Bluejay Mining (JAY.L) published a pre-feasibility study on its Dundas mineral sands project in Greenland in June, and after a quick review, it looks like the best is yet to come as the economics were established on just a portion of the currently known resources while the exploration targets indicate the current resources could still grow by a factor of 3-4.

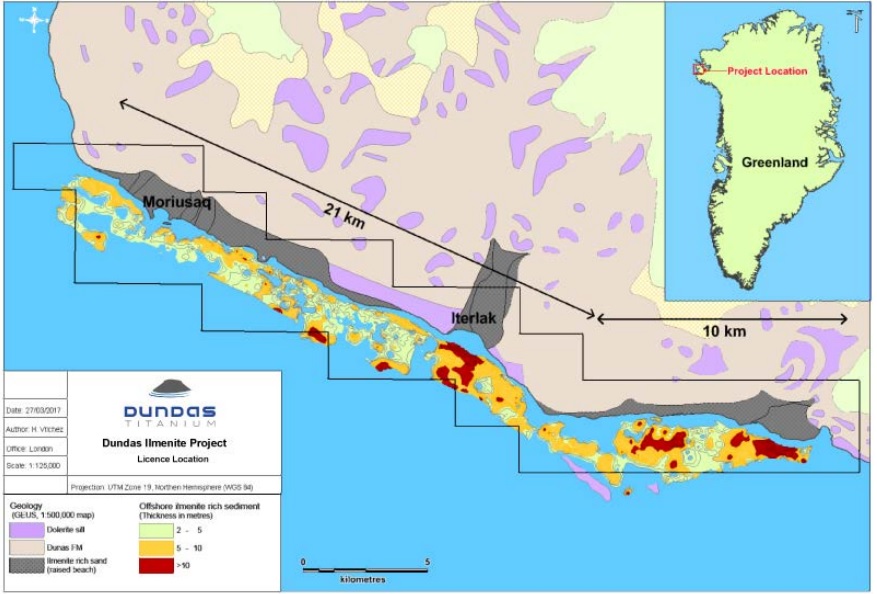

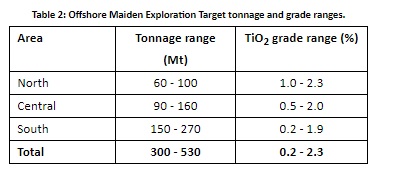

The post-tax NPV5% of US$83M (increasing to $131M using the upside case, unfortunately the press release didn’t clarify what the assumed base case and upside case ilmenite prices were, it only mentioned the cutoff grade of the reserves assumed an ilmenite price of $232/t) appears to be uninspiring considering the initial capex is estimated at almost a quarter of a billion Dollar but the 9 year mine life is based on just 67 million tonnes of the 117 million tonnes currently in the projects resource categories. Additionally, the company has an additional exploration target of 300-530 million tonnes as its licenses have a strike length of approximately 30 kilometers. Unfortunately that exploration target is based on the company’s offshore expectations and have a lower expected grade of 0.4-4.8% ilmenite.

At first sight, the company’s flagship project looks very interesting (considering the expansion potential), but Bluejay Mining should really step up its game and improve its communications. Even after browsing the website it remains spectacularly unclear which ilmenite prices were used in the Pre-Feasibility study while having an outdated corporate presentation (dated January 2019) which pre-dates a substantial resource update (May 2019) and the results of the pre-feasibility study (June 2019). Any self-respecting company should at least make sure the corporate materials are up to date.

Disclosure: The author has no position in Bluejay Mining.