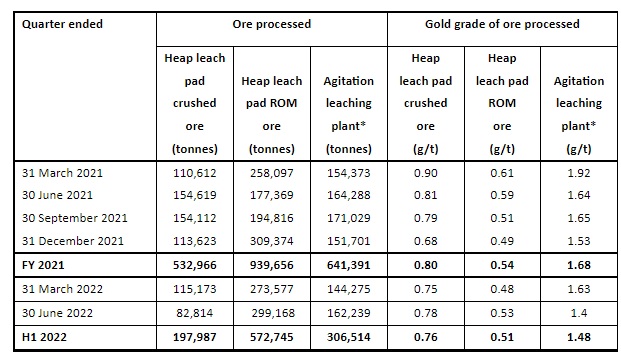

Anglo Asian Mining (AAZ.L) has produced a total of 15,052 gold-equivalent ounces on its Azerbaijan licenses. Just under 11,000 of those 15,000 gold-equivalent ounces consisted of gold and the remainder of the equivalent production was contributed by copper (1.5 million pounds) and silver (just under 50,000 ounces of silver).

This brought the total production in the first semester to just under 29,000 gold-equivalent ounces (including 20,906 ounces of gold). Unfortunately a portion of the gold that was produced during the second quarter hadn’t been sold yet so we shouldn’t expect Anglo’s cash position to show material changes compared to the end of last year. In fact, Anglo acquired a stake in Libero Copper (LBC.V) subscribing for new shares and investing a total of C$6.3M. Anglo Asian invested an additional C$957,000 in Libero Copper’s recent placement. These proceeds will be used to explore the Big Red copper project in British Columbia. Perhaps Anglo should stick to what it knows best as Libero’s assets are quite early stage and the Mocoa flagship project is located in Colombia where permitting an open pit project will be very difficult (especially with the new president and new minister of mines). Additionally, Chairman Ian Slater’s previous company, Red Eagle Mining went bankrupt when it was ramping up production.

It’s good to see Anglo Asian using its strong net cash position to diversify but this is now a buyers market and the tens of millions on the balance sheet can now be carefully deployed to gain exposure to other projects and companies.

Disclosure: The author has no position in Anglo Asian Mining. Please read our disclaimer.