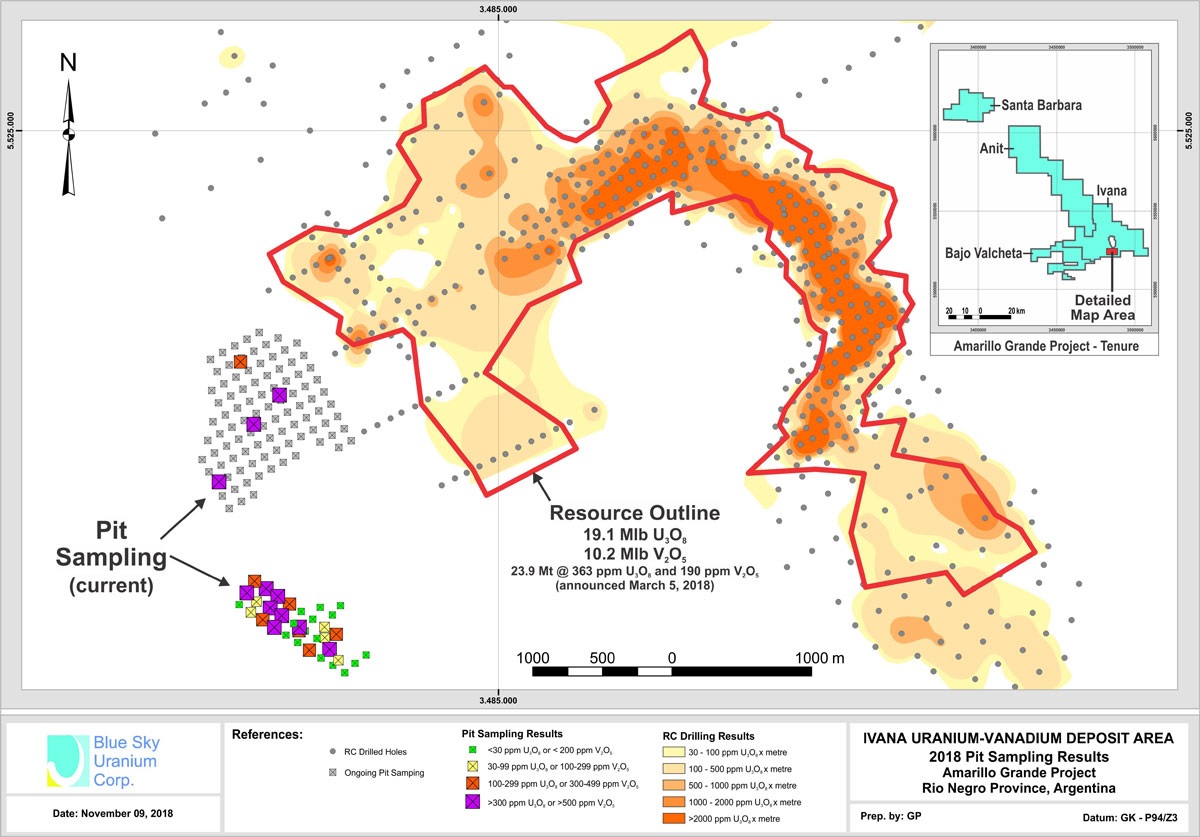

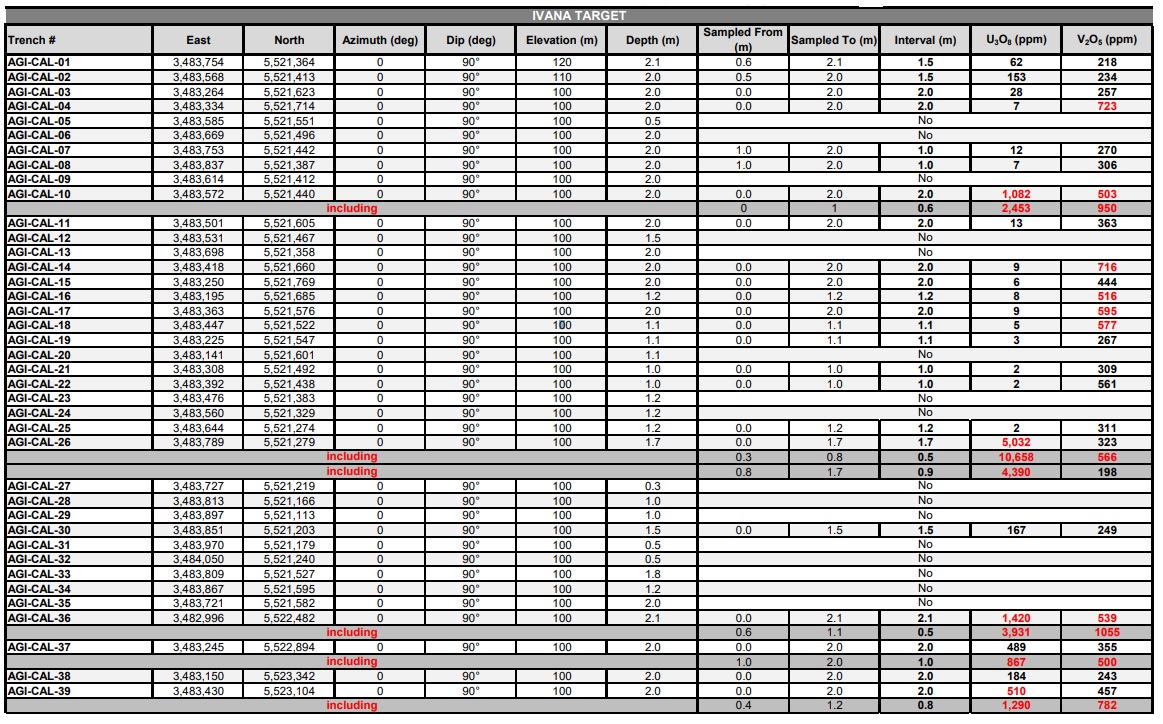

Blue Sky Uranium (BSK.V) has successfully conducted a pit sampling program in an area just one kilometer west of the Ivana uranium-vanadium deposit. Channel samples taken from the pit walls returned high-grade uranium and vanadium values with for instance 2.1 meters at 1,420 ppm U3O8 and 539 ppm V2O5 and several other 1.5-2 meter intervals yielding at least one pound of uranium per tonne of rock.

And that’s good, considering the average grade of the current resources at Ivana is ‘just’ 360 ppm U3O8 and 190 ppm V2O5, so the preliminary results of this sampling program are very encouraging as both the uranium and vanadium grades appear to be higher. This does bode well for the size of a future resource update as well as the economics as higher grade mineralization tends to have higher operating margins.

Blue Sky continues its pit sampling program, which will consist of 133 pits. The results that were released earlier this month were based on the samples from the very first 39 pits, of which 35 pits cover an area of 500,000 square meters. Assuming an average thickness of 4 meters and a density of 1.8, this area covers a total tonnage of 3.6 million tonnes. Should Blue Sky be able to confirm an average grade of 500 ppm U3O8, it wouldn’t be a stretch to expect 4 million pounds of uranium on this zone alone.

It’s needless to say the first resource estimate (containing 19.1 million pounds of uranium and 10.2 million pounds of vanadium-pentoxide) was just the very first step to unlock the uranium potential of the Amarillo Grande project. Blue Sky will continue to work on expanding the current resource and, more importantly, will work on the metallurgical features as well. We aren’t too worried about the recovery rate for the uranium, but it’s in Blue Sky’s best interest to target a high recovery rate for the vanadium as this has now become a potentially very important by-product credit. Assuming a recovery rate of 50% and a V2O5 price of $20/pound, mineralization at an average grade of 250 ppm has a (recoverable) value of $5.5 per tonne of rock.

Meanwhile, Blue Sky Uranium has also received TSX-V approval to extend the expiry date of the warrants that were set to expire on December 19th. The 5.94 million warrants with a strike price of C$0.30 will be extended for one year, and will now expire on December 19th 2020. The acceleration clause remains in place: should the share price of Blue Sky trade above C$0.50 for 5 consecutive trading days, the company could force the warrant holders to exercise their warrants within 20 days.

Go to Blue Sky’s website

The author has a long position in Blue Sky Uranium. Blue Sky is a sponsor of the website. Please read the disclaimer