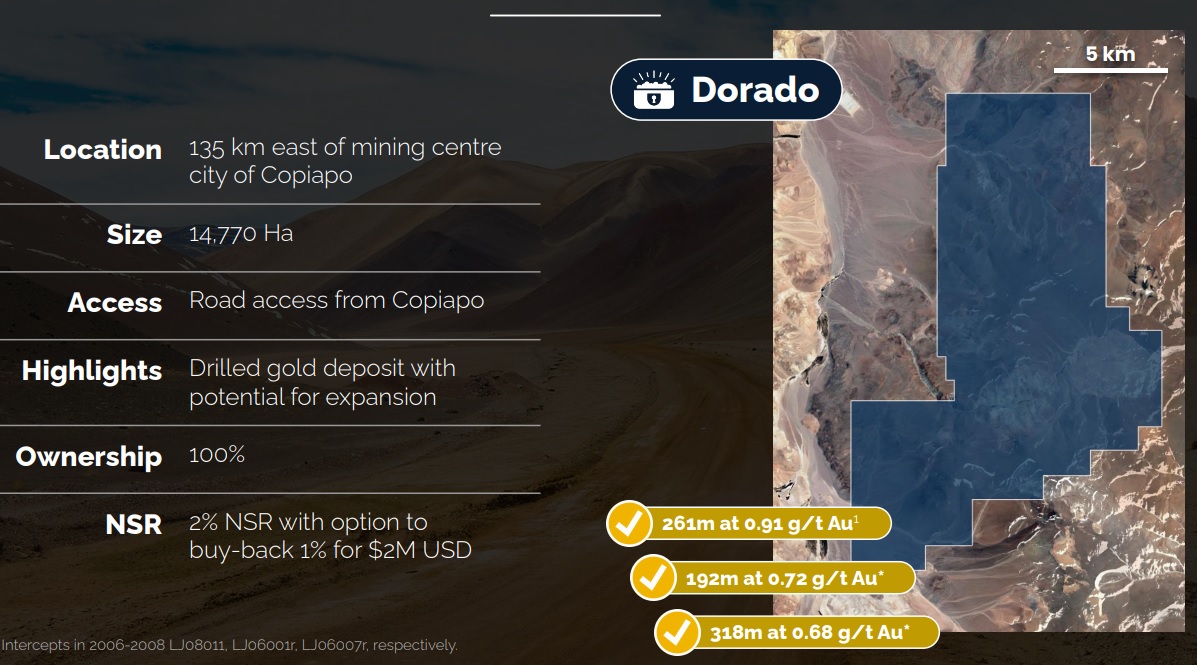

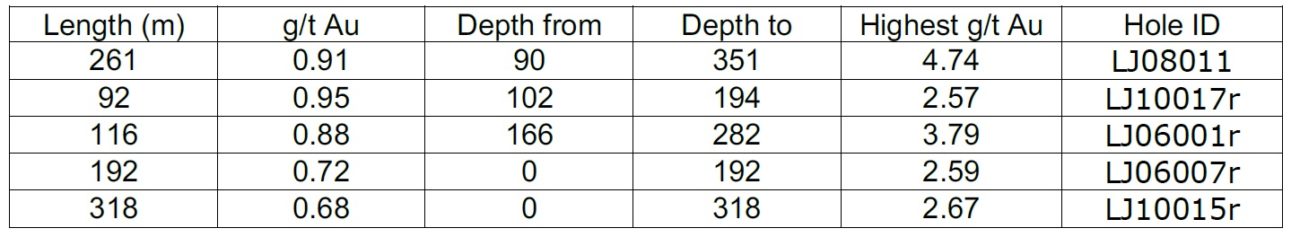

Angold Resources (AAU.V) has been listed for barely two weeks (the first trading day was on December 31st) but isn’t wasting any time as the company has started an initial 5,000 meter core drill program on the Lajitas target, part of the Dorado project. The company is planning to drill 10 holes with an average depth of 500 metes to confirm the historical intervals encountered on the property (see below) while Angold will also try to identify additional gold mineralization beyond the historically known areas of gold mineralization.

Angold’s exploration program is based on the reinterpretation of the geological setting in Chile’s Maricunga belt. The projects in the company’s portfolio aren’t ‘new’ and have been owned and explored in the past. However, now there’s a better understanding of what drives and controls the gold mineralization, Angold hopes to rapidly crack the code at Dorado.

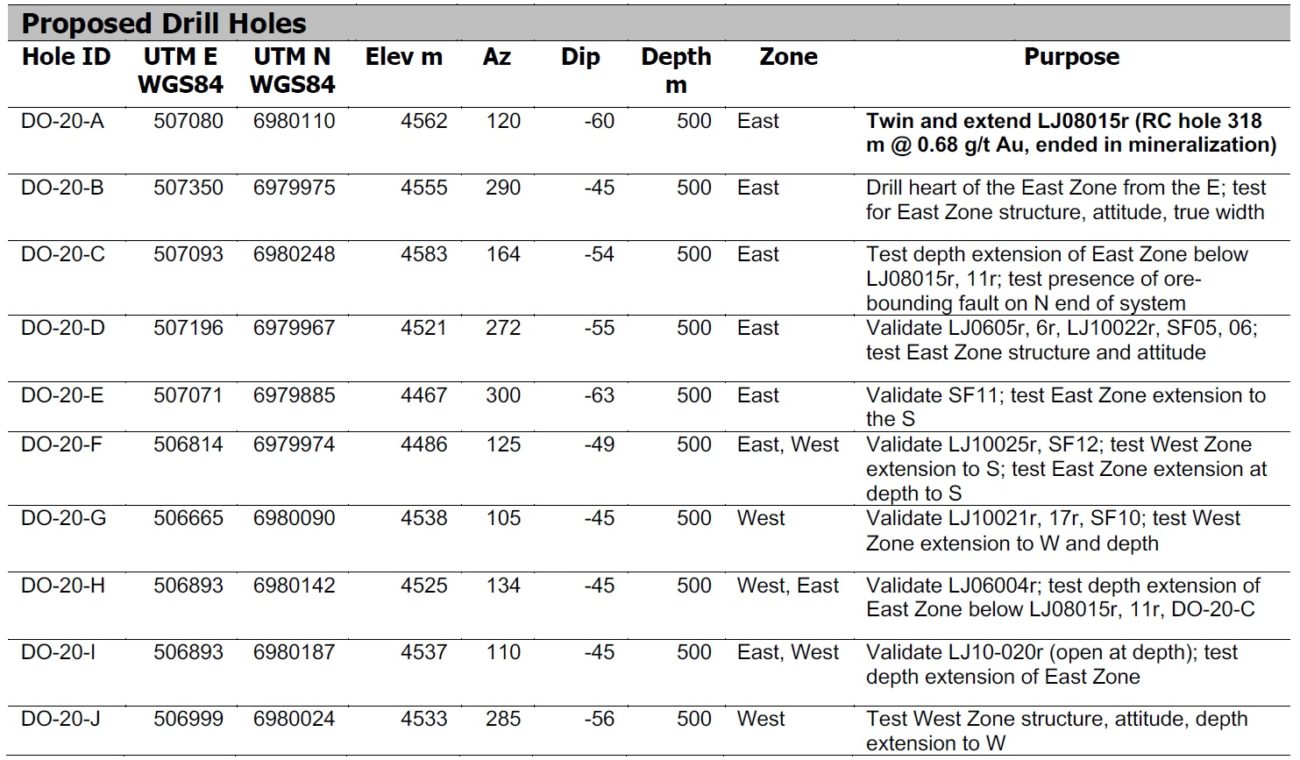

We have to commend the company for its transparency as it disclosed in its press release more details on where and why holes will be drilled and what it hopes to achieve with these holes. This was nicely summarized in a table (see below).

Angold is coming out of the gate with just over C$8M in cash and with just about 84 million shares out, the current market capitalization of less than C$40M remains interesting for a company chasing elephants. The IPO financing was priced at C$0.40 and the share price is currently barely trading higher so although the IPO was oversubscribed and participants were cut back, there still seems to be an opportunity to pay just a few cents more than the IPO price.

Unfortunately Angold is only making the corporate presentation available for people leaving their contact details behind. While it’s understandable the company would like to put a database together of interested shareholders (or potential shareholders), this isn’t a practice a publicly listed company should condone. Basic information should be freely available and not be used as a tool to harvest information.

Disclosure: The author has a long position in Angold Resources and participated in the IPO financing. Please read our disclaimer.