Aztec Minerals (AZT.V) has closed its upsized financing, raising a total of C$3.6M by issuing 20 million units at C$0.18 per unit. Each unit consists of one common share and ½ warrant with each full warrant allowing the warrant holder to acquire an additional share for C$0.24. As 10 million warrants will be issued, the warrant component has the potential to bring in an additional C$2.4M (of course this will only happen if/when the company’s share price trades above this threshold) before they expire in three weeks.

Aztec also mentioned Crescat Capital participated in the financing, and that makes the fund a new institutional shareholder on Aztec’s registry. The CEO and CFO of the company subscribed for 450,000 units (C$81,000).

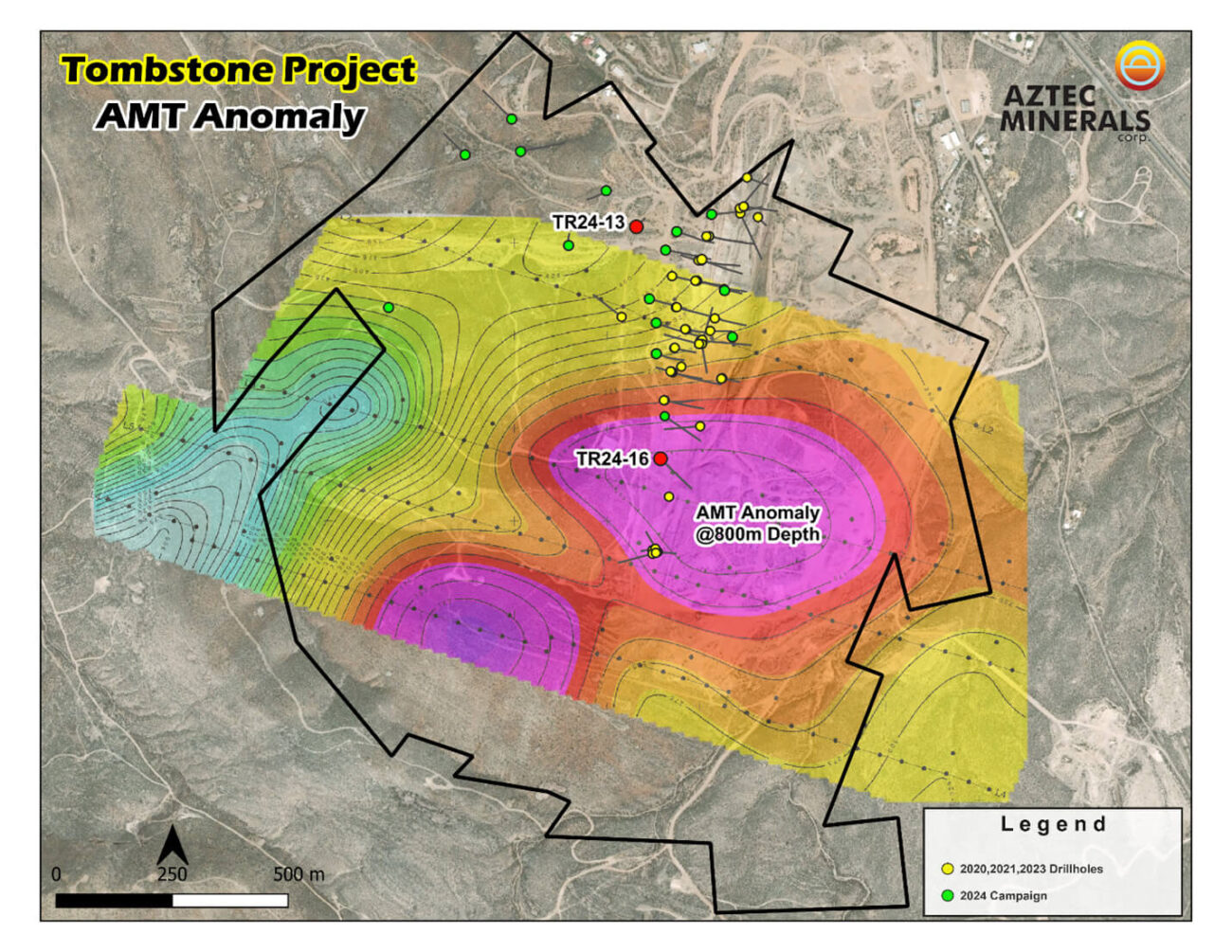

The proceeds of the financing will be used to continue to advance the Tombstone gold-silver-CRD project in the USA and we hope the investment climate in Mexico improves so the Cervantes project can enjoy some renewed attention as well.

Disclosure: The author has a long position in Aztec Minerals. Aztec is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.