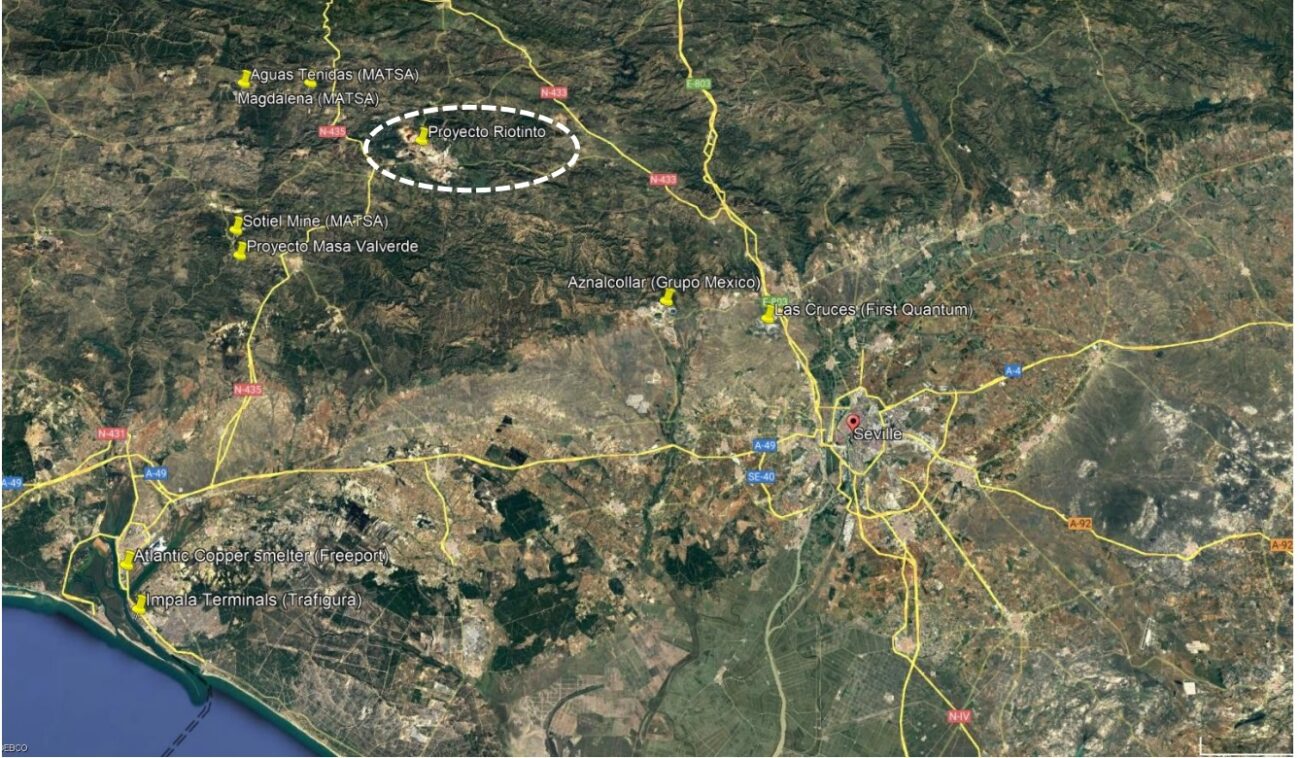

Atalaya Mining (ATYM.L) has released the results of the Preliminary Economic Assessment on its flagship Riotinto copper project in Spain. The PEA focuses on the Cerro Colorado, San Dionisio and San Antonio deposits and includes recent optimisation plans (including a revised mining sequence and using the E-LIX System which could increase the recovery rates of the mineralization).

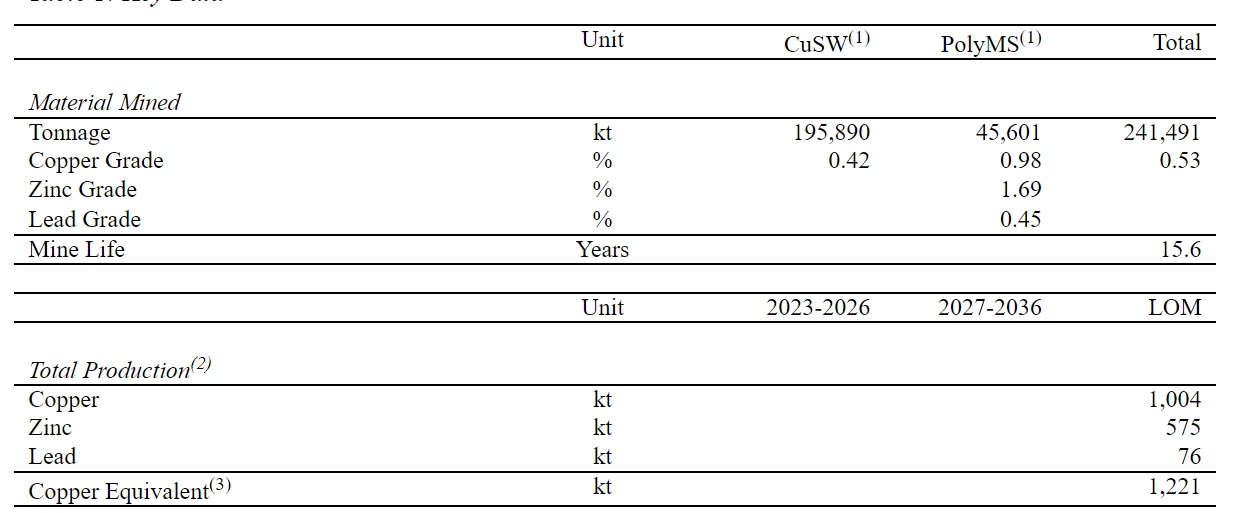

The mine plan now contains just over 240 million tonnes of rock at an average grade of 0.53% copper. This includes 45.6 million tonnes of higher grade polymetallic massive sulphide rock which has a much higher grade of 0.98% copper and in excess of 2.1% ZnPb. This should result in a total of 2.2 billion pounds of copper being produced as well as approximately 1.3 billion pounds of zinc and in excess of 150 million pounds of lead. The higher grade polymetallic zone will really push the production cost down. While the stockwork operations will have an all-in sustaining cost of $2.60 per pound of copper, this will decrease to $1.81 per pound thanks to the higher copper grade and the contribution from the zinc and lead sales which will act as a by-product credit.

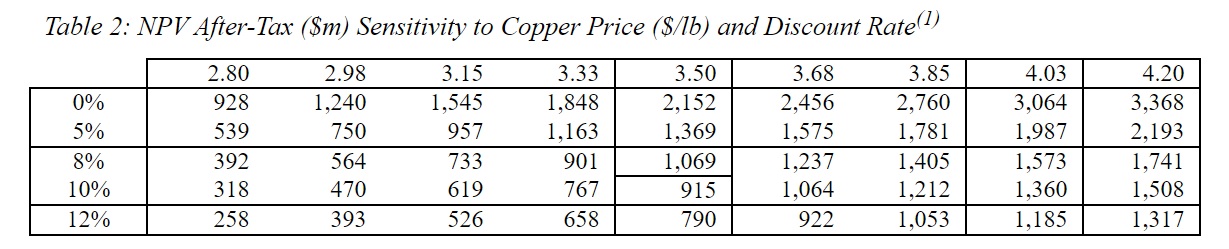

The base case scenario using $3.50 copper, $1.20 zinc and $0.95 lead results in an after-tax NPV8% of US$1.07B. Using $4.03 copper, this after-tax NPV8% increases to $1.57B while even the NPV10% would still be US$1.36B on an after-tax basis. And as you can see below, the economics of the project hold up, even at a lower copper price of $2.80 the after-tax NPV8% is still $392M. Atalaya will now complete additional metallurgical test work as historical test work in the 1980s resulted in higher recovery rates those that have been used in the PEA (the exact recovery rate wasn’t mentioned in the press release).

The total capex needed to include the polymetallic mineralization is very reasonable: Atalaya estimates it needs less than $500M in total capital expenditures (of which $71M is classified as sustaining capex with an additional $32M earmarked for closure-related expenses) over the next 15 years.

Disclosure: The author has no position in Atalaya Mining. Please read our disclaimer.