Berkeley Energia (BKY.L, ASX:BKY) continues to advance its Salamanca uranium project in Spain as the definitive feasibility study has now confirmed the project to be one of the lowest cost uranium mines in the world.

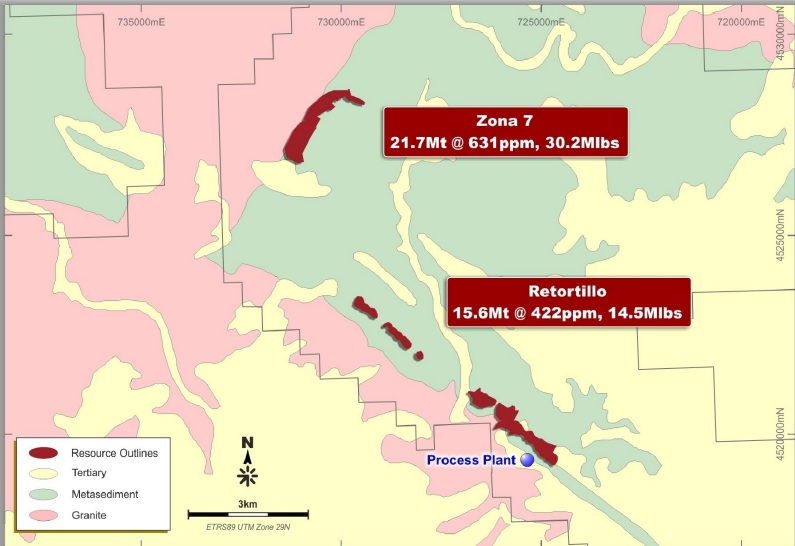

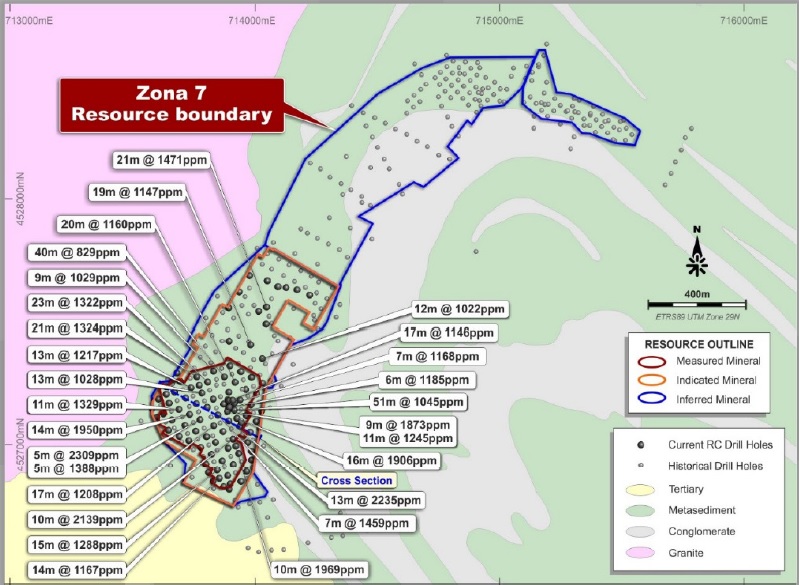

According to the study, the project will produce an average of 4.4 million pounds of uranium at a cash cost of $13.30/lbs. The initial capex will be extremely low (less than US$100M), but that’s predominantly caused by the fact the development of the Zona 7 and Alameda zones ($140M) is considered to be sustaining capex rather than initial capex. When looking at the break-down of the three different zones, both Retortillo and Alameda will produce uranium at an average cost of $20.5/lbs whilst the Zona 7 is the real value creator as Berkeley’s study expects a cash cost of less than $10/lbs.

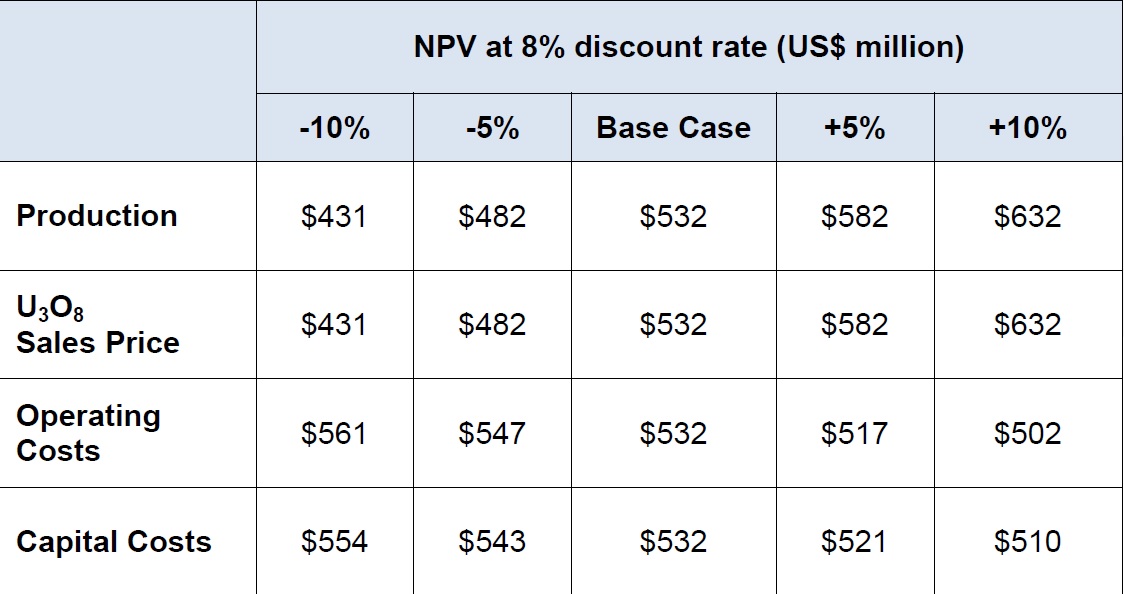

Using a gradually increasing uranium price ($40.10 in 2019, increasing to $56/lbs by 2025, which seems to be very fair and most definitely not too optimistic), the after-tax NPV8% of the project is a stunning US$532M and even if you’d apply a much higher discount rate of 10%, the after-tax NPV would still be approximately US$465M.

Thanks to the low production cost, the economics of the project aren’t too sensitive to changing inputs. Even if you’d use an uranium price of $36/lbs in 2018 and just $50/lbs in 2025, the after-tax NPV8% would still be US$431M (-20%).

Berkeley continues to de-risk the project and has now also signed a letter of intent with Interalloys trading which will commit to purchase one million pounds of uranium during the first five years of the mine life. This is a very small offtake agreement, covering less than 5% of the average production rate of the project, but we would like to make two remarks here.

First of all, this offtake agreement could be seen as something symbolic. It will show the prospective lenders there definitely is interest from offtake parties, and this should speed up and simplify the financing discussions (especially if a second offtake agreement will be completed within the next few weeks or months as well).

But secondly, and this is perhaps more important, is the fact Berkeley Energia was able to lock in a fixed price of $41/lbs, which is even higher than the pricing assumptions used in the DFS for the first few years, indicating a small NPV boost and a shorter payback period.

Go to Berkeley’s website

The author has a long position in Berkeley Energia. Please read the disclaimer