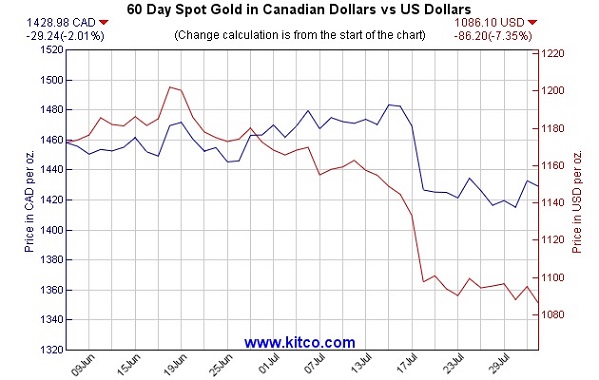

Integra Gold (ICG.V) has lost almost 30% of its market capitalization in just over one month and we feel this isn’t warranted. Yes, the gold price in USD has decreased to less than $1100/oz, but investors seem to be forgetting the Canadian Dollar has also become weaker by the day.

Both inputs compensated for each other and whereas the gold price in USD fell off a cliff, the gold price in Canadian Dollar was much less volatile. As you can see on the previous image, the fall in the Canadian gold price is much less pronounced than the hard landing in USD.

Meanwhile, Integra Gold is making considerable progress at its flagship Lamaque project. After it acquired the old Sigma mill at the other side of the road, Integra Gold has published an updated PEA based on a gold price of US$1175/oz which resulted in an after-tax NPV of C$114M and an IRR of 59%.

This sounds underwhelming for a company which was trading at a market capitalization of roughly C$100M last month, but the market seems to be ignoring two things. First of all, the gold price of US$1175/oz was based on an USD/CAD exchange rate of 1.14 so the base case gold price in Canadian Dollar was C$1340/oz. And guess what? Today’s gold price is even HIGHER than the base case scenario in the January PEA. At C$1430/oz, the pre-tax revenue increases by C$90 per ounce and C$46M over the entire mine life.

About that mine life, Integra Gold decided to use an older resource estimate for its updated PEA. This means the PEA is understating a) the total amount of ounces that will be recovered, and b) the net present value of the project. We would expect an updated economic study to contain 1 million recoverable ounces and if Integra would use the current spot price as its base case scenario, the after-tax NPV will increase to somewhere between C$220M and C$260M.

Of course, an exploration-stage company should not be trading at 1X the NPV, but even if you’d apply a multiple of 0.5 times the expected NPV at the current gold price, Integra’s fair value would be around C$0.40 per share. And keep in mind our assumption of 1M recoverable ounces will very likely be on the low side, as the pre-feasibility study will probably incorporate drill data from an additional 160,000 (!!) meters.

So, yes, we think the market will be in for a surprise once the Pre-Feasibility Study will unveil a much better and more profitable gold project.

> Click here to go to Integra Gold’s website

Disclosure: The author holds a long position in Integra Gold. Integra Gold is a sponsor of the website. Please see our disclaimer for current positions.