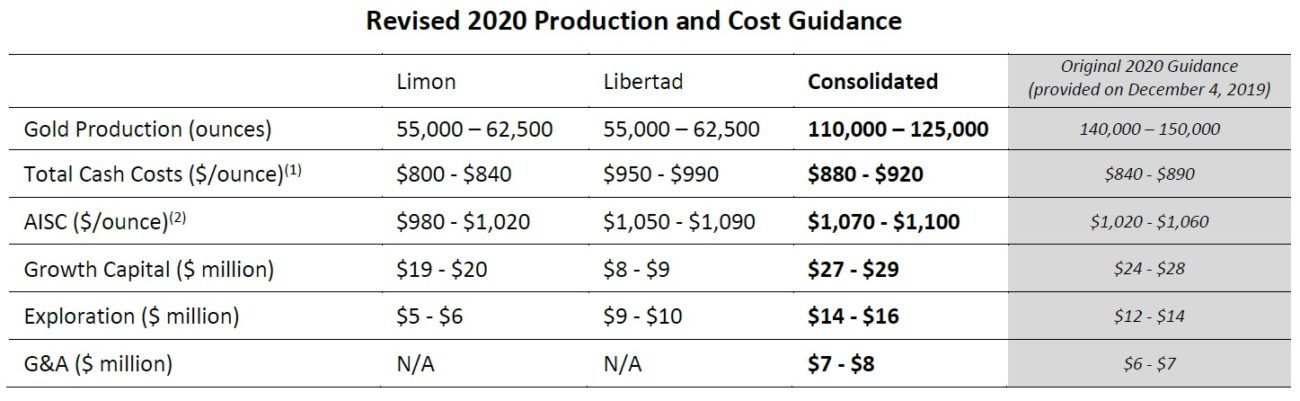

As the initial COVID-19 dust appears to be settling down, Calibre Mining (CXB.TO) now has a better idea what its mines will be able to produce this year. Whereas the original guidance called for a total gold production of 140-150,000 ounces of gold, the revised guidance is now calling for a consolidated production of 110-125,000 ounces of gold (-20%) at a total cash cost of around$900/oz (+5%) while the all-in sustaining cost should not exceed $1100/oz.

This means that the current gold price of $1800/oz, the net margin will still be around $700/oz and Calibre will still generate approximately US$85M in net free cash flow (on a pre-tax basis and on the asset level). This should be sufficient to cover the $28M in growth capex, $15M in exploration expenses and the up to $8M in G&A expenses while also covering all tax payments.

Long story short, if Calibre meets its revised production and cost guidance, all planned expenses including growth and exploration expenses (including a 60,000 meter drill program) should be fully covered. The exploration program will help to convert some of the inferred resources on the Limon and Libertad mines into the measured and indicated category. Additionally, as the gold price appears to be holding its ground at the current levels we can expect the company to use a different cutoff grade for its operations which could add much more ounces to the resource and reserve estimates.

Disclosure: The author has no position in Calibre Mining.