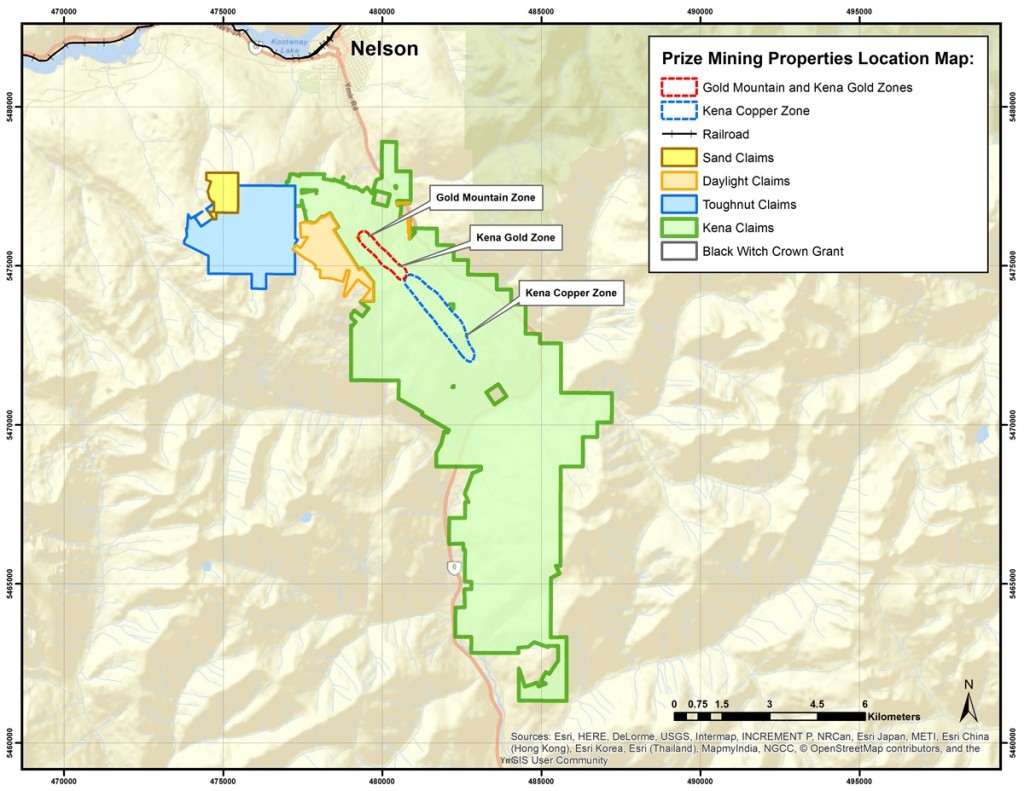

A few years ago, we understood the merits of Prize Mining’s (PRZ.V) Kena-Kena project in a higher gold and copper price environment. The average grade of the 0.5Moz (historical) indicated resource was 0.6 g/t with an additional 1.3Moz at an average grade of 0.48 g/t gold in the inferred resource category. Applying the used recovery rate of 70%, the average recoverable rock value per tonne in the indicated category was approximately 0.42 g/t or just over $17.5/t using $1300 gold. At $1800 gold, the project becomes more intriguing with $24 in recoverable value per tonne of rock. Better, but still not high enough to warrant the development of a mine in a high-cost jurisdiction like British Columbia.

Kena-Toughnut needed higher grades to make it work, as even a moderate boost to 0.8 g/t gold would make things different at an elevated gold price (it also didn’t help we had to wait three years until the gold price effectively ran up to $1800/oz). When Prize Mining acquired the Mexican copper project, Kena-Toughnut was understandably put on the backburner, and it remained there until Prize Mining collapsed when it appeared to be part of the widespread Bridgemark Financial scandal.

Director Bob Archer resigned and pretty much nothing happened during 2019, and absolutely nothing happened after the resignation of Mike McPhie in September 2019 and Prize Mining (renamed into Boundary Gold & Copper (BDGC.V) continued its death spiral reaching 3 cents per share at the end of last year and went all the way down to just 1 cent per share, for a market capitalization of just a few hundred thousand dollars. At that point, the loss on our investment reached almost 99% considering our most recent purchase price was C$0.75 after the five for one share consolidation.

We were surprised to see Boundary’s announcement last week when the company announced it made the C$30,000 cash payment and 10,000 share payment on the third year anniversary of the effective date of the Toughnut project. Does the new management team still believe in the project? Is it planning to try to monetize it and recoup a few dollars? We don’t know. All we do know is Boundary dropped the Manto Negro copper project in Mexico and the Carscallen gold project in Ontario, so the company is back down to just earning in on the Toughnut project.

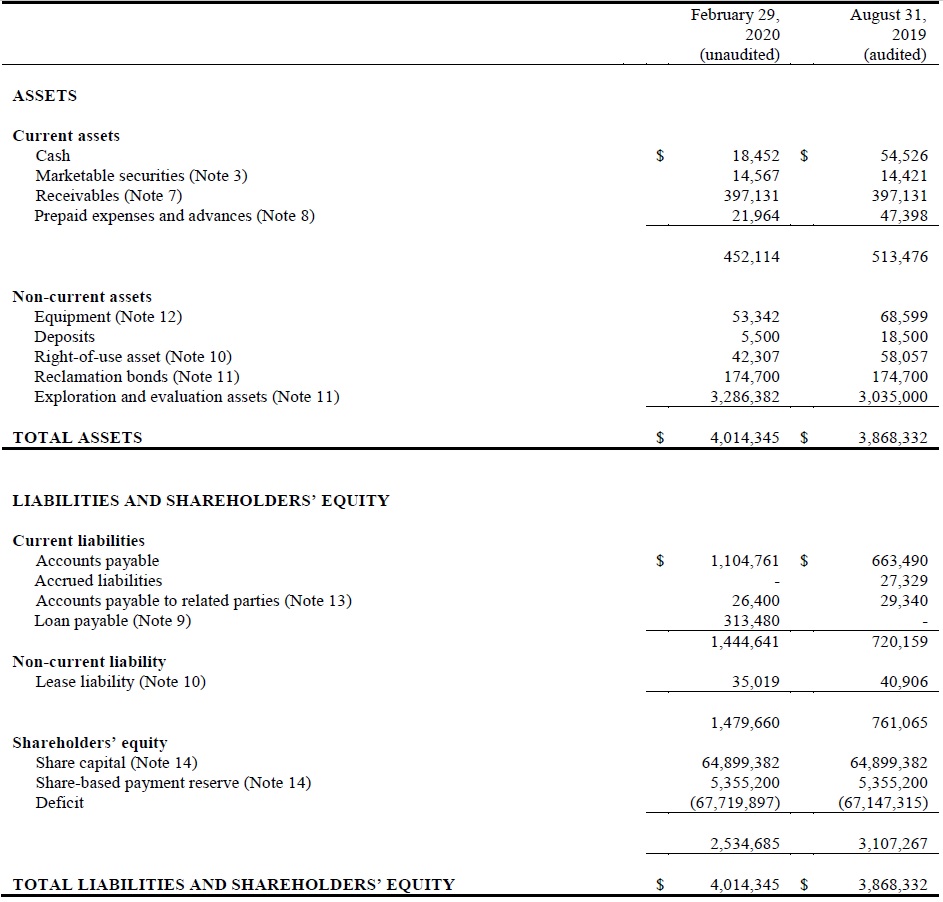

As of the end of February, Boundary Gold had a negative working capital position of around C$1M so there’s also no value to be found there while the Toughnut project remains unviable even at $1800 gold. And with a substantial working capital deficit, Boundary also isn’t an attractive shell.

Long story short, a speculation on exploration upside and higher gold prices went wrong and it looks like we are holding the bag on this one.

Disclosure: The author is a bag holder and (unfortunately) owns stock bought at an average of C$0.75.