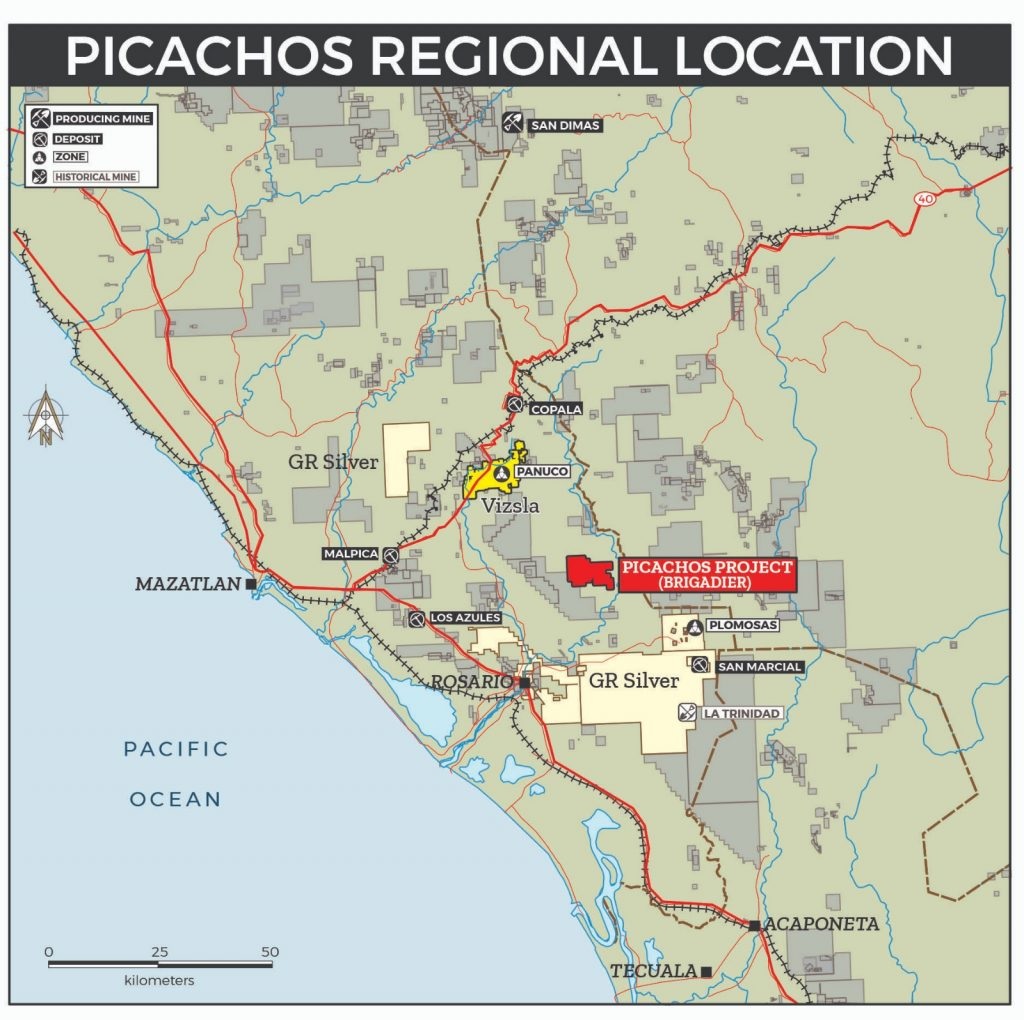

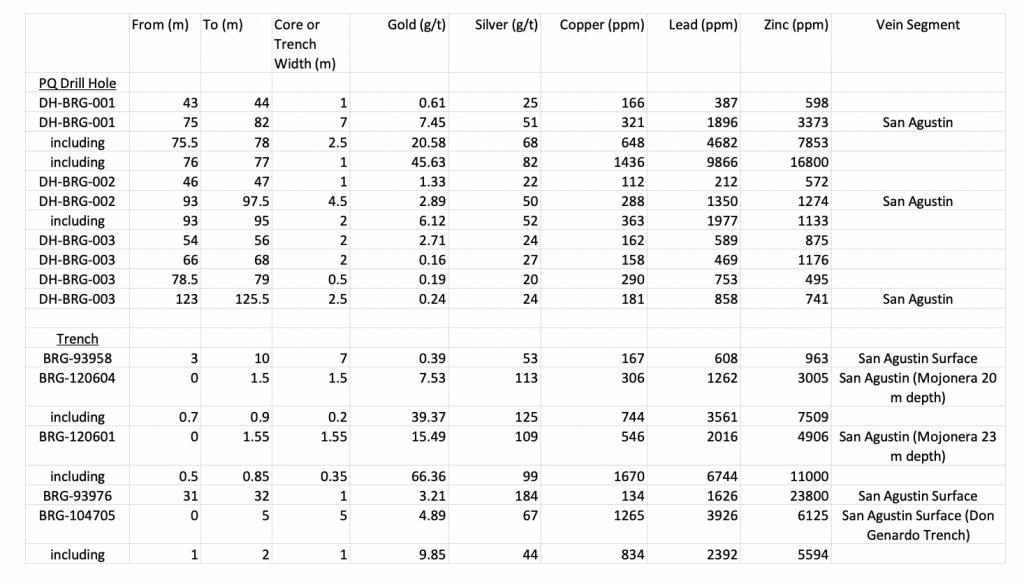

Brigadier Gold (BRG.V) has released the assay results of the first three holes designed to drill-test the San Agustin vein at depth, below the historical mine workings in the Viva Zapata national mine reserve.

The headline result of 1 meter containing 46 g/t gold is the obvious eye-catcher, but the table with the assay results contains more interesting information. The 1 meter interval is a part of a wider 7 meter interval containing 7.45 g/t gold, and this means the remaining 6 meters of that specific interval contains approximately 1.09 g/t gold and almost 46 g/t silver. Hole 2 also contains gold and silver mineralization with 4.5 meters of 2.89 g/t gold and 50 g/t silver as main interval while four distinct mineralized zones were encountered in hole three, of which only the interval closest to surface encountered potentially viable grades.

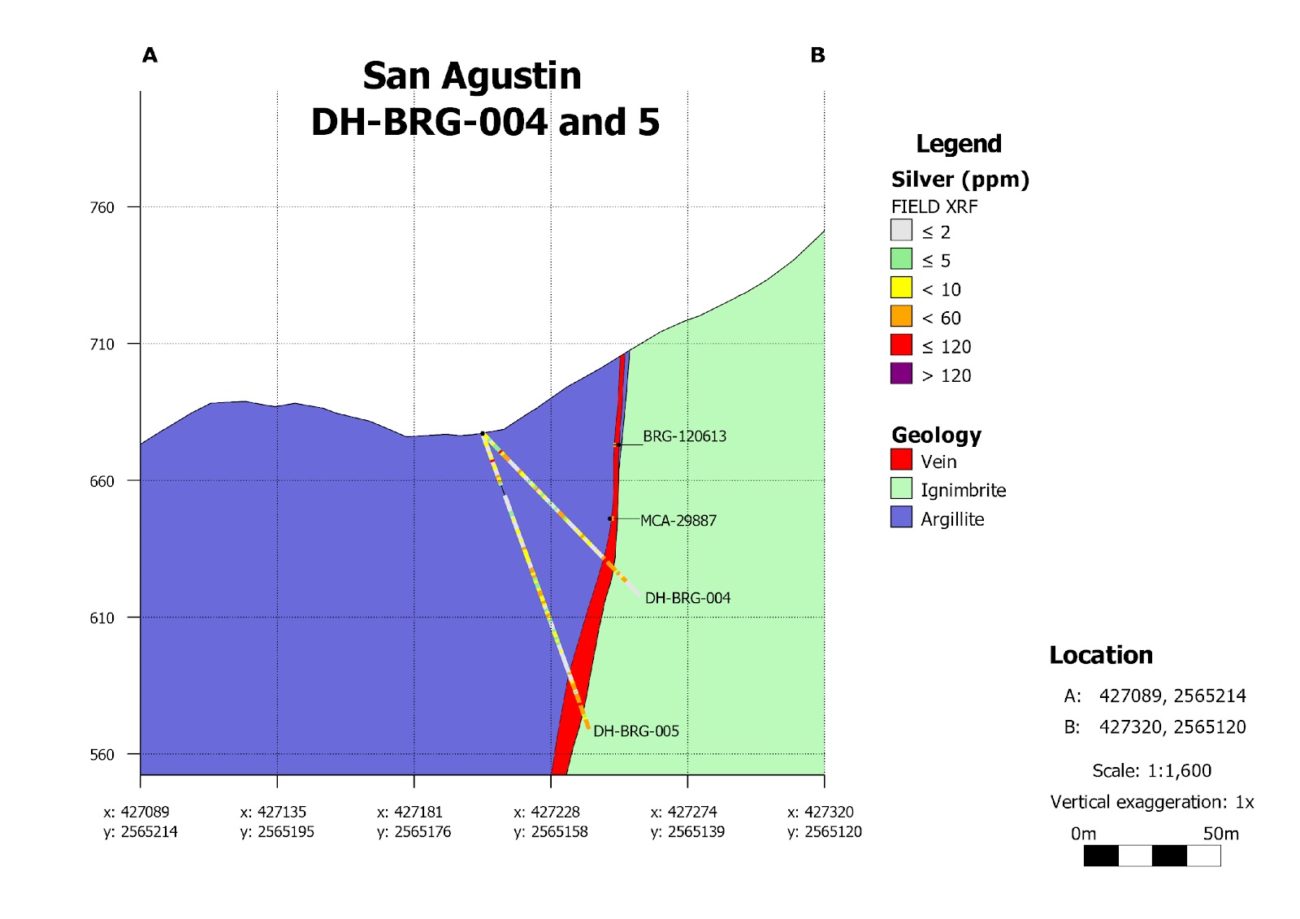

While we would like to emphasize it’s still early days and the assay results of just three holes clearly don’t represent a complete overview of the San Agustin vein, there are some preliminary conclusions we can draw here. On the positive side, all three holes intersected the San Agustin vein and confirmed the vein does indeed contain gold-silver mineralization (with traces of base metals as well). However, the grades and widths clearly need to improve (the true width of the intercepts has not been disclosed or determined yet, but based on the cross section (see below) in the November 2nd press release of Brigadier Gold, we’d estimate the true widths to be 60-80% of the reported widths, but this remains to be confirmed by the company once it has expanded its dataset.

While it’s encouraging to find gold and to see that all gold grades come in at in excess of a gram per tonne (other than the three intervals in hole three), the grade will still have to improve in certain areas. Just to give you an example, the 2 meters of 2.75 g/t gold and 24 g/t silver in hole 3 sounds pretty interesting and if one would use a gold price of $1500/oz and a silver price of $25/oz, the gross rock value per tonne is just over US$150/t. That’s not the ultra-high grade that has been reported elsewhere in Sinaloa, but it should be sufficient for underground operations (at the current precious metals prices). We are ignoring the base metals for now as the grades appear to be too low to bother trying to recover the base metals in a separate concentrate further down the road. So while the grade should be sufficiently high in the current precious metals price environment, Brigadier will also have to build tonnage along the way.

The best way to describe these initial drill results is probably ‘a mixed bag’. The vein has been encountered and does contain gold and silver, but in an ideal world, the precious metals values would have been a bit higher (or wider) than what has been reported. But again, it’s still very early days at Picachos and less than 10% of the 40 holes that have been planned have now been reported on. According to the press release, additional drill results are ‘imminent’, so we are looking forward to seeing a fresh batch of assay results here.

The vein is there, and the vein contains gold and silver. The focus will have to be on grades and widths. 37 holes still have to be reported on, and we expect a steady news flow from now on.

Disclosure: The author has a long position in Brigadier Gold. Brigadier is a sponsor of the website. Please read our disclaimer.